Commodity Trading Programs: Your Ultimate Guide To Unlock Profit Potential

Commodity trading programs have become a game-changer for traders worldwide. Whether you're a seasoned investor or just starting out, these programs can provide the tools and insights you need to succeed in the dynamic world of commodities. But what exactly are commodity trading programs? Simply put, they are advanced software systems designed to streamline trading processes, analyze market trends, and execute trades with precision. In this guide, we'll dive deep into everything you need to know about these powerful tools.

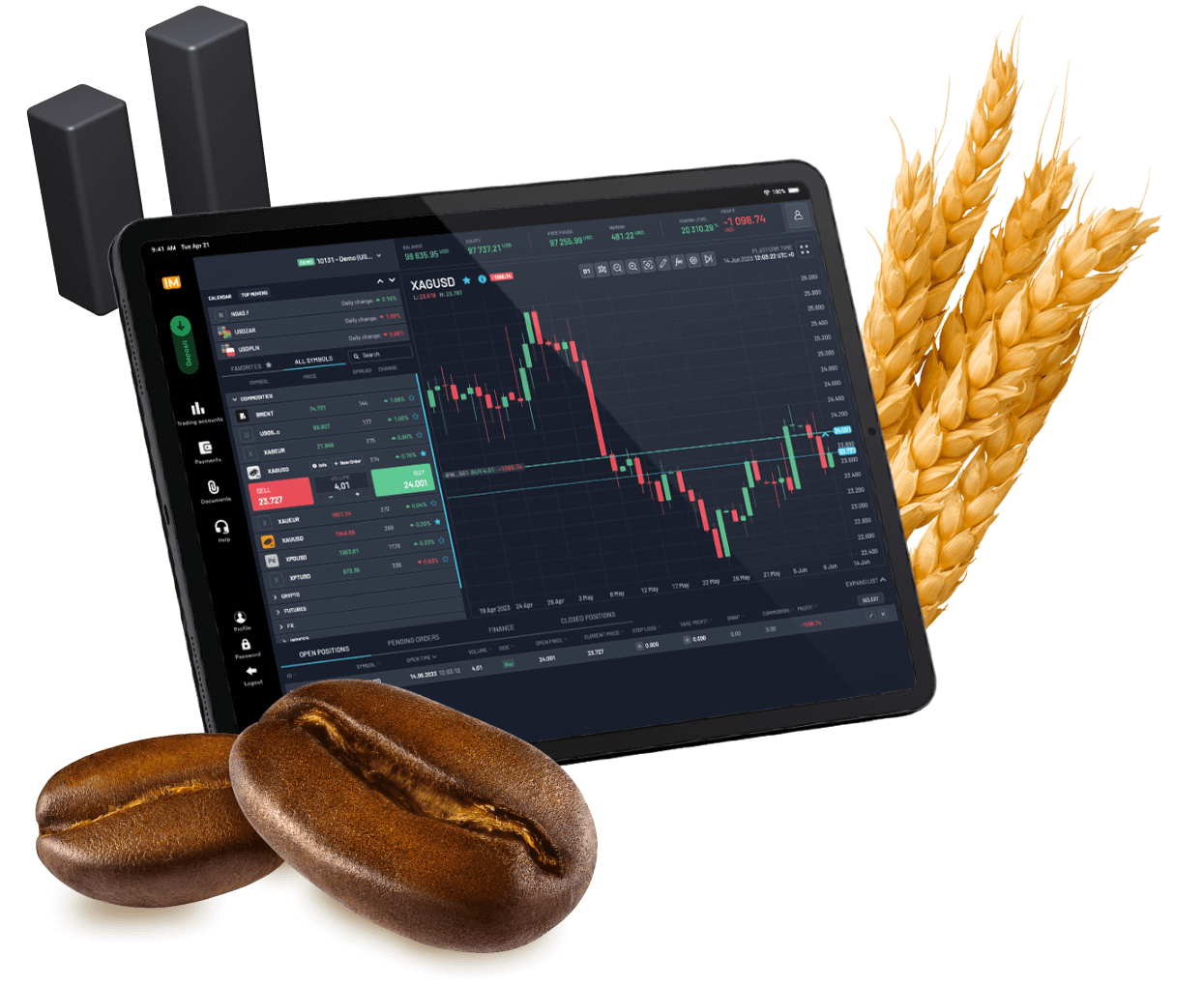

Picture this: you're sitting at your desk, coffee in hand, ready to conquer the financial markets. But instead of spending hours manually analyzing charts and news, you have a digital assistant working tirelessly in the background. That's the power of commodity trading programs. They take the guesswork out of trading, helping you make smarter, data-driven decisions.

As the demand for commodities continues to grow, so does the need for efficient trading solutions. In today's fast-paced world, traders can't afford to rely solely on intuition. Commodity trading programs offer a competitive edge by combining technology, analytics, and automation to give you an upper hand in the market. Let's explore how these programs can transform your trading journey.

What Are Commodity Trading Programs?

Commodity trading programs are software solutions designed specifically for trading commodities like gold, oil, wheat, and coffee. These programs come equipped with features that help traders analyze market trends, execute trades, and manage risk. Think of them as your personal trading assistant, but smarter and faster.

One of the key benefits of these programs is their ability to process vast amounts of data in real-time. They use algorithms to identify patterns and opportunities that might go unnoticed by the human eye. This level of precision is crucial in the volatile world of commodities, where prices can fluctuate rapidly.

Moreover, these programs are highly customizable. You can set up alerts, define trading strategies, and automate repetitive tasks. This not only saves time but also reduces the risk of human error. Whether you're trading on the Chicago Mercantile Exchange or the London Metal Exchange, commodity trading programs can help you stay ahead of the curve.

