Flipkart Stock Price: A Deep Dive Into The Numbers That Matter

Ever wondered why everyone’s talking about Flipkart stock price? Well, buckle up, because we’re diving headfirst into the world of Indian e-commerce and uncovering the secrets behind Flipkart’s financial journey. Whether you’re an investor looking for the next big thing or just someone curious about how this giant is doing, you’re in the right place. Today, we’ll break it all down for you in a way that’s as easy to digest as your favorite snack.

Flipkart stock price has been a hot topic in recent years, especially since its acquisition by Walmart. But what does this mean for investors? Is Flipkart worth your hard-earned cash? These are questions we’ll tackle together. We’ll explore everything from its historical performance to its future prospects, ensuring you’re armed with the knowledge you need to make smart decisions.

Before we jump into the nitty-gritty, let’s set the stage. Flipkart isn’t just another company—it’s a titan in the Indian e-commerce space. With millions of users and a vast product range, it’s no surprise that people are eager to know more about its stock price. So, without further ado, let’s get started!

Understanding Flipkart Stock Price: The Basics

First things first, let’s clear the air. Flipkart isn’t publicly traded, which means you won’t find its stock listed on major exchanges like NASDAQ or the Bombay Stock Exchange. Instead, its valuation is tied to private transactions and investor reports. This makes tracking Flipkart stock price a bit trickier than your average publicly traded company.

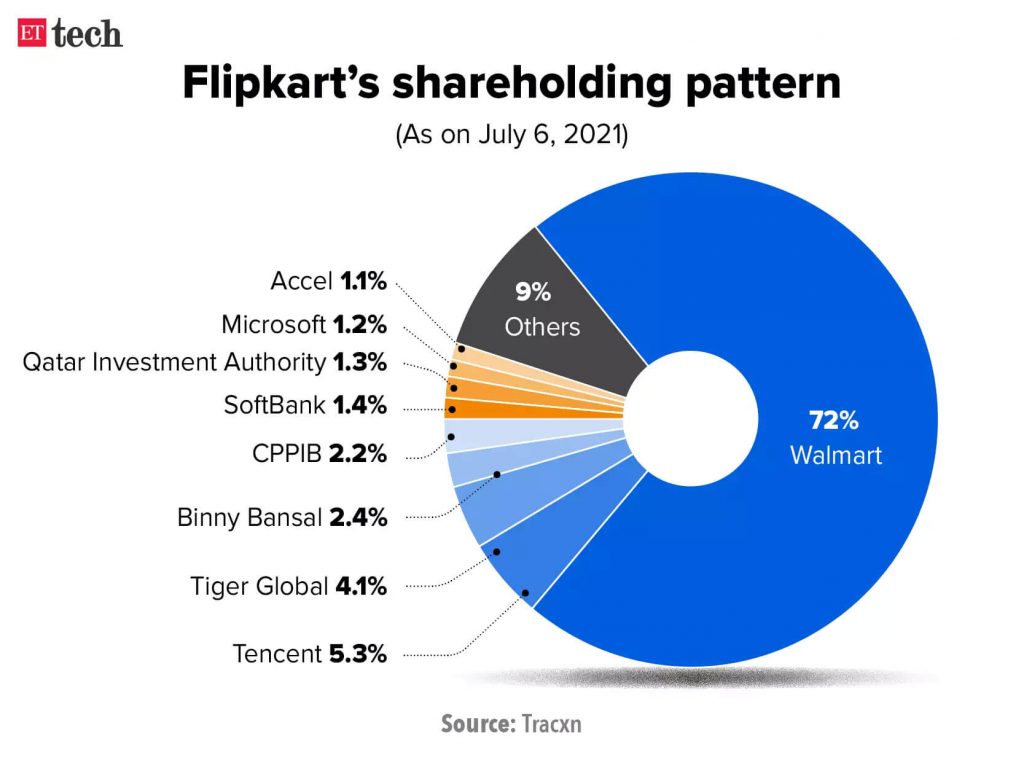

So, how do we even begin to understand Flipkart stock price? The key lies in looking at its funding rounds, acquisition details, and financial health. For instance, Walmart’s acquisition of a significant stake in Flipkart in 2018 sent shockwaves through the industry, raising eyebrows and sparking conversations about its valuation.

Why Flipkart Stock Price Matters

For starters, Flipkart’s valuation affects not only its investors but also the broader Indian economy. As one of the largest e-commerce platforms in the country, its financial performance is a reflection of consumer behavior and market trends. Here’s why Flipkart stock price is such a big deal:

- It impacts Walmart’s global strategy and financials.

- It serves as a benchmark for other startups in India.

- It provides insights into the future of e-commerce in emerging markets.

Historical Performance: A Look Back

To truly grasp Flipkart stock price, we need to take a trip down memory lane. Flipkart’s journey from a small online bookstore to a behemoth in the e-commerce world is nothing short of remarkable. Along the way, its valuation has seen ups and downs, influenced by factors like competition, regulatory changes, and technological advancements.

In 2018, when Walmart acquired a 77% stake in Flipkart for $16 billion, the company’s valuation skyrocketed. This move not only solidified Flipkart’s position in the market but also attracted attention from global investors. Since then, Flipkart has continued to grow, expanding its product offerings and strengthening its logistics network.

