Selling On Ex-Dividend Date: The Ultimate Guide For Smart Investors

So, you've probably heard about the term "selling on ex-dividend date" and wondered what it means. This concept might sound complicated, but trust me, it’s not as scary as it seems. Let’s break it down. Imagine you’re holding some stocks, and the company announces a dividend payout. Cool, right? But here’s the twist—there’s this thing called the ex-dividend date, and it plays a crucial role in determining whether you get that sweet dividend money or not. Stay with me, because understanding this can make or break your investment strategy.

Now, why should you care about selling on the ex-dividend date? Well, if you’re an investor looking to maximize your returns or avoid unnecessary losses, knowing the ins and outs of this process is essential. It’s like having a secret weapon in your investment arsenal. Whether you’re a seasoned pro or just starting out, this guide will help you navigate the world of ex-dividend dates and make informed decisions.

By the end of this article, you’ll have all the tools you need to decide whether selling on the ex-dividend date is the right move for you. So, buckle up, grab a coffee, and let’s dive into the nitty-gritty of this fascinating topic. No fluff, just actionable insights to boost your investment game.

What is an Ex-Dividend Date?

Alright, let’s start with the basics. The ex-dividend date is basically the cutoff point for receiving a dividend payment. If you own the stock before this date, congrats! You’re eligible for the dividend. But if you buy it on or after the ex-dividend date, sorry pal, you’re out of luck for this round. It’s like a VIP event where only the early birds get the goodies.

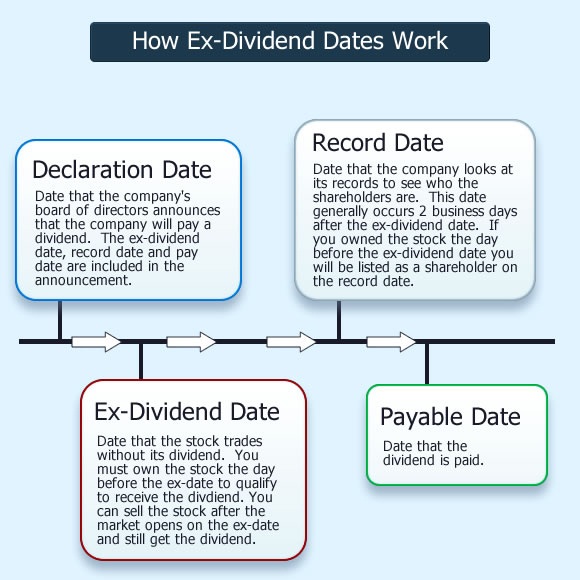

Here’s how it works: When a company declares a dividend, they set a record date to determine who gets paid. The ex-dividend date is usually set a few days before the record date. During this time, the stock price typically drops by the amount of the dividend. Why? Because the company is essentially giving away some of its cash, so the value of the stock decreases accordingly. Makes sense, right?

Why Does the Ex-Dividend Date Matter?

The ex-dividend date is a big deal because it affects both buyers and sellers. For buyers, it means they won’t receive the upcoming dividend if they purchase the stock on or after this date. For sellers, it’s an opportunity to cash out before the stock price drops. But here’s the kicker—selling on the ex-dividend date might not always be the best move. Let me explain why.

Should You Sell on the Ex-Dividend Date?

This is the million-dollar question. Selling on the ex-dividend date can be tempting, especially if you’re trying to avoid the price drop. But hold your horses. There are several factors to consider before making this decision. For starters, think about your overall investment strategy. Are you in it for the long haul, or are you looking for quick gains? Your answer will guide your next move.

Also, consider the tax implications. Selling your stock might trigger capital gains taxes, which could eat into your profits. Plus, if you’re selling just to avoid the ex-dividend price drop, you might be missing out on future gains. It’s like cutting a tree because you don’t like its current shape—you might regret it later when it grows into something beautiful.

Pros and Cons of Selling on Ex-Dividend Date

Let’s weigh the pros and cons to help you make an informed decision.

- Pros: You avoid the immediate price drop, and you can reinvest the proceeds elsewhere. Plus, you might lock in profits if the stock has already appreciated.

- Cons: You miss out on the dividend payment, which could have been reinvested for compound growth. Also, you might incur taxes on the sale, and the stock could rebound after the ex-dividend date.

Understanding Dividend Timing

Dividends aren’t just random payments; they follow a specific timeline. First, there’s the declaration date, where the company announces the dividend amount and schedule. Then comes the ex-dividend date, followed by the record date, and finally, the payment date. Each of these dates plays a crucial role in determining your eligibility for dividends.

