PNC Bank ABA Number: Your Ultimate Guide To Seamless Transactions

Let's talk about PNC Bank ABA numbers because they're more important than you think. Whether you're setting up direct deposits, transferring funds, or paying bills online, knowing your bank's ABA routing number is a game-changer. It’s like the GPS for your money, ensuring it gets to the right destination without any hiccups. So buckle up, because we're diving deep into everything you need to know about PNC Bank ABA numbers.

Alright, so what exactly is an ABA number? Think of it as the bank's address in the financial world. It helps identify which bank your money is coming from or going to. PNC Bank, one of the biggest names in banking, has its own set of ABA numbers that vary depending on where you opened your account. That’s why it's crucial to know which number applies to you.

Now, here's the deal: this guide isn’t just another boring explanation of banking terms. We're breaking it down in a way that makes sense, so you don’t have to stress over jargon or technical stuff. By the time you finish reading, you’ll feel like a pro when it comes to PNC Bank ABA numbers.

What Exactly is an ABA Number?

First things first, let's clarify what an ABA number really is. The ABA number, also known as the routing transit number (RTN), is a 9-digit code assigned to banks and financial institutions in the United States. It’s used to facilitate the processing of checks, electronic payments, and other financial transactions. Without it, your money would be lost in the vast world of banking systems.

Here’s a fun fact: the ABA number was first introduced back in 1910 by the American Bankers Association (hence the name). Since then, it has become a standard part of banking operations. PNC Bank, like every other bank, uses ABA numbers to ensure smooth transactions for its customers.

Why Do You Need a PNC Bank ABA Number?

So, why should you care about the PNC Bank ABA number? Well, it plays a vital role in various banking activities. Here are a few scenarios where you’ll need it:

- Direct Deposits: If you want your employer to deposit your salary directly into your PNC account, they’ll need the correct ABA number.

- Wire Transfers: Sending or receiving money internationally? The ABA number is a must-have for wire transfers.

- Bill Payments: Setting up automatic bill payments requires the ABA number to ensure the payment goes through without issues.

- Internal Transfers: Moving funds between different accounts within PNC Bank? Yep, the ABA number comes into play here too.

See? It’s not just some random number; it’s essential for keeping your financial life running smoothly.

How to Find Your PNC Bank ABA Number

Finding your PNC Bank ABA number isn’t as complicated as it sounds. There are several ways to locate it, and we’ve got you covered with all the methods:

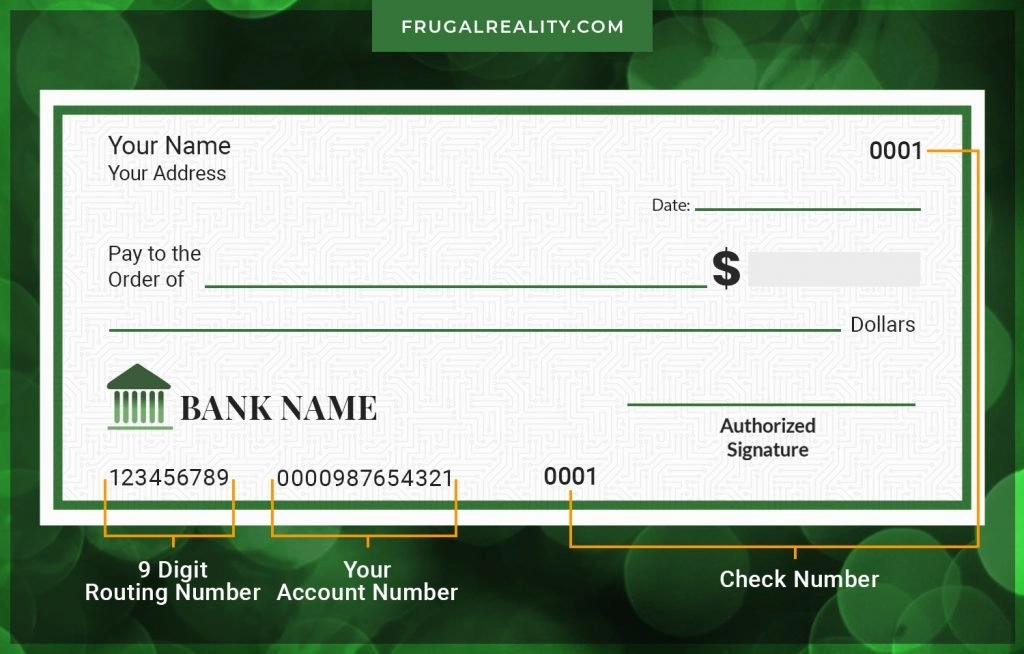

Check Your Checks

One of the easiest ways to find your ABA number is by looking at your personal checks. The 9-digit number at the bottom-left corner of the check is your ABA routing number. Simple, right?

Online Banking

If you’re a digital enthusiast, you can log in to your PNC Bank online account and find the ABA number in the account details section. It’s usually listed under the account information tab.

