Mastering The Art Of Learning Options Trading: A Beginner's Guide

So, you're ready to dive into the world of options trading? Great move! In today's fast-paced financial landscape, learning options trading is like gaining a superpower that can boost your investment strategy. Whether you're a seasoned investor or just starting out, understanding options trading opens up a whole new realm of opportunities. Now, let's get one thing straight—options trading isn't just for Wall Street wizards. It's for anyone who wants to take control of their financial future.

Picture this: you're sitting at home, scrolling through stock market news, and suddenly you hear about some guy who made a fortune trading options. Sounds tempting, right? But hold your horses! Before you jump in headfirst, you need to learn the ropes. Learning options trading is like learning to drive—a little scary at first, but once you get the hang of it, you're cruising down the highway to financial success.

Here's the deal: options trading can be super rewarding if you approach it the right way. But it's not just about making quick bucks. It's about understanding the market, managing risks, and building a solid strategy. Think of it as a game of chess—every move you make matters. So, buckle up, because we're about to take you on a journey to master the art of options trading.

Why Learning Options Trading is Worth Your Time

Let's cut to the chase—why should you bother with learning options trading when there are so many other investment options out there? Well, here's the thing: options trading offers flexibility, leverage, and the ability to hedge your portfolio. Imagine being able to protect your investments from market downturns or amplify your gains when things are going well. That's the power of options trading.

Now, I know what you're thinking—"Isn't options trading super risky?" Sure, it can be risky if you don't know what you're doing. But that's why learning options trading is crucial. With the right knowledge and strategy, you can turn that risk into reward. Think of it like skydiving—if you jump without a parachute, you're in trouble. But with the right gear and training, it's an exhilarating experience.

Benefits of Mastering Options Trading

- Increased flexibility in your investment strategy

- Ability to hedge against market volatility

- Opportunity to generate income through premium selling

- Access to a wide range of trading strategies

- Potential for higher returns compared to traditional investments

Here's the kicker: options trading isn't just for the big players. It's for anyone who wants to take their investing game to the next level. And let's be real—who doesn't want that?

Understanding the Basics of Options Trading

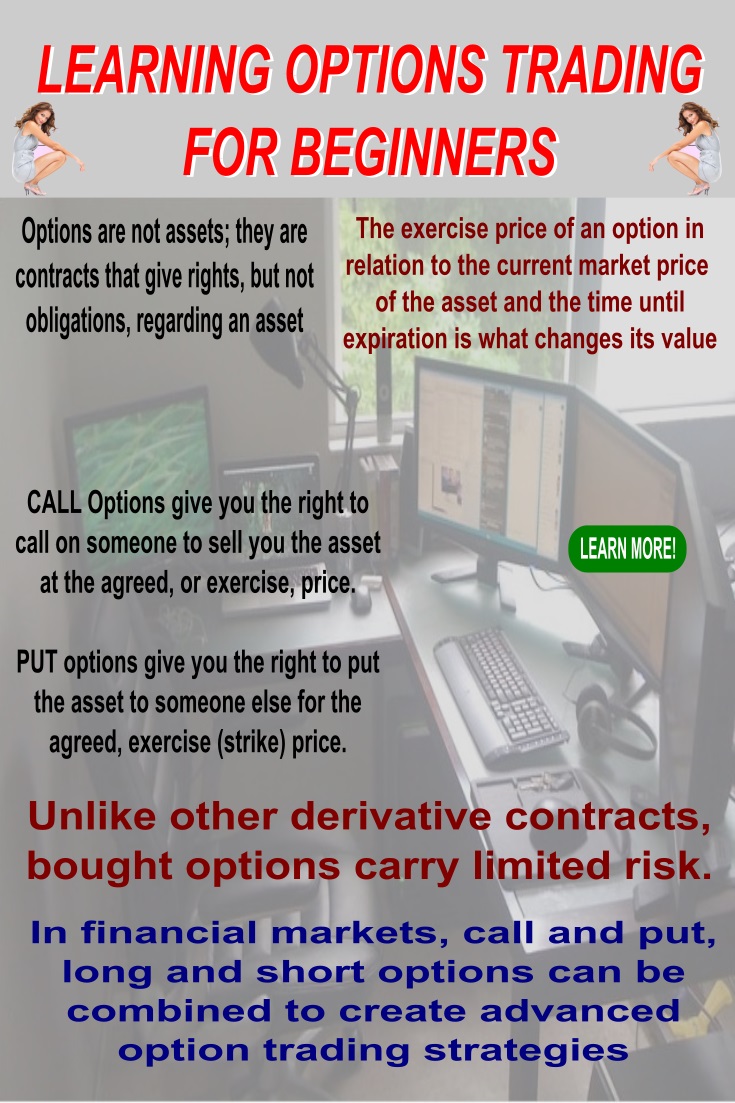

Alright, let's break it down. Options trading is all about contracts that give you the right—but not the obligation—to buy or sell an asset at a specific price within a certain timeframe. Sounds complicated? Don't worry, it's simpler than it sounds. Think of it like buying a movie ticket. You have the option to watch the movie, but you don't have to if you change your mind.

There are two main types of options: calls and puts. A call option gives you the right to buy an asset, while a put option gives you the right to sell. Now, here's where it gets interesting—you can use these options to speculate on market movements or protect your existing investments. It's like having a toolbox full of different tools to tackle any situation.

Key Terms You Need to Know

- Premium: The price you pay for an options contract

- Strike Price: The price at which you can buy or sell the underlying asset

- Expiration Date: The deadline by which you must exercise your option

- In-the-Money: When the option is profitable

- Out-of-the-Money: When the option is not profitable

Now that you know the basics, let's dive deeper into how options trading works. Trust me, it's gonna be worth it.

