Stakeholder Vs Shareholder Difference: A Comprehensive Guide To Understanding The Key Players In Business

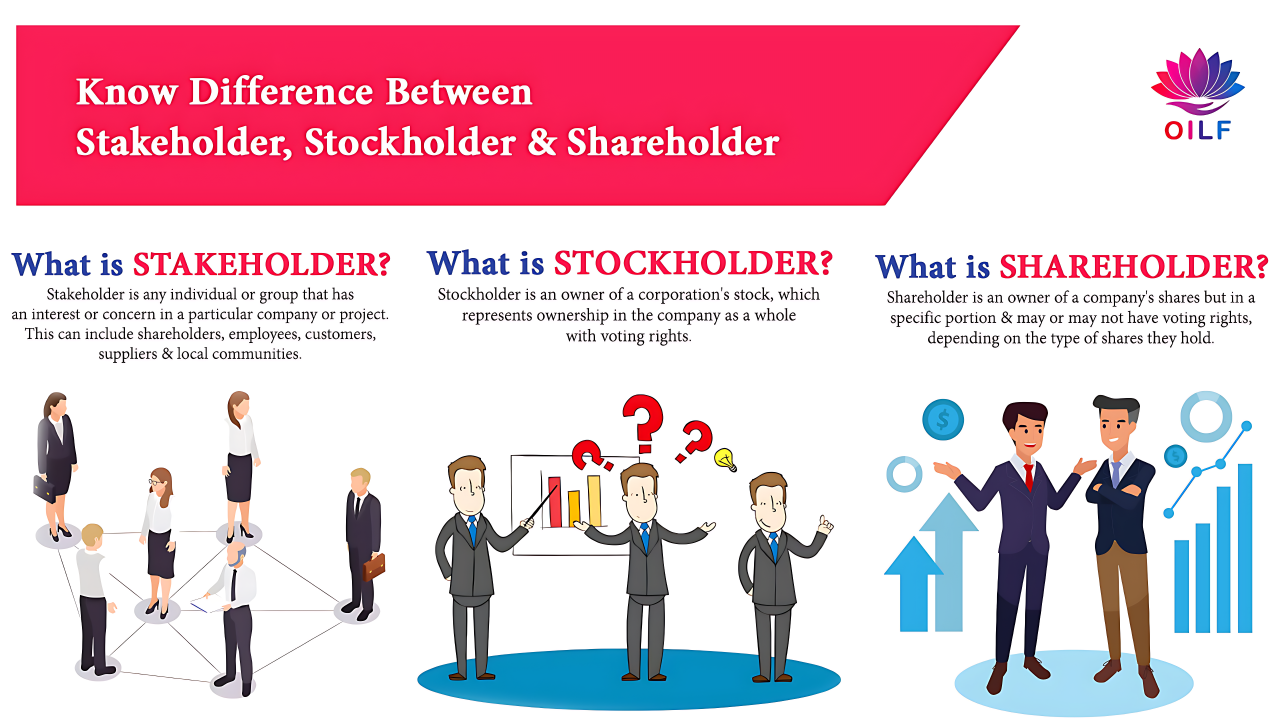

When it comes to the world of business, two terms often pop up that can confuse even the most seasoned professionals: stakeholders and shareholders. These terms may sound similar, but they carry very different meanings and implications. Understanding the stakeholder shareholder difference is crucial for anyone looking to navigate the complex world of corporate governance and business management.

So, why should you care about this distinction? Well, whether you're an entrepreneur, investor, or just someone curious about how businesses operate, knowing the roles of stakeholders and shareholders can help you make informed decisions. In this article, we'll break down the differences in a way that's easy to grasp, even for those who aren't business experts.

Think of it like this: stakeholders are like the extended family of a business, while shareholders are the immediate family. Both groups have a vested interest in the company's success, but their roles, responsibilities, and influence vary significantly. Stick around, and we'll dive deep into what makes each group unique and why their differences matter.

What is a Stakeholder?

