Fin Mutual Fund: Your Ultimate Guide To Building Wealth With Smart Investments

So, you’ve probably heard the buzzword "fin mutual fund" floating around in financial circles. But what exactly does it mean, and why should you care? In today's fast-paced world, where everyone’s chasing financial freedom, understanding mutual funds is like having a secret weapon in your investment arsenal. Think of it as a smart way to grow your money without needing a Ph.D. in finance. Whether you’re a rookie investor or someone looking to expand your portfolio, fin mutual funds could be your ticket to long-term wealth. Stick around because we’re about to break it all down for you.

Investing doesn’t have to be intimidating, and that’s where fin mutual funds come into play. These funds pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, and other securities. The beauty of it? You don’t need a fortune to get started. With just a small amount, you can access a wide range of investments that would otherwise be out of reach for the average person. Sounds pretty cool, right?

Before we dive deeper, let’s clear the air. This article isn’t just another boring financial jargon-filled guide. We’re here to demystify fin mutual funds in a way that’s easy to digest, practical, and packed with actionable insights. By the end of this, you’ll be equipped with the knowledge to make smarter investment decisions. So, grab your favorite drink, and let’s get rolling!

What Exactly Are Fin Mutual Funds?

Alright, let’s cut to the chase. Fin mutual funds are basically investment vehicles that allow you to pool your money with other investors. Think of it like a group project, but instead of making posters, you’re building wealth. A professional fund manager takes charge of the money and invests it in a variety of assets, like stocks, bonds, and even real estate. The goal? To generate returns for everyone involved.

Here’s the kicker: mutual funds come in all shapes and sizes. You’ve got equity funds, bond funds, index funds, and more. Each type caters to different risk appetites and financial goals. For instance, if you’re young and willing to take on more risk, equity funds might be your jam. But if you’re nearing retirement and prefer stability, bond funds could be the safer bet.

