PNC Bank Routing Number NJ: The Ultimate Guide To Managing Your Finances Like A Pro

Let’s talk about something that might sound boring at first, but trust me, it’s super important – PNC Bank Routing Number NJ. If you’ve ever tried to set up direct deposits, pay bills online, or transfer money between accounts, you know how crucial this little number is. Think of it like the zip code for your bank – without it, your money could end up lost in cyberspace. So, let’s dive into everything you need to know about PNC Bank routing numbers in New Jersey and make sure your finances are always on track.

Now, I get it – banking jargon can be confusing. But don’t worry, we’re going to break it down in a way that makes sense. Whether you’re a new PNC Bank customer or just need a refresher, this guide will cover everything from what a routing number is to how you can find yours quickly and easily.

And hey, who doesn’t love saving time and avoiding headaches? By the end of this article, you’ll be a pro at navigating PNC Bank’s routing numbers in New Jersey. Let’s get started!

What is a PNC Bank Routing Number NJ and Why Does It Matter?

Alright, let’s start with the basics. A PNC Bank routing number is a nine-digit code that identifies your specific PNC Bank branch. It’s kind of like a fingerprint for your bank – no two are exactly the same. In New Jersey, PNC Bank uses several different routing numbers depending on the type of transaction you’re making and the location of your account.

But why does it matter? Well, without the right routing number, your transactions might not go through. Whether you’re setting up direct deposit for your paycheck, paying bills online, or transferring funds between accounts, having the correct routing number ensures your money gets where it needs to be. It’s one of those little details that can make a big difference in your financial life.

How to Find Your PNC Bank Routing Number NJ

Finding your PNC Bank routing number is easier than you think. Here are a few quick ways to locate it:

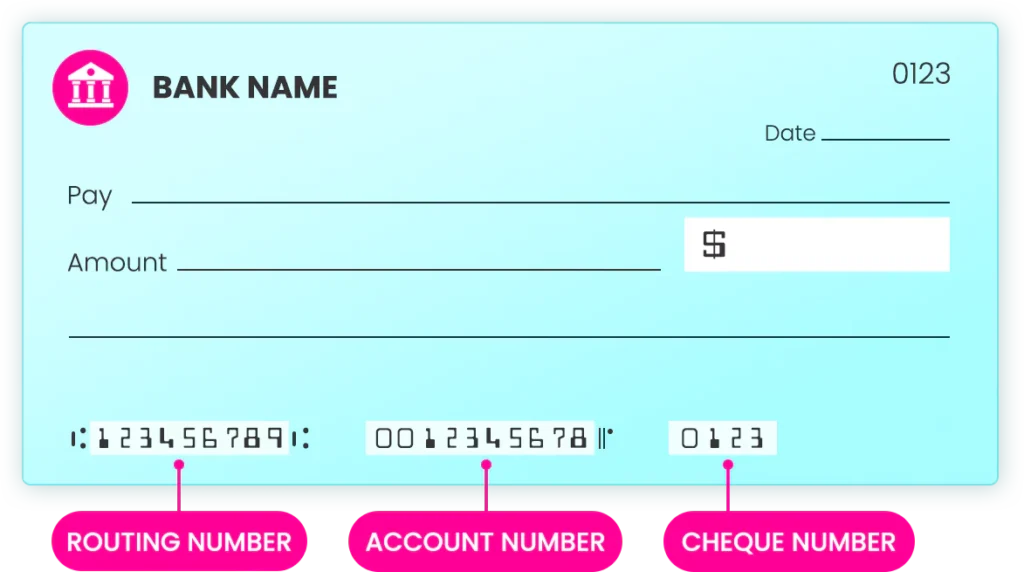

- Check your checks – the routing number is usually printed at the bottom of your checks, on the left side.

- Log in to your PNC Bank online account – your routing number should be listed under account information.

- Call PNC Bank customer service – they can provide you with the correct routing number for your account.

- Visit the PNC Bank website – they often have a handy tool to help you find your routing number based on your location and account type.

Remember, PNC Bank uses different routing numbers for different types of transactions, so make sure you’re using the right one for your needs.

Understanding the Different Types of PNC Bank Routing Numbers in NJ

Here’s where things can get a little tricky – PNC Bank actually has multiple routing numbers for accounts in New Jersey. The routing number you use depends on what you’re trying to do. For example:

Wire Transfers: If you’re sending or receiving money through a wire transfer, you’ll need to use a specific routing number for that purpose. This number is different from the one used for ACH transfers or direct deposits.

ACH Transfers: For electronic payments and transfers, such as direct deposits or bill payments, you’ll use a different routing number. This is the one you’ll most likely use for day-to-day transactions.

International Transactions: If you’re dealing with international transfers, you might need a SWIFT code in addition to a routing number. PNC Bank provides these codes for their customers who need to send money overseas.

Common Mistakes to Avoid When Using PNC Bank Routing Numbers

Now that you know the basics, let’s talk about some common mistakes people make when using PNC Bank routing numbers. These errors might seem small, but they can cause big problems:

- Using the wrong routing number for the type of transaction – double-check that you’re using the correct number for wire transfers, ACH transfers, or international payments.

