Speculation Trading Meaning: Unlocking The Art Of Risky Financial Adventures

Ever wondered what speculation trading meaning is and why it's like a rollercoaster ride in the world of finance? Well, buckle up because we're diving deep into the thrilling yet sometimes perilous waters of speculation trading. It's more than just buying and selling assets; it's about predicting the unpredictable, riding the waves of market fluctuations, and making bold moves that could either make you rich or teach you some hard lessons. So, if you're ready to explore the heart of speculation trading, this is where the journey begins.

Speculation trading meaning isn't as straightforward as flipping a coin. It's a strategic game where traders use their skills, knowledge, and sometimes gut feelings to anticipate market movements. Unlike traditional investing, speculation trading often involves short-term strategies, aiming to capitalize on rapid price changes. But hey, with great risk comes great reward—or sometimes great losses. And that's exactly what makes it so exciting and challenging.

Now, let's not kid ourselves. Speculation trading isn't for the faint-hearted. It demands a strong stomach, sharp instincts, and a willingness to embrace uncertainty. But for those who dare to venture into this arena, the rewards can be substantial. So, whether you're a seasoned trader or just curious about what all the fuss is about, we're about to uncover the secrets behind speculation trading meaning and how it shapes the financial world.

What is Speculation Trading Meaning All About?

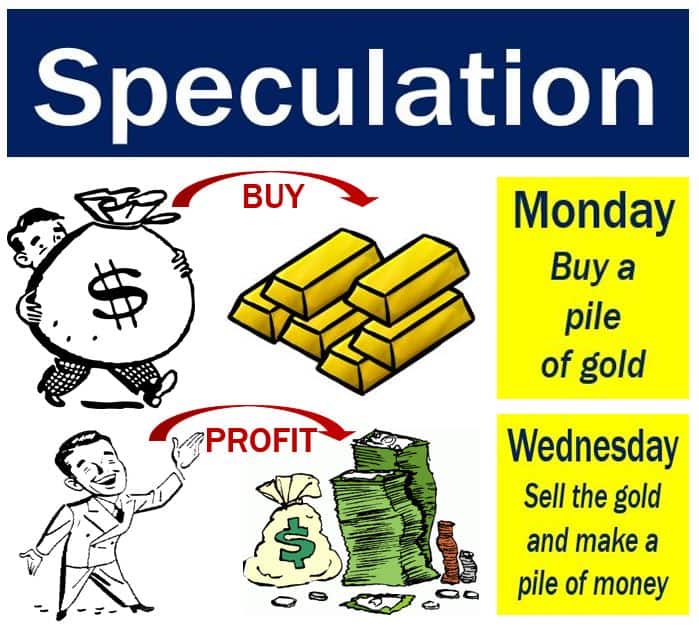

At its core, speculation trading meaning revolves around taking calculated risks in financial markets to profit from price fluctuations. Traders engage in buying and selling assets like stocks, currencies, commodities, or even cryptocurrencies, hoping to cash in on their predictions. The key difference between speculation trading and traditional investing lies in the time frame and the level of risk involved.

In speculation trading, the focus is often on short-term gains. Traders might hold positions for minutes, hours, or days, capitalizing on quick market moves. This contrasts with long-term investors who buy and hold assets for years, relying on fundamental analysis and market trends. Speculation trading meaning isn't just about making money; it's about navigating the complex landscape of financial markets with agility and precision.

Key Features of Speculation Trading

Speculation trading meaning is built on a foundation of specific characteristics that set it apart from other forms of trading:

- High Risk, High Reward: Speculation trading is all about taking risks. The bigger the risk, the greater the potential reward—or loss.

- Short-Term Focus: Unlike long-term investing, speculation trading emphasizes quick trades to capitalize on immediate market opportunities.

- Market Volatility: Speculators thrive on volatility, using it to their advantage by predicting price swings accurately.

- Technical Analysis: Many speculators rely heavily on technical indicators and chart patterns to make informed trading decisions.

Why Do People Engage in Speculation Trading?

Speculation trading meaning isn't just about making money; it's also about the thrill of the chase. For some, it's the adrenaline rush of outsmarting the market, while for others, it's the potential for significant financial gains. Let's break down the reasons why people dive into speculation trading:

1. Profit Potential: Speculation trading offers the chance to earn substantial profits in a short amount of time. This allure draws many traders to the game, despite the inherent risks.

2. Diversification: Engaging in speculation trading can add an exciting dimension to an investor's portfolio, providing opportunities to explore different asset classes and strategies.

3. Market Influence: Speculators play a crucial role in maintaining liquidity and price discovery in financial markets. Their activities help ensure that markets function efficiently.

Understanding the Psychology of Speculation Trading

Speculation trading meaning isn't complete without understanding the psychological aspects that drive traders. Fear, greed, and overconfidence often dictate trading decisions, leading to both success and failure. Developing a sound trading mindset is crucial for long-term success in speculation trading.

How Does Speculation Trading Work?

Now that we've covered the basics, let's dive into the mechanics of how speculation trading works. Speculators use various tools and strategies to predict market movements and capitalize on price changes. Here's a closer look at the process:

1. Market Research: Speculators spend time analyzing market trends, economic indicators, and news events that could impact asset prices.

2. Technical Analysis: Using charts and technical indicators, traders identify patterns and signals that suggest potential price movements.

3. Execution: Once a trade idea is formulated, speculators execute their trades, often using leverage to amplify potential gains—or losses.

