Unlock Your Potential With Trading Class: Your Key To Financial Success

So, you’ve probably heard about trading class, right? It’s like the gateway to understanding the world of finance and investing. Whether you’re a newbie or someone who’s been dabbling in stocks, forex, or cryptocurrencies, taking a trading class can seriously level up your skills. This isn’t just some random course; it’s a structured way to learn the ins and outs of trading from experts who’ve been there, done that. In today’s fast-paced financial world, having a solid foundation is crucial, and that’s where trading classes come in.

You might be thinking, “Do I really need a trading class?” Well, let me tell you something—trading isn’t like playing a video game where you can just wing it. Sure, you can dive in blindly, but chances are, you’ll end up losing more than you gain. A trading class provides you with the tools, strategies, and mindset to navigate the markets like a pro. Think of it as your personal trainer for financial fitness.

And hey, if you’re still on the fence, this article is here to break it all down for you. We’ll cover everything from what trading classes are, why they matter, how to choose the right one, and even share some success stories from people who’ve taken the leap. Stick around, because by the end of this, you’ll have all the info you need to make an informed decision.

Table of Contents

- What is a Trading Class?

- Benefits of Taking a Trading Class

- Types of Trading Classes

- How to Choose the Right Trading Class

- The Cost of Trading Classes

- Learning Methods in Trading Classes

- Success Stories from Trading Class Graduates

- Common Mistakes to Avoid in Trading Classes

- Online vs. In-Person Trading Classes

- Conclusion: Is a Trading Class Worth It?

What is a Trading Class?

Alright, let’s start with the basics. A trading class is essentially an educational program designed to teach individuals how to trade financial instruments like stocks, commodities, forex, or cryptocurrencies. These classes are usually led by experienced traders or financial experts who know the ins and outs of the market. Think of it as a crash course in trading, but way more in-depth and structured.

Trading classes can vary in length, intensity, and focus. Some are short-term workshops that last a few days, while others are full-fledged courses that span several weeks or even months. The goal is to equip students with the knowledge and skills they need to make informed trading decisions. Whether you’re interested in day trading, swing trading, or long-term investing, there’s a trading class out there for you.

Who Should Take a Trading Class?

Now, you might be wondering if a trading class is right for you. The truth is, trading classes are suitable for anyone who wants to learn more about the financial markets. Whether you’re a complete beginner or an experienced trader looking to refine your skills, there’s always something new to learn. Here are a few scenarios where taking a trading class might be beneficial:

- Beginners: If you’re new to trading and have no idea where to start, a trading class can provide a solid foundation.

- Intermediate Traders: If you’ve been trading for a while but feel stuck, a trading class can help you refine your strategies and improve your performance.

- Investors Looking to Diversify: If you’re already investing in traditional assets like stocks and bonds but want to explore other markets, a trading class can introduce you to new opportunities.

Benefits of Taking a Trading Class

So, why should you consider taking a trading class? There are plenty of reasons, but here are some of the most significant benefits:

First off, trading classes provide you with access to expert knowledge. These instructors have been in the trenches, dealing with real-world market conditions. They’ve seen it all, and they can share their insights with you. This is invaluable, especially if you’re just starting out and don’t know what you don’t know.

Another huge benefit is the structure. When you’re learning on your own, it’s easy to get overwhelmed by all the information out there. A trading class gives you a clear roadmap to follow, so you don’t waste time on irrelevant or outdated information. Plus, you’ll have the opportunity to ask questions and get feedback from your instructor, which can accelerate your learning process.

Building Confidence

One of the biggest hurdles for new traders is confidence. It’s one thing to read about trading strategies, but it’s another thing entirely to put them into practice. A trading class can help bridge that gap by giving you hands-on experience in a controlled environment. You’ll get to practice trading without the fear of losing real money, which can be a game-changer.

