Is A Negative P/E Ratio Good? A Deep Dive Into The Numbers

So, you've probably heard about the P/E ratio and how it’s like the financial world's version of a report card for stocks. But what happens when that report card shows a negative number? Is a negative P/E ratio good? Or is it a big red flag you should run from? Let’s break it down, because understanding this can save your wallet and give you an edge in the stock market game.

Now, before we dive deep into the nitty-gritty, let’s get one thing straight: the P/E ratio (Price-to-Earnings ratio) is basically a way to see how much investors are willing to pay for every dollar of a company’s earnings. It’s like asking, “How much am I paying for this company’s ability to make money?” But when earnings are negative, the P/E ratio flips, and things get a little wild.

But hey, don’t panic yet. A negative P/E ratio isn’t always the end of the world. Sometimes it’s just a phase a company is going through. Other times, it might be a sign of deeper trouble. Let’s unpack this mystery together and figure out if a negative P/E ratio is something you should embrace or avoid like a bad investment.

Here’s the deal: if you’re serious about investing, you need to know the ins and outs of financial metrics like the P/E ratio. And yes, that includes understanding what a negative P/E ratio really means. So buckle up, because we’re about to take a deep dive into the world of stock valuation, earnings reports, and market sentiment.

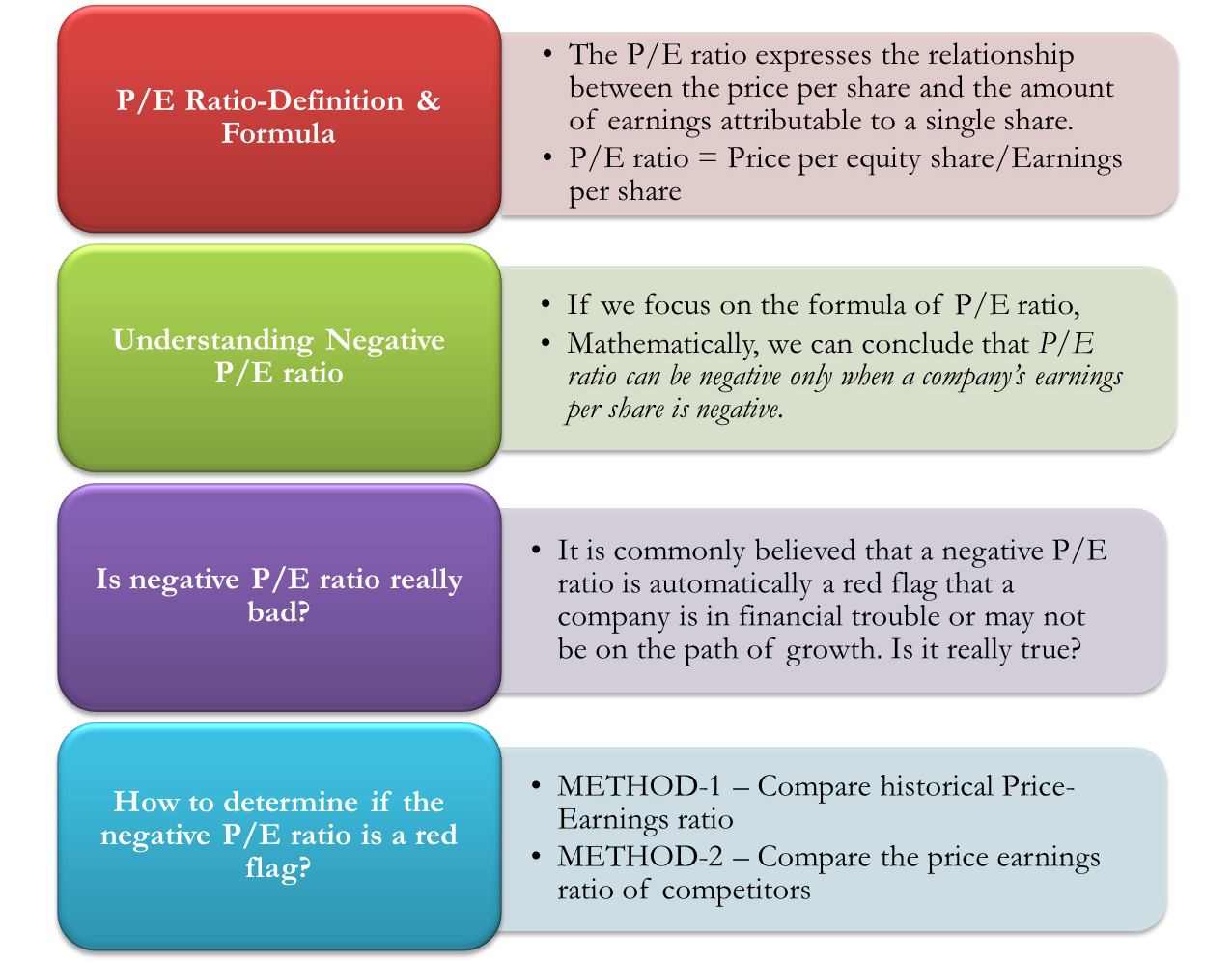

What Exactly Is a P/E Ratio?

Alright, let’s start with the basics. The P/E ratio is like the heartbeat of a stock. It tells you how much people are willing to pay for a company’s earnings. Mathematically, it’s super simple: you take the stock price and divide it by the company’s earnings per share (EPS). But here’s the kicker—when earnings are negative, the whole thing goes sideways.

Think of it like this: if a company is losing money, its EPS is negative, and suddenly, the P/E ratio becomes a negative number. And that’s where things get interesting. A negative P/E ratio doesn’t mean the stock is automatically bad—it just means the company isn’t making a profit right now. But why does this happen? Let’s explore.

Why Does a P/E Ratio Go Negative?

There are a few reasons why a P/E ratio might dip into the negatives. One common reason is that the company is in a growth phase. Maybe they’re investing heavily in new projects, expanding their operations, or developing new products. All of this costs money, and in the short term, it can lead to losses. But if the company executes its plans well, those losses could turn into big profits down the road.

Another reason could be external factors like economic downturns or industry-specific challenges. For example, during a recession, many companies might report negative earnings, leading to negative P/E ratios. Or maybe the company is facing stiff competition or regulatory hurdles that are eating into its profits.

