Cracking The Code Of Stocks Candle Patterns: Your Ultimate Guide To Trading Success

Ever wondered how those tiny candlesticks on your trading screen hold the secret to making big money in stocks? Well, buckle up, because we’re diving deep into the world of stocks candle patterns, where every flicker of light tells a story. Whether you’re a newbie trying to figure out the basics or an experienced trader looking to sharpen your skills, understanding candlestick patterns is like unlocking a treasure map for stock market success. This isn’t just about charts; it’s about reading the market’s mood and making informed decisions.

Imagine this: you’re staring at your trading platform, and those little candles seem to dance to their own tune. But here’s the thing—those dances aren’t random. They’re signals, whispers from the market telling you when to buy, sell, or hold your horses. Stocks candle patterns are like the language of the market, and learning this language can be your ticket to trading greatness. So, let’s break it down and make sense of those wicks and bodies.

Now, before we get into the nitty-gritty, let’s clear one thing up. Candlestick patterns aren’t magic spells that guarantee success. They’re tools, powerful ones at that, but they work best when you know how to use them. Think of them as your trusty compass in the vast sea of trading. Ready to dive in? Let’s go!

What Are Stocks Candle Patterns Anyway?

Let’s start with the basics. Stocks candle patterns are visual representations of price movements over a specific period. Each candlestick shows the open, close, high, and low prices, giving traders a snapshot of market sentiment. Picture each candle as a mini story—telling you whether buyers or sellers had the upper hand during that time frame.

Here’s the fun part: when you string these candles together, they form patterns. And these patterns? They’re like the market’s version of Morse code, sending signals about potential price reversals or continuations. Some patterns scream "buy now!" while others whisper "run for the hills!" So, how do you decipher this code? Stick around, and we’ll break it down step by step.

Why Stocks Candle Patterns Matter

Why should you care about these patterns? Because they’re your secret weapon in the trading battlefield. Unlike other indicators that rely on complex math, candlestick patterns are straightforward and easy to spot. Plus, they’re universally applicable across all markets, whether you’re trading stocks, forex, or cryptocurrencies.

- They offer instant visual cues about market sentiment.

- They help identify potential entry and exit points.

- They provide insights into price reversals and trends.

Think of candlestick patterns as your trading GPS. Sure, you could navigate without them, but why make things harder than they need to be?

