Stock Scanner India: The Ultimate Guide To Boost Your Investment Journey

Investing in the stock market can feel like diving into a vast ocean, especially if you're new to the game. But don’t worry, because stock scanner India has got your back! Imagine having a powerful tool that helps you spot hidden gems, track price movements, and make smarter decisions. Sounds cool, right? Stock scanners aren’t just for pros—they’re for anyone who wants to level up their investment game. So, whether you’re a beginner or a seasoned player, this guide is here to help you unlock the full potential of stock scanners in India.

Let’s face it, the Indian stock market is a beast. With thousands of stocks trading every day, it’s easy to get overwhelmed. But here’s the thing—stock scanners simplify the chaos. They act like a personal assistant, filtering out irrelevant data and showing you exactly what you need to know. And with the rise of fintech and digital tools, stock scanners have become more accessible and user-friendly than ever before.

Now, you might be wondering, “Why do I even need a stock scanner?” Great question! Think of it this way: just like how a GPS helps you navigate unfamiliar roads, a stock scanner helps you navigate the stock market. It gives you real-time insights, alerts you to trends, and helps you spot opportunities before others even realize they exist. So, are you ready to dive in? Let’s explore the world of stock scanners together!

What is a Stock Scanner and Why Should You Care?

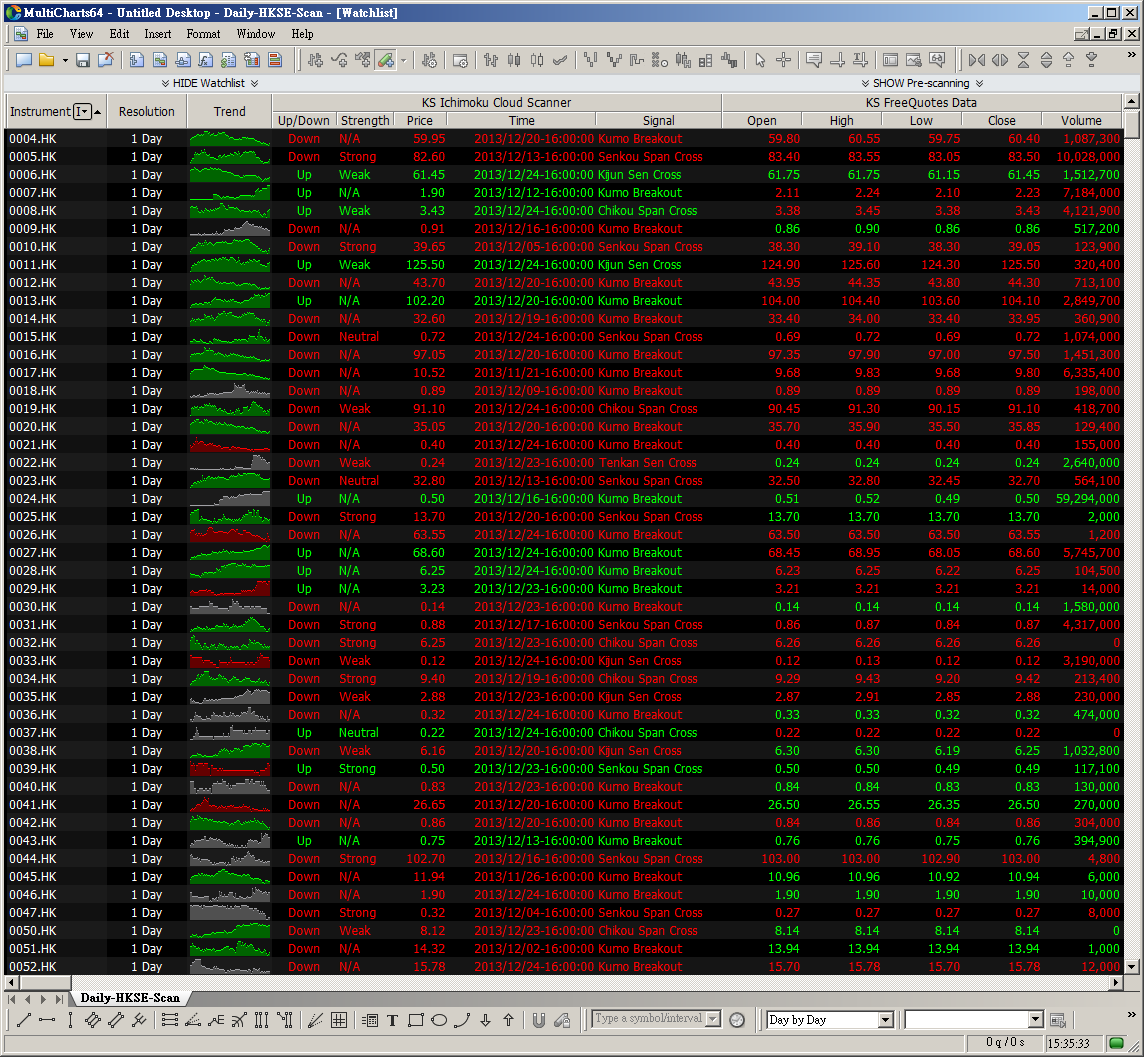

A stock scanner is basically a software tool designed to filter and analyze stock data based on specific criteria. In the context of stock scanner India, these tools are tailored to work with Indian stock exchanges like NSE (National Stock Exchange) and BSE (Bombay Stock Exchange). They help investors identify stocks that meet certain conditions, such as price movements, volume spikes, or technical indicators. This makes it easier to find stocks that align with your investment strategy.

Here’s why stock scanners matter:

- Time-Saving: Instead of manually checking hundreds of stocks, a scanner does the heavy lifting for you.

- Real-Time Alerts: Get notified about price changes, breaking news, and other market events as they happen.

- Customizable Filters: Set up your own rules and criteria to find stocks that fit your risk appetite.

- Technical Analysis: Many scanners come with built-in technical indicators like moving averages, RSI, and MACD, making it easier to spot trends.

