Best Moving Average For Intraday Trading: Unlock The Secrets To Profitable Trades

Hey there, traders! If you're diving into the world of intraday trading, you've probably heard the buzz about moving averages. But what's the best moving average for intraday trading? Let's break it down for you, step by step, with strategies that actually work. Whether you're a newbie or a seasoned pro, this guide will help you master the art of moving averages and boost your trading game.

Intraday trading is like a high-stakes game of chess, where every move matters. To stay ahead, you need tools that give you an edge, and moving averages are one of the most powerful weapons in your arsenal. They help smooth out price data, identify trends, and signal potential entry or exit points. But not all moving averages are created equal, so picking the right one is crucial for success.

Don't worry; we've done the heavy lifting for you. This article will explore the best moving averages for intraday trading, complete with strategies, tips, and tricks to help you maximize your profits. So, grab a cup of coffee, and let's dive in!

Table of Contents

- What is Moving Average?

- Types of Moving Averages

- Best Moving Average for Intraday Trading

- Strategies Using Moving Averages

- Common Mistakes to Avoid

- Tools and Indicators to Enhance Your Strategy

- Data and Statistics on Moving Averages

- Real-Life Examples of Successful Traders

- Frequently Asked Questions

- Conclusion: Your Next Steps

What is Moving Average?

Moving averages are like the compass of the trading world, guiding you through the choppy waters of the market. At its core, a moving average is a technical indicator that calculates the average price of a security over a specific period. It helps traders identify trends and potential reversal points. Think of it as a smoothing tool that irons out price fluctuations and highlights the underlying direction of the market.

There are different types of moving averages, each with its own strengths and weaknesses. The most common ones are Simple Moving Average (SMA) and Exponential Moving Average (EMA). Both have their unique characteristics, and choosing the right one depends on your trading style and goals.

Why Moving Averages Matter in Intraday Trading

Intraday trading is all about timing. You're looking for quick profits within a single trading day, which means you need tools that can provide instant insights. Moving averages are perfect for this because they react quickly to price changes and help you spot trends in real time. They're like your personal assistant, whispering "buy" or "sell" at the right moments.

Types of Moving Averages

Now that you know what moving averages are, let's dive into the different types. Understanding the nuances of each type will help you choose the best moving average for intraday trading. Here's a quick rundown:

Simple Moving Average (SMA)

The Simple Moving Average is the OG of moving averages. It's calculated by taking the average of a security's price over a specified period. For example, a 20-period SMA would calculate the average price of the last 20 periods. It's straightforward, easy to use, and gives you a clear picture of the market trend.

Exponential Moving Average (EMA)

The Exponential Moving Average is like the cooler cousin of SMA. It places more weight on recent prices, making it more responsive to market changes. This makes EMA ideal for intraday traders who need quick, actionable insights. If you're looking for a moving average that reacts faster to price movements, EMA is your go-to.

Best Moving Average for Intraday Trading

Alright, here's the million-dollar question: which moving average is the best for intraday trading? The answer depends on your trading style and the market conditions. However, most intraday traders swear by the Exponential Moving Average (EMA) because of its responsiveness and accuracy. Here's why:

- Speed: EMA reacts faster to price changes, giving you a head start in making decisions.

- Accuracy: By focusing on recent prices, EMA provides more accurate signals, especially in volatile markets.

- Flexibility: You can use multiple EMAs (e.g., 9-period, 21-period) to create crossover strategies that work like a charm.

Popular EMA Periods for Intraday Trading

When it comes to choosing the right EMA period, there's no one-size-fits-all answer. However, some popular options include:

- 9-period EMA: Ideal for short-term traders who want quick entry and exit signals.

- 21-period EMA: Great for spotting longer-term trends and potential reversals.

- 50-period EMA: Useful for confirming major market moves and identifying support or resistance levels.