Top 10 Candlestick Patterns Every Trader Should Know

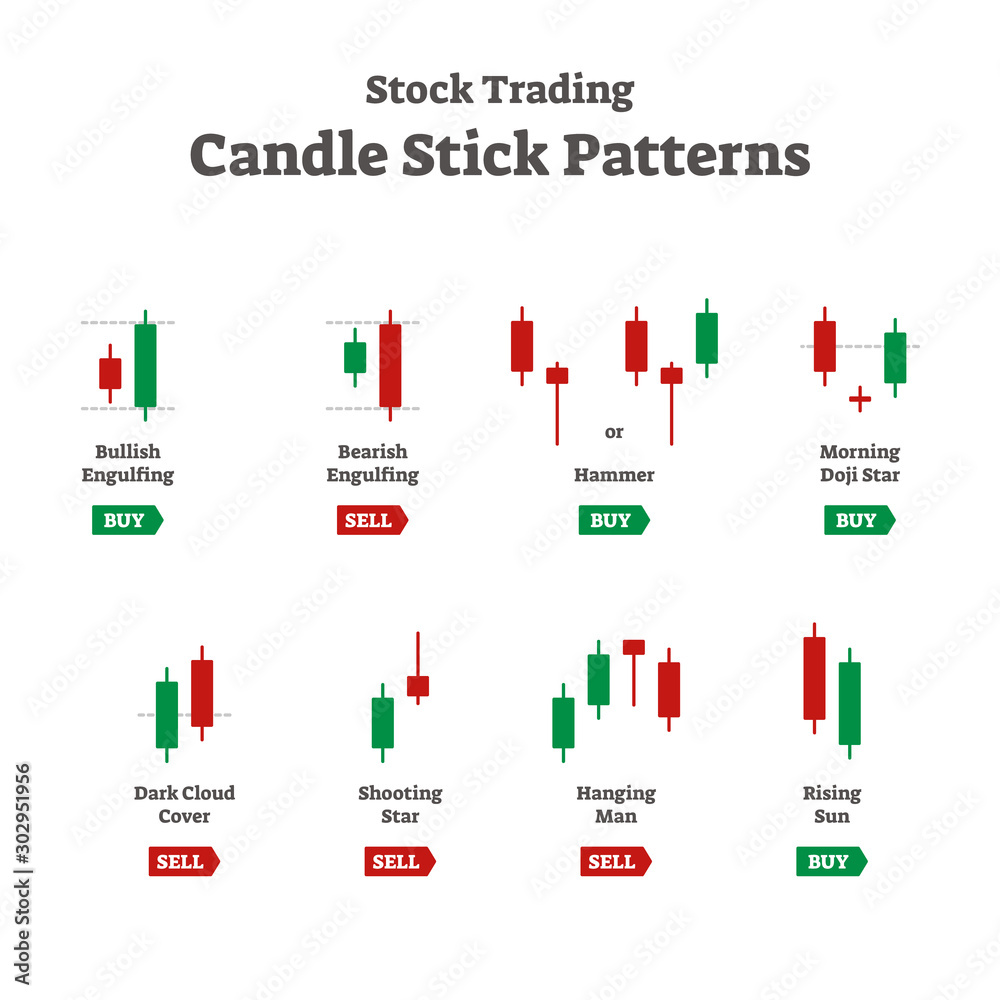

Alright, here’s where the real fun begins. Let’s explore the top 10 candlestick patterns that every trader should have in their arsenal. These aren’t just random shapes—they’re powerful signals that can make or break your trades.

1. Doji: The Market’s Indecision

A Doji is like the market’s pause button. It shows that buyers and sellers are equally matched, resulting in little to no price movement. This pattern often signals an upcoming reversal, so traders pay close attention when a Doji appears.

2. Hammer: The Bullish Reversal Signal

Picture a hammer with a long lower wick and a small body. This pattern suggests that sellers tried to push the price down, but buyers stepped in and regained control. A hammer is a strong indicator of a potential bullish reversal.

3. Shooting Star: The Bearish Counterpart

Just like the hammer, but flipped upside down. A shooting star has a long upper wick and a small body, signaling that buyers attempted to push the price up but were ultimately rejected by sellers. This pattern often precedes a bearish reversal.

4. Engulfing Patterns: When One Candle Swallows Another

Engulfing patterns come in two flavors: bullish and bearish. A bullish engulfing occurs when a large green candle completely engulfs the previous red candle, indicating strong buying pressure. Conversely, a bearish engulfing happens when a large red candle engulfs the previous green candle, signaling strong selling pressure.

5. Harami: The Candle Within a Candle

A Harami pattern occurs when a small candle is completely contained within the body of the previous larger candle. This pattern suggests indecision and often leads to a reversal in the current trend.

Reading Between the Wicks: Advanced Candlestick Analysis

Now that you’ve got the basics down, let’s level up your skills. Advanced candlestick analysis involves looking beyond individual patterns and considering the broader context. Here are a few tips to sharpen your pattern-reading skills:

1. Combine Patterns for Confirmation

Sometimes, one pattern isn’t enough to make a confident trade. Combining multiple patterns can provide stronger confirmation. For example, a hammer followed by a bullish engulfing pattern could signal a powerful reversal.

2. Pay Attention to Volume

Volume is like the market’s heartbeat—it tells you how much energy is behind a pattern. High volume accompanying a reversal pattern increases its reliability, while low volume might suggest a false signal.

3. Context Matters

Where a pattern appears in the overall trend can greatly affect its meaning. A hammer at the bottom of a downtrend is more significant than one in the middle of a consolidation phase. Always consider the bigger picture when analyzing patterns.

