Swing Trading Time Frames: The Ultimate Guide For Profitable Trades

Hey there, traders! If you're reading this, chances are you're looking to dive deep into the world of swing trading time frames. Stick with me, because we're about to uncover some seriously valuable insights that can transform your trading strategy. Swing trading is not just about buying and selling stocks; it's about timing the market with precision. And guess what? The right time frames can make all the difference in your trading journey. Let's get started, shall we?

Before we jump into the nitty-gritty, let's break down what swing trading time frames actually mean. Simply put, swing trading time frames refer to the periods during which traders analyze charts and make decisions. These time frames can range from a few hours to several days, depending on your strategy and goals. By mastering the art of selecting the right time frame, you'll be able to ride market swings like a pro.

Now, here's the kicker: swing trading isn't just for seasoned traders. Whether you're a beginner or a seasoned pro, understanding swing trading time frames can help you make smarter, more informed decisions. So, buckle up, because we're about to take a deep dive into this fascinating topic. Let's get to it!

Understanding Swing Trading Time Frames

Alright, let's start with the basics. Swing trading time frames are essentially the duration you choose to analyze market movements. Think of it like zooming in and out on a map. Different time frames give you different perspectives, and choosing the right one is crucial for success. For swing traders, the most common time frames are daily, 4-hour, and 1-hour charts.

Here's why these time frames matter: they allow you to spot trends, identify support and resistance levels, and make calculated decisions. For instance, a daily chart gives you a broader view of market trends, while a 1-hour chart helps you pinpoint entry and exit points. It's all about finding the sweet spot that aligns with your trading style and goals.

Why Swing Trading Time Frames Are Critical

So, why are swing trading time frames so important? Well, imagine driving a car without a speedometer or GPS. You'd have no idea how fast you're going or where you're headed, right? Similarly, without the right time frames, your trading decisions could be all over the place. Time frames act as your trading compass, guiding you through the ups and downs of the market.

Here's another way to look at it: swing trading time frames help you filter out noise. The market can be chaotic, with countless variables affecting prices. But by focusing on specific time frames, you can cut through the clutter and focus on what truly matters. Whether you're trading stocks, forex, or cryptocurrencies, the right time frame can make your trades more precise and profitable.

Choosing the Right Swing Trading Time Frame

Now that we know why time frames are important, let's talk about how to choose the right one. This is where things get interesting. Your choice of time frame should depend on several factors, including your trading goals, risk tolerance, and available time. For example, if you're a full-time trader, you might prefer shorter time frames like 1-hour or 4-hour charts. On the other hand, if you're trading part-time, daily charts might be more suitable.

Here's a quick breakdown:

- 1-hour charts: Ideal for short-term trades, allowing you to capitalize on quick market movements.

- 4-hour charts: A middle-ground option, perfect for traders who want a balance between short-term and long-term perspectives.

- Daily charts: Great for long-term traders who prefer to analyze broader trends and make fewer, more strategic trades.

How Swing Trading Time Frames Impact Your Strategy

Let's dive deeper into how swing trading time frames influence your overall strategy. Your choice of time frame affects everything from risk management to position sizing. For instance, shorter time frames often require tighter stop losses and smaller position sizes, while longer time frames allow for more flexibility.

Here's a pro tip: always align your time frame with your trading goals. If your goal is to generate consistent, moderate returns, a 4-hour chart might be the way to go. But if you're aiming for quick, high-risk trades, a 1-hour chart could be more appropriate. Remember, there's no one-size-fits-all solution. It's all about finding what works best for you.

Common Mistakes to Avoid in Swing Trading Time Frames

As with any trading strategy, there are common pitfalls to watch out for when it comes to swing trading time frames. One of the biggest mistakes is overtrading. Some traders get so caught up in analyzing multiple time frames that they end up making impulsive decisions. Trust me, I've been there. It's easy to get overwhelmed by all the data, but simplicity is key.

Another common mistake is ignoring the bigger picture. While shorter time frames can be tempting, they often lack the context provided by longer time frames. Always remember to zoom out and look at the overall trend before making any trades. And finally, don't neglect risk management. No matter which time frame you choose, always set stop losses and stick to your trading plan.

Overtrading: The Silent Killer

Let's talk about overtrading for a moment. This is one of the most common mistakes new traders make, and it can be disastrous for your portfolio. Overtrading happens when you make too many trades without a clear strategy, often driven by fear or greed. To avoid this, focus on quality over quantity. Choose your trades wisely, and don't be afraid to sit on the sidelines when the market conditions aren't favorable.