For instance, imagine you’re looking for stocks that have broken out of a key resistance level. A stock scanner can scan the entire market and show you a list of stocks that meet this condition in seconds. That’s the power of automation at work!

Key Features of Stock Scanner India

When it comes to stock scanners in India, there are several features that set them apart from generic tools. Here’s a breakdown of what you can expect:

1. Real-Time Data

One of the biggest advantages of stock scanners is their ability to provide real-time data. Whether it’s stock prices, trading volumes, or news updates, everything is updated instantly. This ensures that you’re always working with the latest information, giving you an edge over other investors who rely on delayed data.

2. Customizable Alerts

Who doesn’t love a good alert? Stock scanners allow you to set up custom notifications for specific events. For example, you can get an alert when a stock crosses a certain price level or when its trading volume spikes. These alerts keep you informed without requiring you to constantly monitor the market.

3. Advanced Filtering

Filtering is the heart of any stock scanner. You can create complex filters to narrow down your search. For instance, you might want to find stocks that are trading above their 50-day moving average and have a P/E ratio below 15. With advanced filtering options, you can fine-tune your criteria to perfection.

4. Technical Indicators

Technical analysis is a crucial part of stock trading, and stock scanners make it easy to incorporate these tools into your strategy. Most scanners come with built-in indicators like RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands. These indicators help you identify trends, reversals, and potential entry/exit points.

How to Choose the Best Stock Scanner India

With so many stock scanners available in the market, choosing the right one can be overwhelming. Here are some factors to consider:

- Platform Compatibility: Does the scanner work on your preferred device? Look for tools that are available on both desktop and mobile platforms.

- Data Accuracy: Ensure the scanner provides accurate and up-to-date data. Check reviews and user feedback to gauge its reliability.

- Feature Set: Does the scanner offer the features you need? Make a list of must-haves and compare different options.

- Price: While some scanners are free, others come with a subscription fee. Decide how much you’re willing to spend and whether the features justify the cost.

Some popular stock scanners in India include TradingView, Marketcalls, and Angel Broking’s Smart Money Scanner. Each of these tools has its own strengths, so it’s worth trying them out to see which one suits your needs.

