Cup And Handle Pattern: Bullish Or Bearish? Unlocking The Secrets Of This Powerful Chart Formation

Ever wondered what makes the stock market tick? One of the most reliable chart patterns that traders swear by is the cup and handle pattern. This formation has been around for decades, and it continues to be a go-to strategy for both novice and seasoned investors. Whether you're bullish or bearish, understanding this pattern can give you a serious edge in your trading game.

Imagine this: you're scrolling through your favorite trading platform, and you spot a stock that looks like it's forming a cup-like shape. But wait, there's more! After the cup forms, there's a small consolidation phase that resembles a handle. This is no ordinary chart pattern—it's the cup and handle, and it could signal a potential breakout or breakdown, depending on how you play it.

But here's the catch: not all cup and handle patterns are created equal. While some can lead to massive gains, others might leave you scratching your head. That's why it's crucial to understand the nuances of this pattern, whether you're bullish or bearish. In this article, we'll dive deep into the world of cup and handle patterns, breaking down everything you need to know to make informed trading decisions.

What is a Cup and Handle Pattern?

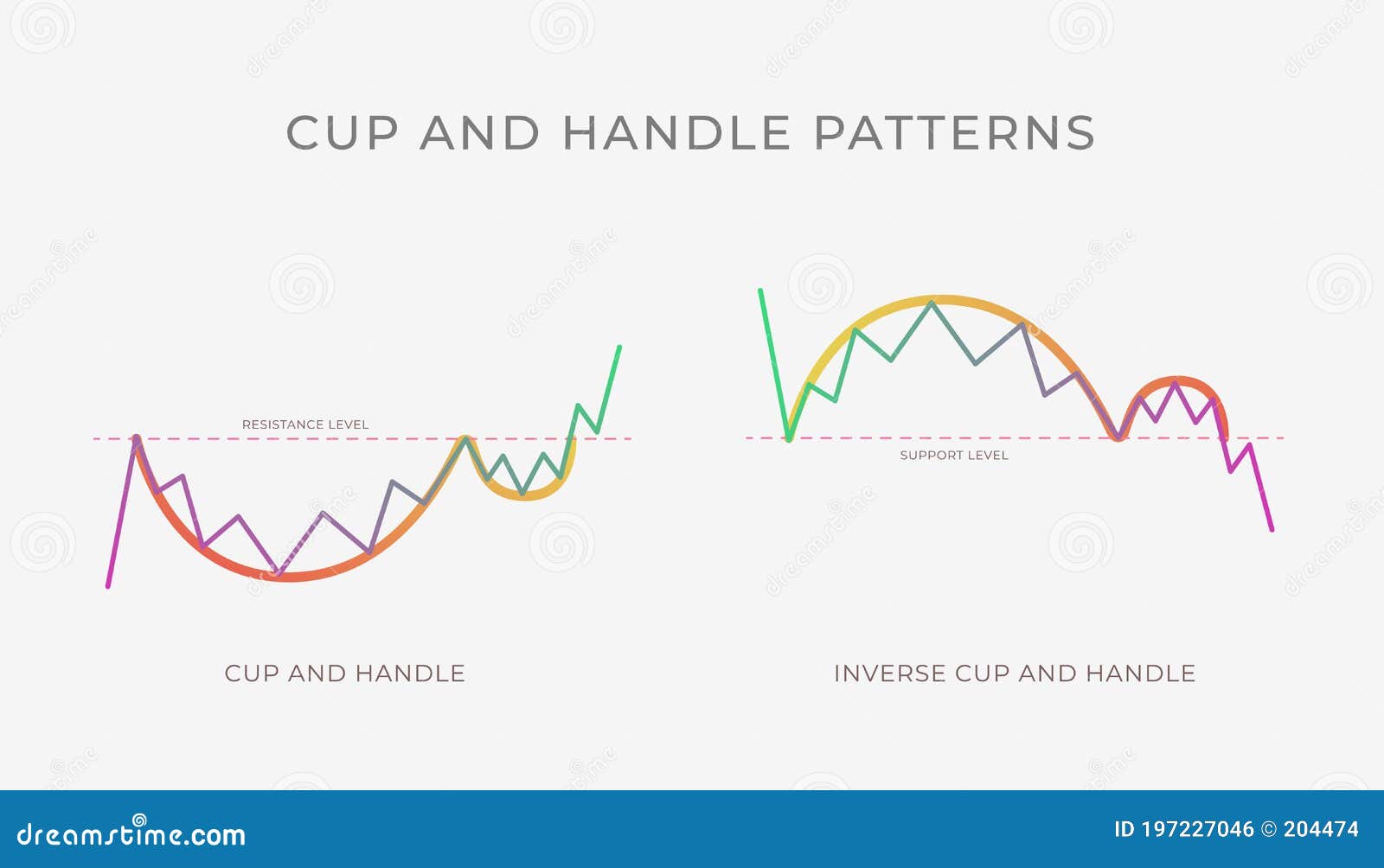

The cup and handle pattern is a technical analysis formation that resembles a cup with a handle. It's typically considered a bullish continuation pattern, but it can also appear in bearish scenarios, depending on the market context. This pattern usually forms after an upward or downward trend, signaling a potential breakout or breakdown.