4. Risk Management: Effective risk management is essential in speculation trading. Traders use stop-loss orders and position sizing to protect their capital.

Tools and Platforms for Speculation Trading

To succeed in speculation trading, having the right tools and platforms is crucial. Here are some popular options:

- Trading Platforms: Platforms like MetaTrader, TradingView, and Interactive Brokers offer advanced tools for speculation trading.

- Charting Software: Technical analysts rely on charting tools to visualize price movements and identify trading opportunities.

- News Aggregators: Staying informed about global events and market news is vital for speculators, making news aggregators indispensable.

Speculation Trading vs. Traditional Investing

Understanding the differences between speculation trading and traditional investing is crucial for anyone considering a career in finance. While both involve buying and selling assets, their approaches and objectives differ significantly.

Speculation Trading: Short-term, high-risk, focuses on quick gains through price fluctuations.

Traditional Investing: Long-term, lower risk, emphasizes capital growth and income generation through dividends or interest.

Speculation trading meaning isn't just about making money; it's about navigating the financial markets with a different mindset. While traditional investors focus on fundamentals, speculators rely on market sentiment and technical analysis to make their moves.

Which Is Better: Speculation Trading or Traditional Investing?

The answer depends on individual goals, risk tolerance, and financial circumstances. Speculation trading offers the potential for quick profits but comes with significant risks. Traditional investing, on the other hand, provides a more stable path to wealth accumulation over time. Ultimately, the choice lies in understanding your financial objectives and selecting the strategy that aligns with them.

Types of Speculation Trading

Speculation trading meaning isn't limited to one type of asset or market. Traders engage in various forms of speculation trading across different financial instruments. Here's a breakdown:

1. Stock Speculation: Traders buy and sell stocks based on short-term price movements, often using technical analysis to guide their decisions.

2. Currency Speculation: In the forex market, speculators trade currencies, capitalizing on exchange rate fluctuations driven by economic and geopolitical factors.

3. Commodity Speculation: Traders speculate on the prices of commodities like gold, oil, and agricultural products, often influenced by supply and demand dynamics.

4. Cryptocurrency Speculation: The rise of digital currencies has opened new avenues for speculation trading, with traders seeking to profit from volatile price swings.

Choosing the Right Type of Speculation Trading

Selecting the right type of speculation trading depends on your expertise, interests, and risk appetite. Each market has its unique characteristics and challenges, requiring traders to adapt their strategies accordingly. Whether you're drawn to the excitement of stock trading or the unpredictability of cryptocurrencies, understanding the nuances of each market is key to success.

Risks and Challenges in Speculation Trading

Speculation trading meaning isn't all glitz and glamour. It comes with its fair share of risks and challenges that traders must navigate carefully. Let's explore some of the most significant hurdles:

1. Market Volatility: While volatility creates opportunities, it also increases the likelihood of sudden and unexpected price swings that can wipe out trading accounts.

2. Emotional Distress: The psychological toll of speculation trading can be immense, with stress and anxiety affecting decision-making abilities.

3. Regulatory Risks: Changes in financial regulations can impact trading activities, especially in markets like cryptocurrencies where rules are still evolving.

How to Mitigate Risks in Speculation Trading

To minimize risks, traders can adopt several strategies:

- Set Clear Goals: Define your trading objectives and stick to them.

- Use Protective Orders: Implement stop-loss orders to limit potential losses.

- Stay Informed: Keep up with market news and economic indicators to make informed trading decisions.

Success Stories in Speculation Trading

While speculation trading meaning often involves risks, it also offers opportunities for success. Many traders have achieved remarkable results through their skills and strategies. Let's take a look at a few inspiring stories:

1. George Soros: Known for his famous bet against the British pound, Soros's speculation trading prowess earned him billions and cemented his place in financial history.

2. Jesse Livermore: A legendary figure in trading circles, Livermore's insights into market psychology and speculation trading strategies continue to influence traders today.

These success stories highlight the potential rewards of speculation trading while reminding us of the importance of discipline and strategy.

Lessons from Successful Speculators

What can we learn from these trading legends? Here are some key takeaways:

- Adaptability: Successful speculators are flexible and willing to adjust their strategies based on changing market conditions.

- Patience: Waiting for the right opportunities and not rushing into trades can lead to better outcomes.

- Continuous Learning: The financial markets are constantly evolving, and staying informed is crucial for long-term success.

Conclusion: Is Speculation Trading for You?

Speculation trading meaning offers a world of possibilities for those willing to take the leap. It's a thrilling journey filled with risks, rewards, and lessons that can shape your financial future. Whether you're a seasoned trader or a newcomer, understanding the ins and outs of speculation trading is essential for success.

Take Action: If you're ready to dive into the world of speculation trading, start by educating yourself, setting clear goals, and developing a solid trading strategy. And don't forget to share your thoughts and experiences in the comments below. Let's keep the conversation going and help each other succeed in this exciting endeavor!

Remember, speculation trading meaning isn't just about making money; it's about embracing the challenge, learning from your experiences, and growing as a trader. So, are you ready to take the plunge?

Table of Contents

- What is Speculation Trading Meaning All About?

- Why Do People Engage in Speculation Trading?

- How Does Speculation Trading Work?

- Speculation Trading vs. Traditional Investing

- Types of Speculation Trading

- Risks and Challenges in Speculation Trading

- Success Stories in Speculation Trading

- Conclusion: Is Speculation Trading for You?