For example, let’s say a company declares a $1 dividend with an ex-dividend date of October 15th. If you own the stock before October 15th, you’ll receive the dividend. But if you buy it on or after that date, you’ll have to wait for the next payout cycle. Simple, right? Well, not exactly. There are nuances to consider, like market volatility and stock performance.

How Dividends Impact Stock Prices

When a company pays a dividend, its stock price usually drops by the same amount. Why? Because the company is essentially transferring wealth from its equity to its shareholders. Think of it like withdrawing money from your bank account—the account balance decreases, but you still have the cash. Similarly, the stock price adjusts to reflect the dividend payout.

Strategies for Selling on Ex-Dividend Date

If you’re still considering selling on the ex-dividend date, here are a few strategies to help you make the most of it.

1. Evaluate Your Portfolio

Take a step back and assess your overall portfolio. Is this stock a key component of your investment strategy, or is it just a small piece of the puzzle? If it’s the latter, selling might not be a big deal. But if it’s a core holding, you might want to reconsider.

2. Consider Tax Implications

Taxes can significantly impact your decision. If you’ve held the stock for less than a year, you’ll be subject to short-term capital gains taxes, which are usually higher than long-term rates. On the other hand, if you’ve held it for over a year, you might qualify for lower tax rates. Do the math before pulling the trigger.

3. Look at Market Trends

Market conditions can influence your decision. If the stock is performing well and you expect it to continue rising, holding onto it might be the better option. But if the market is volatile or the stock is underperforming, selling might be a smart move.

Common Misconceptions About Ex-Dividend Dates

There are a few myths floating around about ex-dividend dates that can mislead investors. Let’s debunk them.

1. Selling Avoids Losses

Some people think selling on the ex-dividend date avoids losses, but that’s not entirely true. While you avoid the immediate price drop, you also miss out on the dividend payment. Plus, if the stock rebounds, you could end up buying it back at a higher price.

2. Ex-Dividend Date is the Same as Record Date

Nope, these are two different things. The ex-dividend date determines eligibility for the dividend, while the record date is when the company finalizes the list of shareholders who will receive the payout. Confusing, right? That’s why it’s important to understand the difference.

Real-Life Examples of Selling on Ex-Dividend Date

To illustrate the concept, let’s look at a couple of real-life examples.

Example 1: Apple Inc.

Suppose Apple declares a $0.23 dividend with an ex-dividend date of November 10th. If you own the stock before that date, you’ll receive the dividend. But if you sell on November 10th, you’ll avoid the price drop but also forfeit the dividend payment. It’s a trade-off that requires careful consideration.

Example 2: Microsoft Corporation

Now, let’s say Microsoft announces a $0.62 dividend with an ex-dividend date of December 15th. If you’re thinking of selling, you need to weigh the potential price drop against the dividend payment. If Microsoft’s stock is on an upward trend, holding onto it might be the better choice.

Expert Insights on Selling on Ex-Dividend Date

According to financial experts, selling on the ex-dividend date should be part of a broader investment strategy. It’s not a one-size-fits-all solution. For instance, Warren Buffett, the legendary investor, advocates for long-term holding rather than short-term trading. He believes that the best investments are those that compound over time, and dividends play a crucial role in that process.

On the other hand, some traders focus on capturing short-term gains by selling before the ex-dividend date. They argue that the price drop is temporary, and they can reinvest the proceeds elsewhere for higher returns. Both approaches have their merits, but the key is to align your decisions with your financial goals.

Conclusion: Is Selling on Ex-Dividend Date Right for You?

So, there you have it—the lowdown on selling on ex-dividend date. It’s a complex topic with no one-size-fits-all answer. Whether you should sell depends on your investment strategy, tax situation, and market conditions. My advice? Do your homework, consult with a financial advisor, and make decisions that align with your long-term goals.

Before you go, I’d love to hear your thoughts. Have you ever sold on the ex-dividend date? What was your experience? Drop a comment below and let’s chat. And if you found this article helpful, don’t forget to share it with your fellow investors. Together, we can all become smarter, savvier investors. Cheers!

Table of Contents

- What is an Ex-Dividend Date?

- Why Does the Ex-Dividend Date Matter?

- Should You Sell on the Ex-Dividend Date?

- Pros and Cons of Selling on Ex-Dividend Date

- Understanding Dividend Timing

- Strategies for Selling on Ex-Dividend Date

- Common Misconceptions About Ex-Dividend Dates

- Real-Life Examples of Selling on Ex-Dividend Date

- Expert Insights on Selling on Ex-Dividend Date

- Conclusion: Is Selling on Ex-Dividend Date Right for You?