How To Learn Trading: Your Ultimate Guide To Mastering The Market

So, you're thinking about jumping into the trading world, huh? It's like stepping into a giant casino, except it's not all luck—there's skill, strategy, and yes, a ton of learning involved. Learning how to trade is not as simple as buying stocks or currencies and hoping for the best. It's a journey that requires dedication, patience, and a solid understanding of the markets. Whether you're a complete beginner or someone who's dabbled a bit, this guide will help you navigate the trading labyrinth.

Trading isn't just about making quick bucks. It's about understanding the market, knowing your risks, and having a plan. Think of it like learning to drive. You wouldn't just hop into a Ferrari without knowing how to use the brakes, right? Same goes for trading. You need to know the ins and outs before you start pressing buttons on your trading platform.

But don't worry, we're here to break it down for you. From the basics to advanced strategies, this article will cover everything you need to know about how to learn trading. So, buckle up and get ready to dive into the world of finance!

Understanding the Basics of Trading

What Is Trading, Anyway?

Let's start with the basics. Trading is essentially buying and selling financial instruments—like stocks, currencies, commodities, or even cryptocurrencies—with the goal of making a profit. It's like a game, but instead of Monopoly money, you're dealing with real cash. And just like any game, you need to know the rules before you start playing.

Trading can take many forms. You could be trading stocks, which means buying shares of a company and selling them when the price goes up. Or you could be trading forex, where you're buying and selling currencies. Each type of trading has its own set of rules and strategies, so it's important to understand what you're getting into.

Why Learn How to Trade?

Now, you might be wondering, "Why should I bother learning how to trade?" Well, for starters, trading can be a great way to build wealth. If done correctly, it can provide a steady stream of income. Plus, it's a skill that can give you financial independence and flexibility. Imagine being able to work from anywhere in the world, as long as you have an internet connection. Sounds pretty sweet, right?

But trading isn't just about money. It's also about personal growth. Learning how to trade teaches you discipline, patience, and critical thinking. It's like a mental workout for your brain. And let's be honest, who doesn't want to be smarter and richer?

Setting Up Your Trading Foundation

Choosing the Right Trading Platform

One of the first steps in learning how to trade is choosing the right platform. Think of it like picking the right tool for the job. There are tons of trading platforms out there, each with its own features and benefits. Some are great for beginners, while others are more suited for advanced traders.

- Platforms like eToro are great for beginners because they offer a user-friendly interface and a variety of educational resources.

- MetaTrader is a popular choice for forex traders because of its advanced charting tools and automation capabilities.

- Robinhood is another option that's gaining popularity, especially among younger traders, due to its commission-free trades.

It's important to do your research and choose a platform that fits your needs and trading style. Don't be afraid to try out a few before settling on one.

