Mastering Learning Stock Trading: Your Ultimate Guide To Market Success

Learning stock trading can feel like diving into a deep ocean without a map. But hey, don’t panic! With the right mindset, tools, and strategies, you can turn this seemingly complex world into your playground. Whether you're a complete beginner or someone who’s been dabbling around, this guide is designed to help you navigate the ins and outs of the stock market. Stick with me, and we’ll make you a pro in no time.

Let’s face it—learning stock trading isn’t just about picking stocks or following charts. It’s about understanding the market dynamics, managing risks, and developing a disciplined approach. This isn’t just another boring financial article; we’re going to break it down in a way that makes sense and keeps you engaged. Think of it as a casual chat over coffee, but with actionable insights that’ll change your investing life.

By the end of this article, you’ll have a solid foundation to start trading confidently. We’ll cover everything from the basics of stock trading to advanced techniques that even seasoned traders use. So grab your favorite drink, sit back, and let’s dive into the exciting world of learning stock trading!

Table of Contents

- What Is Stock Trading?

- Why Learn Stock Trading?

- Basics of Learning Stock Trading

- Choosing the Right Broker

- Understanding the Stock Market

- Risk Management in Stock Trading

- Technical Analysis for Beginners

- Fundamental Analysis Explained

- Top Trading Strategies You Need to Know

- Common Mistakes to Avoid

What Is Stock Trading?

Alright, let’s start with the basics. Stock trading is essentially buying and selling stocks (or shares) of publicly listed companies. Think of it as owning a tiny piece of a company. When the company performs well, the value of your shares increases, and vice versa. But here’s the twist—it’s not just about holding onto stocks for years; trading involves active buying and selling to capitalize on short-term price movements.

Stock trading differs from investing in one major way: timing. While investors focus on long-term growth, traders aim to profit from short-term fluctuations. And guess what? This makes learning stock trading a thrilling yet challenging journey.

Key Features of Stock Trading

- Liquidity: Stocks are highly liquid, meaning you can buy or sell them quickly without affecting their price.

- Variety: With thousands of stocks available, there’s always something for everyone, whether you’re into tech, healthcare, or energy.

- Risk and Reward: Higher potential returns often come with higher risks, so it’s crucial to understand what you’re getting into.

Why Learn Stock Trading?

Now, you might be wondering, “Why bother with all this hassle?” Well, here’s the deal—learning stock trading can open doors to financial independence. Imagine being able to generate income from the comfort of your home, using nothing more than a laptop and an internet connection. Sounds too good to be true? Not if you do it right.

Trading offers flexibility, the potential for high returns, and the opportunity to be your own boss. Plus, it’s a skill that keeps evolving, making it a lifelong learning experience. But remember, success in stock trading doesn’t happen overnight. It takes time, effort, and a lot of practice.

Benefits of Learning Stock Trading

- Financial Growth: Build wealth through strategic buying and selling.

- Independence: Create a passive income stream that works for you.

- Knowledge: Gain a deeper understanding of how markets work.

Basics of Learning Stock Trading

Before we dive deeper, let’s talk about the fundamental concepts you need to grasp. First up, understanding stock market terminology. Words like “bullish,” “bearish,” “volatility,” and “dividends” may sound intimidating, but they’re your new best friends in the trading world.

Next, familiarize yourself with different types of orders—market orders, limit orders, and stop-loss orders. Each one serves a specific purpose and can impact your trades significantly. For example, a stop-loss order helps protect your capital by automatically selling a stock when it reaches a certain price.

Building a Strong Foundation

- Start Small: Don’t jump in headfirst. Begin with small trades to get a feel for the market.

- Use Demo Accounts: Practice trading without risking real money until you’re comfortable.

- Learn Continuously: Stay updated with market trends, news, and economic indicators.

Choosing the Right Broker

Your broker is your gateway to the stock market, so choosing the right one is crucial. Look for brokers that offer low fees, reliable platforms, and excellent customer support. Some popular options include TD Ameritrade, E*TRADE, and Robinhood. But don’t just pick one based on its name—do your research!

Consider factors like trading tools, educational resources, and the range of assets available. A good broker will provide everything you need to succeed, from real-time data feeds to advanced charting software.

Tips for Selecting a Broker

- Compare Fees: Check commission rates and hidden costs.

- Test the Platform: Ensure it’s user-friendly and meets your needs.

- Read Reviews: See what other traders have to say about their experience.

Understanding the Stock Market

The stock market is like a giant puzzle with many moving pieces. To succeed, you need to understand how it operates. Factors like supply and demand, economic conditions, and geopolitical events can all influence stock prices. Keep an eye on key indices like the S&P 500, Dow Jones, and NASDAQ—they provide a snapshot of overall market performance.

Additionally, pay attention to earnings reports, dividend announcements, and major news stories. These can create opportunities—or challenges—for traders. The more informed you are, the better decisions you’ll make.

Key Components of the Stock Market

- Exchanges: Platforms where stocks are bought and sold, such as NYSE and NASDAQ.

- Participants: Retail investors, institutional investors, hedge funds, and market makers.

- Regulations: Rules set by bodies like the SEC to ensure fair trading practices.

Risk Management in Stock Trading

Risk management is the backbone of successful trading. No matter how good you are, there will always be uncertainties in the market. The key is to minimize potential losses while maximizing gains. This involves setting clear goals, defining your risk tolerance, and sticking to a well-defined strategy.

One effective technique is diversification—spreading your investments across different stocks, sectors, or asset classes. This reduces the impact of a single poor-performing stock on your portfolio. Another must-have tool is a stop-loss order, which we discussed earlier.

Practical Risk Management Strategies

- Set Stop-Losses: Limit your downside by automatically exiting trades at predetermined levels.

