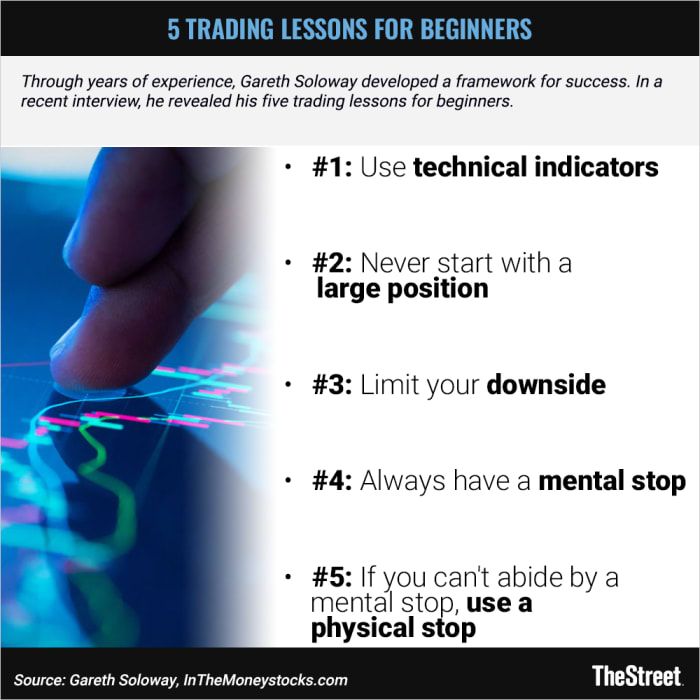

Mastering Options Trading Lessons: A Comprehensive Guide To Building Wealth

Hey there, fellow finance enthusiasts! If you're reading this, chances are you're curious about options trading lessons and how they can transform your financial journey. Let's dive right in, shall we? Whether you're a complete beginner or someone looking to refine their skills, this article is packed with insights that will help you navigate the world of options trading. Stick around because we're about to uncover some game-changing strategies!

Now, before we get too deep into the nitty-gritty, let's talk about why options trading lessons matter. The stock market can feel like a wild rollercoaster, but options trading offers a unique way to hedge risk and potentially boost your returns. It's not just about making money; it's about understanding the market and using tools like options to your advantage. So, let's break it down step by step.

In this guide, we'll cover everything from the basics of options trading to advanced strategies. By the end of this article, you'll have a solid foundation to start your journey or enhance your current trading strategies. Ready to level up your financial game? Let's go!

Here's a quick roadmap to help you navigate:

- What Are Options?

- Options Trading Basics

- Why Learn Options Trading?

- Common Mistakes in Options Trading

- Best Options Trading Strategies

- Tools and Resources for Learning

- Risk Management in Options Trading

- Tax Considerations for Options Traders

- Emotional Control and Discipline

- Final Thoughts and Call to Action

What Are Options?

Alright, let's start with the basics. Options are financial contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a specific price within a certain time frame. Think of them as a kind of insurance policy for your investments. Options can be used for speculation, hedging, or generating income.

There are two main types of options: calls and puts. A call option gives you the right to buy an asset, while a put option allows you to sell it. Pretty straightforward, right? But here's the catch—options trading involves leverage, which means small movements in the market can lead to big gains or losses.

Now, why should you care about options? Well, they offer flexibility and can be tailored to fit different trading goals. Whether you're looking to protect your portfolio or capitalize on market movements, options can be a powerful tool in your arsenal.

Options Trading Basics

Before you jump into options trading lessons, it's crucial to understand the fundamentals. First off, you need to know about strike prices, premiums, and expiration dates. The strike price is the price at which you can buy or sell the underlying asset. The premium is the cost of the option itself, and the expiration date is when the option contract ends.

Here are some key terms you should familiarize yourself with:

- Strike Price: The price at which the option can be exercised.

- Premium: The price you pay for the option.

- Expiration Date: The last day the option can be exercised.

- Underlying Asset: The stock, commodity, or index the option is based on.

Once you grasp these concepts, you'll be better equipped to make informed decisions. Remember, knowledge is power, especially in the world of finance.

Why Learn Options Trading?

So, why should you invest time and effort into learning options trading? For starters, options provide a level of flexibility that traditional stocks can't match. You can use them to hedge against potential losses, generate income, or even speculate on market movements. Plus, options trading can be a great way to diversify your portfolio.

Another benefit is the potential for higher returns. Because options involve leverage, even small price movements can result in significant gains. Of course, this also means there's a higher risk involved, which is why proper education and risk management are essential.