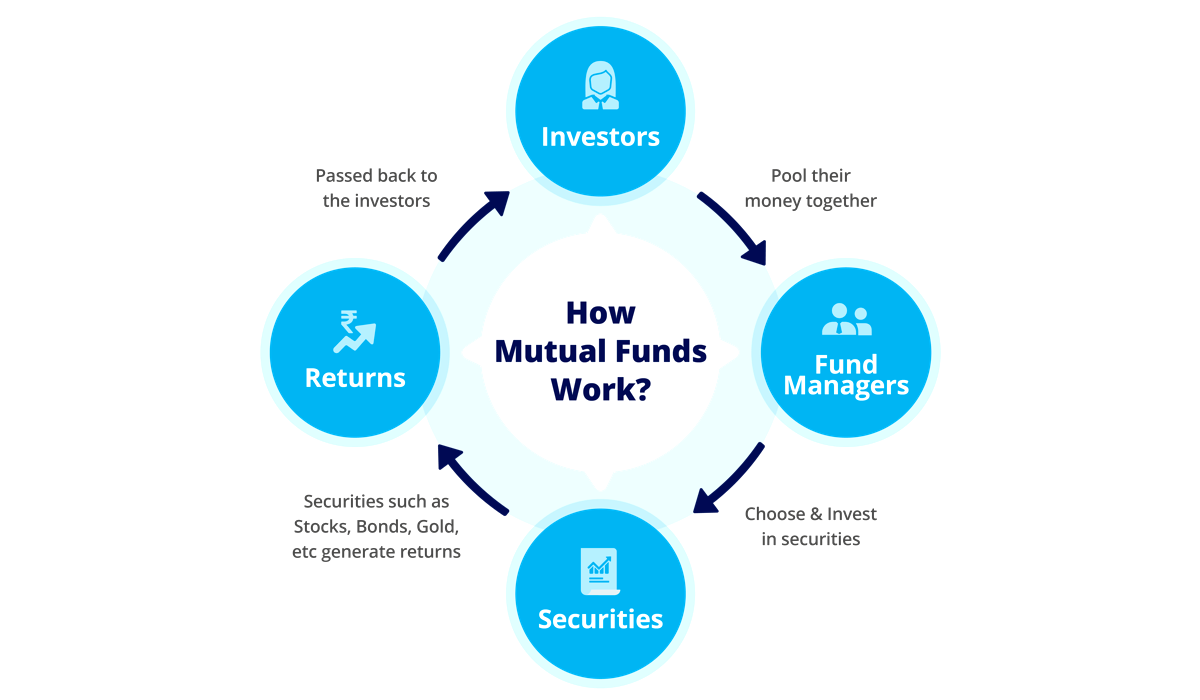

How Do Fin Mutual Funds Work?

Now that we’ve defined what fin mutual funds are, let’s talk about how they actually work. When you invest in a mutual fund, you’re essentially buying units or shares of that fund. The value of these units fluctuates based on the performance of the underlying assets. Here’s a quick breakdown:

- Pooling Money: Your money gets combined with other investors’ funds.

- Professional Management: A fund manager decides where to invest the pooled money.

- Diversification: The fund spreads investments across various asset classes to minimize risk.

- Profit Sharing: If the fund performs well, you get a share of the profits in the form of dividends or capital gains.

Simple, right? But here’s the thing: mutual funds aren’t one-size-fits-all. Your choice of fund should align with your financial goals, risk tolerance, and investment horizon.

Why Should You Invest in Fin Mutual Funds?

Let’s face it—saving money in a traditional bank account won’t cut it if you want to beat inflation and build wealth. That’s where fin mutual funds come in. Here are a few reasons why they’re worth considering:

1. Diversification: One of the biggest advantages of mutual funds is diversification. Instead of putting all your eggs in one basket, you’re spreading your investments across multiple assets. This reduces the risk of losing everything if one particular stock or bond underperforms.

2. Professional Management: If you’re not a finance wizard, don’t worry. Mutual funds are managed by experienced professionals who do the heavy lifting for you. They analyze market trends, pick the best investments, and make adjustments as needed.

3. Liquidity: Unlike some other investments, mutual funds are relatively liquid. You can usually redeem your units and get your money back within a few days. This makes them a great option for those who need quick access to cash.

Types of Fin Mutual Funds

Not all mutual funds are created equal. Here’s a look at the most common types:

- Equity Funds: These invest primarily in stocks and are ideal for long-term growth.

- Bond Funds: These focus on fixed-income securities and offer stability and regular income.

- Index Funds: These mimic a specific market index, like the S&P 500, and are known for their low fees.

- Money Market Funds: These invest in short-term, low-risk securities and are great for parking cash.

Choosing the right type of fund depends on your financial goals and risk tolerance. For example, if you’re saving for a down payment on a house in five years, a bond fund might be a safer bet than an equity fund.

How to Choose the Right Fin Mutual Fund

Picking the perfect mutual fund can feel overwhelming, but it doesn’t have to be. Here’s a step-by-step guide to help you make the right choice:

1. Define Your Goals: Are you investing for retirement, a child’s education, or a dream vacation? Knowing your goals will help you choose a fund that aligns with them.

2. Assess Your Risk Tolerance: Are you comfortable with short-term fluctuations in your investment value? If not, you might want to steer clear of high-risk funds.

3. Research the Fund: Look at the fund’s historical performance, fees, and management team. A fund with a strong track record and low expenses is usually a good bet.

Key Factors to Consider

When evaluating mutual funds, keep these factors in mind:

- Expense Ratio: This is the annual fee charged by the fund. Lower ratios mean more of your money stays in your pocket.

- Track Record: A fund’s past performance can give you insight into its potential future performance.

- Management Team: A skilled fund manager can make all the difference in how well the fund performs.

Remember, past performance doesn’t guarantee future results, but it’s a good indicator of a fund’s consistency.