Why Choose Commodity Trading Programs?

So, why should you consider using commodity trading programs? The answer lies in their ability to enhance your trading experience. Here are a few reasons why these programs are worth exploring:

- Efficiency: Automate repetitive tasks and focus on more strategic decisions.

- Accuracy: Rely on data-driven insights to make informed trading decisions.

- Flexibility: Customize the program to match your trading style and preferences.

- Accessibility: Access the program from anywhere, at any time, via cloud-based platforms.

In a world where time is money, commodity trading programs offer a solution that maximizes both. They allow you to trade smarter, not harder, and can significantly improve your chances of success in the market.

How Do Commodity Trading Programs Work?

At their core, commodity trading programs work by leveraging advanced algorithms and machine learning to analyze market data. These algorithms process information from various sources, including price movements, economic indicators, and news updates, to identify potential trading opportunities.

Here's a step-by-step breakdown of how these programs operate:

- Data Collection: The program gathers data from multiple sources, including exchanges, news outlets, and historical price charts.

- Data Analysis: Using complex algorithms, the program analyzes the data to identify trends and patterns.

- Strategy Execution: Based on the analysis, the program executes trades automatically or provides recommendations for manual execution.

- Performance Monitoring: The program continuously monitors market conditions and adjusts strategies as needed.

This process ensures that traders have access to up-to-date information and can respond quickly to changing market conditions. It's like having a team of analysts working around the clock to support your trading activities.

Key Features of Commodity Trading Programs

Not all commodity trading programs are created equal. To make the most of these tools, it's important to understand their key features. Here are some of the must-have features to look for:

1. Real-Time Market Data

Access to real-time data is crucial for making informed trading decisions. Top-tier programs provide live updates on price movements, order books, and market news, ensuring that you're always in the loop.

2. Advanced Analytics

Commodity trading programs come equipped with powerful analytics tools that help you identify trends and predict market movements. These tools use machine learning and artificial intelligence to provide actionable insights.

3. Customizable Trading Strategies

Every trader has a unique style and approach. A good commodity trading program allows you to create and customize trading strategies that align with your goals and preferences.

4. Risk Management Tools

Managing risk is a critical aspect of trading. These programs offer tools to help you set stop-loss orders, position sizing, and other risk management parameters to protect your capital.

Popular Commodity Trading Programs

With so many options available, choosing the right commodity trading program can be overwhelming. Here's a look at some of the most popular programs in the market:

1. TradeStation

TradeStation is a well-known platform that offers comprehensive tools for trading commodities. It features advanced charting capabilities, customizable trading strategies, and real-time data feeds.

2. MetaTrader 5

MetaTrader 5 is another popular choice among traders. It supports multiple asset classes, including commodities, and offers a wide range of technical indicators and trading tools.

3. NinjaTrader

NinjaTrader is a powerful platform designed specifically for futures trading. It provides advanced charting, automated trading, and a robust community of traders to support your journey.

Benefits of Using Commodity Trading Programs

Using commodity trading programs can offer numerous benefits, from increased efficiency to improved accuracy. Here's a closer look at some of the advantages:

- Time Savings: Automate repetitive tasks and focus on more important aspects of trading.

- Reduced Errors: Minimize the risk of human error by relying on algorithm-driven decisions.

- Enhanced Insights: Gain deeper insights into market trends and patterns through advanced analytics.

- Increased Profit Potential: Leverage data-driven strategies to maximize your returns.

These benefits make commodity trading programs an invaluable asset for traders of all levels. They provide the tools and support needed to navigate the complexities of the commodities market.

Challenges and Risks of Commodity Trading Programs

While commodity trading programs offer numerous advantages, they also come with their own set of challenges and risks. Here are a few to keep in mind:

1. Over-Reliance on Technology

Traders may become overly reliant on these programs, leading to a lack of critical thinking and decision-making skills. It's important to strike a balance between using technology and trusting your instincts.

2. System Failures

Like any technology, commodity trading programs can experience glitches or outages. Having a backup plan in place is essential to ensure that your trading activities aren't disrupted.

3. Learning Curve

These programs can be complex, and mastering their features may require time and effort. However, the investment is worth it in the long run as you gain more control over your trading activities.

Tips for Success with Commodity Trading Programs

To make the most of your commodity trading program, here are a few tips to keep in mind:

- Start Small: Begin with simple strategies and gradually expand as you become more comfortable with the program.

- Test Your Strategies: Use demo accounts to test your strategies before implementing them in live trading.

- Stay Updated: Keep up with market trends and news to ensure that your strategies remain relevant.

- Seek Feedback: Engage with other traders and seek feedback to continuously improve your skills.

By following these tips, you can maximize the potential of your commodity trading program and achieve greater success in the market.

Conclusion

In conclusion, commodity trading programs have revolutionized the way traders approach the commodities market. They offer a range of benefits, from increased efficiency to improved accuracy, making them an essential tool for anyone serious about trading. However, it's important to be aware of the challenges and risks involved and to approach these programs with a balanced mindset.

So, if you're ready to take your trading to the next level, consider investing in a commodity trading program. With the right tools and strategies, you can unlock new opportunities and achieve your financial goals. Don't forget to share your thoughts and experiences in the comments below, and be sure to check out our other articles for more insights into the world of trading.

Table of Contents

- What Are Commodity Trading Programs?

- Why Choose Commodity Trading Programs?

- How Do Commodity Trading Programs Work?

- Key Features of Commodity Trading Programs

- Popular Commodity Trading Programs

- Benefits of Using Commodity Trading Programs

- Challenges and Risks of Commodity Trading Programs

- Tips for Success with Commodity Trading Programs

- Conclusion