Is a Negative P/E Ratio Always Bad?

Not necessarily. Sometimes, a negative P/E ratio is just a temporary blip on the radar. It could mean the company is going through a rough patch but has a solid long-term plan. Other times, it could be a warning sign that the company is struggling to stay afloat. The key is to look beyond the number and analyze the bigger picture.

For instance, if a tech startup is burning through cash to develop a game-changing product, a negative P/E ratio might not be a dealbreaker. Investors might see the potential and be willing to overlook the losses for now. But if the company has been losing money for years with no clear path to profitability, that’s a red flag you can’t ignore.

When Is a Negative P/E Ratio a Good Thing?

Believe it or not, there are situations where a negative P/E ratio can actually be a good thing. Here are a few examples:

- High Growth Potential: Some companies are willing to sacrifice short-term profits for long-term gains. If a company is investing heavily in R&D or expanding its market share, a negative P/E ratio might be a sign of future success.

- Industry Disruption: In industries like biotech or renewable energy, companies often operate at a loss for years before they start turning a profit. But if they’re working on something groundbreaking, the potential rewards can be massive.

- Temporary Challenges: Sometimes, external factors like supply chain disruptions or geopolitical tensions can cause short-term losses. If the company has a strong track record and solid fundamentals, a negative P/E ratio might just be a temporary hiccup.

What Are the Risks of a Negative P/E Ratio?

While a negative P/E ratio isn’t always bad, it does come with its own set of risks. For starters, it could indicate that the company is struggling to generate revenue or control costs. If the losses persist, it could lead to cash flow problems, debt issues, or even bankruptcy.

Another risk is that the market might lose confidence in the company. When investors see a negative P/E ratio, they might start selling off their shares, driving the stock price down even further. And if the company can’t turn things around quickly, it could spiral into a vicious cycle of declining performance and falling stock prices.

How to Assess the Risks of a Negative P/E Ratio

So, how do you know if a negative P/E ratio is a warning sign or just a temporary setback? Here are a few things to look for:

- Revenue Growth: Is the company still generating revenue, even if it’s not profitable? If revenue is growing steadily, it could be a sign that the company is on the right track.

- Balance Sheet Strength: Does the company have enough cash reserves to weather the storm? A strong balance sheet can help a company survive tough times and come out stronger on the other side.

- Management Quality: Are the company’s leaders experienced and capable of steering the ship through choppy waters? A skilled management team can make all the difference when it comes to turning things around.

