Options Trading For Beginners PDF: Your Ultimate Guide To Unlocking Profits

Hey there, future trader! If you're looking to dive into the world of options trading for beginners PDF, you've landed in the right place. Whether you're a complete newbie or just brushing up on the basics, this guide is here to break it all down for you. Think of it as your trusty sidekick in the wild world of finance. So, buckle up, because we're about to take a deep dive into everything you need to know to start your trading journey.

Options trading can seem like a maze at first, but don't sweat it. This isn't some secret club with a complicated handshake. It's a powerful tool that, when used correctly, can help you grow your wealth. The best part? There's a ton of resources out there, like PDFs, that can help you learn the ropes without breaking the bank.

But here's the deal: not all PDFs are created equal. Some are great, others? Not so much. That's why we're here—to guide you through the process, step by step, so you can make smart decisions and avoid common pitfalls. Let's get started, shall we?

This guide will cover everything from the basics of options trading to advanced strategies, all tailored for beginners. And hey, we'll even throw in some insider tips to keep you ahead of the game. So, whether you're trading from your couch or your favorite coffee shop, this guide's got your back.

Why Options Trading for Beginners PDF is Your Best Friend

Let's start with the basics. Why should you care about options trading for beginners PDF? Well, think of it this way: PDFs are like a treasure chest full of knowledge that you can carry around in your pocket. They're easy to access, packed with info, and often free or super affordable. Plus, you can read them anytime, anywhere, which is a huge plus if you're juggling a busy schedule.

But here's the kicker: not all PDFs are created equal. Some are outdated, some are too complex, and others just don't cut it. That's why it's crucial to find the right ones. Look for PDFs that are updated regularly, written by experts, and cover a wide range of topics. That way, you're getting the most bang for your buck (or in this case, your time).

Also, don't underestimate the power of visuals. A good PDF will have charts, graphs, and examples that make complex concepts easier to understand. And let's be real, who doesn't love a good chart? They're like the CliffsNotes of finance, breaking down the complicated stuff into bite-sized pieces.

How to Choose the Right Options Trading PDF

Now that you know why PDFs are awesome, let's talk about how to pick the right one. First things first: do your research. Look for PDFs that are recommended by trusted sources, like financial websites or forums. And don't be afraid to ask for recommendations from other traders. Chances are, they've already done the legwork for you.

Another tip? Check the author. Are they a seasoned trader with years of experience? Do they have a track record of success? These are important questions to ask. You wouldn't take financial advice from someone who's never traded before, right? Same goes for PDFs.

Lastly, make sure the PDF covers the topics you're interested in. Whether it's beginner strategies, advanced techniques, or risk management, there's a PDF out there for you. Just take your time and find the one that fits your needs.