Understanding Risks and Rewards

Every investment comes with risks, and mutual funds are no exception. However, the rewards can be well worth it if you play your cards right. Here’s a closer look at the risks and rewards:

Risks:

- Market Fluctuations: The value of your investment can go down as well as up.

- Management Risks: Even the best fund managers can make mistakes.

- Inflation Risk: If your returns don’t outpace inflation, your purchasing power could decrease.

Rewards:

- Potential for High Returns: Equity funds, in particular, have the potential to deliver substantial gains over time.

- Diversification: Spreading your investments across multiple assets reduces the risk of a single loss wiping out your portfolio.

- Professional Oversight: You get the benefit of expert management without needing to be an expert yourself.

Managing Risks

While you can’t eliminate all risks, you can take steps to mitigate them. Here’s how:

- Diversify: Spread your investments across different types of funds to minimize risk.

- Stay Informed: Keep up with market trends and news that could impact your investments.

- Rebalance Regularly: Adjust your portfolio periodically to ensure it aligns with your goals and risk tolerance.

By taking a proactive approach, you can protect your investments and maximize your returns.

Getting Started with Fin Mutual Funds

Ready to dip your toes into the world of mutual funds? Here’s a simple guide to help you get started:

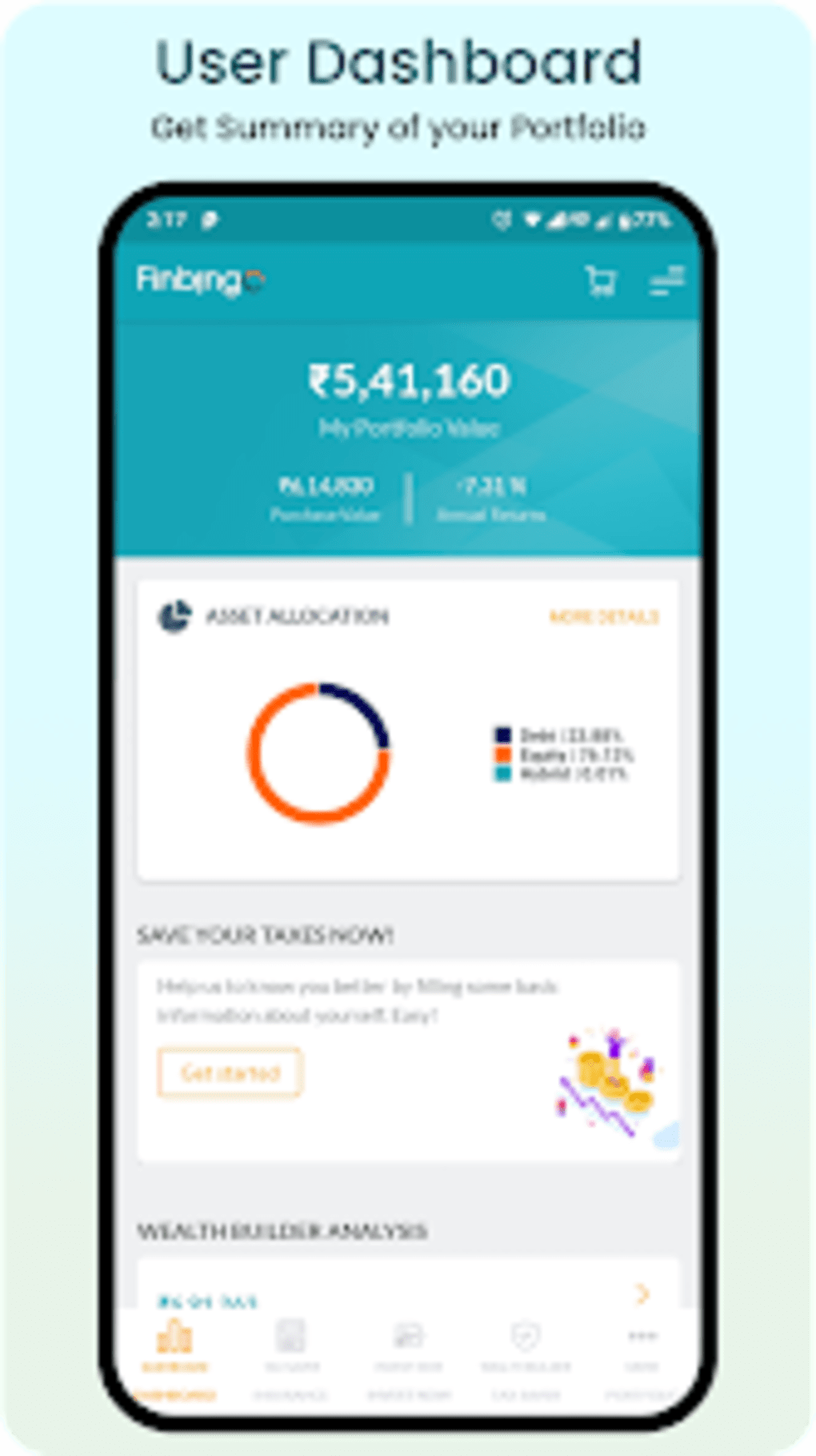

1. Open an Investment Account: You’ll need an account with a brokerage firm or a mutual fund company to invest.

2. Choose Your Funds: Based on your research, select the funds that best match your goals and risk tolerance.

3. Start Investing: You can invest a lump sum or set up a regular contribution plan to make investing easier.

Common Mistakes to Avoid

As with any investment, there are pitfalls to watch out for. Here are a few common mistakes to avoid:

- Chasing Returns: Don’t invest in a fund just because it performed well last year. Past performance doesn’t guarantee future success.

- Ignoring Fees: High expense ratios can eat into your returns over time.

- Overtrading: Constantly buying and selling funds can lead to unnecessary costs and tax liabilities.