Let's start with the basics. A stakeholder is anyone who has an interest in or is affected by the activities and outcomes of a business. This could include employees, customers, suppliers, communities, and even the environment. Stakeholders don't necessarily own a part of the company, but they have a stake in its success or failure.

For example, if a company decides to cut costs by outsourcing jobs, its employees are stakeholders who could be negatively impacted. Similarly, if the same company invests in sustainable practices, the local community and environment become stakeholders benefiting from those efforts. Stakeholders are essentially the people or entities whose lives are touched by the business's actions.

Types of Stakeholders

Stakeholders come in many shapes and sizes. Here are some common types:

- Internal Stakeholders: These are people within the organization, like employees and management.

- External Stakeholders: This group includes customers, suppliers, investors, and the broader community.

- Primary Stakeholders: These are individuals or groups who directly interact with the business, such as customers and employees.

- Secondary Stakeholders: These are groups indirectly affected by the business, like the government or media.

Understanding the different types of stakeholders helps businesses tailor their strategies to meet the needs of each group. It's like catering to a diverse audience at a party—everyone wants something different, and it's your job to make sure everyone leaves happy.

What is a Shareholder?

Now let's talk about shareholders. Unlike stakeholders, shareholders have a direct financial interest in the company because they own shares of its stock. They are essentially partial owners of the business and have a say in major decisions, depending on the number of shares they hold.

Shareholders are typically focused on the financial performance of the company, as their investment depends on it. If the company does well, their stock value increases, and they might even receive dividends. However, if the company struggles, their investment could lose value. It's a high-stakes game, but one that can pay off big time if played right.

Types of Shareholders

Shareholders can also be categorized into different types:

- Common Shareholders: These shareholders have voting rights and can participate in major company decisions.

- Preferred Shareholders: While they don't usually have voting rights, preferred shareholders receive dividends before common shareholders.

- Institutional Shareholders: These are large organizations, like mutual funds or pension funds, that own significant portions of a company's stock.

Each type of shareholder has its own set of rights and responsibilities, making the landscape of corporate ownership even more complex. But don't worry—we'll break it down further as we go along.

Key Differences Between Stakeholders and Shareholders

Now that we've defined both terms, let's dive into the stakeholder shareholder difference. Here are the main points to consider:

Ownership

Shareholders own a part of the company, while stakeholders do not. This distinction is crucial because it affects how each group interacts with the business. Shareholders have a financial stake in the company's success, while stakeholders are more concerned with the broader impact of its operations.

Focus

Shareholders are primarily focused on financial returns, such as stock price appreciation and dividends. On the other hand, stakeholders are more concerned with the overall impact of the business on society, the environment, and the economy. It's like comparing a short-term investor to a long-term visionary—one is all about the money, while the other looks at the bigger picture.

Influence

Shareholders have a direct say in major company decisions through voting rights, while stakeholders typically don't have the same level of influence. However, stakeholders can still wield power indirectly by advocating for change or boycotting products if they feel the company isn't meeting their expectations.

Why the Stakeholder Shareholder Difference Matters

Understanding the stakeholder shareholder difference is essential for businesses that want to thrive in today's competitive environment. Companies that focus solely on pleasing shareholders may overlook the needs of other important groups, leading to long-term problems. On the other hand, businesses that prioritize stakeholder interests can build stronger relationships and create a more sustainable future.

Consider the case of a company that prioritizes short-term profits over environmental sustainability. While shareholders might be happy in the short run, the damage to the environment and the community could lead to long-term consequences that hurt everyone involved. It's a delicate balancing act, but one that can pay off if done right.

The Rise of Stakeholder Capitalism

In recent years, there's been a growing movement toward stakeholder capitalism, where businesses focus on creating value for all stakeholders, not just shareholders. This approach recognizes that a company's success depends on more than just financial performance—it also relies on its ability to contribute positively to society and the environment.

Companies that embrace stakeholder capitalism often find themselves in a better position to attract top talent, retain loyal customers, and build strong relationships with their communities. It's like building a house on a solid foundation—if you take care of the people and the planet, the profits will follow.

