Candlesticks Trade: The Ultimate Guide To Unlocking Profit Secrets

Trading with candlesticks is like having a treasure map for the stock market. Imagine reading the emotions of buyers and sellers through simple patterns. It’s powerful stuff! But before we dive deep, let me ask you this: Have you ever wondered why candlestick charts are so popular among traders? They’re more than just colorful sticks—they’re a language that speaks directly to the market’s soul.

Let’s face it, trading can be overwhelming. You’ve got charts, indicators, and numbers flying everywhere. But candlesticks simplify it all. They’re like the Swiss Army knife of technical analysis. Whether you’re a beginner or a seasoned pro, understanding candlesticks can level up your trading game big time.

In this guide, we’re going to break down everything you need to know about candlesticks trade. From the basics to advanced strategies, we’ll cover it all. So grab a coffee, sit back, and let’s unlock the secrets of candlestick trading together. Trust me, by the end of this, you’ll feel like a trading ninja!

Table of Contents

Common Candlestick Patterns You Should Know

Tools and Resources for Candlestick Trading

The Psychology Behind Candlestick Patterns

Conclusion: Why Candlesticks Trade Matters

What Are Candlesticks?

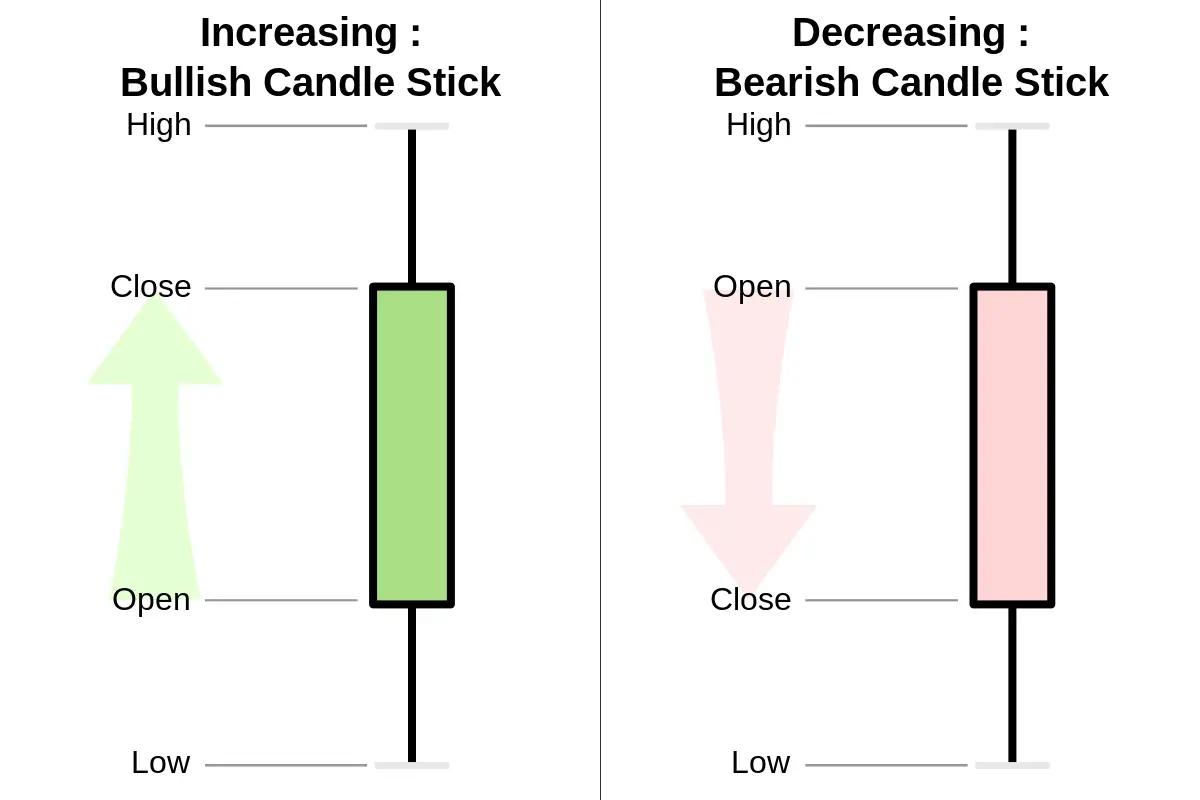

Candlesticks are basically visual representations of price movements. Think of them as little snapshots of what’s happening in the market. Each candlestick shows the opening price, closing price, high, and low for a specific time period. They come in two colors—green (or white) for bullish candles and red (or black) for bearish ones. It’s like having a mini story for every trading session.

Now, why are candlesticks so important? Well, they give you a ton of info in one glance. You can see trends, reversals, and even market sentiment without needing a PhD in finance. Plus, they’re super easy to interpret once you get the hang of it. No wonder they’ve been around for centuries!