Call Customer Service

Still can’t find it? Don’t worry. Give PNC Bank’s customer service a call, and they’ll be happy to provide you with the correct ABA number for your account. Just make sure you have your account details ready for verification.

Understanding PNC Bank’s ABA Number Structure

Let’s break down the structure of a PNC Bank ABA number so you can understand how it works. The 9-digit code is divided into specific sections:

- First Four Digits: Represent the Federal Reserve routing symbol.

- Next Four Digits: Identify the bank or financial institution.

- Last Digit: Acts as a check digit to verify the accuracy of the routing number.

This structure ensures that each ABA number is unique and can be easily identified by banking systems.

Regional Differences in PNC Bank ABA Numbers

It’s worth noting that PNC Bank has different ABA numbers based on the region where your account was opened. For example, accounts opened in Pennsylvania might have a different ABA number compared to those opened in Ohio. Always double-check to ensure you’re using the correct number for your specific account.

Common Misconceptions About ABA Numbers

There are a few myths and misconceptions floating around about ABA numbers. Let’s clear them up:

- ABA Numbers Never Change: Actually, they can change if the bank undergoes mergers or acquisitions.

- All Banks Have the Same ABA Number: Nope, each bank has its own unique set of ABA numbers.

- ABA Numbers Are Only for Checks: Wrong! They’re used for a variety of transactions, including online payments and transfers.

Now that we’ve busted these myths, you’re better equipped to navigate the world of ABA numbers.

Tips for Using PNC Bank ABA Numbers Safely

Security is key when it comes to sharing your ABA number. Here are some tips to keep your information safe:

- Verify Recipients: Always confirm the recipient’s details before sharing your ABA number for a transaction.

- Use Secure Channels: Avoid sharing your ABA number over unsecured networks or platforms.

- Monitor Transactions: Keep an eye on your account activity to ensure all transactions are legitimate.

By following these precautions, you can minimize the risk of fraud and protect your financial information.

What Happens if You Use the Wrong ABA Number?

Using the wrong ABA number can lead to delays or even failed transactions. If you accidentally provide an incorrect number, the funds might get sent to the wrong account or get stuck in limbo. That’s why it’s crucial to double-check the number before initiating any transaction.

ABA Numbers vs. SWIFT Codes

While we’re on the topic, let’s address the difference between ABA numbers and SWIFT codes. Both are used for transferring money, but they serve different purposes:

- ABA Numbers: Used for domestic transactions within the United States.

- SWIFT Codes: Used for international transactions between banks in different countries.

So, if you’re sending money overseas, you’ll need a SWIFT code instead of an ABA number.

When to Use Each?

Here’s a quick guide:

- Domestic Transfers: Use your PNC Bank ABA number.

- International Transfers: Use PNC Bank’s SWIFT code, which is PNCCUS33.

Simple, right?

How Technology is Revolutionizing ABA Numbers

With advancements in technology, the use of ABA numbers is evolving. Many banks, including PNC, are integrating digital solutions to make transactions faster and more secure. Features like mobile banking apps and online payment platforms are making it easier than ever to manage your finances.

For instance, PNC Virtual Wallet allows you to initiate transfers and payments directly from your smartphone, using the ABA number to ensure accuracy and security.

The Future of Banking

As we move towards a more digital-first world, the role of ABA numbers may shift. However, for now, they remain a crucial component of the banking system. Staying informed about how to use them effectively will keep you ahead of the curve.

Conclusion: Take Control of Your Finances

In summary, understanding your PNC Bank ABA number is essential for managing your financial transactions smoothly. From setting up direct deposits to transferring funds, knowing the right ABA number ensures your money reaches its destination without any hiccups.

So, take a moment to locate your ABA number and keep it handy for whenever you need it. And remember, if you ever have doubts or questions, don’t hesitate to reach out to PNC Bank’s customer service for assistance.

Now that you’re armed with this knowledge, it’s time to put it into action. Whether you’re setting up automatic payments or sending money to a friend, you’re ready to tackle it like a pro. Share this guide with others who might find it useful, and let’s spread the word about the importance of ABA numbers.

Thanks for reading, and happy banking!

Table of Contents

- PNC Bank ABA Number: Your Ultimate Guide to Seamless Transactions

- What Exactly is an ABA Number?

- Why Do You Need a PNC Bank ABA Number?

- How to Find Your PNC Bank ABA Number

- Check Your Checks

- Online Banking

- Call Customer Service

- Understanding PNC Bank’s ABA Number Structure

- Regional Differences in PNC Bank ABA Numbers

- Common Misconceptions About ABA Numbers

- Tips for Using PNC Bank ABA Numbers Safely

- What Happens if You Use the Wrong ABA Number?

- ABA Numbers vs. SWIFT Codes

- When to Use Each?

- How Technology is Revolutionizing ABA Numbers

- The Future of Banking

- Conclusion: Take Control of Your Finances