How Companies Balance Stakeholder and Shareholder Interests

Striking the right balance between stakeholder and shareholder interests is no easy feat, but it's essential for long-term success. Here are some strategies companies can use:

Corporate Social Responsibility (CSR)

CSR initiatives allow companies to address the needs of stakeholders while still maintaining profitability. By investing in sustainable practices, community development, and ethical business operations, companies can create value for all parties involved.

Transparent Communication

Keeping stakeholders and shareholders informed about the company's goals, challenges, and progress is key to building trust. Regular updates and open dialogue can help bridge the gap between these two groups and ensure everyone is on the same page.

Inclusive Decision-Making

Inviting input from a diverse range of stakeholders can lead to better decision-making and more innovative solutions. By considering the perspectives of employees, customers, and communities, companies can create strategies that benefit everyone involved.

Data and Statistics on Stakeholders and Shareholders

Let's take a look at some numbers that highlight the importance of understanding the stakeholder shareholder difference:

- According to a 2021 survey by Edelman, 81% of consumers believe that companies should take a stand on societal issues.

- A report by McKinsey found that companies with strong environmental, social, and governance (ESG) practices outperform their peers in terms of financial returns.

- The Global Reporting Initiative (GRI) estimates that over 90% of the world's largest companies now publish sustainability reports, highlighting their commitment to stakeholder interests.

These statistics underscore the growing importance of balancing stakeholder and shareholder interests in today's business environment. Companies that fail to adapt risk being left behind in an increasingly competitive marketplace.

Case Studies: Real-World Examples of Stakeholder and Shareholder Dynamics

To better understand the stakeholder shareholder difference, let's look at a few real-world examples:

BP Oil Spill

In 2010, BP faced one of the worst environmental disasters in history when its Deepwater Horizon oil rig exploded, spilling millions of gallons of oil into the Gulf of Mexico. While shareholders were initially concerned about the financial impact, stakeholders like environmental groups and local communities demanded accountability and action. BP's response, which included cleanup efforts and compensation payments, highlighted the importance of balancing stakeholder and shareholder interests in times of crisis.

Patagonia's Commitment to Sustainability

Outdoor apparel company Patagonia has long been a champion of stakeholder capitalism, prioritizing environmental sustainability and social responsibility over short-term profits. By investing in sustainable materials, reducing waste, and advocating for environmental causes, Patagonia has built a loyal customer base and earned a reputation as a leader in responsible business practices.

How to Apply This Knowledge in Your Business

Now that you understand the stakeholder shareholder difference, how can you apply this knowledge to your own business? Here are a few tips:

- Identify all your stakeholders and assess their needs and concerns.

- Develop strategies that address both stakeholder and shareholder interests.

- Communicate openly and transparently with all parties involved.

- Measure the impact of your efforts and adjust your strategies as needed.

By taking a holistic approach to business management, you can create a sustainable and successful enterprise that benefits everyone involved.

Conclusion: The Future of Stakeholder and Shareholder Relations

In conclusion, understanding the stakeholder shareholder difference is crucial for anyone looking to navigate the complex world of business. While shareholders have a direct financial interest in the company, stakeholders represent a broader range of interests that must be considered for long-term success. By balancing these two groups' needs, companies can create value for everyone involved and build a more sustainable future.

So, what's next? We invite you to share your thoughts in the comments below or explore other articles on our site that delve deeper into the world of business and finance. Together, we can create a better understanding of the forces that shape our economy and society. Thanks for reading, and see you in the next article!

Table of Contents

- What is a Stakeholder?

- Types of Stakeholders

- What is a Shareholder?

- Types of Shareholders

- Key Differences Between Stakeholders and Shareholders

- Why the Stakeholder Shareholder Difference Matters

- How Companies Balance Stakeholder and Shareholder Interests

- Data and Statistics on Stakeholders and Shareholders

- Case Studies: Real-World Examples of Stakeholder and Shareholder Dynamics

- How to Apply This Knowledge in Your Business