The History of Candlesticks

Believe it or not, candlesticks didn’t start in Wall Street or Silicon Valley. They’ve actually been around since the 18th century, thanks to a rice trader named Munehisa Homma. This dude was trading rice futures in Japan way back when, and he noticed patterns in price movements that could predict future trends. Genius, right?

Fast forward to today, and candlesticks are used by traders all over the world. They’ve stood the test of time because they work. Whether you’re trading stocks, forex, or cryptocurrencies, candlestick patterns are a universal language that everyone can understand.

How to Read Candlesticks

Reading candlesticks is like learning a new language, but don’t worry—it’s easier than it sounds. Let’s break it down:

- Body: The main part of the candlestick shows the opening and closing prices. If the body is green, it means the closing price was higher than the opening price. If it’s red, the opposite is true.

- Wicks: These are the lines above and below the body. They represent the highest and lowest prices during the period.

- Size Matters: A long body indicates strong buying or selling pressure, while a small body suggests indecision in the market.

Once you understand these basics, you’ll start seeing patterns everywhere. It’s like having a secret code to the market’s behavior.

Common Candlestick Patterns You Should Know

Alright, here’s where things get interesting. Candlestick patterns are like little signals the market sends you. Here are some of the most common ones:

Doji

A Doji is a pattern where the opening and closing prices are almost the same. It looks like a cross or a plus sign and usually indicates indecision in the market. Think of it as a pause before the next big move.

Hammer

This guy has a long lower wick and a small body at the top. It’s a bullish signal that often appears at the bottom of a downtrend. Basically, it means buyers are stepping in and pushing prices back up.

Shooting Star

The opposite of a Hammer, the Shooting Star has a long upper wick and a small body at the bottom. It’s a bearish signal that usually appears at the top of an uptrend. Sellers are taking control here.

Bullish Candlestick Patterns

Now let’s talk about the good stuff—patterns that signal upward momentum. These are your friends if you’re looking to go long:

- Bullish Engulfing: A small red candle followed by a big green one that completely engulfs it. It’s a strong reversal signal.

- Piercing Pattern: A red candle followed by a green one that closes halfway into the red candle’s body. It suggests a potential trend reversal.

- Morning Star: A three-candle pattern with a small body in the middle, followed by a big green candle. It’s a classic bullish reversal signal.

These patterns can help you catch the wave when the market is turning around. Timing is everything!

Bearish Candlestick Patterns

On the flip side, we’ve got patterns that warn you of downward momentum. These are important if you’re considering shorting a stock:

- Bearish Engulfing: A small green candle followed by a big red one that engulfs it. It’s a powerful signal of a potential downtrend.

- Dark Cloud Cover: A green candle followed by a red one that closes halfway into the green candle’s body. It indicates selling pressure.

- Evening Star: Similar to the Morning Star, but in reverse. It’s a bearish reversal pattern that signals the end of an uptrend.

Recognizing these patterns can save you from getting caught in a falling market. Knowledge is power, my friend!

Candlesticks Trade Strategies

So, how do you actually use candlestick patterns in your trading? Here are a few strategies to get you started:

Confirmation with Indicators

Always pair candlestick patterns with technical indicators like RSI or MACD. This helps confirm the signals and increases your chances of success. Think of it as double-checking your work before hitting the trade button.

Stop Loss Placement

Knowing where to place your stop loss is crucial. For example, if you’re trading a bullish pattern, set your stop below the low of the pattern. This way, you’re protected if the market moves against you.

Position Sizing

Don’t forget to manage your risk. Only trade with a percentage of your portfolio that you’re comfortable losing. It’s all about staying in the game for the long haul.

Tools and Resources for Candlestick Trading

There are tons of tools out there to help you with candlestick trading. Here are a few of my favorites:

- TradingView: A powerful charting platform with built-in candlestick patterns.

- MetaTrader: Great for forex traders who want to analyze candlestick patterns in real-time.

- Books: If you’re serious about mastering candlesticks, check out "Japanese Candlestick Charting Techniques" by Steve Nison.

Having the right tools can make all the difference in your trading journey. Experiment and find what works best for you.

The Psychology Behind Candlestick Patterns

Let’s talk about the elephant in the room—human psychology. Candlestick patterns work because they reflect how traders think and behave. When you see a pattern like a Hammer or a Shooting Star, it’s often because a large number of traders are reacting the same way.

Understanding this psychology can give you an edge in the market. It’s not just about numbers—it’s about people. And if you can read the market’s mood, you’re already halfway there.

Conclusion: Why Candlesticks Trade Matters

So there you have it, folks—a comprehensive guide to candlesticks trade. Whether you’re a beginner or a seasoned trader, mastering candlestick patterns can take your game to the next level. They’re simple, effective, and packed with valuable insights.

Remember, trading is a marathon, not a sprint. Take your time to learn, practice, and refine your strategies. And most importantly, always stay curious. The market is constantly evolving, and so should you.

Now it’s your turn. Did you find this guide helpful? What’s your favorite candlestick pattern? Drop a comment below and let’s keep the conversation going. Happy trading, and may the odds be ever in your favor!