Key Milestones in Flipkart’s Financial Journey

Here’s a quick rundown of some of the most significant milestones in Flipkart’s financial history:

- 2007: Flipkart is founded by Sachin Bansal and Binny Bansal.

- 2014: Flipkart raises $1 billion in funding, valuing the company at $7 billion.

- 2018: Walmart acquires a majority stake in Flipkart for $16 billion.

- 2021: Flipkart announces plans for an IPO, further boosting investor interest.

Factors Influencing Flipkart Stock Price

Flipkart stock price isn’t determined by a single factor. Instead, it’s influenced by a complex web of variables that include market conditions, competition, and internal performance. Let’s break it down:

Market Conditions

The state of the Indian economy and global markets plays a crucial role in shaping Flipkart’s valuation. Factors like inflation, interest rates, and consumer spending patterns can all impact Flipkart stock price. For instance, during periods of economic uncertainty, investors may become more cautious, affecting the company’s perceived value.

Competition

Flipkart operates in a highly competitive landscape, with players like Amazon India vying for market share. The strategies employed by these competitors—such as pricing wars, marketing campaigns, and partnerships—can influence Flipkart stock price. Staying ahead in this game requires constant innovation and adaptability.

Internal Performance

At the end of the day, Flipkart’s financial health is a major determinant of its stock price. Metrics like revenue growth, profit margins, and customer acquisition costs are closely monitored by analysts and investors. A strong performance in these areas can boost confidence in the company’s future prospects.

Flipkart Stock Price: The Numbers Game

Numbers don’t lie, and when it comes to Flipkart stock price, they tell a compelling story. According to recent reports, Flipkart’s valuation is estimated to be around $37.6 billion, making it one of the most valuable privately held companies in India. But what does this mean for potential investors?

While Flipkart isn’t publicly traded, its valuation is often used as a proxy for its stock price. Analysts look at factors like revenue growth, market share, and profitability to estimate its worth. For example, Flipkart’s revenue grew by 30% in 2022, driven by strong demand during festive seasons like Diwali and Big Billion Days.

Breaking Down the Valuation

Here’s a breakdown of the key metrics that contribute to Flipkart’s valuation:

- Revenue: Over $10 billion annually

- Market Share: Approximately 40% of India’s e-commerce market

- Customer Base: Over 300 million users

- Profitability: Operating margins improving steadily

Future Prospects: What Lies Ahead for Flipkart Stock Price?

Looking ahead, the future of Flipkart stock price seems promising. With plans for an IPO on the horizon and ongoing investments in technology and infrastructure, the company is well-positioned to capitalize on the growing e-commerce market in India. But what does this mean for investors?

Experts predict that Flipkart’s valuation could reach $50 billion or more in the coming years, driven by factors like increasing internet penetration, rising disposable incomes, and a favorable regulatory environment. Of course, challenges remain, including intense competition and evolving consumer preferences.

Key Growth Drivers

Here are some of the key growth drivers that could impact Flipkart stock price in the future:

- Expansion into new product categories

- Investments in AI and machine learning

- Strengthening supply chain and logistics

- Focus on sustainability and corporate responsibility

Investor Sentiment: What the Experts Say

When it comes to Flipkart stock price, investor sentiment plays a critical role. Analysts and experts often provide insights into the company’s financial health and future prospects, helping potential investors make informed decisions. But what do they have to say?

Many experts believe that Flipkart’s unique position in the Indian market gives it a competitive edge. Its deep understanding of local consumer behavior, coupled with its strong partnerships and technological advancements, positions it well for long-term success. However, they also caution against overestimating its growth potential, citing the risks associated with a rapidly changing market.

Common Misconceptions About Flipkart Stock Price

There are a few misconceptions floating around when it comes to Flipkart stock price. One of the biggest is that its valuation is solely based on revenue growth. While revenue is certainly important, it’s just one piece of the puzzle. Other factors, like profitability, market share, and customer loyalty, also play a significant role.

Conclusion: Is Flipkart Stock Price Worth Your Attention?

As we wrap up our deep dive into Flipkart stock price, it’s clear that this company is a force to be reckoned with. From its humble beginnings to its current status as a global e-commerce powerhouse, Flipkart has consistently proven its ability to adapt and thrive in a competitive landscape.

For investors, Flipkart stock price offers both opportunities and challenges. While its valuation is impressive, it’s important to approach it with a long-term perspective and a solid understanding of the factors that influence its performance. Whether you’re a seasoned investor or just starting out, keeping an eye on Flipkart’s financial journey is definitely worth your time.

So, what’s next? If you found this article helpful, don’t forget to share it with your friends and colleagues. And if you have any thoughts or questions about Flipkart stock price, drop a comment below. Let’s keep the conversation going!

Table of Contents

- Understanding Flipkart Stock Price: The Basics

- Historical Performance: A Look Back

- Key Milestones in Flipkart’s Financial Journey

- Factors Influencing Flipkart Stock Price

- Market Conditions

- Competition

- Internal Performance

- Flipkart Stock Price: The Numbers Game

- Breaking Down the Valuation

- Future Prospects: What Lies Ahead for Flipkart Stock Price?

- Key Growth Drivers

- Investor Sentiment: What the Experts Say

- Common Misconceptions About Flipkart Stock Price

- Conclusion: Is Flipkart Stock Price Worth Your Attention?