- Diversify: Don’t put all your eggs in one basket.

- Monitor Performance: Regularly review your trades and adjust your strategy as needed.

Technical Analysis for Beginners

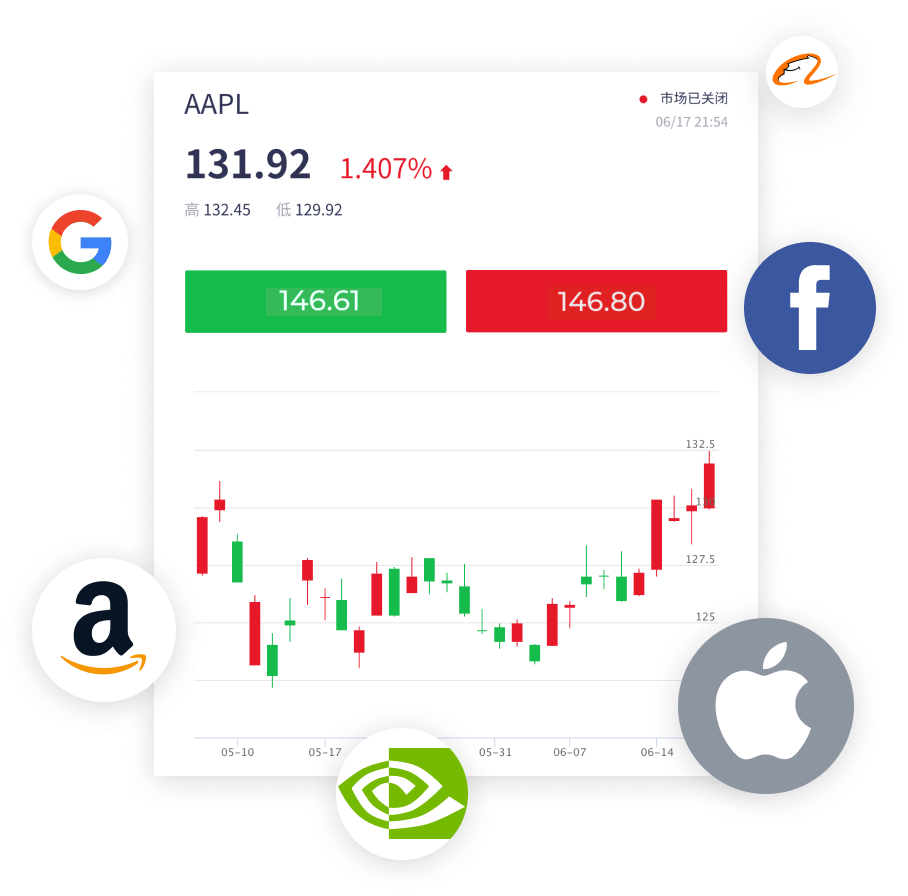

Technical analysis is the art of predicting future price movements based on historical data. Traders use charts, patterns, and indicators to identify trends and make informed decisions. While it may seem complicated at first, with practice, you’ll become proficient in no time.

Some common technical indicators include moving averages, relative strength index (RSI), and Bollinger Bands. These tools help you spot entry and exit points, as well as potential reversals. Remember, technical analysis is just one piece of the puzzle—combine it with other methods for a holistic approach.

Getting Started with Technical Analysis

- Learn Chart Patterns: Familiarize yourself with head-and-shoulders, double tops, and triangles.

- Use Indicators Wisely: Don’t overload your charts—stick to a few reliable indicators.

- Practice Regularly: The more you practice, the better you’ll get at interpreting market signals.

Fundamental Analysis Explained

While technical analysis focuses on price action, fundamental analysis examines a company’s intrinsic value. This involves analyzing financial statements, earnings reports, and industry trends to determine whether a stock is undervalued or overvalued.

Key metrics to consider include price-to-earnings ratio (P/E), earnings per share (EPS), and debt-to-equity ratio. By combining fundamental analysis with technical insights, you’ll gain a comprehensive view of the market.

Essential Fundamental Analysis Metrics

- P/E Ratio: Measures how much investors are willing to pay for each dollar of earnings.

- EPS: Indicates a company’s profitability on a per-share basis.

- Revenue Growth: Shows how well a company is expanding its sales over time.

Top Trading Strategies You Need to Know

Having a solid trading strategy is essential for consistent success. Here are some popular approaches used by traders:

- Day Trading: Buying and selling stocks within the same day to capitalize on short-term price movements.

- Swing Trading: Holding positions for several days to weeks, aiming to capture larger price swings.

- Position Trading: Taking a longer-term view, holding stocks for months or even years.

Experiment with different strategies to find what works best for you. Remember, consistency is key—once you find a strategy that suits your style, stick with it and refine it over time.

Common Mistakes to Avoid

Even the best traders make mistakes. The difference is that they learn from them and adapt. Here are some common pitfalls to avoid:

- Overtrading: Making too many trades without a clear plan can lead to unnecessary losses.

- Emotional Trading: Letting fear or greed dictate your decisions can be disastrous.

- Ignoring Stops: Not using stop-loss orders can result in significant capital erosion.

Stay disciplined, stay focused, and most importantly, stay patient. Success in stock trading doesn’t happen overnight—it’s a marathon, not a sprint.

Conclusion

Learning stock trading is a journey filled with challenges, rewards, and endless opportunities. By mastering the basics, choosing the right tools, and developing a disciplined approach, you can navigate the markets with confidence. Remember, the key to success lies in continuous learning, adaptability, and risk management.

So, what are you waiting for? Take the first step today and start building your trading knowledge. Share this article with friends who might find it helpful, leave a comment below, or check out our other resources for more insights. Your future self will thank you!