Top Stock Scanners in India

Now that you know what to look for, let’s take a closer look at some of the top stock scanners available in India:

1. TradingView

TradingView is a global leader in stock scanning and charting tools. It offers a wide range of features, including real-time data, customizable charts, and a massive library of technical indicators. What sets TradingView apart is its vibrant community of traders who share ideas and strategies. While it’s not specifically tailored for the Indian market, it works seamlessly with NSE and BSE data.

2. Marketcalls

Marketcalls is a homegrown stock scanner that focuses exclusively on the Indian market. It offers a variety of scans, including breakout scans, volume spike scans, and technical indicator scans. One of its standout features is the ability to backtest your strategies using historical data. This allows you to refine your approach before putting real money on the line.

3. Angel Broking Smart Money Scanner

Angel Broking’s Smart Money Scanner is a powerful tool for both retail and institutional investors. It provides real-time data, advanced filtering options, and integrated charting capabilities. One of its unique features is the “Smart Money Flow” indicator, which shows you where the big players are putting their money.

How to Use Stock Scanners Effectively

Having a stock scanner is one thing, but using it effectively is another. Here are some tips to help you get the most out of your scanner:

1. Define Your Strategy

Before you start scanning, it’s important to define your investment strategy. Are you a swing trader looking for short-term opportunities? Or are you a long-term investor focused on fundamental analysis? Your strategy will determine the type of scans you create and the criteria you use.

2. Test Your Scans

Not all scans are created equal. Some may generate too many false positives, while others may miss important opportunities. To avoid this, test your scans using historical data. This will help you refine your criteria and improve the accuracy of your results.

3. Combine Scans with Fundamental Analysis

While technical analysis is powerful, it’s not the only factor to consider. Always combine your scans with fundamental analysis to ensure you’re making well-rounded decisions. Look at factors like earnings growth, debt levels, and industry trends to get a complete picture of a stock’s potential.

Common Mistakes to Avoid

Even the best tools can lead to poor results if used incorrectly. Here are some common mistakes to avoid when using stock scanners:

- Overcomplicating Filters: While advanced filters are great, overcomplicating them can lead to missed opportunities. Keep your criteria simple and focused.

- Ignoring Context: A stock might meet all your criteria, but if it’s in a declining sector, it might not be worth investing in. Always consider the broader market context.

- Blindly Following Alerts: Alerts are helpful, but they shouldn’t be the sole basis for your decisions. Always verify the information and analyze the stock further before making a move.

By avoiding these pitfalls, you can maximize the effectiveness of your stock scanner and improve your investment outcomes.

The Future of Stock Scanners in India

As technology continues to evolve, stock scanners are becoming more sophisticated. We’re seeing advancements like AI-driven analytics, machine learning algorithms, and cloud-based platforms. These innovations are making it easier than ever for investors to access high-quality data and insights.

In the coming years, we can expect stock scanners to become even more integrated with other financial tools. Imagine a world where your scanner automatically syncs with your brokerage account, executes trades on your behalf, and provides personalized recommendations based on your portfolio. The possibilities are endless!

Conclusion

Stock scanner India has revolutionized the way investors approach the stock market. By providing real-time data, customizable alerts, and advanced filtering options, these tools empower traders to make smarter, more informed decisions. Whether you’re a beginner or a seasoned pro, a stock scanner can help you navigate the complexities of the market and achieve your financial goals.

So, what are you waiting for? Dive into the world of stock scanners and take your investment journey to the next level. And don’t forget to share this article with your friends and fellow investors. Together, we can unlock the secrets of the stock market and build a brighter financial future!

Table of Contents

- Stock Scanner India: The Ultimate Guide to Boost Your Investment Journey

- What is a Stock Scanner and Why Should You Care?

- Key Features of Stock Scanner India

- How to Choose the Best Stock Scanner India

- Top Stock Scanners in India

- How to Use Stock Scanners Effectively

- Common Mistakes to Avoid

- The Future of Stock Scanners in India

- Conclusion