Unlock Your Potential: A Comprehensive Guide To Learning Commodity Trading

Alright folks, let's dive straight into the world of trading because learning commodity trading is like unlocking a treasure chest full of opportunities. Whether you're a newbie looking to dip your toes into the financial waters or a seasoned investor eager to diversify your portfolio, commodities trading offers a unique and exciting way to grow your wealth. But hey, before you start thinking it's all about getting rich quick, let’s break it down and understand what it really takes to succeed in this game.

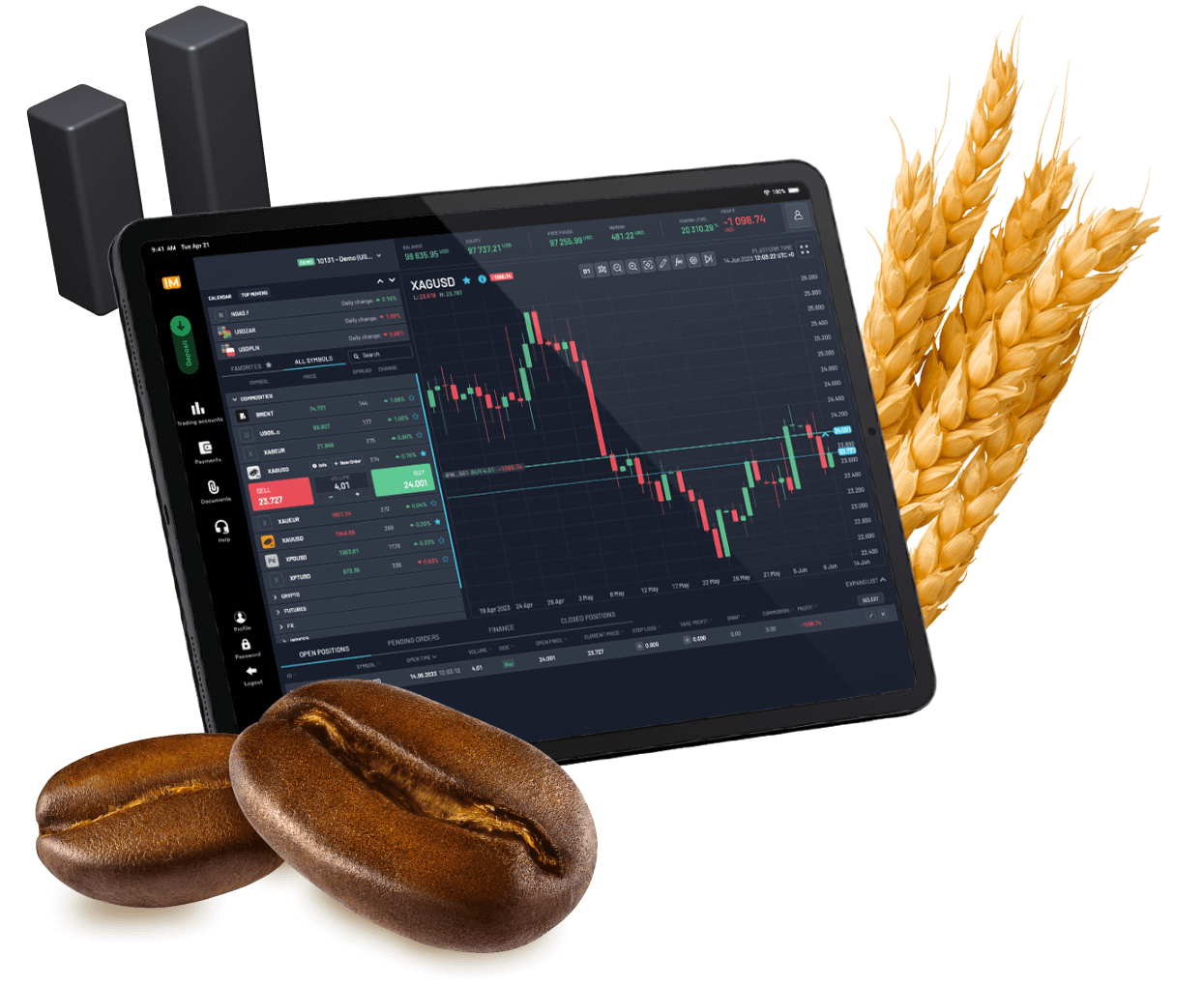

Commodity trading isn't just about buying and selling stuff like gold, oil, or coffee beans. It’s about understanding the market dynamics, analyzing trends, and making smart decisions that can lead to profitable outcomes. And trust me, it’s not as complicated as it sounds. With the right mindset, tools, and knowledge, anyone can learn how to trade commodities effectively.