How Options Trading Works: A Step-by-Step Guide

Alright, let's walk through the process of options trading step by step. First, you need to identify the underlying asset you want to trade. This could be stocks, commodities, or even currencies. Next, you decide whether you want to buy a call or a put option based on your market outlook.

Once you've made your decision, it's time to determine the strike price and expiration date. This is where strategy comes into play. Do you want a short-term trade or a long-term position? It all depends on your goals and risk tolerance. Remember, every trade you make should align with your overall investment strategy.

Factors That Affect Options Pricing

- Underlying Asset Price: The current price of the asset

- Volatility: The degree of price fluctuation in the market

- Time Decay: The reduction in value as the expiration date approaches

- Interest Rates: The cost of borrowing money

Now, here's the fun part—putting it all together. Once you've analyzed all the factors, it's time to execute your trade. But don't forget to keep an eye on the market. Things can change quickly, and you want to be ready to adjust your strategy if needed.

Strategies for Successful Options Trading

Let's talk strategy. Options trading is all about having a plan. One popular strategy is the covered call, where you own the underlying stock and sell call options against it. This allows you to generate income while protecting your downside. Another strategy is the protective put, where you own the stock and buy put options to hedge against potential losses.

Then there's the iron condor—a more advanced strategy that involves buying and selling both call and put options. It's like building a fortress around your portfolio. But remember, not all strategies are created equal. You need to find the one that works best for your risk tolerance and investment goals.

Choosing the Right Strategy

- Assess your risk tolerance

- Align with your investment goals

- Consider market conditions

- Test different strategies in a demo account

Here's the bottom line: there's no one-size-fits-all strategy. It's all about finding what works for you and sticking to it. And don't be afraid to make adjustments along the way. After all, the market is always changing.

Risk Management in Options Trading

Risk management is the name of the game in options trading. You can't avoid risk altogether, but you can manage it effectively. One way to do this is by setting stop-loss orders to limit your potential losses. Another way is by diversifying your portfolio to spread out the risk.

It's also important to have a solid understanding of the Greeks—delta, gamma, theta, and vega. These metrics help you measure and manage risk in your options trades. Think of them as your trusty sidekicks in the world of options trading.

Tools for Managing Risk

- Stop-Loss Orders: Automatically exit a trade if it goes against you

- Hedging: Protect your portfolio from adverse market movements

- Position Sizing: Determine the appropriate size for each trade

Remember, risk management isn't just about avoiding losses—it's about maximizing your gains while minimizing your risks. It's like wearing a seatbelt while driving—you're not expecting an accident, but it's always good to be prepared.

Building a Solid Options Trading Strategy

Now that you know the basics and the importance of risk management, it's time to build your options trading strategy. Start by setting clear goals—what do you want to achieve with options trading? Are you looking for income generation, portfolio protection, or speculative opportunities?

Next, develop a trading plan that outlines your entry and exit criteria, position sizing, and risk management rules. Think of it like a blueprint for your trading journey. And don't forget to backtest your strategy to see how it would have performed in the past. It's like practicing before the big game.

Components of a Winning Strategy

- Clear Goals: Define what you want to achieve

- Trading Plan: Outline your entry and exit rules

- Risk Management: Set limits on your potential losses

- Backtesting: Test your strategy on historical data

Here's the deal: building a solid options trading strategy takes time and effort. But trust me, it's worth it. A well-thought-out strategy can make all the difference in your trading success.

Common Mistakes to Avoid in Options Trading

Let's talk about what not to do. One of the biggest mistakes in options trading is overtrading. It's easy to get caught up in the excitement of the market, but trading too much can lead to poor decision-making. Another common mistake is ignoring risk management. You might think you're invincible, but the market can humble you in a heartbeat.

Then there's the temptation to chase big returns without doing your homework. Sure, it sounds tempting, but it's a recipe for disaster. Always do your research and understand the risks involved before jumping into a trade.

How to Avoid These Mistakes

- Stick to your trading plan

- Practice disciplined risk management

- Do your research before making trades

- Avoid emotional decision-making

Here's the secret: successful options trading is all about discipline and patience. Don't let emotions cloud your judgment. Stick to your plan and let the market come to you.

Resources for Learning Options Trading

Alright, let's talk resources. There are tons of great resources out there to help you learn options trading. Online courses, webinars, and books are all great places to start. Some of my personal favorites include "Options as a Strategic Investment" by Lawrence G. McMillan and "Trading Options Greeks" by Dan Passarelli.

Don't forget about online communities and forums where you can connect with other traders. It's like having a support group for your trading journey. And let's not forget about practice accounts—where you can test your strategies without risking real money. It's like a sandbox for your trading ideas.

Top Resources for Learning Options Trading

- Books: "Options as a Strategic Investment" by Lawrence G. McMillan

- Online Courses: Udemy, Coursera, and Thinkorswim

- Communities: Reddit, StockTwits, and Option Alpha

Remember, learning options trading is a journey. Take your time, soak up the knowledge, and don't be afraid to ask questions. The more you learn, the better equipped you'll be to succeed in the market.

Conclusion: Take the First Step Today

So, there you have it—everything you need to know about learning options trading. It's not just about making money—it's about taking control of your financial future. Whether you're a beginner or an experienced trader, options trading offers endless possibilities for growth and success.

Now, here's the most important part—take action! Don't just sit there reading this article. Go out there and start learning, practicing, and building your options trading strategy. And remember, the market is always changing, so stay informed and adapt as needed.

So, what are you waiting for? Take the first step today and start your journey to mastering the art of options trading. And don't forget to share this article with your friends and leave a comment below. Together, we can build a community of successful options traders. Cheers to your financial success!