Types of Trading Classes

Not all trading classes are created equal. Depending on your goals and preferences, you might want to consider different types of classes. Here’s a breakdown of the most common types:

- Stock Trading Classes: Focused on teaching you how to trade stocks, these classes cover everything from technical analysis to fundamental analysis.

- Forex Trading Classes: If you’re interested in trading currencies, forex trading classes are for you. You’ll learn about currency pairs, exchange rates, and global economic factors that affect forex markets.

- Cryptocurrency Trading Classes: With the rise of digital currencies, more and more people are turning to crypto trading. These classes teach you how to trade Bitcoin, Ethereum, and other cryptocurrencies.

- Options Trading Classes: For those looking to explore more advanced trading strategies, options trading classes can be a great option. You’ll learn about options contracts, hedging, and risk management.

Specialized Trading Classes

In addition to the general types of trading classes, there are also specialized courses that focus on specific aspects of trading. For example, you might find classes that focus on algorithmic trading, behavioral finance, or even trading psychology. These specialized classes can be incredibly useful if you want to dive deeper into a particular area of trading.

How to Choose the Right Trading Class

With so many trading classes available, choosing the right one can be overwhelming. Here are a few things to consider when making your decision:

First, think about your goals. Are you looking to become a full-time trader, or are you just interested in learning more about the markets? Your goals will help determine the type of class you should take. For example, if you’re interested in day trading, you’ll want to look for a class that focuses on short-term trading strategies.

Next, consider the instructor’s credentials. You want to make sure that the person teaching the class has real-world experience in trading. Look for reviews or testimonials from past students to get an idea of the instructor’s effectiveness.

Cost and Value

Of course, cost is also a factor. Trading classes can range from free online courses to expensive in-person programs. While price isn’t always an indicator of quality, it’s important to weigh the cost against the value you’ll receive. Ask yourself: Will this class help me achieve my goals? Is the price reasonable for the amount of knowledge and support I’ll gain?

The Cost of Trading Classes

Talking about cost, trading classes can vary significantly in price. Some are completely free, while others can cost thousands of dollars. The price usually depends on the level of instruction, the length of the course, and the reputation of the instructor.

Free trading classes are often available online, and while they can be a great starting point, they might not offer the depth or personal attention you’d get from a paid course. On the other hand, premium trading classes can provide a more comprehensive learning experience, but they come with a higher price tag.

What to Look for in a Paid Class

If you decide to go with a paid trading class, here are a few things to look for:

- Curriculum: Make sure the class covers the topics you’re interested in. Look for a detailed syllabus that outlines what you’ll learn.

- Instructor Qualifications: As mentioned earlier, the instructor’s credentials are important. Look for someone with real-world trading experience.

- Support: Does the class offer ongoing support after it’s over? This can be crucial for applying what you’ve learned in real-world situations.

Learning Methods in Trading Classes

Trading classes can be delivered in a variety of ways, each with its own advantages and disadvantages. Here are some of the most common learning methods:

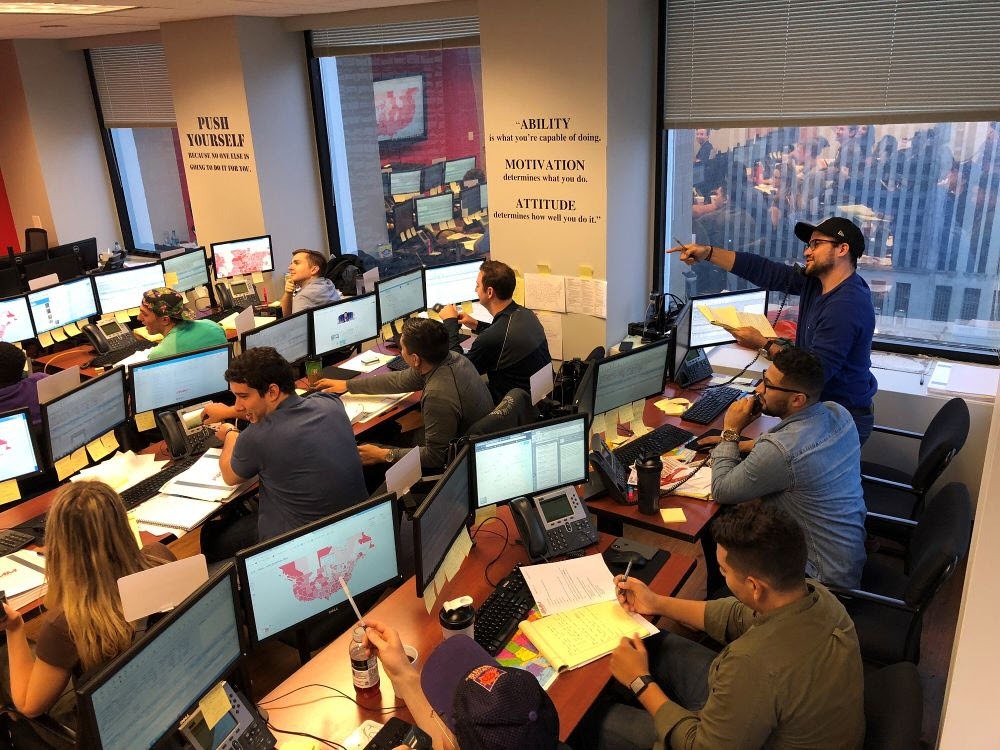

In-Person Classes: These classes are held in a physical location, where you’ll interact with the instructor and other students face-to-face. This can be great for hands-on learning and networking, but it might not be convenient for everyone.

Online Classes: With the rise of digital learning, online trading classes have become increasingly popular. They offer flexibility, allowing you to learn at your own pace and on your own schedule.

Blended Learning

Some trading classes offer a blended learning approach, combining both in-person and online elements. This can be a great option if you want the best of both worlds. You’ll get the personal interaction of an in-person class, along with the convenience of online learning.

Success Stories from Trading Class Graduates

Hearing about other people’s success stories can be incredibly motivating. Here are a few examples of people who’ve taken trading classes and achieved great results:

John D: “I took a stock trading class a few years ago, and it completely changed my life. Before the class, I was losing money left and right. Now, I’m consistently making profits and have even started my own trading business.”

Sarah M: “I was skeptical at first, but the forex trading class I took was eye-opening. I learned so much about currency markets and how to manage risk. It’s been a game-changer for my financial independence.”

What Can You Achieve?

These success stories are just a glimpse of what’s possible. By taking a trading class, you can gain the knowledge and skills you need to achieve your financial goals. Whether you want to supplement your income, build wealth, or simply become more financially literate, a trading class can help you get there.

Common Mistakes to Avoid in Trading Classes

Even with the best intentions, people can make mistakes in trading classes. Here are a few common ones to watch out for:

- Not Doing Your Research: Before signing up for a class, make sure you’ve done your homework. Check the instructor’s credentials, read reviews, and make sure the class aligns with your goals.

- Expecting Instant Results: Trading is a skill that takes time to develop. Don’t expect to become an expert overnight. Be patient and persistent.

- Ignoring Risk Management: One of the most important things you’ll learn in a trading class is how to manage risk. Don’t skip over this crucial aspect of trading.

Staying Focused

Another common mistake is losing focus. Trading can be exciting, but it’s also demanding. Stay committed to your learning process, and don’t get sidetracked by shiny new strategies or get-rich-quick schemes.

Online vs. In-Person Trading Classes

When it comes to choosing between online and in-person trading classes, there are pros and cons to both. Here’s a quick comparison:

Online Classes: Pros include flexibility, convenience, and often lower cost. Cons might include less personal interaction and the potential for distractions at home.

In-Person Classes: Pros include face-to-face interaction, networking opportunities, and a more structured learning environment. Cons might include travel costs, time constraints, and limited availability.

Finding the Right Fit

Ultimately, the best choice depends on your personal preferences and circumstances. If you’re someone who thrives in a structured environment, an in