Comparing Negative P/E Ratios Across Industries

It’s important to remember that not all industries are created equal. Some sectors, like biotech or clean energy, are more likely to have companies with negative P/E ratios because they require heavy upfront investments. In these cases, a negative P/E ratio might not be as alarming as it would be in a more mature industry like banking or retail.

For example, a biotech company might be losing money now, but if it successfully develops a life-saving drug, it could become incredibly profitable in the future. On the other hand, a retail company with a negative P/E ratio might be struggling to compete with online giants like Amazon, and its chances of recovery might be slim.

Industry-Specific Factors to Consider

When evaluating a negative P/E ratio, it’s crucial to consider the industry context. Here are a few factors to keep in mind:

- Market Dynamics: Is the industry growing or shrinking? Are there new technologies or trends that could impact the company’s future prospects?

- Competitive Landscape: How does the company stack up against its competitors? Does it have a unique advantage or a strong brand that can help it weather the storm?

- Regulatory Environment: Are there any regulatory challenges or opportunities that could affect the company’s performance? For example, a change in government policy could either help or hurt a company’s bottom line.

Real-World Examples of Negative P/E Ratios

To better understand how negative P/E ratios work in practice, let’s look at a few real-world examples. These case studies will give you a clearer picture of when a negative P/E ratio is a good thing and when it’s not.

Example 1: Tesla

Tesla is a great example of a company that had a negative P/E ratio for years but eventually turned things around. Despite losing money for years, Tesla was able to capture the imagination of investors with its innovative electric vehicles and bold vision for the future. And when it finally started turning a profit, its stock price soared.

Example 2: Blockbuster

On the flip side, Blockbuster is a cautionary tale of what can happen when a company fails to adapt to changing market conditions. Even though it had a strong brand and a large customer base, it couldn’t compete with the rise of streaming services like Netflix. Its negative P/E ratio was a warning sign that it was headed for trouble, and unfortunately, it eventually went bankrupt.

How to Interpret a Negative P/E Ratio

Interpreting a negative P/E ratio requires a combination of quantitative analysis and qualitative judgment. You need to look at the numbers, but you also need to understand the broader context. Here are a few tips to help you make sense of it all:

- Look Beyond the Numbers: Don’t get too hung up on the P/E ratio alone. Consider other metrics like revenue growth, gross margins, and operating cash flow.

- Understand the Business Model: Is the company’s business model sustainable in the long run? Does it have a competitive advantage that can help it weather tough times?

- Assess the Management Team: Are the company’s leaders experienced and capable of executing their strategy? A strong management team can make all the difference when it comes to turning things around.

Final Thoughts: Is a Negative P/E Ratio Good?

So, is a negative P/E ratio good? The answer, as you might have guessed, is “it depends.” In some cases, a negative P/E ratio can be a sign of future growth and potential. In other cases, it could be a warning sign that the company is in trouble. The key is to look beyond the number and analyze the bigger picture.

If you’re serious about investing, you need to develop a keen eye for spotting opportunities and avoiding pitfalls. A negative P/E ratio isn’t something to fear, but it is something to investigate. By combining quantitative analysis with qualitative judgment, you can make informed decisions that align with your investment goals.

And remember, the stock market is a marathon, not a sprint. Don’t let a single metric like the P/E ratio dictate your investment decisions. Instead, focus on the fundamentals, do your research, and stay patient. Over time, your diligence will pay off.

Call to Action

Now that you know the ins and outs of negative P/E ratios, it’s time to put your knowledge to work. Take a closer look at your portfolio and see if any of your stocks have negative P/E ratios. Are they temporary setbacks or warning signs? Share your thoughts in the comments below, and don’t forget to check out our other articles for more investing tips and insights.

Oh, and one last thing—before you make any investment decisions, always do your due diligence. The stock market can be unpredictable, but with the right tools and mindset, you can navigate it with confidence. Happy investing!

Table of Contents

Why Does a P/E Ratio Go Negative?

Is a Negative P/E Ratio Always Bad?

When Is a Negative P/E Ratio a Good Thing?

What Are the Risks of a Negative P/E Ratio?

How to Assess the Risks of a Negative P/E Ratio

Comparing Negative P/E Ratios Across Industries

Industry-Specific Factors to Consider

Real-World Examples of Negative P/E Ratios

How to Interpret a Negative P/E Ratio