Shareholder Vs Stakeholder: What's The Real Difference And Why Should You Care?

So you've heard the terms "shareholder" and "stakeholder" being thrown around in business meetings, articles, or even casual conversations, but do you really know what they mean? Let's break it down for you. These two terms are often used interchangeably, but they're not the same thing. Understanding the shareholder stakeholder difference is crucial if you want to navigate the business world like a pro. Whether you're an entrepreneur, investor, or just someone curious about how companies operate, this distinction matters big time.

Picture this: you're sitting in a boardroom, and someone starts talking about shareholders and stakeholders. You nod along, but deep down, you're wondering, "What's the difference?" Well, you're not alone. Even seasoned professionals sometimes mix these terms up. But don't worry, by the time you finish reading this article, you'll be able to explain the shareholder stakeholder difference like a boss.

Let's dive right in. The shareholder stakeholder difference isn't just some fancy business jargon. It's a fundamental concept that affects how companies make decisions, allocate resources, and measure success. So, whether you're looking to invest in a company, work for one, or just understand the business landscape better, this knowledge is essential. Stick around, and we'll break it down step by step.

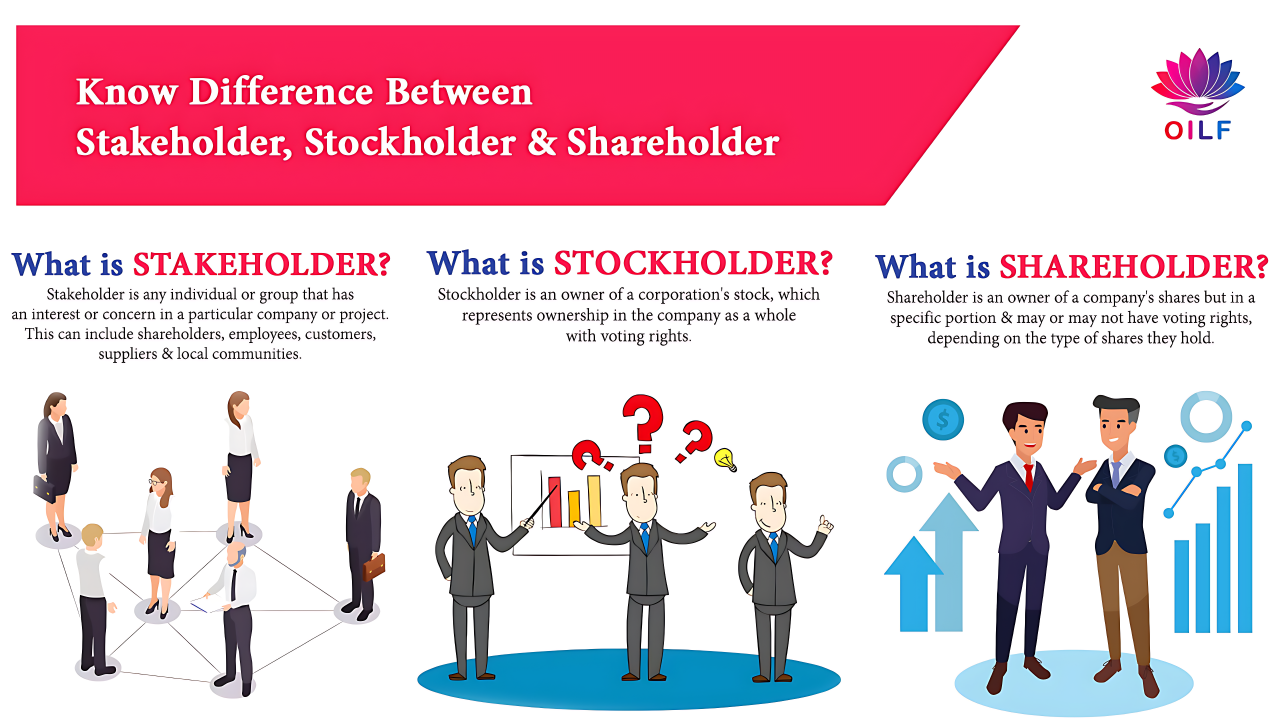

Understanding Shareholders: Who Are They and What Do They Want?

Who Are Shareholders Anyway?

First things first, let's talk about shareholders. These are the folks who own a part of a company by purchasing its stock. When you buy shares in a company, you become a shareholder. Pretty straightforward, right? But here's the kicker: shareholders aren't just looking for a piece of the pie; they're after a bigger slice. Their primary goal is to see their investment grow, which means they want the company to be profitable.

