If You Sell On Ex Dividend Date: A Comprehensive Guide For Investors

Investing in stocks can be a wild ride, but understanding the ins and outs of dividends is key to maximizing your profits. If you sell on ex dividend date, you’re stepping into a world where timing and strategy matter more than ever. Whether you’re a seasoned investor or just starting out, this guide will break it down for you in simple terms. So, buckle up, because we’re diving deep into the world of dividends and stock trading!

Let’s face it, the stock market can feel like a rollercoaster sometimes. One minute you’re riding high, and the next, you’re wondering if you should hang on or jump ship. When it comes to dividends, the ex-dividend date is a critical moment that can make or break your investment strategy. Understanding what happens if you sell on ex dividend date is like having a cheat code for your portfolio.

This article isn’t just about definitions; it’s about equipping you with the knowledge you need to navigate the complexities of stock trading. From the basics of dividends to advanced strategies, we’ve got you covered. So, whether you’re here to learn, grow, or optimize your investments, let’s get started!

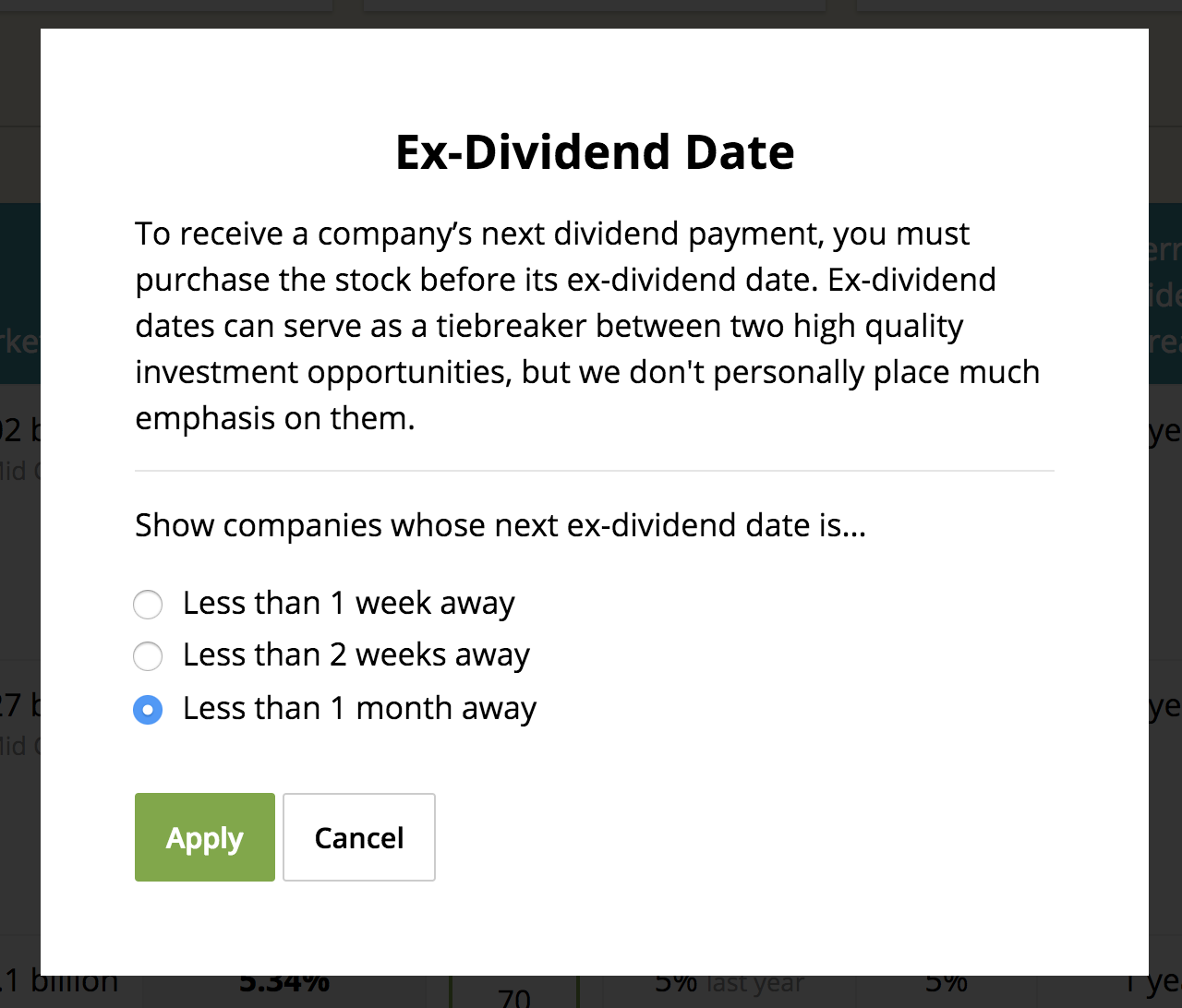

What is the Ex Dividend Date?

The ex-dividend date might sound like a fancy term, but it’s actually pretty straightforward. This is the date when a stock starts trading without its upcoming dividend. If you sell on ex dividend date, you won’t qualify for that dividend payment. It’s like missing out on a bonus check because you handed in your resignation at the wrong time. The ex-dividend date is set by the company issuing the stock, and it’s usually announced well in advance.

Here’s a quick breakdown:

- Ex-dividend date is the cutoff point for dividend eligibility.

- If you own the stock before this date, you’re entitled to the dividend.

- If you sell on ex dividend date, you forfeit your right to the dividend.

Think of it as a deadline for claiming your reward. Missing it means you’re out of luck, so timing is everything. Now, let’s dive deeper into what happens when you sell on ex dividend date.

Why Does the Ex Dividend Date Matter?

The ex-dividend date is more than just a calendar entry; it’s a crucial factor in your investment strategy. When you sell on ex dividend date, you’re essentially giving up your right to the dividend. But why does this matter so much? Let’s break it down:

First off, dividends are a key source of income for many investors. They’re like little gifts from the company, rewarding shareholders for their loyalty. If you sell on ex dividend date, you’re walking away from that gift. It’s like refusing free money, and who in their right mind would do that?

Additionally, the ex-dividend date affects the stock price. On this date, the stock typically drops by the amount of the dividend. So, if you sell on ex dividend date, you might also be selling at a lower price. It’s a double whammy that can impact your overall returns.

How the Ex Dividend Date Impacts Stock Prices

Let’s talk numbers. When a stock goes ex-dividend, its price usually drops by the amount of the dividend. For example, if a stock is trading at $100 and the dividend is $2, the stock price will likely drop to $98 on the ex-dividend date. If you sell on ex dividend date, you’re selling at this reduced price.

This price adjustment is automatic and happens to ensure fairness in the market. It prevents investors from buying the stock just to collect the dividend and then selling it immediately. By understanding this mechanism, you can make more informed decisions about when to buy or sell.

What Happens If You Sell on Ex Dividend Date?

Selling on ex dividend date means you’re waving goodbye to the dividend. But what exactly happens? Let’s walk through the process:

First, you’ll need to confirm that the sale goes through before the market closes on the ex-dividend date. Once the sale is complete, you’re no longer considered a shareholder of record for the dividend. This means the company won’t include you in the list of shareholders eligible for the payout.

But here’s the kicker: the stock price might already reflect the dividend reduction. So, if you sell on ex dividend date, you could be selling at a lower price. It’s like trying to sell a house after the neighborhood association has announced a new tax hike. The value just isn’t the same.

Understanding the Timeline

To fully grasp what happens if you sell on ex dividend date, you need to understand the timeline:

- Declaration Date: The company announces the dividend.

- Ex-Dividend Date: The date when the stock starts trading without the dividend.

- Record Date: The date the company determines who is eligible for the dividend.

- Payment Date: The date the dividend is actually paid out.

If you sell on ex dividend date, you’re out of the game by the time the record date rolls around. It’s like being disqualified from a race before the starting gun even fires.