Understanding the Basics of Options Trading

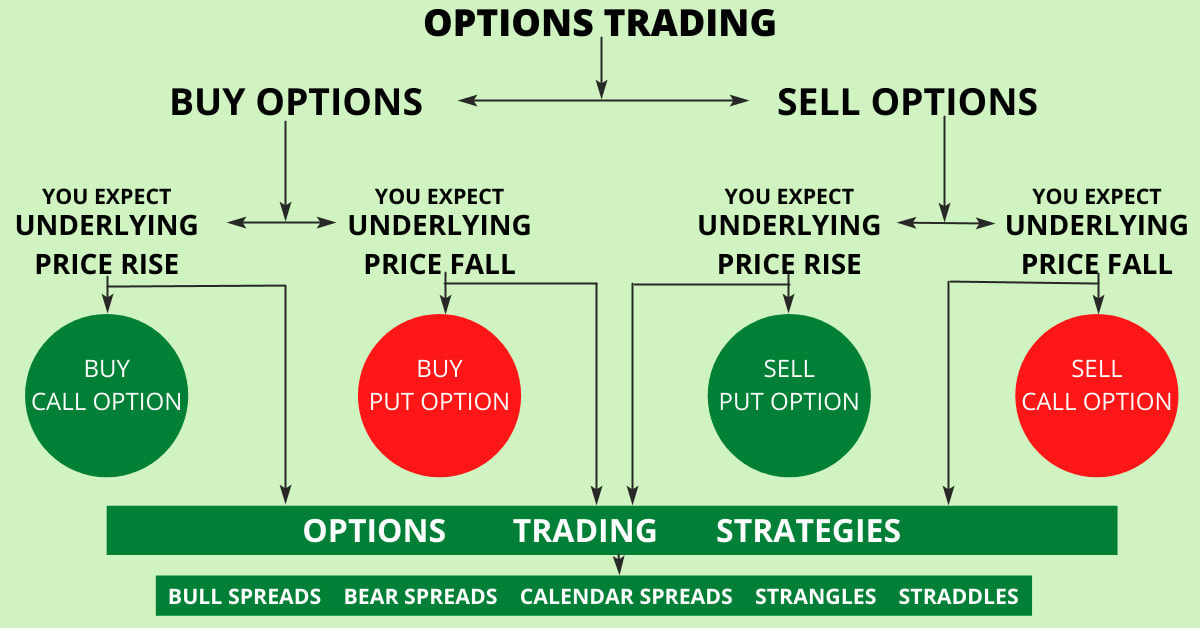

Alright, let's get into the nitty-gritty. What exactly is options trading? In a nutshell, it's a type of financial derivative that gives you the right, but not the obligation, to buy or sell an asset at a predetermined price. Think of it like a contract between two parties, where one agrees to buy or sell, and the other agrees to honor that agreement.

There are two main types of options: calls and puts. A call option gives you the right to buy an asset, while a put option gives you the right to sell. Simple, right? Well, sort of. There's a lot more to it, but we'll get into that later.

One of the biggest advantages of options trading is leverage. With options, you can control a large amount of stock with a relatively small investment. This can lead to big profits, but it also comes with big risks. So, it's important to understand the ins and outs before diving in headfirst.

Key Terms You Need to Know

Before we go any further, let's break down some key terms you'll come across in options trading:

- Premium: The price you pay for an option.

- Strike Price: The price at which you can buy or sell the underlying asset.

- Expiration Date: The date by which the option must be exercised.

- In the Money (ITM): When the option has intrinsic value.

- Out of the Money (OTM): When the option has no intrinsic value.

These terms might sound like a foreign language at first, but trust us, they'll become second nature in no time. Just keep reading, and it'll all click.

Setting Up Your Options Trading Strategy

Now that you know the basics, it's time to start thinking about your strategy. A good strategy is like a roadmap—it helps you navigate the twists and turns of the market. But here's the thing: there's no one-size-fits-all approach. What works for one trader might not work for another. So, it's important to find a strategy that aligns with your goals and risk tolerance.

One popular strategy for beginners is the covered call. This involves owning the underlying stock and selling call options against it. It's a great way to generate income while limiting your risk. Another strategy is the protective put, which involves owning the stock and buying put options to hedge against potential losses.

But remember, strategies are just tools. They won't guarantee success, but they can increase your chances of making smart decisions. So, take the time to learn about different strategies and see which ones resonate with you.

Managing Risk in Options Trading

Risk management is one of the most important aspects of options trading. Think of it like wearing a seatbelt—it might not seem like a big deal until something goes wrong. And trust us, things can go wrong in the blink of an eye.

So, how do you manage risk? Start by setting stop-loss orders. These automatically sell your options if they reach a certain price, helping you limit your losses. Another tip? Don't put all your eggs in one basket. Diversify your portfolio by investing in different assets and sectors.

Lastly, don't forget about position sizing. This means deciding how much of your portfolio to allocate to each trade. A good rule of thumb is to risk no more than 1-2% of your portfolio on any single trade. That way, even if things go south, you won't lose everything.

Common Mistakes to Avoid in Options Trading

Even the best traders make mistakes, but that doesn't mean you have to. By learning from others' mistakes, you can avoid some of the most common pitfalls in options trading.

One of the biggest mistakes beginners make is overtrading. This happens when you trade too frequently, often out of excitement or fear. Not only does it increase your chances of making bad decisions, but it also racks up transaction fees, which can eat into your profits.

