How To Understand Candlesticks: Your Ultimate Guide To Mastering The Art

Ever wondered why candlesticks look so mysterious and complicated? Well, let me tell ya, they ain't as scary as they seem. Candlestick charts are like the secret language of traders, and once you crack the code, you'll unlock a whole new world of market insights. Understanding candlesticks isn't just about reading charts; it's about learning how to interpret the emotions and behaviors of buyers and sellers in real time. So buckle up, because we're about to dive deep into the fascinating world of candlestick patterns and analysis.

Now, I know what you're thinking—“Do I really need to learn this?” The answer is a big fat YES. Candlesticks are one of the most powerful tools in a trader's arsenal. They provide a visual representation of price action, making it easier to spot trends, reversals, and key market moments. Whether you're trading stocks, forex, or cryptocurrencies, candlesticks can help you make smarter decisions.

But here's the thing—candlestick analysis isn't just for pros. Anyone can learn it, and with a little practice, you'll be reading charts like a pro in no time. So, let's break it down step by step and make sense of those wicks, bodies, and shadows. Ready to level up your trading game? Let's go!

Table of Contents

- What Are Candlesticks?

- Parts of a Candlestick

- Types of Candlestick Patterns

- How to Read Candlestick Charts

- Common Candlestick Patterns

- Importance of Candlesticks in Trading

- Candlestick Patterns in Action

- Tips for Mastering Candlesticks

- Common Mistakes to Avoid

- Conclusion

What Are Candlesticks?

Candlesticks are like little snapshots of the market's mood. Each candlestick represents a specific time period, whether it's a minute, an hour, a day, or even a week. They show you the opening price, closing price, highest price, and lowest price during that time frame. Think of them as little stories that tell you what happened in the market during that period.

But why are they called "candlesticks"? Well, they kinda look like candles with wicks, don't they? The main body of the candlestick shows the difference between the opening and closing prices, while the wicks (or shadows) represent the high and low prices. It's a pretty neat way to visualize price action, and traders have been using it for centuries.

Here's the cool part—candlesticks aren't just random shapes. They carry a ton of information about market sentiment. A long green candlestick, for example, might indicate strong buying pressure, while a long red candlestick could mean sellers are in control. By understanding these patterns, you can get a better sense of where the market might be headed.

Parts of a Candlestick

Let's break down the anatomy of a candlestick. Understanding its components is crucial if you want to read charts like a pro. Here's what you need to know:

- Body: The main part of the candlestick that shows the difference between the opening and closing prices. If the body is green (or white), it means the closing price was higher than the opening price. If it's red (or black), the closing price was lower.

- Wicks (or Shadows): The thin lines above and below the body that represent the highest and lowest prices during the period. Wicks can give you clues about volatility and market sentiment.

- Open and Close: The top and bottom of the body indicate where the price opened and closed during the period.

- High and Low: The tips of the wicks show the highest and lowest prices reached during the period.

Now that you know the parts, let's move on to the fun stuff—patterns!