By steering clear of these mistakes, you can make smarter investment decisions.

Fin Mutual Fund vs. Other Investment Options

So, how do mutual funds stack up against other investment options? Let’s compare them with stocks, bonds, and ETFs:

Stocks: While stocks offer the potential for high returns, they also come with higher risk. Mutual funds, on the other hand, provide diversification, which can reduce risk.

Bonds: Bonds are generally safer than stocks, but they also offer lower returns. Mutual funds that invest in bonds can provide a balance of safety and income.

ETFs: Exchange-traded funds (ETFs) are similar to mutual funds but trade like stocks on an exchange. They often have lower fees but may lack the active management of traditional mutual funds.

Which One’s Right for You?

The answer depends on your goals and risk tolerance. If you want professional management and diversification, mutual funds might be the way to go. But if you prefer more control and lower fees, ETFs could be a better fit.

Expert Tips for Success

Here are a few expert tips to help you succeed with fin mutual funds:

- Start Early: The power of compounding can work wonders if you start investing early.

- Stay Consistent: Regular contributions can help you build wealth over time.

- Be Patient: Investing is a marathon, not a sprint. Don’t let short-term market fluctuations derail your long-term strategy.

Final Thoughts

Fin mutual funds offer a smart and accessible way to grow your wealth. Whether you’re a seasoned investor or a newcomer to the financial world, they can play a valuable role in your portfolio. Just remember to do your research, choose wisely, and stay disciplined.

So, what are you waiting for? Take the first step toward financial independence today. And don’t forget to share this article with your friends and family who might benefit from it. Together, we can all become smarter investors!

Table of Contents

- What Exactly Are Fin Mutual Funds?

- How Do Fin Mutual Funds Work?

- Why Should You Invest in Fin Mutual Funds?

- Types of Fin Mutual Funds

- How to Choose the Right Fin Mutual Fund

- Understanding Risks and Rewards

- Getting Started with Fin Mutual Funds

- Fin Mutual Fund vs. Other Investment Options

- Expert Tips for Success

- Final Thoughts