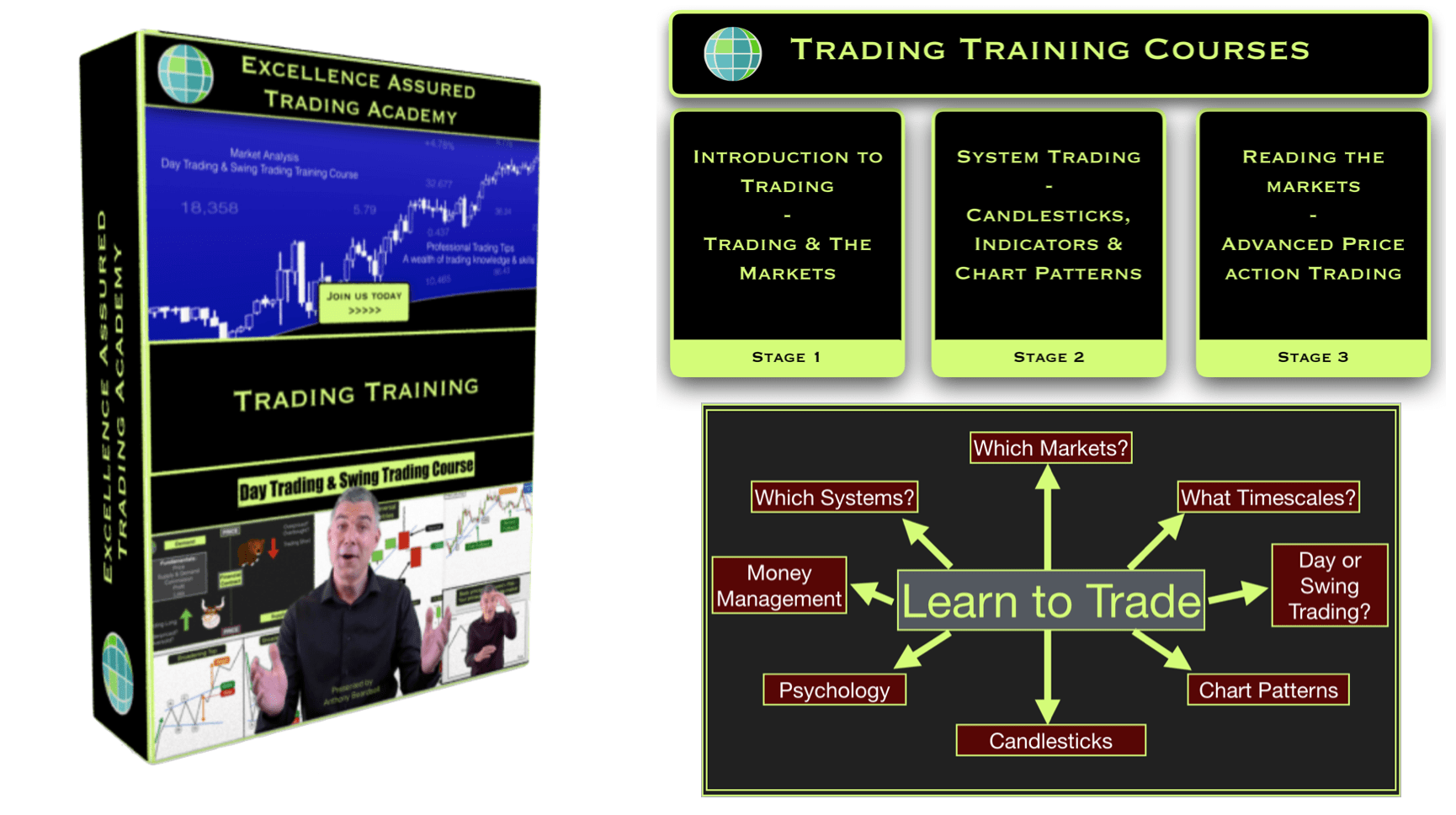

Understanding Different Types of Trading

Trading comes in many flavors, and it's important to understand the differences. Here are some of the most common types:

- Stock Trading: Buying and selling shares of publicly traded companies.

- Forex Trading: Trading currencies on the foreign exchange market.

- Cryptocurrency Trading: Buying and selling digital currencies like Bitcoin and Ethereum.

- Commodity Trading: Trading physical goods like gold, oil, or coffee.

Each type of trading has its own risks and rewards, so it's important to choose one that aligns with your goals and risk tolerance. Don't be afraid to experiment with different types to see what works best for you.

Building a Solid Trading Strategy

Learning the Art of Technical Analysis

Technical analysis is like the secret sauce of trading. It involves studying past market data, primarily price and volume, to predict future price movements. Think of it like reading tea leaves, but with charts and graphs instead of leaves.

Some popular technical analysis tools include:

- Charts: Line charts, bar charts, and candlestick charts are all used to visualize price movements.

- Indicators: Tools like moving averages, RSI, and MACD help traders identify trends and potential entry and exit points.

- Patterns: Chart patterns like head and shoulders, triangles, and flags can signal potential price movements.

Learning technical analysis takes time and practice, but it's a crucial skill for any trader. The more you practice, the better you'll become at spotting trends and making informed decisions.

Understanding Fundamental Analysis

While technical analysis focuses on price movements, fundamental analysis looks at the underlying factors that affect a company's value. This includes things like financial statements, economic indicators, and industry trends.

For example, if you're trading stocks, you might look at a company's earnings reports, revenue growth, and debt levels to determine its potential for future success. If you're trading forex, you might look at interest rates, inflation rates, and geopolitical events that could affect currency values.

Fundamental analysis can be a bit more complex than technical analysis, but it provides valuable insights that can help you make better trading decisions.

Managing Risk in Trading

The Importance of Risk Management

Risk management is one of the most important aspects of trading. It's like wearing a seatbelt when you're driving—it might not seem necessary at the time, but it could save your life. In trading, risk management involves setting limits on how much you're willing to lose on each trade and sticking to those limits.

Some key risk management strategies include:

- Setting stop-loss orders to automatically sell a position if it falls below a certain price.

- Using position sizing to control how much of your portfolio is allocated to each trade.

- Diversifying your portfolio to spread out risk across different assets.

