Stakeholder Vs Shareholder Difference: A Comprehensive Guide

When it comes to the world of business and finance, understanding the difference between stakeholders and shareholders is crucial. These terms are often thrown around in boardroom discussions, corporate meetings, and strategy sessions. But what exactly do they mean? And why should you care? If you're scratching your head trying to figure out the distinction, don't worry—you're not alone. In this article, we'll break down the stakeholder and shareholder difference in a way that’s easy to digest while diving deep into their roles, responsibilities, and importance.

Now, let's be real here. Both stakeholders and shareholders play a vital role in the success of a company. But their involvement and influence are quite different. Some people think they’re the same thing, but that’s like comparing apples to oranges—or maybe apples to apple pies. So, buckle up because we’re about to unravel the mystery behind these two important concepts.

By the end of this article, you'll not only know the stakeholder and shareholder difference but also how they impact businesses and why they matter in today's competitive market. Whether you're an entrepreneur, investor, or just someone curious about business dynamics, this guide has got you covered.

Table of Contents

- What Are Stakeholders?

- What Are Shareholders?

- Key Differences Between Stakeholders and Shareholders

- Types of Stakeholders

- Roles and Responsibilities of Shareholders

- Why the Difference Matters

- Potential Conflicts Between Stakeholders and Shareholders

- Balancing Stakeholder and Shareholder Interests

- The Legal Perspective on Stakeholder vs Shareholder

- Conclusion: Final Thoughts on Stakeholder and Shareholder Difference

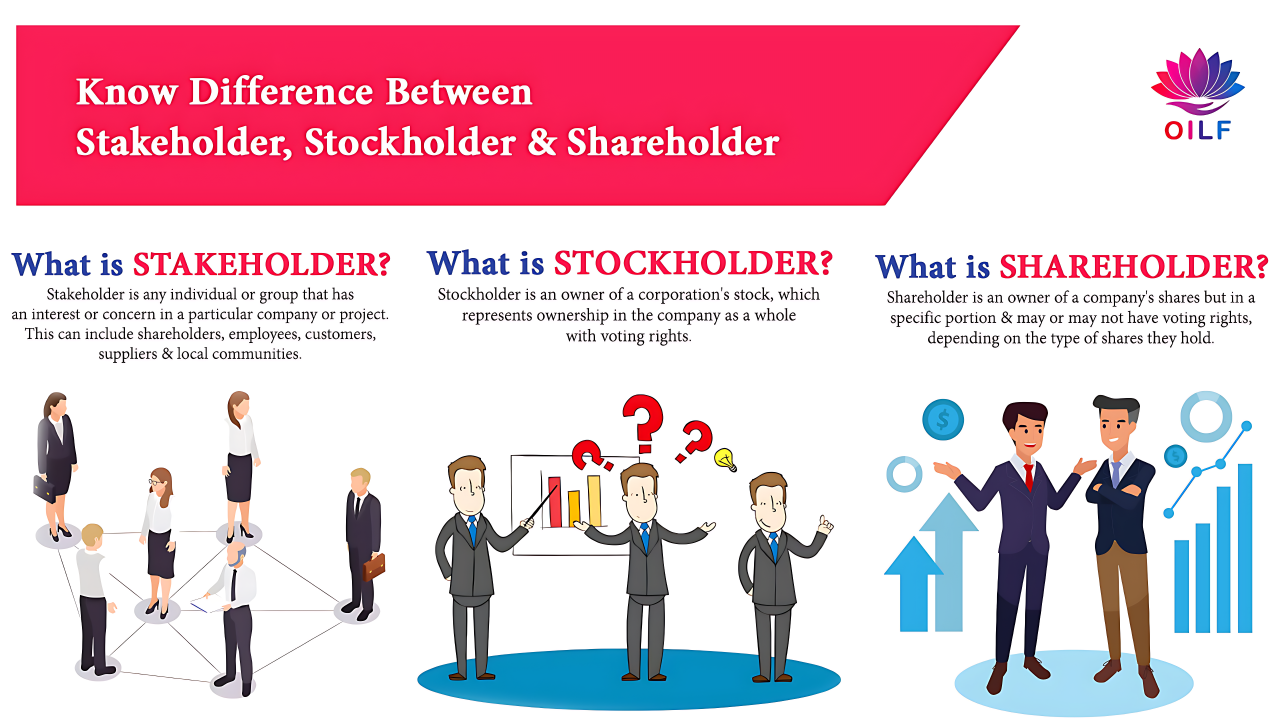

What Are Stakeholders?

Alright, let’s start with the basics. A stakeholder is anyone who has an interest or concern in a business. Think of it as a big tent where everyone under it has some kind of connection to the company—whether directly or indirectly. Stakeholders can range from employees and customers to suppliers, local communities, and even the environment. They're basically the people who care about what the company does and how it affects them.

Here's the kicker: stakeholders don't always have to own part of the company. Their involvement might stem from needing the company’s products, working for the company, or simply living in the area where the business operates. And hey, sometimes stakeholders are just concerned citizens who want companies to act responsibly.

So, why does this matter? Well, because stakeholders can influence a company's decisions in various ways. For instance, unhappy employees might strike, unhappy customers might boycott, and unhappy communities might protest. That's why companies need to keep their stakeholders happy—it’s all about maintaining harmony.