- Typing the number incorrectly – those nine digits need to be exact, so take your time when entering them.

- Not verifying the number – if you’re unsure, it’s always a good idea to confirm the routing number with PNC Bank customer service before proceeding with any transactions.

By avoiding these mistakes, you can ensure that your transactions go smoothly and your money gets where it needs to be.

Why PNC Bank Routing Numbers Are Essential for Financial Management

Let’s talk about why PNC Bank routing numbers are so important in managing your finances. Whether you’re a small business owner or just trying to keep your personal finances in order, having the right routing number can save you time, money, and headaches. Here are a few reasons why:

Efficient Transactions: With the correct routing number, your transactions will process faster and more accurately. This is especially important for things like direct deposits, where you want your paycheck to hit your account as soon as possible.

Security: Using the right routing number helps protect your account from fraud. If someone tries to use the wrong number, the transaction will be flagged and potentially stopped, keeping your money safe.

Convenience: In today’s digital world, having the ability to manage your finances online is a game-changer. Knowing your PNC Bank routing number allows you to take full advantage of online banking features, like setting up automatic bill payments and transferring funds between accounts.

How PNC Bank Routing Numbers Impact Your Daily Life

Let’s break it down even further – here are some real-life scenarios where knowing your PNC Bank routing number can make a big difference:

- Direct Deposits: If you’re setting up direct deposit for your paycheck, having the right routing number ensures your money gets deposited into your account on time.

- Bill Payments: Whether you’re paying your mortgage, utilities, or credit card bills online, the correct routing number ensures your payments are processed correctly.

- Transfers: If you need to transfer money to another account or person, the routing number helps ensure the funds reach their destination without any issues.

These might seem like small details, but they can have a big impact on your daily life. By understanding and using your PNC Bank routing number correctly, you can streamline your financial transactions and avoid unnecessary delays or errors.

Tips for Keeping Your PNC Bank Routing Number Safe

Now that you know how important your PNC Bank routing number is, let’s talk about how to keep it safe. While it’s not as sensitive as your account number or Social Security number, it’s still a piece of information that should be protected. Here are a few tips:

- Don’t Share It Unnecessarily: Only provide your routing number to trusted sources, such as your employer for direct deposit or your utility company for bill payments.

- Be Wary of Phishing Scams: If someone contacts you asking for your routing number, be cautious. Legitimate companies will never ask for this information via email or text.

- Use Secure Connections: When entering your routing number online, make sure you’re using a secure connection. Look for the padlock icon in your browser’s address bar to ensure the site is safe.

By following these tips, you can help protect your PNC Bank routing number and keep your financial information safe from potential threats.

How to Verify Your PNC Bank Routing Number

Before you use your PNC Bank routing number for any transactions, it’s always a good idea to verify it. Here’s how you can do that:

- Check Your Checks: As we mentioned earlier, the routing number is printed on the bottom of your checks. Double-check that the number matches what you’re entering online.

- Log In to Your Account: Your online PNC Bank account should list your routing number under account information. Compare it to what you have to ensure accuracy.

- Call Customer Service: If you’re still unsure, give PNC Bank customer service a call. They can confirm your routing number and provide any additional information you might need.

Verifying your routing number is a quick and easy step that can save you a lot of trouble down the road.

Conclusion: Mastering Your PNC Bank Routing Number NJ

So there you have it – everything you need to know about PNC Bank routing numbers in New Jersey. From understanding what they are to finding and using them correctly, you’re now equipped with the knowledge to manage your finances like a pro.

Remember, the key to successful financial management is attention to detail. By knowing your PNC Bank routing number and using it correctly, you can ensure that your transactions go smoothly and your money is always where it needs to be.

Now it’s your turn – take what you’ve learned and put it into action. Whether you’re setting up direct deposit, paying bills online, or transferring funds, your PNC Bank routing number is your key to financial success. And don’t forget to share this article with your friends and family – the more people who understand their routing numbers, the better off we all are.

Table of Contents

- PNC Bank Routing Number NJ: The Ultimate Guide to Managing Your Finances Like a Pro

- What is a PNC Bank Routing Number NJ and Why Does It Matter?

- How to Find Your PNC Bank Routing Number NJ

- Understanding the Different Types of PNC Bank Routing Numbers in NJ

- Common Mistakes to Avoid When Using PNC Bank Routing Numbers

- Why PNC Bank Routing Numbers Are Essential for Financial Management

- How PNC Bank Routing Numbers Impact Your Daily Life

- Tips for Keeping Your PNC Bank Routing Number Safe

- How to Verify Your PNC Bank Routing Number

- Conclusion: Mastering Your PNC Bank Routing Number NJ

Stay informed, stay safe, and keep your finances in check. You’ve got this!

![Your PNC Bank Routing Number [Revealed!]](https://theblissfulbudget.com/wp-content/uploads/2022/09/pnc-bank-routing-number.jpg)