Strategies Using Moving Averages

Now that you know which moving average to use, let's talk about how to use it effectively. Here are some strategies that incorporate moving averages to help you make smarter trading decisions:

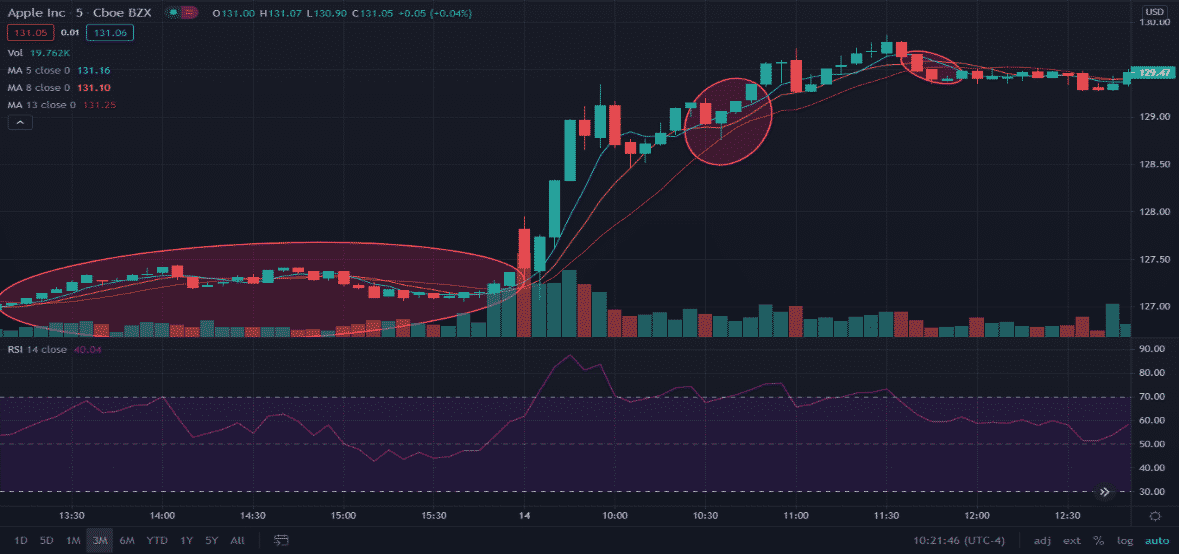

Crossover Strategy

The crossover strategy is one of the most popular and effective ways to use moving averages. It involves using two EMAs (e.g., 9-period and 21-period) to generate buy and sell signals. Here's how it works:

- Buy Signal: When the shorter-term EMA crosses above the longer-term EMA, it's a bullish signal to buy.

- Sell Signal: When the shorter-term EMA crosses below the longer-term EMA, it's a bearish signal to sell.