So, why should you care about learning commodity trading? Well, in today's fast-paced world, where financial markets are constantly evolving, having a diverse set of skills and investment strategies can be a game-changer. Commodities are a key component of any well-rounded investment portfolio, providing stability and growth potential. Plus, it’s kinda cool to say you trade commodities, right?

What is Commodity Trading?

Let’s start with the basics. Commodity trading involves buying and selling raw materials or primary agricultural products. These can range from precious metals like gold and silver to energy products like crude oil and natural gas, and even agricultural goods like wheat and coffee. The goal is simple: buy low, sell high, and make a profit.

But here’s the twist—commodity trading isn’t just about physical goods. Most of the time, traders deal with contracts that represent these commodities rather than the actual items themselves. These contracts are called futures contracts, and they allow traders to speculate on the future price movements of commodities without ever having to physically own them.

For instance, if you think the price of crude oil is going to rise, you can buy a futures contract today and sell it later when the price goes up. It’s like betting on the future price of something, but with a lot more research and strategy involved.

Why Learn Commodity Trading?

Now that we’ve got the basics down, let’s talk about why learning commodity trading is worth your time. First off, commodities are essential to the global economy. They’re used in everything from manufacturing to energy production, which means their prices are influenced by a wide range of factors, including supply and demand, geopolitical events, and even weather patterns.

This creates a dynamic and ever-changing market that offers plenty of opportunities for profit. Plus, commodities often move independently of stocks and bonds, making them a great way to diversify your investments and reduce risk. And let’s not forget the thrill of it all—watching the market fluctuate and making strategic moves to capitalize on those changes is a rush like no other.

Understanding the Types of Commodities

Commodities can be broadly categorized into four main types: energy, metals, agricultural products, and livestock. Each type has its own unique characteristics and market dynamics, so it’s important to understand them before diving in.

Energy Commodities

Energy commodities include crude oil, natural gas, and gasoline. These are some of the most actively traded commodities in the world due to their importance in powering the global economy. Prices for energy commodities are heavily influenced by factors like OPEC decisions, geopolitical tensions, and changes in global energy demand.

Precious Metals

Precious metals like gold, silver, and platinum are often seen as safe-haven investments during times of economic uncertainty. They tend to hold their value well and can provide a hedge against inflation. Traders often use precious metals to balance out riskier investments in their portfolios.

Agricultural Products

Agricultural commodities include grains like corn, wheat, and soybeans, as well as soft commodities like coffee, sugar, and cotton. These are heavily influenced by weather conditions, crop yields, and global food demand. Trading agricultural commodities can be particularly challenging due to the unpredictable nature of these factors.

Livestock and Meat

Finally, we have livestock and meat commodities, which include products like cattle, hogs, and pork bellies. These are often traded in the form of live animals or carcasses and are influenced by factors like feed costs, disease outbreaks, and consumer preferences.

How to Start Learning Commodity Trading

Alright, so you’re convinced that commodity trading is something you want to explore. But where do you start? Here’s a step-by-step guide to help you get started:

- Learn the Basics: Start by understanding what commodities are and how the market works. There are plenty of online resources, books, and courses available to help you build a solid foundation.

- Choose a Broker: Once you’ve got the basics down, it’s time to choose a broker. Look for one that offers competitive pricing, reliable customer service, and access to the markets you want to trade.

- Set Up a Demo Account: Before you start trading with real money, practice with a demo account. This will allow you to test your strategies and get a feel for the market without risking your hard-earned cash.

- Develop a Strategy: Successful traders don’t just jump into the market blindly. They have a well-thought-out strategy that guides their decisions. Spend some time developing a strategy that works for you, and stick to it.

