Mastering Trading Learning: The Ultimate Guide For Aspiring Traders

So, you've heard the buzz about trading learning and how it can change your financial future, right? Let's be honest here, trading isn't just about making quick bucks; it's a skill that requires dedication, discipline, and a solid understanding of the market. Whether you're a complete beginner or someone looking to refine their trading strategies, this article will be your go-to resource. We'll break down everything you need to know about trading learning in a way that's easy to digest and actionable.

Trading learning is more than just a buzzword these days. It’s a journey that can open doors to financial independence and personal growth. But here’s the thing: not everyone knows where to start. The market can feel overwhelming, especially when you're bombarded with jargon and complex strategies. Don't worry, though—we’ve got your back. This article will guide you step by step, ensuring you don’t miss a beat.

Before we dive deep into the nitty-gritty of trading learning, let’s set the stage. This isn’t just another generic article you’ll skim through. We’re here to provide value, share insights, and help you build a strong foundation. So, grab a cup of coffee, sit back, and let’s get started on this exciting journey to mastering the art of trading.

Why Trading Learning is Essential in Today’s Market

Let’s cut to the chase—trading learning is crucial if you want to survive and thrive in today’s fast-paced financial world. Markets are constantly evolving, influenced by global events, technological advancements, and shifting investor sentiment. Without a solid understanding of how these factors impact trading, you’re essentially flying blind. Here’s why trading learning is a game-changer:

First off, the financial markets are no longer exclusive to Wall Street elites. Thanks to technology, anyone with an internet connection can participate. But here’s the catch—just because you can trade doesn’t mean you should. Without proper education, you’re more likely to make costly mistakes. Trading learning equips you with the knowledge and tools to make informed decisions, reducing the risk of losing your hard-earned money.

Moreover, trading learning isn’t just about understanding the markets; it’s about understanding yourself. It teaches you how to manage emotions, control impulses, and stick to a plan. These are skills that extend beyond trading and can positively impact other areas of your life. So, whether you’re trading stocks, forex, or cryptocurrencies, trading learning is your secret weapon.

Key Benefits of Investing in Trading Learning

Still not convinced? Here are some key benefits that make trading learning a worthwhile investment:

- Increased Confidence: Knowledge is power, and when you understand the markets, you’ll feel more confident in your trading decisions.

- Improved Risk Management: Trading learning teaches you how to assess risks and develop strategies to mitigate them.

- Higher Potential Returns: With the right knowledge and strategies, you can increase your chances of achieving consistent profits.

- Long-Term Success: Trading learning isn’t a quick fix; it’s a long-term investment in your financial future.

Remember, the goal isn’t to become a billionaire overnight but to build a sustainable trading career. And that starts with learning.