Now, shareholders come in all shapes and sizes. You've got individual investors who might own just a few shares, and then there are institutional investors like pension funds or mutual funds that own thousands or even millions of shares. Regardless of how many shares they own, all shareholders share one common goal: making money.

What Do Shareholders Want?

So, what exactly do shareholders want? Well, it's all about the bottom line. They want the company to perform well financially, which translates into higher stock prices and dividends. Dividends are like little bonuses that companies pay out to shareholders from their profits. It's like getting a thank-you note with some cash inside.

But it's not just about the money. Shareholders also want a say in how the company is run. They get to vote on important matters, like who sits on the board of directors or whether the company should merge with another. It's like being a part-owner, but without the day-to-day responsibilities. Pretty sweet deal, huh?

Unpacking Stakeholders: The Broader Picture

Who Are Stakeholders?

Now let's shift our focus to stakeholders. Unlike shareholders, stakeholders are a much broader group. They include anyone who has an interest in or is affected by the company's actions. This can range from employees and customers to suppliers, communities, and even the environment. Yeah, it's a pretty big tent.

Think about it this way: a company doesn't operate in a vacuum. Its decisions and actions have ripple effects that touch many different groups. For example, if a company decides to cut costs by outsourcing jobs, its employees are going to feel the impact. Similarly, if it pollutes a local river, the surrounding community is going to suffer. That's why stakeholders matter.

What Do Stakeholders Want?

So, what do stakeholders want? Well, it depends on who you're talking about. Employees might want job security and fair wages. Customers might want quality products at reasonable prices. Suppliers might want reliable payment terms. And the community might want the company to be a good neighbor by supporting local initiatives and minimizing its environmental impact.

As you can see, stakeholders have a wide range of interests, and they don't always align with each other or with the company's goals. That's why managing stakeholder relationships can be a bit tricky. But it's also why it's so important for companies to consider the needs and concerns of all their stakeholders when making decisions.

Key Differences Between Shareholders and Stakeholders

Ownership vs Influence

One of the key differences between shareholders and stakeholders is ownership versus influence. Shareholders own a part of the company, which gives them certain rights and privileges. They have a direct financial stake in the company's success or failure. On the other hand, stakeholders don't necessarily own a part of the company, but they can still have a significant influence on its operations and outcomes.

For example, a local community might not own any shares in a company, but if that company pollutes the local environment, the community can exert pressure through protests, petitions, or even legal action. Similarly, employees might not be shareholders, but their productivity and morale can have a big impact on the company's bottom line.

Financial vs Non-Financial Interests

Another important distinction is financial versus non-financial interests. Shareholders are primarily concerned with financial returns. They want the company to make money so that their investment grows. Stakeholders, on the other hand, have a broader range of interests, many of which are non-financial.

For instance, customers might care about the quality and safety of the products they buy. Employees might care about their working conditions and opportunities for career growth. The environment might care about the company's carbon footprint and waste management practices. These are all non-financial concerns that stakeholders care about, but they can have a significant impact on the company's long-term success.

Short-Term vs Long-Term Focus

There's also a difference in focus between shareholders and stakeholders. Shareholders often have a short-term focus. They want to see immediate returns on their investment, which can lead to pressure on companies to prioritize quarterly earnings over long-term growth. Stakeholders, on the other hand, often have a long-term focus. They want the company to be sustainable and responsible, which can sometimes mean making sacrifices in the short term for greater benefits in the future.

For example, a company might decide to invest in renewable energy sources, which could reduce its profits in the short term but make it more environmentally friendly and cost-effective in the long run. This decision might not please shareholders who are focused on immediate returns, but it could be a win for stakeholders who care about sustainability.

Why the Shareholder Stakeholder Difference Matters

Impact on Company Strategy

Understanding the shareholder stakeholder difference is crucial for companies when developing their strategies. A company that focuses solely on pleasing its shareholders might make decisions that are financially rewarding in the short term but harmful in the long term. On the other hand, a company that considers the needs of all its stakeholders is more likely to create sustainable value over time.

For example, a company that prioritizes environmental responsibility might attract customers who are willing to pay a premium for green products. It might also attract employees who want to work for a company that aligns with their values. These are benefits that go beyond just financial returns.

Corporate Social Responsibility (CSR)

The concept of corporate social responsibility (CSR) is closely tied to the shareholder stakeholder difference. CSR is all about companies taking responsibility for their impact on society and the environment. It's about balancing the needs of shareholders with the needs of stakeholders.

