How To Draw A Trend Line: A Beginner's Guide To Mastering Market Trends

**If you're diving into the world of trading or investing, learning how to draw a trend line is like learning how to ride a bike—it’s essential!** Whether you're a rookie trader or a seasoned pro, understanding trend lines can help you navigate the choppy waters of the stock market. Think of it as your GPS in the financial jungle. A trend line is a powerful tool that helps traders identify potential opportunities and make smarter decisions. But how do you draw one? Stick around, and we'll break it down step by step, no jargon, just real talk.

Drawing a trend line might seem intimidating at first, but trust me, it's simpler than you think. It's all about connecting the dots—literally. By mastering this skill, you'll be able to spot trends, predict price movements, and ultimately boost your trading game. So, grab your pencil (or open your trading platform) and let's get started!

Before we dive deeper, let’s clear the air: trend lines are not some magical formula that guarantees success. They’re more like a guide, helping you see patterns that might otherwise go unnoticed. And hey, who doesn’t love a good pattern? Let’s roll!

What Exactly is a Trend Line?

A trend line is like a roadmap for traders. It’s a straight line drawn on a chart that connects two or more price points, showing the general direction of a market trend. Think of it as the pulse of the market—it tells you whether prices are moving up, down, or sideways. It's a crucial tool for technical analysts because it helps them make sense of the chaos in the market.

Now, here’s the kicker: not all trend lines are created equal. Some are stronger than others, and the way you draw them can make a big difference. That’s why learning the right technique is so important. A well-drawn trend line can help you spot potential reversals, support levels, and resistance levels, giving you a competitive edge in the market.

Why Are Trend Lines Important?

Trend lines are more than just lines on a chart—they’re insights into the market’s behavior. Here’s why they matter:

- Identifying Trends: They help you see the bigger picture and determine whether the market is bullish (upward trend) or bearish (downward trend).

- Support and Resistance: Trend lines act as barriers, showing where prices might bounce back or break through.

- Predicting Reversals: A break in a trend line can signal a potential reversal, giving you a heads-up to adjust your strategy.

- Risk Management: By understanding trends, you can set better stop-loss orders and protect your investments.

So, whether you're trading stocks, forex, or cryptocurrencies, trend lines are your best friend. Now, let’s move on to the nitty-gritty of how to draw them.

How to Draw a Trend Line: Step-by-Step Guide

Ready to put your newfound knowledge into practice? Here’s a step-by-step guide to drawing a trend line like a pro:

Step 1: Choose the Right Chart

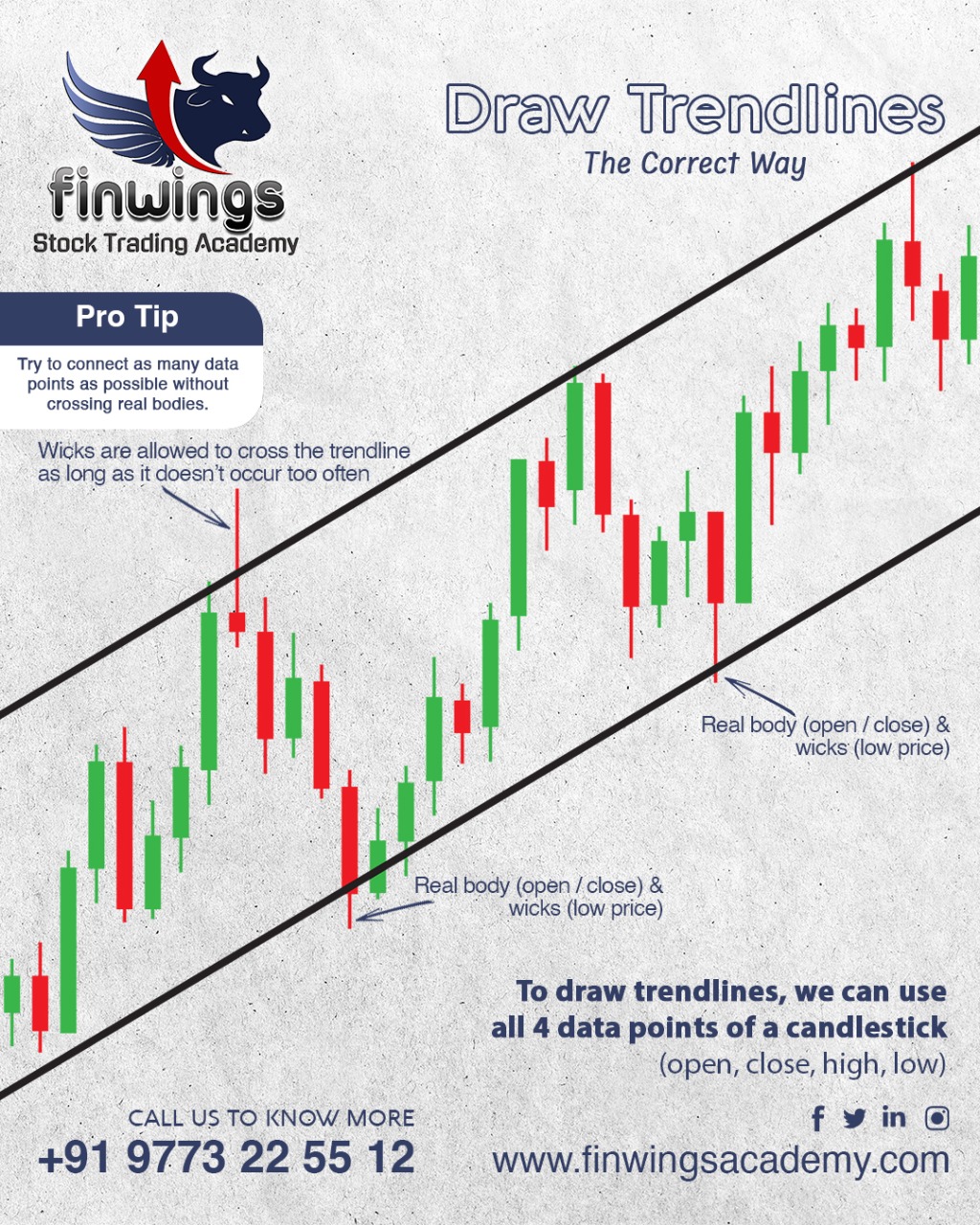

First things first, you need the right canvas. Make sure you’re using a chart that shows enough historical data to identify a clear trend. A candlestick chart is often the go-to choice for traders because it provides detailed price information.

Step 2: Identify Key Price Points

Next, look for significant price points on your chart. For an uptrend, these are the lowest points where prices reversed upward. For a downtrend, they’re the highest points where prices reversed downward. Think of them as the "peaks" and "valleys" of the market.

Step 3: Connect the Dots

Once you’ve identified your key points, it’s time to connect them with a straight line. For an uptrend, draw a line from the lowest point to the next lowest point. For a downtrend, connect the highest points. Remember, the line should follow the general direction of the trend.

Step 4: Validate the Trend Line

Not every line you draw will be a valid trend line. A good trend line should touch at least three price points. The more times the price touches the line, the stronger the trend. If the price keeps bouncing off the line, you’re on the right track!

Step 5: Adjust as Needed

Markets are dynamic, and so are trend lines. Don’t be afraid to adjust your line if the market changes direction. A trend line is a living tool, and it should evolve with the market.

Tips for Drawing Accurate Trend Lines

Now that you know the basics, here are a few tips to help you draw trend lines like a pro:

- Use Multiple Timeframes: Analyze charts across different timeframes to get a broader perspective. What looks like a trend on a daily chart might be just noise on a weekly chart.

- Focus on Significant Points: Don’t get distracted by minor fluctuations. Stick to the major highs and lows that truly define the trend.

- Combine with Other Indicators: Trend lines work best when used alongside other technical indicators like moving averages or RSI. This gives you a more complete picture of the market.

- Be Patient: Drawing trend lines takes practice. Don’t rush the process—take your time to ensure accuracy.

Remember, the goal is to find trends that are both clear and reliable. The more practice you get, the better you’ll become at spotting them.

Common Mistakes to Avoid

Even the best traders make mistakes when drawing trend lines. Here are a few pitfalls to watch out for:

1. Overcomplicating Things

Some traders try to draw too many trend lines, thinking more is better. But in reality, fewer, well-defined lines are more effective. Keep it simple and focus on the most important trends.

2. Ignoring Volume

Volume is a crucial indicator of trend strength. If a trend line is supported by high trading volume, it’s more likely to hold. Always check the volume before relying on a trend line.

3. Relying Solely on Trend Lines

Trend lines are powerful, but they’re not infallible. Always use them in conjunction with other tools and indicators to get a well-rounded view of the market.

Understanding Trend Types

Not all trends are the same. Here’s a quick breakdown of the three main types:

1. Uptrends

An uptrend is characterized by higher highs and higher lows. Prices are generally moving upward, and traders look for opportunities to buy during pullbacks.

2. Downtrends

A downtrend is the opposite of an uptrend, featuring lower highs and lower lows. Prices are moving downward, and traders might look to short sell during rallies.

3. Sideways Trends

Sometimes, prices move sideways, creating a range-bound market. In this case, traders focus on buying at support and selling at resistance.

Using Trend Lines in Real-Life Scenarios

Let’s put theory into practice with a real-life example. Imagine you’re analyzing a stock that’s been trending upward for the past few months. You identify the key lows and draw a trend line connecting them. The price keeps bouncing off the line, confirming the trend. Suddenly, the price breaks below the trend line. What does this mean?

It could signal a potential trend reversal, prompting you to reevaluate your position. This is the power of trend lines—they help you spot changes in market behavior before they become obvious to everyone else.

Data and Statistics to Support Your Trading

According to a study by the Journal of Financial Markets, traders who use trend lines as part of their analysis tend to outperform those who don’t. Another report from Investopedia found that trend lines are among the most widely used tools in technical analysis, with over 80% of traders relying on them in some capacity.

These numbers don’t lie—trend lines are a proven strategy for improving trading outcomes. But remember, they’re just one piece of the puzzle. Always combine them with other tools and strategies for the best results.

Final Thoughts: How to Draw a Trend Line Like a Pro

So, there you have it—a comprehensive guide to drawing trend lines like a pro. By following these steps and tips, you’ll be able to identify trends, predict price movements, and make smarter trading decisions. But don’t stop here—keep practicing, keep learning, and most importantly, keep adapting to the ever-changing market.

And hey, if you found this article helpful, why not share it with your trading buddies? Or leave a comment below and let us know how trend lines have helped your trading journey. The more we share, the more we grow!

Table of Contents

- What Exactly is a Trend Line?

- Why Are Trend Lines Important?

- How to Draw a Trend Line: Step-by-Step Guide

- Tips for Drawing Accurate Trend Lines

- Common Mistakes to Avoid

- Understanding Trend Types

- Using Trend Lines in Real-Life Scenarios

- Data and Statistics to Support Your Trading

- Final Thoughts: How to Draw a Trend Line Like a Pro