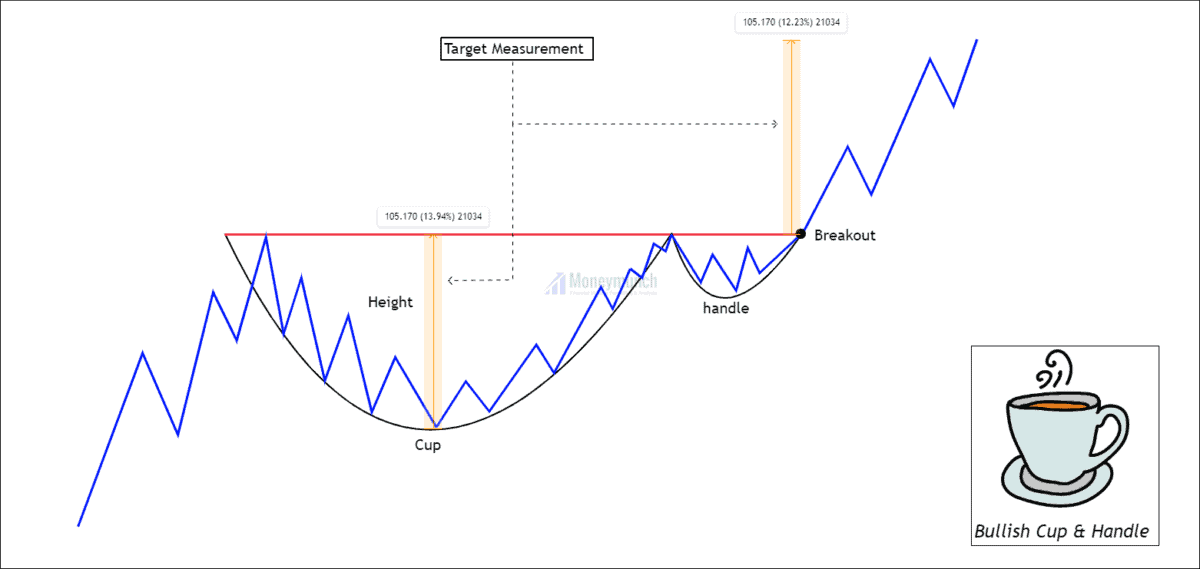

In a bullish cup and handle pattern, the cup represents a consolidation phase where the price moves sideways or slightly downward, forming a U-shape. The handle, on the other hand, is a smaller consolidation phase that follows the cup, often resembling a flag or pennant. Once the handle completes, the price may break out, leading to significant gains.

On the flip side, a bearish cup and handle pattern works in reverse. Instead of a U-shape, the cup forms an inverted U, followed by a handle that consolidates before a potential breakdown. Understanding the differences between these two patterns is key to capitalizing on market opportunities.

How to Identify a Cup and Handle Pattern

Spotting a cup and handle pattern requires a keen eye and a solid understanding of technical analysis. Here's how you can identify this formation:

- Look for a Cup: The cup should form a smooth U-shape, with no sharp V-shaped bottoms. Ideally, the left and right sides of the cup should be symmetrical.

- Check the Handle: The handle is a smaller consolidation phase that follows the cup. It usually forms a downward-sloping trendline, resembling a flag or pennant.

- Volume Matters: Volume tends to decrease during the formation of the cup and handle, only to spike during the breakout or breakdown phase.

- Measure the Depth: The depth of the cup should ideally be between 20% to 33% of the prior move. Anything deeper might indicate a reversal rather than a continuation pattern.