Remember, trading is all about managing risk. The more you can control your risk, the better your chances of long-term success.

Learning from Your Mistakes

Let's face it, everyone makes mistakes in trading. The key is to learn from them and not repeat them. Keep a trading journal to track your trades, including what worked and what didn't. This will help you identify patterns and areas for improvement.

It's also important to have a growth mindset. Instead of getting discouraged by losses, view them as learning opportunities. Every trade, whether it's a win or a loss, is a chance to improve your skills and become a better trader.

Choosing the Right Trading Style

Day Trading vs. Swing Trading

When it comes to trading styles, two of the most popular are day trading and swing trading. Day trading involves buying and selling assets within the same day, while swing trading involves holding positions for several days or even weeks.

- Day Trading: Requires constant monitoring of the markets and quick decision-making. Best suited for traders who enjoy the fast-paced nature of trading.

- Swing Trading: Allows for more flexibility and less time spent monitoring the markets. Great for traders who want to take advantage of larger price movements.

Both styles have their pros and cons, so it's important to choose one that fits your personality and lifestyle.

Position Trading and Scalping

Two other popular trading styles are position trading and scalping. Position trading involves holding positions for weeks, months, or even years, while scalping involves making quick trades to capture small price movements.

- Position Trading: Best for long-term investors who believe in the fundamental value of an asset.

- Scalping: Ideal for traders who want to make quick profits and don't mind the high level of risk involved.

Again, it's all about finding the style that works best for you. Don't be afraid to experiment and find what feels right.

Staying Informed and Educated

The Role of Education in Trading

Education is the backbone of successful trading. Just like you wouldn't go into a job interview without doing your research, you shouldn't enter the trading world without a solid understanding of the markets. There are tons of resources available to help you learn, from online courses to books and podcasts.

Some great resources for learning how to trade include:

- Books: "Trading for a Living" by Dr. Alexander Elder and "Market Wizards" by Jack Schwager are must-reads for any trader.

- Courses: Platforms like Udemy and Coursera offer a variety of trading courses for all skill levels.

- Podcasts: Shows like "The Investors Podcast" and "Chat with Traders" provide valuable insights from experienced traders.

Remember, learning is a lifelong journey. The more you know, the better equipped you'll be to navigate the markets.

Staying Updated with Market News

Staying informed is crucial in trading. The markets are constantly changing, and what works today might not work tomorrow. That's why it's important to stay up-to-date with the latest news and trends.

Some great sources for market news include:

- Bloomberg: Provides real-time market data and news from around the world.

- Reuters: Offers in-depth analysis and breaking news on global markets.

- Investopedia: A great resource for educational content and market updates.

By staying informed, you'll be better prepared to make smart trading decisions.

Building Confidence in Trading

The Psychology of Trading

Trading is as much about psychology as it is about strategy. It's important to have a strong mindset and be able to handle the ups and downs of the market. This involves managing emotions like fear and greed, which can cloud judgment and lead to poor decision-making.

Some tips for building confidence in trading include:

- Setting realistic goals and expectations.

- Practicing consistently and learning from your experiences.

- Staying disciplined and sticking to your trading plan.

Remember, trading is a marathon, not a sprint. The more you practice and stay disciplined, the more confident you'll become.

Joining a Trading Community

One of the best ways to build confidence is by joining a trading community. Surrounding yourself with like-minded individuals can provide support, motivation, and valuable insights. Whether it's an online forum, a local trading group, or a social media community, connecting with others can make a big difference in your trading journey.

Some great communities to check out include:

- Reddit: Subreddits like r/stocks and r/investing offer a wealth of knowledge and support.

- Twitter: Follow experienced traders and market analysts for real-time updates and insights.

- Facebook Groups: Many groups focus on specific types of trading and offer a supportive environment for learning and growth.

By joining a community, you'll have access to a wealth of knowledge and support that can help you become a better trader.

Final Thoughts

So, there you have it—your ultimate guide to learning how to trade. From understanding the basics to building a solid strategy and managing risk, this article has covered everything you need to know to start your trading journey. Remember, trading is a skill that takes time and practice to master, so don't get discouraged if you don't see results right away.

Here are some key takeaways to keep in mind:

- Start with the basics and build a strong foundation.

- Choose the right trading platform and style for your needs.

- Learn technical and fundamental analysis to make informed decisions.

- Manage risk effectively and learn from your mistakes.

- Stay informed and educated to stay ahead of the markets.

Now it's your turn. Take action and start learning how to trade. Whether it