And let's not forget the educational aspect. Learning options trading teaches you about market dynamics, volatility, and financial strategies. It's like getting a crash course in finance without having to enroll in a university program.

Common Mistakes in Options Trading

Now that we've covered the basics, let's talk about some common pitfalls to avoid. One of the biggest mistakes new traders make is not understanding the risks involved. Options trading can be lucrative, but it's not a get-rich-quick scheme. You need to have a solid strategy and be prepared for both wins and losses.

Another rookie mistake is overtrading. It's tempting to jump into every opportunity that comes your way, but this can lead to poor decision-making. Stick to your plan and don't let emotions dictate your trades.

Here's a quick list of common mistakes to watch out for:

- Not doing enough research

- Ignoring risk management

- Trading without a plan

- Letting emotions cloud your judgment

By being aware of these mistakes, you'll be better equipped to avoid them and improve your trading performance.

Best Options Trading Strategies

Now that you know what to avoid, let's talk about some winning strategies. One popular approach is the covered call strategy. This involves owning the underlying stock and selling call options against it. It's a great way to generate additional income from your portfolio.

Another effective strategy is the protective put. This involves buying a put option to hedge against potential losses in your stock portfolio. Think of it as insurance for your investments. It might cost you a bit upfront, but it can save you a lot of money in the long run.

For more advanced traders, strategies like spreads and straddles can be highly profitable. These involve combining multiple options contracts to create complex positions. While they require a deeper understanding of options, they can offer significant rewards.

Tools and Resources for Learning

When it comes to options trading lessons, having the right tools and resources can make all the difference. Start by checking out reputable online platforms that offer courses and tutorials. Websites like Investopedia, The Options Industry Council, and various brokerage platforms provide valuable information for beginners and experienced traders alike.

Additionally, consider joining trading communities and forums. These can be great places to exchange ideas, ask questions, and learn from others' experiences. Just remember to take everything with a grain of salt and verify the information before acting on it.

And don't forget about practice accounts! Many brokers offer demo accounts where you can test your strategies without risking real money. It's a fantastic way to gain experience and build confidence before diving into live trading.

Risk Management in Options Trading

Risk management is one of the most critical aspects of options trading. Without a solid risk management plan, even the best strategies can fail. Start by setting clear limits on how much you're willing to lose on each trade. This will help you stay disciplined and avoid impulsive decisions.

Another important tip is to diversify your portfolio. Don't put all your eggs in one basket. Spread your investments across different assets and strategies to reduce your overall risk. And always keep an eye on market conditions. Volatility can change quickly, and being prepared can save you from unexpected losses.

Lastly, don't forget to review your trades regularly. Analyze what worked and what didn't, and adjust your strategies accordingly. Continuous learning and improvement are key to long-term success in options trading.

Tax Considerations for Options Traders

Taxes are an often-overlooked aspect of options trading, but they can have a significant impact on your profits. Depending on your location, you may be subject to different tax rules and regulations. It's crucial to understand how options trading income is taxed and plan accordingly.

In the U.S., for example, options trading profits are typically taxed as capital gains. Short-term gains are taxed at your ordinary income tax rate, while long-term gains are taxed at a lower rate. Keep accurate records of your trades and consult with a tax professional if you're unsure about your obligations.

And don't forget about tax-loss harvesting. This involves selling losing positions to offset gains and reduce your tax liability. It's a smart strategy that can help you keep more of your profits.

Emotional Control and Discipline

Emotions can be a trader's worst enemy. Fear and greed often lead to poor decision-making, which can result in significant losses. That's why emotional control and discipline are so important in options trading.

One way to maintain emotional control is by sticking to your trading plan. Don't let market movements or news headlines sway you from your strategy. Trust in your research and analysis, and stay focused on your goals.

Another tip is to practice mindfulness and stress management techniques. Meditation, exercise, and a healthy work-life balance can all contribute to better trading performance. Remember, trading is a marathon, not a sprint. Stay patient and consistent, and the results will follow.

Final Thoughts and Call to Action

Alright, we've covered a lot of ground in this options trading lesson. From understanding the basics to mastering advanced strategies, you now have the tools and knowledge to start your trading journey. Remember, success in options trading doesn't happen overnight. It requires dedication, discipline, and a willingness to learn and adapt.

So, what's next? Start by setting clear goals and creating a trading plan. Use the resources and tools we've discussed to educate yourself and practice your strategies. And don't forget to manage your risks and emotions along the way.

Finally, I'd love to hear from you! Share your thoughts, questions, or experiences in the comments below. And if you found this article helpful, be sure to share it with your fellow traders. Together, we can build a community of knowledgeable and successful options traders. Happy trading, and may the odds be ever in your favor!