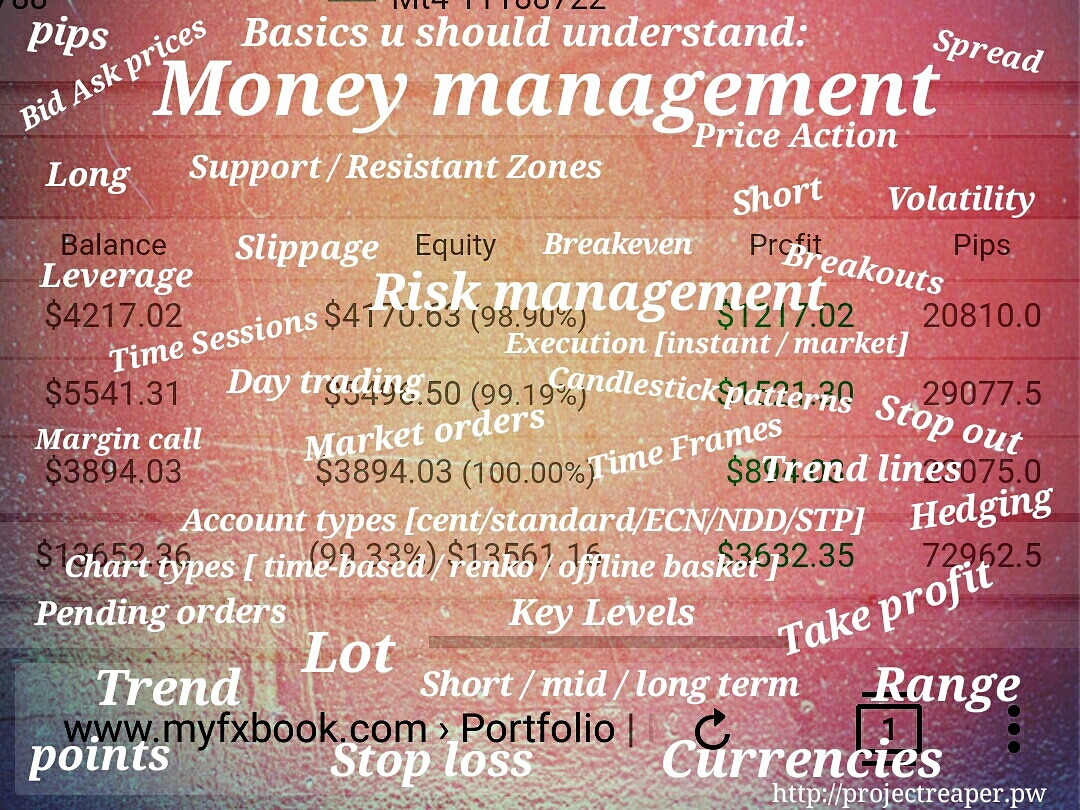

The Basics of Trading Learning: What You Need to Know

Now that we’ve established why trading learning is essential, let’s break down the basics. Think of this section as your foundation—without it, everything else will crumble. So, let’s get into the nitty-gritty:

Trading learning begins with understanding the markets. Whether you’re trading stocks, forex, commodities, or cryptocurrencies, each market has its own characteristics and dynamics. For instance, the stock market is influenced by company performance and economic indicators, while the forex market is driven by global events and currency fluctuations. Knowing these differences is crucial for developing effective trading strategies.

Another fundamental aspect of trading learning is understanding technical analysis. This involves using charts and indicators to predict price movements. While it may sound complicated, it’s actually pretty straightforward once you get the hang of it. Tools like moving averages, RSI, and MACD can provide valuable insights into market trends and potential entry and exit points.

Key Concepts in Trading Learning

Here are some key concepts you need to grasp:

- Supply and Demand: This is the backbone of any market. Understanding how supply and demand drive prices is essential for making informed trading decisions.

- Risk Management: As we mentioned earlier, managing risk is crucial. This involves setting stop-loss orders, position sizing, and diversifying your portfolio.

- Psychology: Trading is as much about psychology as it is about numbers. Learning how to control your emotions and avoid impulsive decisions can significantly improve your trading performance.

By mastering these basics, you’ll be well on your way to becoming a successful trader. But remember, trading learning is a continuous process. Markets are constantly changing, so staying updated is key.

Building a Solid Trading Learning Plan

Alright, now that you’ve got the basics down, it’s time to build a solid trading learning plan. Think of this as your roadmap to success. Without a plan, you’re just wandering aimlessly in the market. So, let’s get organized:

Start by setting clear goals. What do you want to achieve through trading? Are you looking for short-term gains or long-term wealth building? Your goals will determine your trading strategy and approach. For example, if you’re focused on long-term growth, you might consider investing in blue-chip stocks or index funds. On the other hand, if you’re looking for quick profits, day trading or swing trading might be more suitable.

Once you’ve set your goals, it’s time to create a learning plan. This should include a mix of theoretical knowledge and practical experience. Start by reading books and articles on trading, watching tutorials, and attending webinars. Then, apply what you’ve learned by practicing on a demo account. This will help you get a feel for the market without risking real money.

Creating a Personalized Learning Path

Here’s a step-by-step guide to creating a personalized trading learning path:

- Assess Your Knowledge: Identify your strengths and weaknesses. Are you familiar with technical analysis? Do you understand market fundamentals? This will help you focus on areas that need improvement.

- Set Learning Goals: Break down your overall goal into smaller, achievable milestones. For example, aim to understand candlestick patterns in the first month, then move on to more advanced chart patterns.

- Choose Your Resources: There are tons of resources available for trading learning. Choose ones that align with your learning style and goals. Some popular options include TradingView, Investopedia, and Coursera.

- Track Your Progress: Keep a journal of your learning journey. Note down what you’ve learned, what worked, and what didn’t. This will help you stay on track and make adjustments as needed.

By following this plan, you’ll be able to build a strong foundation and develop the skills needed to succeed in trading.

