Routing Number For Pnc Bank: A Comprehensive Guide To Simplify Your Banking

Imagine this—you're sitting at your desk, ready to set up a direct deposit or send money to a friend, but suddenly you’re stuck. What’s the routing number for PNC Bank? If you’ve ever found yourself scratching your head over this, don’t worry, you’re not alone. Routing numbers are like secret codes that banks use to ensure your money gets to the right place. But let’s face it, figuring out which number to use can feel like solving a riddle.

Whether you’re new to banking or just trying to make sure you’ve got the right digits, having the correct routing number is crucial. It’s like the zip code for your bank account, making sure every transaction lands where it needs to go. In this guide, we’ll break it all down for you so you can stop stressing and start sending.

So buckle up, because we’re diving deep into the world of routing numbers for PNC Bank. By the end of this, you’ll be a pro at navigating this often-confusing aspect of banking. No more awkward phone calls or frantic Google searches—just clear, straightforward answers.

What is a Routing Number Anyway?

Alright, let’s start with the basics. A routing number is basically a nine-digit code that banks use to identify themselves during transactions. Think of it as a digital fingerprint for your bank. Without it, your money could end up floating around cyberspace forever—or worse, in the wrong account.

Now, here’s the kicker: not all routing numbers are created equal. Depending on where you live or what type of transaction you’re making, the number you need might differ. For PNC Bank, there’s a whole list of routing numbers based on location and purpose. Sounds complicated? Don’t sweat it—we’re about to untangle the mess for you.

Why Do You Need a Routing Number?

Let’s break it down real quick. You’ll need a routing number for just about anything that involves moving money in or out of your account. Setting up direct deposits? Check. Paying bills online? Check. Sending funds to another person? Double check. Without the right routing number, your transaction could get delayed—or worse, rejected altogether.

Here’s a quick rundown of common scenarios where you’ll need that magical nine-digit code:

- Direct deposits from your employer

- Bill payments through online services

- Transfers between accounts at different banks

- Check processing

- Wire transfers

See? It’s everywhere. So yeah, knowing your routing number is kind of a big deal.

Routing Number for PNC Bank: The Breakdown

Now that we’ve got the basics covered, let’s talk specifics. PNC Bank uses different routing numbers depending on where you’re located and what you’re trying to do. Yeah, it’s a little confusing, but once you get the hang of it, it’s no sweat.

For most PNC Bank customers in the U.S., the primary routing number is **043000096**. This is the one you’ll likely use for most transactions, especially if you’re setting up direct deposits or paying bills online. But here’s the thing—this number might not work for everyone. If you live in certain states or are making a wire transfer, you’ll need to double-check the exact number for your situation.

State-Specific Routing Numbers

Here’s where things get a little more complicated. PNC Bank has specific routing numbers for certain states. Why? Because banking rules can vary depending on where you are. For example, if you’re in Pennsylvania, you’ll use a different number than someone in Ohio. Crazy, right?

Let’s break it down by state:

- Pennsylvania: 031000093

- Ohio: 041001039

- Illinois: 071000510

- Florida: 063101970

And the list goes on. If you’re unsure which number applies to you, don’t panic. Just give PNC Bank a call or check your bank statements—they’ll have the info you need.

How to Find Your Routing Number

So, now you know that there are multiple routing numbers for PNC Bank. But how do you figure out which one is yours? Lucky for you, there are a few easy ways to find it:

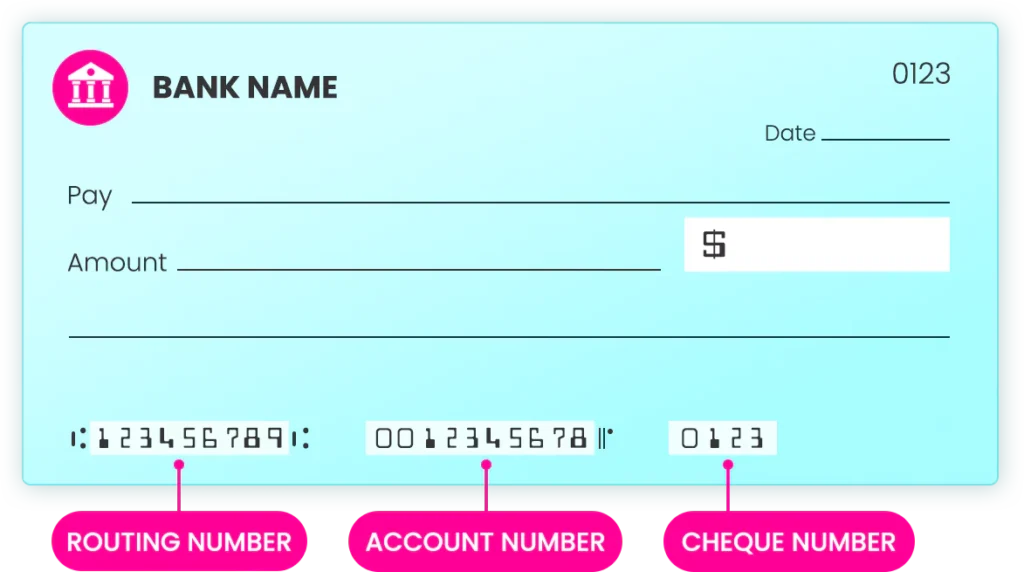

1. Check Your Checks

Believe it or not, your checks are like little treasure maps for your routing number. Flip one over and look at the bottom. See that nine-digit code on the left? That’s your routing number. Easy peasy.

2. Log In to Your Online Account

If you’re into digital banking (and let’s face it, who isn’t these days?), you can find your routing number right in your online account. Just log in, head over to the account details section, and voila—it’s right there waiting for you.

3. Call Customer Service

Still stuck? No worries. PNC Bank’s customer service team is standing by to help. Give them a call, and they’ll walk you through everything you need to know. Plus, you might even get a free laugh line while you’re at it.

Understanding Wire Transfers

Wire transfers are a bit different from regular transactions. Instead of using the standard routing number, you’ll need a special wire transfer number. For PNC Bank, the wire transfer routing number is **043000096** for domestic transfers and **026009593** for international transfers.

Why the difference? Well, wire transfers are usually larger transactions, so banks need extra security measures to make sure everything’s legit. Just remember to double-check the number before hitting send—you don’t want your money ending up in the wrong hands.

Tips for Wire Transfers

Here are a few quick tips to keep in mind when making a wire transfer:

- Always verify the recipient’s account information

- Double-check the routing number before submitting

- Keep a record of the transaction details

Trust us, these little steps can save you a lot of hassle down the road.

Common Mistakes to Avoid

Alright, here’s where we talk about the pitfalls. Even the best of us can make mistakes when dealing with routing numbers. But don’t worry—we’ve got your back. Here are some common errors to avoid:

1. Using the Wrong Number

This one’s a no-brainer, but it happens more often than you’d think. Make sure you’re using the correct routing number for your location and transaction type. Mixing them up can lead to delays or even rejected transactions.

2. Forgetting to Include It

Another rookie mistake? Forgetting to include the routing number altogether. Whether you’re setting up direct deposit or sending a wire transfer, leaving out this crucial piece of info can cause big problems.

3. Typing It Wrong

Nine digits might not seem like a lot, but one tiny typo can throw everything off. Take your time when entering the number, and double-check it before submitting.

Why Trust PNC Bank?

When it comes to banking, trust is everything. PNC Bank has been around since 1852, so they know a thing or two about keeping your money safe. With their state-of-the-art security measures and customer-focused approach, you can rest easy knowing your finances are in good hands.

Plus, their customer service team is top-notch. Whether you’re trying to figure out a routing number or need help with something more complex, they’re always ready to lend a helping hand.

PNC Bank’s Commitment to Security

PNC Bank takes security seriously. They use advanced encryption technology to protect your personal and financial information. And with their fraud detection tools, you can be confident that your accounts are being monitored for suspicious activity.

Final Thoughts

So there you have it—everything you need to know about routing numbers for PNC Bank. Whether you’re setting up direct deposits, making wire transfers, or just trying to keep your finances in order, having the right routing number is key.

Remember, if you’re ever unsure about which number to use, don’t hesitate to reach out to PNC Bank’s customer service team. They’re there to help, and they’ll make sure you’ve got all the info you need to keep your money moving smoothly.

And hey, if you found this guide helpful, don’t forget to share it with your friends. Knowledge is power, and who knows—maybe you’ll save someone else from a routing number headache.

Table of Contents

What is a Routing Number Anyway?

Why Do You Need a Routing Number?

Routing Number for PNC Bank: The Breakdown

State-Specific Routing Numbers

How to Find Your Routing Number