Companies that embrace CSR often find that it pays off in the long run. They build stronger relationships with their stakeholders, which can lead to increased loyalty, better reputation, and ultimately, greater financial success. It's a win-win situation for everyone involved.

Legal and Ethical Considerations

There are also legal and ethical considerations to keep in mind. In many jurisdictions, companies have a legal obligation to act in the best interests of their shareholders. However, they also have ethical obligations to consider the impact of their actions on all their stakeholders.

This can sometimes create conflicts. For example, a company might be legally required to maximize shareholder value, but ethically obligated to minimize its environmental impact. Navigating these complexities requires a deep understanding of the shareholder stakeholder difference and a commitment to finding solutions that work for everyone.

Case Studies: Real-World Examples of Shareholder Stakeholder Dynamics

Case Study 1: Tesla's Balancing Act

Tesla is a great example of a company that has to balance the interests of its shareholders and stakeholders. On one hand, shareholders want the company to be profitable and grow its market share. On the other hand, stakeholders like environmental groups want Tesla to continue innovating in the field of electric vehicles and renewable energy.

Tesla has managed to do both by focusing on long-term growth and sustainability. It has invested heavily in research and development, which has allowed it to produce cutting-edge products that appeal to both its shareholders and stakeholders. This approach has paid off, with Tesla becoming one of the most valuable companies in the world.

Case Study 2: BP's Deepwater Horizon Disaster

BP's Deepwater Horizon disaster is a sobering example of what can happen when a company prioritizes shareholder interests over stakeholder concerns. In 2010, an explosion at one of BP's oil rigs in the Gulf of Mexico resulted in one of the worst environmental disasters in history. The disaster had devastating effects on the local environment and communities, and it cost BP billions of dollars in fines and cleanup costs.

While BP's shareholders might have been happy with the company's short-term profits, the long-term damage to its reputation and relationships with stakeholders was significant. This case highlights the importance of considering the needs of all stakeholders, not just shareholders.

Practical Tips for Navigating the Shareholder Stakeholder Difference

Engage with Stakeholders

One of the best ways to navigate the shareholder stakeholder difference is to engage with stakeholders. This means listening to their concerns, understanding their needs, and involving them in decision-making processes. Companies that do this well often find that they can create value for both shareholders and stakeholders.

For example, a company might hold regular meetings with community leaders to discuss its environmental impact and get feedback on its sustainability initiatives. It might also conduct surveys of its employees to understand their concerns and preferences. These are all ways to build stronger relationships with stakeholders.

Balance Short-Term and Long-Term Goals

Another tip is to balance short-term and long-term goals. Companies need to be mindful of the fact that shareholders often have a short-term focus, while stakeholders tend to have a long-term focus. Finding ways to align these goals can be challenging, but it's essential for long-term success.

For instance, a company might decide to invest in employee training programs that might not yield immediate financial returns but will improve productivity and innovation over time. This is a way to satisfy both shareholders and stakeholders.

Embrace Transparency and Accountability

Finally, companies should embrace transparency and accountability. This means being open about their decisions, actions, and outcomes. It also means holding themselves accountable for the impact they have on all their stakeholders.

For example, a company might publish an annual sustainability report that outlines its environmental and social impact. It might also establish a board of directors that includes representatives from different stakeholder groups. These are all ways to build trust and credibility with stakeholders.

Conclusion: Why You Should Care About the Shareholder Stakeholder Difference

In conclusion, the shareholder stakeholder difference is a crucial concept for anyone interested in business, investing, or even just understanding how companies operate. By understanding the distinction between these two groups, you can better appreciate the complexities of corporate decision-making and the importance of balancing different interests.

So, what can you do with this knowledge? Well, if you're an investor, you can use it to make more informed decisions about where to put your money. If you're a business professional, you can use it to develop strategies that create value for both shareholders and stakeholders. And if you're just a curious citizen, you can use it to hold companies accountable for their actions and advocate for more responsible business practices.

We'd love to hear your thoughts on this topic. Do you have any personal experiences with the shareholder stakeholder difference? Any questions or insights you'd like to share? Drop a comment below, and let's keep the conversation going. And don't forget to share this article with your friends and colleagues. Knowledge is power, and the more people understand the shareholder stakeholder difference, the better off we'll all be.

Table of Contents

- Shareholder vs Stakeholder: What's the Real Difference and Why Should You Care?

- Understanding Shareholders: Who Are They and What Do They Want?

- Unpacking Stakeholders: The Broader Picture