- Stay Informed: The commodities market is constantly changing, so it’s important to stay up-to-date on the latest news and trends. Follow financial news outlets, subscribe to market analysis reports, and join online communities to keep your finger on the pulse.

Key Factors That Influence Commodity Prices

Understanding what drives commodity prices is crucial to becoming a successful trader. Here are some of the key factors to keep an eye on:

Supply and Demand

Supply and demand are the most fundamental drivers of commodity prices. When demand exceeds supply, prices tend to rise. Conversely, when supply exceeds demand, prices usually fall. Factors like production levels, inventory levels, and consumption patterns all play a role in determining supply and demand.

Geopolitical Events

Political instability, trade wars, and conflicts can have a significant impact on commodity prices, especially for energy products like oil and natural gas. For example, tensions in the Middle East can lead to disruptions in oil supply, causing prices to spike.

Weather Conditions

Weather plays a big role in agricultural commodities. Droughts, floods, and other extreme weather events can affect crop yields, leading to price fluctuations. Similarly, cold snaps or heatwaves can impact energy demand, influencing prices for natural gas and heating oil.

Economic Indicators

Economic data like GDP growth, inflation rates, and employment numbers can also influence commodity prices. For instance, strong economic growth often leads to increased demand for energy and industrial metals, driving prices higher.

Tools and Resources for Learning Commodity Trading

Now that you know what to look for, let’s talk about the tools and resources that can help you along the way. Here are a few essentials:

- Trading Platforms: Most brokers offer powerful trading platforms that provide real-time market data, charting tools, and advanced order types. Make sure to choose a platform that suits your trading style and needs.

- Market Analysis: Stay informed with market analysis reports from reputable sources. These reports can provide valuable insights into market trends and help you make more informed trading decisions.

- Online Courses: There are plenty of online courses available that can teach you the ins and outs of commodity trading. Look for courses that offer hands-on experience and practical examples.

- Community Forums: Joining online communities of traders can be a great way to learn from others and share your experiences. You can ask questions, get advice, and even collaborate on trading strategies.

Risks and Challenges in Commodity Trading

Of course, no discussion about commodity trading would be complete without talking about the risks and challenges involved. Here are a few things to keep in mind:

- Volatility: Commodities markets can be highly volatile, with prices fluctuating rapidly in response to news and events. This can lead to significant gains, but also to substantial losses if you’re not careful.

- Leverage: Many brokers offer leverage, which allows you to trade larger positions with less capital. While this can amplify your profits, it can also increase your losses if the market moves against you.

- Market Manipulation: In some cases, large players in the market can manipulate prices, making it difficult for smaller traders to profit. Staying informed and sticking to your strategy can help mitigate this risk.

Success Stories in Commodity Trading

Let’s take a look at a few success stories to inspire you on your journey. One of the most famous commodity traders of all time is Jim Rogers, who made a fortune by betting on the rise of commodities in the 1970s and 1980s. Another notable figure is Andreas Clenow, whose quantitative approach to trading has earned him millions.

These traders didn’t achieve success overnight. They spent years learning the market, developing their strategies, and honing their skills. But with dedication and perseverance, they were able to turn their passion for commodities into a profitable career.

Conclusion and Call to Action

Alright folks, that’s a wrap on our comprehensive guide to learning commodity trading. As you can see, it’s a fascinating and rewarding field that offers plenty of opportunities for growth and profit. But remember, success doesn’t come overnight. It takes time, effort, and a willingness to learn and adapt.

So, what are you waiting for? Start exploring the world of commodity trading today. Whether you’re a complete beginner or a seasoned pro, there’s always something new to learn. And don’t forget to share your experiences with us in the comments below. We’d love to hear about your journey and how you’re using commodity trading to achieve your financial goals.

Table of Contents:

- What is Commodity Trading?

- Why Learn Commodity Trading?

- Understanding the Types of Commodities

- How to Start Learning Commodity Trading

- Key Factors That Influence Commodity Prices

- Tools and Resources for Learning Commodity Trading

- Risks and Challenges in Commodity Trading

- Success Stories in Commodity Trading