Best Time Frames For Swing Trading: Unlock The Secrets Of Profitable Trades

Swing trading is a powerful strategy that lets you ride market trends while minimizing risk. Whether you're a beginner or an experienced trader, choosing the right time frames can make all the difference. In this article, we'll dive deep into the world of swing trading and uncover the best time frames to supercharge your trading success. So, buckle up and let's get started!

Swing trading has become a go-to strategy for traders who want to capture short-term price movements without the stress of day trading. But here's the thing – not all time frames are created equal. Picking the wrong one can lead to missed opportunities or unnecessary risks. That's why understanding the best time frames for swing trading is crucial if you want to stay ahead of the game.

Throughout this article, we'll explore the ins and outs of swing trading time frames, backed by real-world examples and expert insights. You'll learn how to align your trading strategy with market conditions, identify optimal entry and exit points, and build a profitable trading plan. So, whether you're trading stocks, forex, or cryptocurrencies, this guide has got you covered.

What Exactly is Swing Trading?

Before we dive into the best time frames for swing trading, let's break down what swing trading actually is. Swing trading is all about capturing price movements over a few days to several weeks. Unlike day trading, where positions are closed within a single day, swing traders aim to ride the market's natural swings for bigger profits. It's like surfing – you want to catch the right wave at the right time!

One of the key advantages of swing trading is flexibility. You don't need to be glued to your screen 24/7, making it ideal for part-time traders. Plus, it allows you to take advantage of larger price movements, which can lead to more substantial gains. But to make the most of it, you need to know when to jump in and when to bail out. That's where time frames come into play.

Why Time Frames Matter in Swing Trading

Choosing the right time frame is like picking the perfect lens for your camera. It determines how you view the market and can significantly impact your trading decisions. Different time frames offer different perspectives on price action, trends, and volatility. For swing traders, finding the sweet spot between too short and too long is essential.

Too short, and you might get caught up in market noise. Too long, and you could miss out on juicy trading opportunities. The key is to strike a balance that aligns with your trading style and objectives. By selecting the best time frames for swing trading, you can filter out unnecessary distractions and focus on high-probability setups.

Top Time Frames for Swing Trading Success

Now, let's get down to business and explore the top time frames that work best for swing trading. These time frames have been tested and proven by seasoned traders across various markets. So, whether you're trading stocks, forex, or crypto, these insights will help you refine your strategy.

Daily Time Frame (D1)

The daily time frame is a favorite among swing traders for good reason. It provides a clear picture of the market's overall trend while still offering enough detail to spot entry and exit points. Many traders use the daily chart as their primary time frame and refer to higher or lower time frames for confirmation.

Here are some key advantages of the daily time frame:

- Reduces market noise, making it easier to identify trends

- Allows for better risk management with wider stop-loss distances

- Perfect for traders who want to hold positions for several days

4-Hour Time Frame (H4)

Next up is the 4-hour time frame, which strikes a balance between the daily and lower time frames. It's ideal for traders who want more frequent trading opportunities without getting bogged down by short-term fluctuations. The 4-hour chart is especially useful for identifying key support and resistance levels.

Why traders love the 4-hour time frame:

- Offers detailed insights into intraday price action

- Helps confirm trends seen on the daily chart

- Perfect for shorter-term swing trades lasting 1-3 days

Combining Multiple Time Frames for Maximum Profit

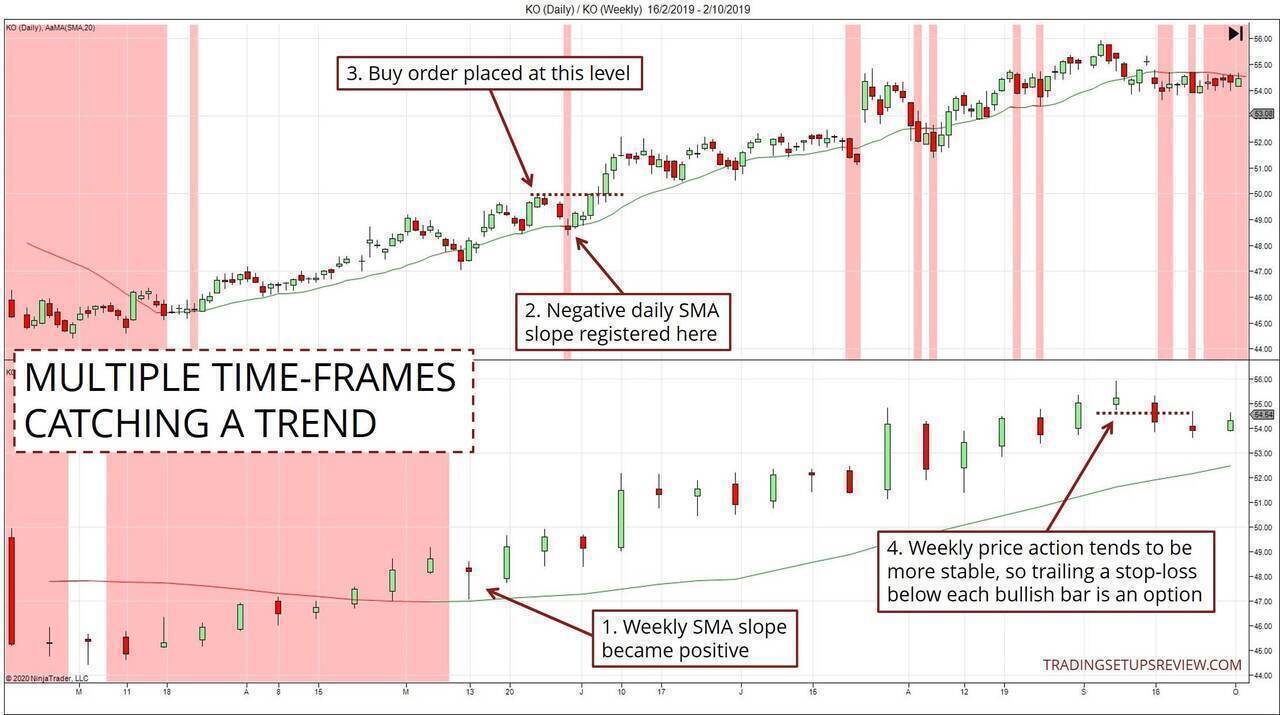

While individual time frames have their strengths, combining multiple time frames can take your swing trading to the next level. This approach, known as multi-timeframe analysis, allows you to zoom in and out of the market to gain a comprehensive view. Think of it like using a telescope and a microscope at the same time – you get the big picture and the fine details.

Here's how you can use multiple time frames in your swing trading:

- Use the weekly (W1) chart to identify long-term trends

- Refer to the daily (D1) chart for entry and exit points

- Use the 4-hour (H4) chart to fine-tune your trades

By aligning your trades across multiple time frames, you can increase your confidence in high-probability setups and reduce the risk of false signals.

Factors to Consider When Choosing Time Frames

Not all markets behave the same way, which means the best time frames for swing trading can vary depending on several factors. Let's take a look at some of the key considerations:

Market Volatility

Volatility plays a huge role in determining the optimal time frames for swing trading. Highly volatile markets may require shorter time frames to capture quick price movements, while less volatile markets might benefit from longer time frames to avoid unnecessary noise.

Trading Instrument

Different instruments have different characteristics that influence time frame selection. For example, forex pairs like EUR/USD tend to be more liquid and less volatile than smaller stocks or cryptocurrencies. This means you might need to adjust your time frames accordingly.

Trading Style

Your personal trading style also matters. Are you a patient trader who prefers to hold positions for several days? Or do you like to jump in and out of trades more frequently? Your answers will guide you toward the best time frames for your approach.

Best Practices for Swing Trading

Now that you know the best time frames for swing trading, let's talk about some best practices to help you succeed. These tips are based on real-world experience and can make a big difference in your trading performance.

Set Clear Entry and Exit Rules

Having a well-defined trading plan is crucial for swing trading success. Know exactly where you'll enter and exit trades before you place them. This helps you avoid emotional decision-making and stick to your strategy.

Manage Risk Wisely

Risk management is the backbone of any profitable trading strategy. Always use stop-loss orders to limit potential losses, and never risk more than 1-2% of your account on a single trade. This way, even if a trade goes south, your account remains intact.

Stay Updated on Market News

Market-moving news can have a significant impact on your trades, so it's important to stay informed. Follow economic calendars, earnings reports, and geopolitical developments that could affect your trading instruments.

Common Mistakes to Avoid in Swing Trading

Even the best traders make mistakes, but learning from them can save you a lot of headaches. Here are some common pitfalls to watch out for:

Overtrading

Trading too frequently can lead to emotional decision-making and increased transaction costs. Stick to your trading plan and avoid the temptation to jump in and out of trades unnecessarily.

Ignoring Stop-Loss Orders

A stop-loss is your safety net, so don't ignore it when the market moves against you. Letting losing trades run can quickly wipe out your profits and damage your account.

Failing to Adapt

Markets are constantly changing, and what works today might not work tomorrow. Stay flexible and be willing to adjust your strategy as market conditions evolve.

Real-World Examples of Successful Swing Trades

To bring these concepts to life, let's look at some real-world examples of successful swing trades using the best time frames:

Example 1: Stock Market Swing Trade

Imagine you're trading a popular tech stock like Apple (AAPL). Using the daily time frame, you notice a strong uptrend with clear support and resistance levels. You enter a trade near support and set a stop-loss just below it. Over the next few days, the stock rallies, allowing you to exit with a solid profit.

Example 2: Forex Swing Trade

In the forex market, you spot a breakout on the EUR/USD pair on the 4-hour chart. The pair has broken above a key resistance level, signaling the start of a new uptrend. You enter the trade with a tight stop-loss and trail your profits as the trend continues.

Conclusion: Mastering the Best Time Frames for Swing Trading

Swing trading is a rewarding strategy that offers the perfect balance between risk and reward. By choosing the best time frames for swing trading, you can enhance your trading performance and increase your chances of success. Remember to align your time frames with your trading style, market conditions, and personal preferences.

So, what's next? Take action! Start experimenting with different time frames in your trading practice account. Test out the strategies we've discussed and see which ones work best for you. And don't forget to share your experiences in the comments below – we'd love to hear from you!

Finally, if you found this article helpful, be sure to check out our other guides on trading strategies, market analysis, and risk management. Knowledge is power, and the more you learn, the better equipped you'll be to succeed in the markets. Happy trading, and may the odds be ever in your favor!

Table of Contents

- Best Time Frames for Swing Trading

- What Exactly is Swing Trading?

- Why Time Frames Matter in Swing Trading

- Top Time Frames for Swing Trading Success

- Combining Multiple Time Frames for Maximum Profit

- Factors to Consider When Choosing Time Frames

- Best Practices for Swing Trading

- Common Mistakes to Avoid in Swing Trading

- Real-World Examples of Successful Swing Trades

- Conclusion: Mastering the Best Time Frames for Swing Trading