Examples of Stakeholders

- Employees: They rely on the company for income and job security.

- Customers: They depend on the company’s products or services.

- Suppliers: They supply materials and expect timely payments.

- Communities: They may be affected by the company’s operations or environmental impact.

What Are Shareholders?

On the flip side, we have shareholders. These guys are the ones who actually own part of the company by purchasing its stocks or shares. Unlike stakeholders, shareholders have a financial stake in the business. Their main goal is usually to see the company succeed so that the value of their shares increases.

But here’s the thing: shareholders aren’t just passive investors. Depending on the size of their investment, they may have voting rights in major company decisions. For example, they might get to vote on who sits on the board of directors or whether the company should pursue a merger or acquisition.

And while shareholders are typically seen as profit-driven, many of them also care about the company's long-term success. After all, no one wants to invest in a company that burns out quickly. So yeah, shareholders can be pretty invested—literally and figuratively.

Types of Shareholders

- Common Shareholders: They own common stock and usually have voting rights.

- Preferred Shareholders: They own preferred stock and often receive fixed dividends, but they usually don’t have voting rights.

Key Differences Between Stakeholders and Shareholders

Now that we’ve defined both terms, let’s dive into the stakeholder and shareholder difference. Here’s a quick breakdown:

- Involvement: Stakeholders include anyone with an interest in the company, while shareholders are specifically those who own shares.

- Financial Stake: Shareholders have a direct financial interest in the company’s success, whereas stakeholders may or may not have a financial stake.

- Influence: Shareholders often have voting rights and can influence major decisions, while stakeholders exert influence through other means like protests or feedback.

- Goals: Shareholders are primarily focused on maximizing profits, while stakeholders may prioritize social responsibility, sustainability, and ethical practices.

See? It’s not just about owning a piece of the pie—it’s about who cares about the pie and why.

Types of Stakeholders

Internal Stakeholders

These are the folks inside the company who make it tick. Think employees, management, and board members. Internal stakeholders are directly involved in the day-to-day operations and decision-making processes. Without them, the company wouldn’t function.

External Stakeholders

Then you’ve got the external stakeholders—people outside the company who still have a stake in its success. This group includes customers, suppliers, investors, and even the general public. External stakeholders might not be involved in the nitty-gritty details, but they’re still affected by the company’s actions.

Roles and Responsibilities of Shareholders

Shareholders might seem like silent partners, but they actually play a pretty active role in a company’s life. Here’s what they typically do:

- Invest Capital: They provide the funds needed for the company to grow and thrive.

- Vote on Decisions: Shareholders with voting rights can weigh in on important matters like leadership changes or strategic moves.

- Monitor Performance: They keep an eye on the company’s financial health and demand accountability.

At the end of the day, shareholders want their investment to pay off. That means they’re often pushing for profitability and efficiency—but not always at the expense of other stakeholders.

Why the Difference Matters

Understanding the stakeholder and shareholder difference is more than just academic—it’s essential for running a successful business. Companies that focus solely on shareholders might neglect other important groups, like employees or the environment. On the flip side, businesses that prioritize stakeholders might struggle to deliver profits to their investors.

So, finding the right balance is key. A company that considers both groups’ needs is more likely to thrive in the long run. And let’s face it: happy stakeholders and shareholders lead to a happy company.

Potential Conflicts Between Stakeholders and Shareholders

Let’s be honest—stakeholders and shareholders don’t always see eye to eye. For example:

- Profit vs Purpose: Shareholders might push for cost-cutting measures that harm employees or the environment, while stakeholders might demand more sustainable practices.

- Short-Term vs Long-Term: Shareholders may prioritize immediate profits, while stakeholders might focus on long-term growth and stability.

These conflicts can create tension, but they also present opportunities for dialogue and compromise. Companies that address these issues openly tend to fare better in the long run.

Balancing Stakeholder and Shareholder Interests

So, how do you strike the right balance? It starts with communication. Companies need to listen to both groups and find ways to meet their needs. This might involve:

- Implementing sustainable practices that benefit all stakeholders.

- Providing transparent financial reporting to keep shareholders informed.

- Engaging in community outreach programs to build trust with external stakeholders.

Ultimately, it’s about creating a win-win situation where everyone feels valued and heard. Easier said than done, but definitely worth the effort.

The Legal Perspective on Stakeholder vs Shareholder

From a legal standpoint, the stakeholder and shareholder difference is pretty clear. Shareholders have specific rights under corporate law, including the right to vote and receive dividends. Stakeholders, on the other hand, don’t always have the same legal protections—but they do have influence through advocacy and public pressure.

Some countries have even started recognizing the importance of stakeholder rights in corporate governance. This shift reflects a growing awareness that companies need to consider more than just profits—they need to contribute positively to society as a whole.

Conclusion: Final Thoughts on Stakeholder and Shareholder Difference

Alright, let’s wrap things up. The stakeholder and shareholder difference is more than just a matter of semantics—it’s a fundamental distinction that affects how companies operate and succeed. By understanding both groups’ needs and finding ways to balance them, businesses can thrive in today’s complex world.

So, what’s next? If you found this article helpful, feel free to leave a comment or share it with your friends. And hey, if you want to dive deeper into business topics, check out our other articles. After all, knowledge is power—and staying informed is the key to success.