Key Characteristics of the Cup and Handle Pattern

Now that you know how to identify a cup and handle pattern, let's dive into its key characteristics:

1. Symmetry of the Cup

A well-formed cup and handle pattern should have a symmetrical cup. This means that the left and right sides of the cup should mirror each other, creating a smooth U-shape. If the cup looks distorted or has sharp edges, it might not be a valid formation.

2. Handle Length and Slope

The handle should be relatively short compared to the cup, ideally lasting between one to four weeks. A longer handle might indicate a lack of buying pressure, reducing the chances of a successful breakout. Additionally, the handle should slope downward slightly, creating a flag-like structure.

3. Volume Patterns

Volume plays a crucial role in confirming the validity of a cup and handle pattern. During the formation of the cup, volume tends to decrease, indicating consolidation. However, during the breakout phase, volume should spike, signaling increased buying pressure.

Is the Cup and Handle Pattern Bullish or Bearish?

Here's the million-dollar question: is the cup and handle pattern bullish or bearish? The answer depends on the market context and the direction of the prior trend. In most cases, the cup and handle pattern is considered bullish, especially when it forms after an upward trend. However, it can also appear in bearish scenarios, signaling a potential breakdown.

In a bullish cup and handle pattern, the price consolidates after an upward trend, forming a U-shaped cup. The handle then consolidates further before breaking out, leading to significant gains. On the other hand, a bearish cup and handle pattern forms after a downward trend, with an inverted U-shaped cup followed by a handle. Once the handle completes, the price may break down, leading to further losses.

How to Trade the Cup and Handle Pattern

Trading the cup and handle pattern requires a strategic approach. Here's how you can capitalize on this formation:

1. Entry Point

The ideal entry point for a bullish cup and handle pattern is when the price breaks above the resistance level formed by the handle. For a bearish cup and handle pattern, the entry point is when the price breaks below the support level formed by the handle.

2. Stop-Loss Placement

Placing a stop-loss is crucial to managing risk. For a bullish cup and handle pattern, set your stop-loss below the lowest point of the handle. For a bearish cup and handle pattern, set your stop-loss above the highest point of the handle.

3. Target Price

To determine your target price, measure the height of the cup from the highest point to the lowest point. Add this measurement to the breakout point for a bullish pattern or subtract it from the breakdown point for a bearish pattern.

Common Mistakes to Avoid

While the cup and handle pattern is a powerful tool, it's not foolproof. Here are some common mistakes to avoid:

- Jumping the Gun: Entering a trade too early, before the breakout or breakdown is confirmed, can lead to losses.

- Ignoring Volume: Failing to confirm the pattern with volume analysis can result in false signals.

- Overtrading: Trying to force a cup and handle pattern where one doesn't exist can lead to poor trading decisions.

Real-World Examples of Cup and Handle Patterns

Let's take a look at some real-world examples of cup and handle patterns in action:

Example 1: Bullish Cup and Handle Pattern

In 2020, Apple Inc. formed a bullish cup and handle pattern after a strong upward trend. The cup consolidated for several weeks, followed by a handle that sloped downward slightly. Once the price broke above the resistance level, it surged, leading to significant gains for traders who recognized the pattern.

Example 2: Bearish Cup and Handle Pattern

In 2018, Tesla Inc. formed a bearish cup and handle pattern after a prolonged downward trend. The inverted U-shaped cup was followed by a handle that consolidated before the price broke below the support level. Traders who shorted the stock during the breakdown phase were rewarded with substantial profits.

Conclusion

The cup and handle pattern is a powerful tool for traders looking to capitalize on market opportunities. Whether you're bullish or bearish, understanding this formation can give you an edge in your trading game. By identifying key characteristics, avoiding common mistakes, and using real-world examples, you can harness the potential of the cup and handle pattern to achieve trading success.

So, what are you waiting for? Start analyzing your charts and see if you can spot a cup and handle pattern. And don't forget to share your thoughts in the comments below or check out our other articles for more trading tips and strategies. Happy trading!

Table of Contents

What is a Cup and Handle Pattern?

How to Identify a Cup and Handle Pattern

Key Characteristics of the Cup and Handle Pattern

Is the Cup and Handle Pattern Bullish or Bearish?

How to Trade the Cup and Handle Pattern

Real-World Examples of Cup and Handle Patterns