Another common mistake is ignoring the fundamentals. Sure, technical analysis is important, but so is understanding the underlying asset. Take the time to research the company, its financials, and its industry. This will give you a better sense of whether it's a good investment.

Lastly, don't let emotions cloud your judgment. It's easy to get caught up in the hype or panic when things don't go your way. But the best traders are the ones who can stay calm under pressure and make rational decisions.

How to Stay Disciplined in Options Trading

Discipline is key in options trading. Without it, even the best strategies can fall apart. So, how do you stay disciplined? Start by setting clear goals. What do you want to achieve with your trading? Is it to generate income, grow your wealth, or both? Having a clear vision will help you stay focused.

Next, create a trading plan. This should include your strategy, risk management rules, and entry/exit points. Stick to this plan, even when things get tough. And don't forget to track your progress. Keep a journal of your trades, noting what worked and what didn't. This will help you learn from your mistakes and improve over time.

Finally, take breaks when you need them. Trading can be stressful, and it's important to recharge your batteries every now and then. Whether it's a weekend getaway or just a day off, do something that relaxes you and clears your mind.

Advanced Options Trading Strategies

Once you've mastered the basics, it's time to take things to the next level. Advanced options trading strategies can help you maximize your profits and minimize your risks. But here's the catch: they require a deeper understanding of the market and more experience.

One popular advanced strategy is the iron condor. This involves selling both call and put options at different strike prices, creating a range-bound trade. It's a great way to profit from low volatility, but it also comes with higher risks.

Another strategy is the butterfly spread. This involves buying and selling options at three different strike prices, creating a profit zone in the middle. It's a bit more complex, but it can be very rewarding if done correctly.

But remember, advanced strategies aren't for everyone. If you're not comfortable with them, that's okay. Stick with what you know and work your way up. There's no rush to become an expert overnight.

Using Technical Analysis in Options Trading

Technical analysis is a powerful tool in options trading. It involves using charts and indicators to predict future price movements. While it's not foolproof, it can help you make more informed decisions.

Some popular technical indicators include moving averages, relative strength index (RSI), and MACD. These can help you identify trends, support and resistance levels, and potential entry/exit points. But here's the thing: technical analysis is just one piece of the puzzle. It should be used in conjunction with fundamental analysis and other tools to get a complete picture.

Also, don't overcomplicate things. While it's tempting to use every indicator under the sun, sometimes less is more. Stick with a few key indicators that work for you and ignore the noise.

Where to Find Reliable Options Trading Resources

So, where can you find reliable options trading resources? The internet is full of information, but not all of it is trustworthy. That's why it's important to stick with reputable sources.

Some of the best resources include financial websites like Investopedia, Yahoo Finance, and TheStreet. These sites offer a wealth of information on options trading, from beginner guides to advanced strategies. And don't forget about forums and communities, where you can connect with other traders and share tips.

Books are another great resource. Some popular options trading books include "Options as a Strategic Investment" by Lawrence G. McMillan and "The Options Bible" by Guy Cohen. These books are packed with valuable insights and real-world examples that can help you take your trading to the next level.

Final Thoughts and Call to Action

Well, there you have it—your ultimate guide to options trading for beginners PDF. We hope this guide has given you the tools and confidence you need to start your trading journey. Remember, trading is a marathon, not a sprint. It takes time, patience, and practice to become a successful trader.

So, what are you waiting for? Download some PDFs, start learning, and take action. And don't forget to share this guide with your friends and fellow traders. The more knowledge we spread, the better off we all are. Happy trading, and good luck out there!

Table of Contents

- Why Options Trading for Beginners PDF is Your Best Friend

- How to Choose the Right Options Trading PDF

- Understanding the Basics of Options Trading

- Key Terms You Need to Know

- Setting Up Your Options Trading Strategy

- Managing Risk in Options Trading

- Common Mistakes to Avoid in Options Trading

- How to Stay Disciplined in Options Trading

- Advanced Options Trading Strategies

- Using Technical Analysis in