Common Mistakes to Avoid in Trading Learning

Let’s face it—everyone makes mistakes when they’re starting out. But here’s the good news: learning from others’ mistakes can save you a lot of time and money. So, let’s go over some common pitfalls to avoid:

One of the biggest mistakes beginners make is jumping into the market without proper preparation. They see someone else make a quick profit and think it’s easy. Trust me, it’s not. Trading requires a solid understanding of the markets, risk management, and psychology. Without these fundamentals, you’re setting yourself up for failure.

Another common mistake is overtrading. Some traders get caught up in the excitement and end up making too many trades, which can lead to significant losses. Remember, trading isn’t a race. It’s better to make a few well-thought-out trades than to make dozens of impulsive ones.

How to Avoid These Mistakes

Here are some tips to help you avoid these common mistakes:

- Do Your Research: Before making any trade, do thorough research. Understand the market conditions, company fundamentals, and technical indicators.

- Stick to Your Plan: Develop a trading plan and stick to it. Don’t let emotions dictate your decisions.

- Practice Patience: Trading requires patience. Don’t rush into trades just because you’re eager to make a profit.

By avoiding these mistakes, you’ll increase your chances of success and reduce the risk of losing money.

Advanced Trading Learning Techniques

Now that you’ve got the basics down and know what to avoid, let’s talk about advanced trading learning techniques. These are strategies and tools that can take your trading to the next level:

One of the most effective advanced techniques is algorithmic trading. This involves using computer programs to execute trades based on predefined rules. While it may sound complex, it’s actually quite simple once you understand the basics. Algorithmic trading can help you make faster, more accurate trades and reduce the risk of human error.

Another advanced technique is using machine learning and artificial intelligence to analyze market data. These technologies can identify patterns and trends that humans might miss, giving you a competitive edge. However, it’s important to remember that these tools are only as good as the data they’re fed. Garbage in, garbage out, as they say.

Implementing Advanced Techniques in Your Trading

Here’s how you can implement these advanced techniques:

- Learn the Basics First: Before diving into advanced techniques, make sure you have a solid understanding of the basics. Trying to run before you can walk will only lead to frustration.

- Start Small: When implementing advanced techniques, start with small trades. This will help you get comfortable with the tools and strategies without risking too much money.

- Stay Updated: The world of trading is constantly evolving. Stay updated on the latest trends and technologies to ensure your strategies remain effective.

By incorporating these advanced techniques into your trading learning plan, you’ll be able to take your skills to the next level.

Building a Support Network for Trading Learning

Trading can be a lonely journey, but it doesn’t have to be. Building a support network can make a huge difference in your trading learning experience. Whether it’s joining a trading community, attending seminars, or finding a mentor, having people to bounce ideas off and learn from can significantly improve your skills.

Online trading communities are a great place to start. Platforms like Reddit, TradingView, and StockTwits offer forums where traders share their experiences, insights, and strategies. Engaging with these communities can provide valuable learning opportunities and help you stay motivated.

Another option is finding a mentor. A good mentor can provide guidance, share their expertise, and offer constructive feedback. While it may cost you some money, the value of having a mentor can be priceless.

How to Build a Strong Support Network

Here are some tips for building a strong support network:

- Join Online Communities: Participate in forums and discussions to connect with like-minded individuals.

- Attend Seminars and Workshops: These events are great for networking and learning from experts.

- Find a Mentor: Look for someone with experience who can guide you on your trading journey.

By building a strong support network, you’ll have access to a wealth of knowledge and resources that can accelerate your learning process.

Measuring Your Progress in Trading Learning

As you progress in your trading learning journey, it’s important to measure your progress. This will help you identify areas that need improvement and celebrate your successes. But how do you measure progress in trading? Let’s break it down:

Start by tracking your trades. Keep a journal of every trade you make, including the reasons behind it, the outcome, and what you learned. This will help you identify patterns and make adjustments to your strategy. For example, if you notice that you’re consistently losing money on certain types of trades, it might be time to reassess your approach.

Another way to measure progress is by setting benchmarks. These could be financial goals, such as increasing your profit margin by a certain percentage, or skill-based goals, like mastering a new trading technique. Whatever benchmarks you set, make sure they’re realistic and achievable.

Tools for Measuring Progress

Here are some tools you can use to measure your progress:

- Trading Journals: Use a journal to track your trades and analyze your performance.

- Performance Metrics: Use metrics like win rate, risk-reward ratio, and drawdown to evaluate your trading performance.

- Feedback from Peers