How Stocks Candle Patterns Fit Into Your Trading Strategy

Understanding candlestick patterns is one thing, but integrating them into your trading strategy is another. Here’s how you can make these patterns work for you:

Start by identifying your trading goals. Are you looking for short-term trades or long-term investments? Different patterns suit different strategies. For example, reversal patterns like hammers and shooting stars are ideal for day traders, while continuation patterns like flags and pennants work well for swing traders.

Next, set up your trading rules. Decide how you’ll use patterns to determine entry and exit points, position sizing, and risk management. Consistency is key in trading, so having a solid plan in place can make all the difference.

1. Entry Points

Use candlestick patterns to identify potential entry points. For instance, if you spot a bullish engulfing pattern in an oversold market, it could be a great opportunity to buy.

2. Exit Points

Patterns can also help you decide when to exit a trade. A bearish engulfing pattern in an overbought market might be your cue to sell or take profits.

3. Risk Management

Set your stop-loss levels based on pattern characteristics. For example, if you enter a trade after a hammer pattern, place your stop-loss just below the low of the hammer to protect yourself from unexpected moves.

Data-Driven Insights: The Power of Candlestick Patterns

Let’s talk stats. Studies show that candlestick patterns have a success rate of around 70% when used correctly. That’s not a guarantee, but it’s a pretty good odds in the world of trading. For instance, a study by the Journal of Finance found that bullish engulfing patterns resulted in an average return of 1.5% over the next week.

But don’t just take our word for it. Test these patterns yourself. Backtest them on historical data to see how they perform in different market conditions. Platforms like TradingView and MetaTrader offer powerful tools for analyzing candlestick patterns and testing strategies.

1. Backtesting

Backtesting allows you to simulate trades based on historical data, helping you refine your strategy before risking real money. It’s like practicing in a controlled environment before stepping into the real game.

2. Forward Testing

Once you’ve backtested a strategy, try forward testing it in a live market using a demo account. This gives you a taste of real trading conditions without the financial risk.

Common Mistakes to Avoid When Using Stocks Candle Patterns

Even the best tools can fail if used incorrectly. Here are some common mistakes to avoid when working with candlestick patterns:

- Overtrading: Don’t chase every pattern you see. Stick to high-probability setups.

- Ignoring Context: Always consider the bigger picture. A pattern in isolation might not mean much.

- Not Using Stops: Protect your capital by setting stop-loss levels based on pattern characteristics.

Remember, trading is a marathon, not a sprint. Patience and discipline are your best allies.

Resources for Mastering Stocks Candle Patterns

Ready to take your candlestick game to the next level? Here are some resources to help you along the way:

- Investopedia: A great starting point for learning the basics of candlestick patterns.

- TradingView: A powerful platform for analyzing charts and testing strategies.

- MetaTrader: A popular trading platform with advanced charting tools.

Books like "Japanese Candlestick Charting Techniques" by Steve Nison are also excellent resources for diving deeper into the world of candlestick patterns.

Conclusion: Master the Market with Stocks Candle Patterns

There you have it—a comprehensive guide to stocks candle patterns. From understanding the basics to integrating them into your trading strategy, these patterns can be your secret weapon in the trading world. Remember, success in trading isn’t about finding the perfect pattern; it’s about using patterns effectively within a well-thought-out strategy.

So, what are you waiting for? Dive in, practice, and let those candlesticks guide you to trading success. And don’t forget to share this article with your fellow traders. Knowledge is power, and sharing it makes everyone stronger. Happy trading!

Table of Contents

- What Are Stocks Candle Patterns Anyway?

- Why Stocks Candle Patterns Matter

- Top 10 Candlestick Patterns Every Trader Should Know

- Reading Between the Wicks: Advanced Candlestick Analysis

- How Stocks Candle Patterns Fit Into Your Trading Strategy

- Data-Driven Insights: The Power of Candlestick Patterns

- Common Mistakes to Avoid When Using Stocks Candle Patterns

- Resources for Mastering Stocks Candle Patterns

- Biography

- Conclusion