Types of Candlestick Patterns

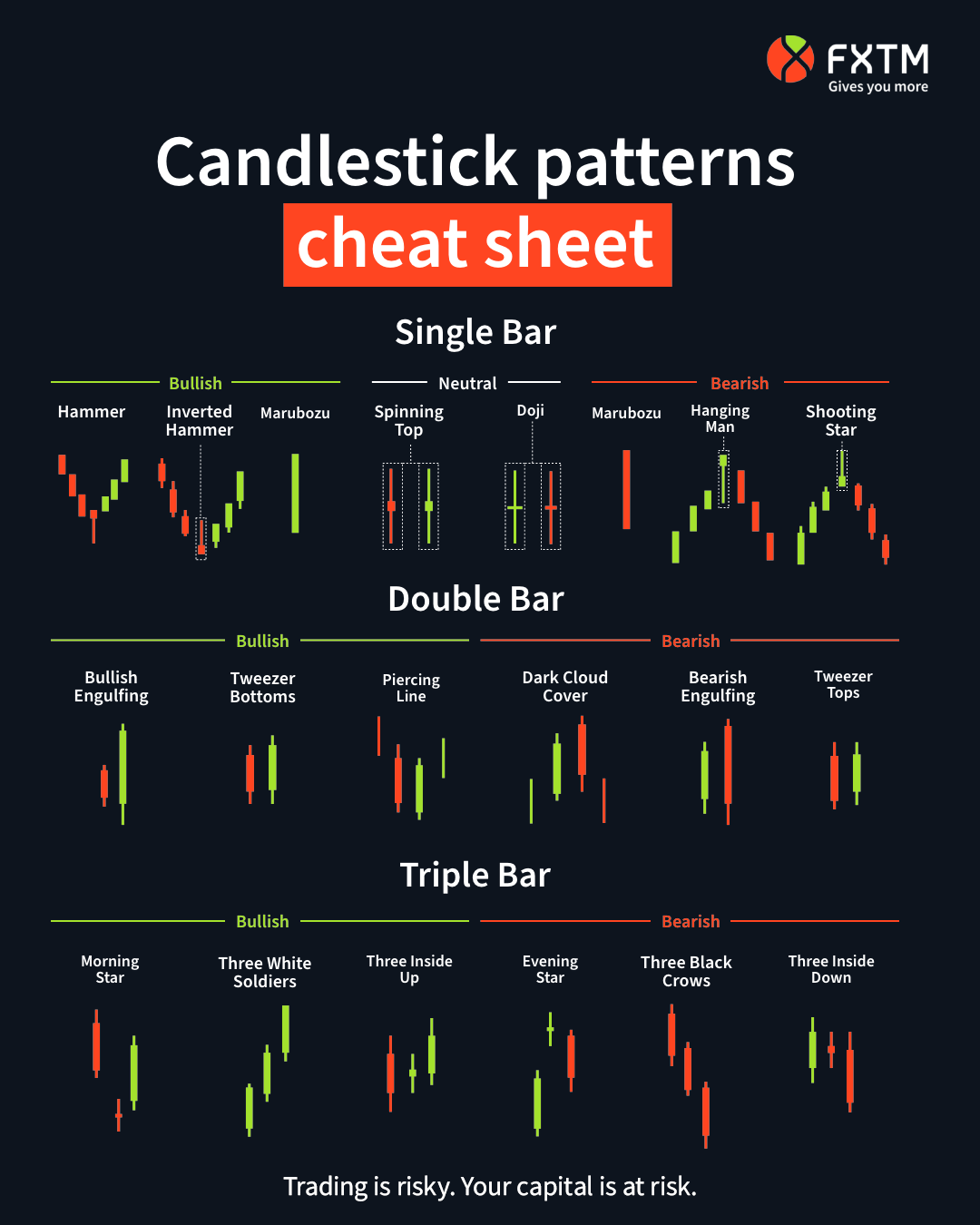

Single Candlestick Patterns

Single candlestick patterns are like solo acts—they tell you a lot about the market with just one candle. Here are a few common ones:

- Doji: A Doji is a candlestick where the opening and closing prices are almost the same, creating a tiny body. It often signals indecision in the market.

- Marubozu: A Marubozu has no wicks, meaning the opening or closing price was either the high or low of the period. It indicates strong buying or selling pressure.

- Spinning Tops: These candles have small bodies and long wicks, suggesting a battle between buyers and sellers.

Double Candlestick Patterns

When two candles come together, they can form some pretty powerful patterns. Here are a couple of examples:

- Bullish Engulfing: This pattern occurs when a large green candle completely engulfs a smaller red candle. It signals a potential reversal from bearish to bullish.

- Bearish Engulfing: The opposite of a bullish engulfing, this pattern suggests a shift from bullish to bearish.

How to Read Candlestick Charts

Reading candlestick charts is like learning a new language, but don't worry—it's not as hard as it seems. Here are some tips to help you get started:

- Start with the Basics: Focus on understanding the body and wicks before diving into complex patterns.

- Look for Patterns: Keep an eye out for common patterns like Dojis, Engulfings, and Pin Bars.

- Combine with Indicators: Candlestick patterns work best when combined with other technical indicators like moving averages or RSI.

Remember, practice makes perfect. The more you study charts, the better you'll get at spotting patterns and predicting market movements.

Common Candlestick Patterns

There are dozens of candlestick patterns out there, but some are more common than others. Let's take a look at a few:

Harami Pattern

A Harami pattern occurs when a small candlestick is completely contained within the body of the previous candle. It often signals a potential reversal.

Hammer Pattern

A Hammer is a single candlestick with a long lower wick and a small body. It usually appears at the bottom of a downtrend and suggests a possible reversal.

Shooting Star

Similar to a Hammer, but upside down. A Shooting Star has a long upper wick and appears at the top of an uptrend, indicating a potential reversal.

These patterns are just the tip of the iceberg. As you dive deeper into candlestick analysis, you'll discover even more patterns and their meanings.

Importance of Candlesticks in Trading

Why do traders love candlesticks so much? Because they provide a wealth of information at a glance. Here are a few reasons why they're so important:

- Visual Clarity: Candlesticks make it easy to spot trends and reversals without having to analyze a bunch of numbers.

- Market Sentiment: They give you insights into how buyers and sellers are feeling, which can help you make better trading decisions.

- Universal Language: Candlestick charts are used by traders all over the world, making them a universal tool for market analysis.

Whether you're a beginner or a seasoned pro, understanding candlesticks can give you a competitive edge in the market.

Candlestick Patterns in Action

Talking about patterns is one thing, but seeing them in action is another. Let's take a look at a real-world example:

Imagine you're trading a stock that's been in a strong downtrend. Suddenly, you notice a Hammer pattern forming at the bottom of the trend. This could be a sign that buyers are starting to step in, and the downtrend might be reversing. You decide to enter a long position, and sure enough, the stock starts to climb. That's the power of candlestick patterns in action!

Of course, it's not always that simple. Markets can be unpredictable, and no pattern is foolproof. But by combining candlestick analysis with other tools, you can increase your chances of success.

Tips for Mastering Candlesticks

Ready to become a candlestick master? Here are a few tips to help you on your journey:

- Practice Regularly: Study charts every day to improve your pattern recognition skills.

- Use Historical Data: Test your skills by analyzing past charts and seeing how patterns played out.

- Stay Updated: Keep up with market news and trends to better understand the context behind the patterns.

Remember, learning candlestick analysis is a marathon, not a sprint. Be patient, stay disciplined, and most importantly, have fun!

Common Mistakes to Avoid

Even the best traders make mistakes, but you can avoid some common pitfalls by being aware of them. Here are a few to watch out for:

- Overtrading: Don't rely solely on candlestick patterns. Always confirm them with other indicators.

- Ignoring Context: Patterns don't exist in a vacuum. Consider the broader market conditions before making trades.

- Chasing Patterns: Not every pattern is worth trading. Be selective and focus on high-probability setups.

By avoiding these mistakes, you'll be well on your way to becoming a candlestick pro.

Conclusion

So there you have it—your ultimate guide to understanding candlesticks. From the basics to advanced patterns, we've covered everything you need to know to start reading charts like a pro. Remember, mastering candlestick analysis takes time and practice, but the rewards are well worth it.

Now it's your turn. Take what you've learned and start applying it to your trading. And don't forget to share this article with your fellow traders. Knowledge is power, and the more we share, the stronger we all become. Happy trading, and may your charts always be green!