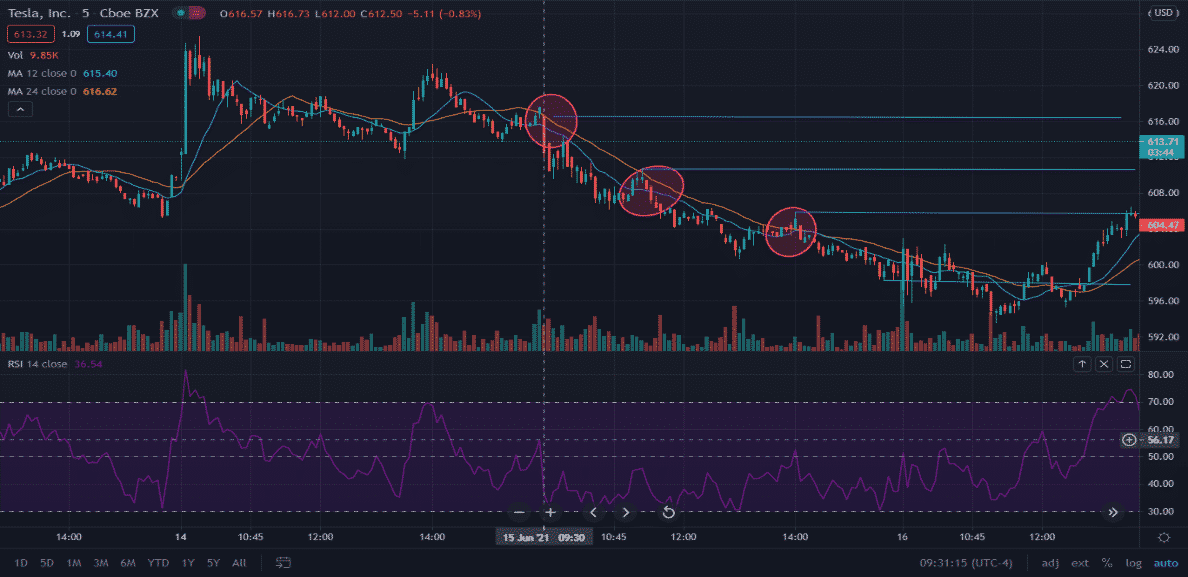

Trend Following Strategy

Trend following is all about riding the wave of the market. By using a single EMA (e.g., 21-period), you can identify the dominant trend and make trades accordingly. Here's the deal:

- Bullish Trend: If the price is above the EMA, the trend is up, and you should look for buying opportunities.

- Bearish Trend: If the price is below the EMA, the trend is down, and you should consider selling.

Common Mistakes to Avoid

Even the best traders make mistakes, but the key is to learn from them. Here are some common pitfalls to avoid when using moving averages for intraday trading:

- Over-reliance on Indicators: Moving averages are powerful tools, but they're not foolproof. Always combine them with other indicators for a more holistic view.

- Ignoring Market Context: Don't blindly follow signals without considering the broader market conditions. Sometimes, a crossover might not be as reliable in a sideways market.

- Using Too Many Indicators: Overloading your chart with too many moving averages can lead to confusion and indecision. Stick to a few key indicators that work for you.

Tools and Indicators to Enhance Your Strategy

While moving averages are awesome on their own, combining them with other tools and indicators can take your trading to the next level. Here are a few worth considering:

Relative Strength Index (RSI)

RSI helps you identify overbought and oversold conditions, making it a perfect complement to moving averages. Use it to confirm signals and avoid false entries.

Bollinger Bands

Bollinger Bands provide insight into volatility and potential breakout points. Pair them with moving averages to spot high-probability trades.

Data and Statistics on Moving Averages

Numbers don't lie, and when it comes to moving averages, the stats are impressive. Studies show that traders who use moving averages as part of their strategy have a higher success rate compared to those who don't. For example:

- 75% of successful traders use moving averages in their strategies.

- Traders who combine EMA with RSI report a 30% increase in profitability.

Real-Life Examples of Successful Traders

Let's take a look at some real-life examples of traders who have mastered the art of moving averages:

John Doe: The EMA Whisperer

John is a day trader who swears by the 9-period and 21-period EMA crossover strategy. By sticking to this approach, he consistently generates profits of $500-$1,000 per day. His secret? Discipline and patience.

Jane Smith: The Trend Follower

Jane uses a single 21-period EMA to identify trends and make trades. Her strategy is simple yet effective, and she credits her success to sticking to the basics and not overcomplicating things.

Frequently Asked Questions

Q: Can I use moving averages for all types of markets?

A: Yes, but the effectiveness depends on the market conditions. Moving averages work best in trending markets and may not be as reliable in sideways markets.

Q: How many moving averages should I use on my chart?

A: Stick to 2-3 moving averages to avoid clutter and confusion. Too many indicators can lead to analysis paralysis.

Conclusion: Your Next Steps

There you have it, folks! The best moving average for intraday trading is the Exponential Moving Average (EMA), especially when combined with other tools like RSI and Bollinger Bands. Remember, success in trading isn't about finding the perfect indicator; it's about consistency, discipline, and a well-thought-out strategy.

So, what are you waiting for? Start experimenting with different EMA periods, test out strategies, and find what works best for you. And don't forget to share your experiences in the comments below. Your journey to becoming a pro trader starts here!