Strategies for Selling Around the Ex Dividend Date

Now that you know what happens if you sell on ex dividend date, let’s talk strategy. There are a few approaches you can take to maximize your returns:

One option is to hold onto the stock until after the ex-dividend date. This way, you’ll still be eligible for the dividend. It’s like staying in the game long enough to collect your prize. Another strategy is to sell before the ex-dividend date to avoid the price drop. This can be a smart move if you believe the stock is overvalued or if you need the cash.

Ultimately, the best strategy depends on your investment goals and risk tolerance. Are you in it for the long haul, or are you looking for quick gains? Understanding your objectives will help you make the right decision.

Pros and Cons of Selling on Ex Dividend Date

Every strategy has its pros and cons. Selling on ex dividend date is no exception:

- Pros: You avoid the price drop and lock in your gains.

- Cons: You forfeit the dividend and miss out on potential future growth.

It’s a trade-off, and only you can decide which side of the coin is right for you. Just remember, every decision you make in the stock market comes with its own set of risks and rewards.

Common Misconceptions About Ex Dividend Dates

There’s a lot of misinformation out there about ex dividend dates. Let’s clear up a few common misconceptions:

One myth is that selling on ex dividend date will somehow save you money. In reality, you’re just trading one loss for another. Another misconception is that the ex-dividend date is the same as the payment date. They’re two completely different things, and confusing them can cost you.

By educating yourself about these misconceptions, you can avoid costly mistakes and make smarter investment decisions.

How Dividends Affect Your Portfolio

Dividends aren’t just about immediate cash flow; they also play a crucial role in portfolio growth. Reinvesting dividends can compound your returns over time, leading to significant wealth accumulation. If you sell on ex dividend date, you’re missing out on this potential growth.

Think of it this way: dividends are like seeds that grow into trees. If you pluck the seeds too early, you’ll never see the forest. By holding onto your stocks and collecting dividends, you’re planting the seeds for future prosperity.

Real-World Examples of Selling on Ex Dividend Date

Let’s look at some real-world examples to see how selling on ex dividend date plays out:

Imagine you own 100 shares of a stock trading at $50 per share. The company announces a $1 dividend, and the ex-dividend date is set for next week. If you sell on ex dividend date, you’ll likely sell at $49 per share. That’s a $100 loss right off the bat. Plus, you’ll miss out on the $100 dividend payout.

Now, consider the alternative: holding onto the stock until after the ex-dividend date. You’ll still see the price drop, but you’ll receive the $100 dividend. It’s like taking a hit but still walking away with a prize.

Case Studies and Lessons Learned

Case studies can provide valuable insights into the world of dividends and stock trading. By analyzing real-world scenarios, you can learn from the successes and failures of others. Whether you’re studying the moves of Warren Buffett or analyzing the performance of blue-chip stocks, there’s always something to be gained from observing the market in action.

Conclusion: Making the Right Choice

In conclusion, selling on ex dividend date is a decision that requires careful consideration. While it might seem like a simple choice, the implications can be far-reaching. By understanding the ex-dividend date, its impact on stock prices, and the various strategies available, you can make more informed decisions about your investments.

So, what’s the takeaway? If you sell on ex dividend date, you’re giving up your right to the dividend and potentially selling at a lower price. But sometimes, this might be the right move for your portfolio. It all depends on your goals and circumstances.

Now, it’s your turn to take action. Leave a comment below and let us know your thoughts on selling on ex dividend date. Are you a dividend collector or a quick trader? Share your experiences and insights with the community. And don’t forget to check out our other articles for more tips and tricks on navigating the stock market!

Table of Contents

- What is the Ex Dividend Date?

- Why Does the Ex Dividend Date Matter?

- How the Ex Dividend Date Impacts Stock Prices

- What Happens If You Sell on Ex Dividend Date?

- Understanding the Timeline

- Strategies for Selling Around the Ex Dividend Date

- Pros and Cons of Selling on Ex Dividend Date

- Common Misconceptions About Ex Dividend Dates

- How Dividends Affect Your Portfolio

- Real-World Examples of Selling on Ex Dividend Date