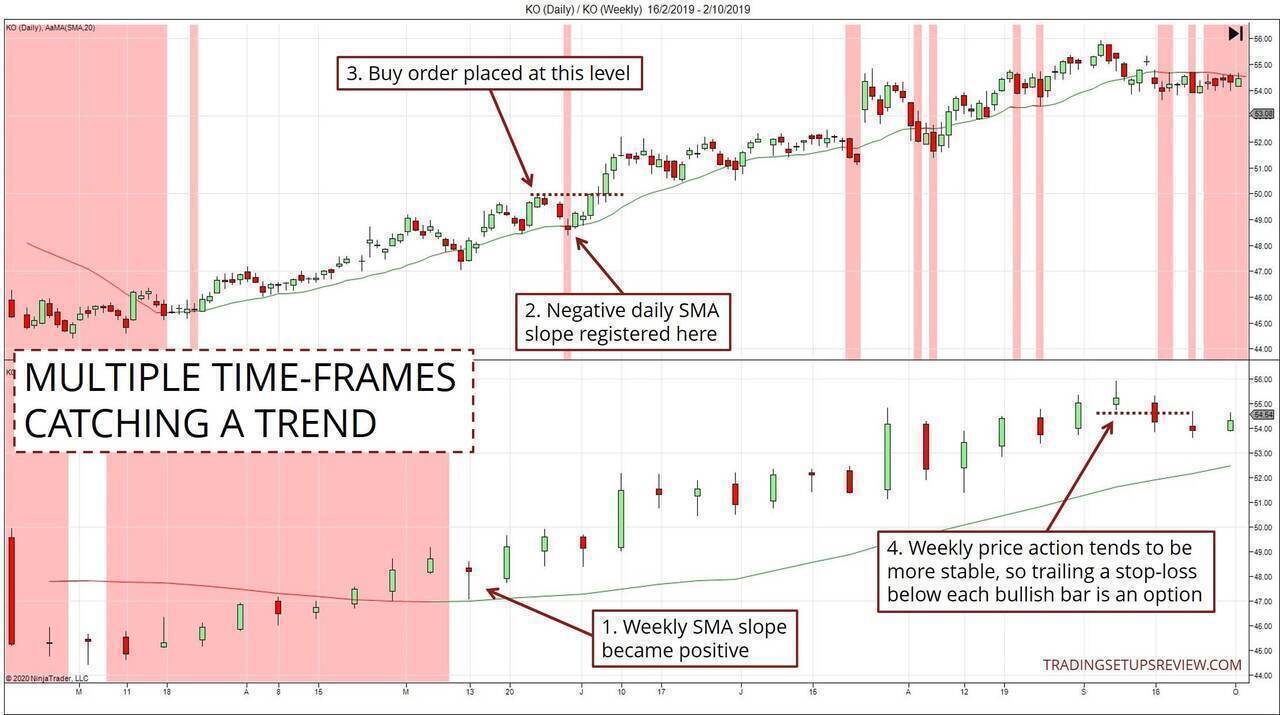

Combining Multiple Time Frames for Better Results

Now, here's a strategy that can take your swing trading to the next level: combining multiple time frames. By analyzing both short-term and long-term charts, you can gain a more comprehensive understanding of market dynamics. For example, you might use a daily chart to identify the overall trend and a 4-hour chart to pinpoint entry and exit points.

This approach allows you to capitalize on both short-term opportunities and long-term trends. Just remember to prioritize one time frame as your primary focus and use the others as supplementary tools. It's like having a backup plan for your backup plan. Trust me, it works!

Tools and Indicators for Swing Trading Time Frames

When it comes to swing trading time frames, having the right tools and indicators can make all the difference. Some of the most popular tools include moving averages, relative strength index (RSI), and Bollinger Bands. These indicators can help you identify trends, measure momentum, and spot potential reversals.

Here's how they work:

- Moving Averages: These smooth out price data to create a trend-following indicator. Common periods include 50-day and 200-day moving averages.

- RSI: This measures the speed and change of price movements, helping you identify overbought or oversold conditions.

- Bollinger Bands: These provide a visual representation of volatility, helping you spot potential breakouts or reversals.

Why Indicators Matter in Swing Trading

Indicators are like your trading sidekicks. They provide valuable insights that can enhance your decision-making process. However, it's important to use them wisely. Overloading your charts with too many indicators can lead to confusion and analysis paralysis. Stick to a few key indicators that align with your strategy, and you'll be good to go.

Real-Life Examples of Swing Trading Time Frames

Let's look at some real-life examples of how swing trading time frames can work in practice. Imagine you're trading a stock that's been trending upward for several weeks. By analyzing a daily chart, you notice that the stock is approaching a resistance level. You then switch to a 4-hour chart to identify potential entry points and set a stop loss.

In this scenario, the combination of time frames allows you to make a more informed decision. You're not just relying on one perspective; you're using multiple viewpoints to increase your chances of success. And that's the beauty of swing trading time frames.

Conclusion: Mastering Swing Trading Time Frames

Alright, we've covered a lot of ground here. From understanding the basics of swing trading time frames to avoiding common mistakes, you now have the knowledge to take your trading to the next level. Remember, the key to success lies in choosing the right time frame, aligning it with your goals, and sticking to your strategy.

So, what's next? Take action! Start practicing with different time frames and see what works best for you. And don't forget to share your thoughts and experiences in the comments below. Your feedback is invaluable, and it helps create a community of traders who are all striving for success. Happy trading, and good luck out there!

Table of Contents

- Understanding Swing Trading Time Frames

- Why Swing Trading Time Frames Are Critical

- Choosing the Right Swing Trading Time Frame

- How Swing Trading Time Frames Impact Your Strategy

- Common Mistakes to Avoid in Swing Trading Time Frames

- Combining Multiple Time Frames for Better Results

- Tools and Indicators for Swing Trading Time Frames

- Real-Life Examples of Swing Trading Time Frames

- Conclusion: Mastering Swing Trading Time Frames