Unlock The Secrets Of Value Investing Class: Your Path To Financial Freedom

Value investing class has become the ultimate guide for anyone looking to master the art of smart investing. Imagine this: you're sitting in a room filled with seasoned investors, each sharing their secrets to building wealth over time. But here's the twist – you don't have to be physically present in that room. With value investing classes now available online, the world of finance is literally at your fingertips. Whether you're a beginner or an experienced investor, these classes offer the tools and knowledge you need to make informed decisions and grow your wealth.

Picture this: you're scrolling through the internet, looking for ways to grow your money. You stumble upon the term "value investing," and suddenly, a whole new world opens up. Value investing class isn't just about learning how to pick stocks; it's about understanding the principles that have made legends like Warren Buffett so successful. These classes teach you how to identify undervalued assets, assess risk, and build a portfolio that stands the test of time.

Now, before we dive deeper into the nitty-gritty of value investing class, let's get one thing straight: this isn't some get-rich-quick scheme. This is about discipline, patience, and a deep understanding of the markets. So, buckle up, because we're about to take you on a journey that could change the way you think about money forever.

What Exactly is Value Investing Class?

A value investing class is essentially a structured program designed to teach individuals the principles and strategies of value investing. These classes cover everything from the basics of stock analysis to advanced techniques for identifying undervalued assets. The goal? To help you become a smarter, more informed investor who can make decisions based on fundamental analysis rather than market hype.

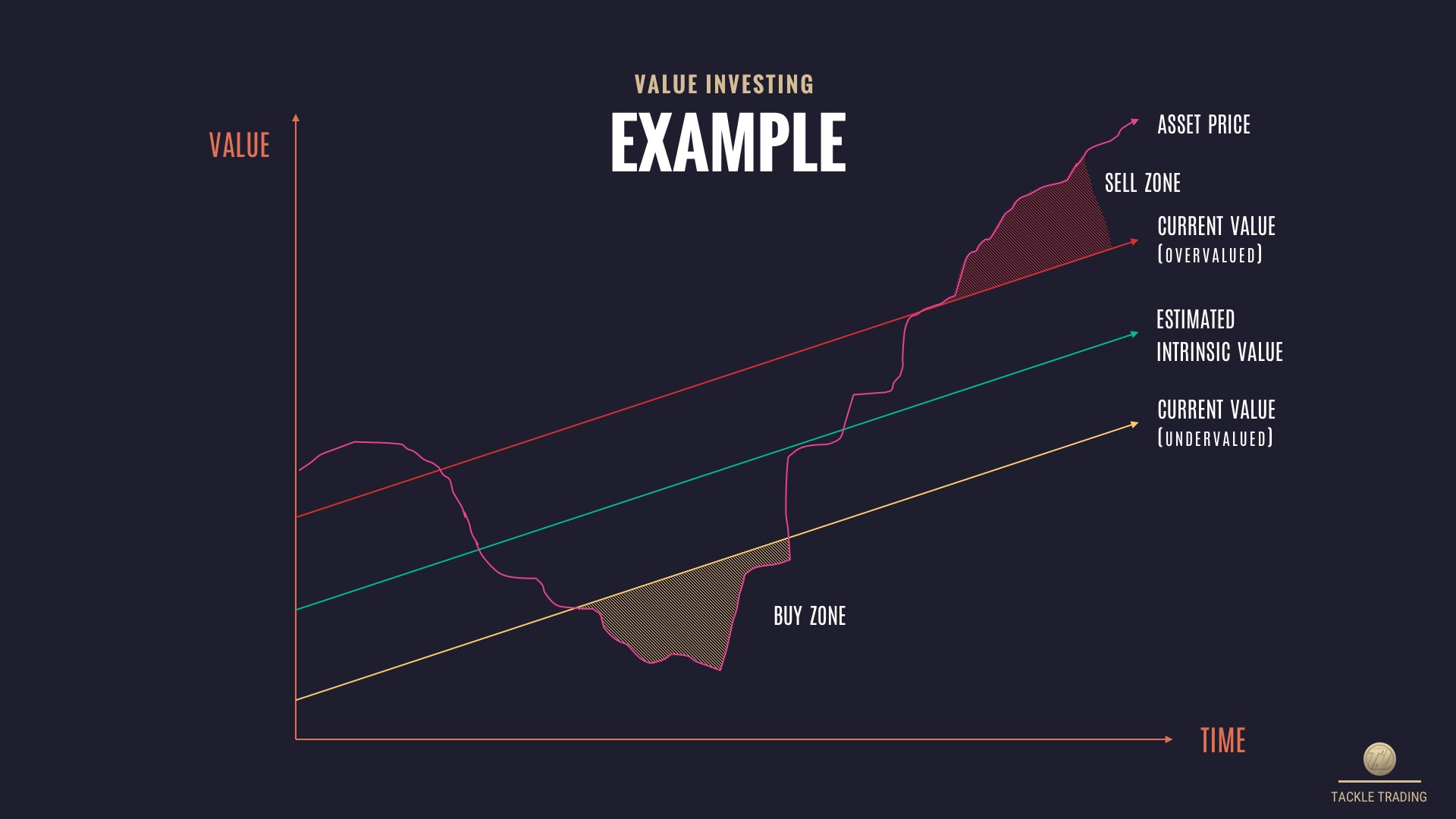

But what makes value investing so special? Well, it's all about finding diamonds in the rough. Instead of chasing the latest stock market trends, value investors focus on companies that are currently undervalued by the market but have strong fundamentals. Think of it like buying a high-quality car at a garage sale price. Sounds pretty good, right?

Key Principles of Value Investing

Before you jump into a value investing class, it's important to understand the core principles that guide this investment strategy:

- Intrinsic Value: This is the true worth of a company, independent of its current market price. Value investors use various methods to calculate intrinsic value, such as discounted cash flow analysis.

- Margin of Safety: This principle involves buying stocks at a significant discount to their intrinsic value to minimize risk and maximize potential returns.

- Long-Term Perspective: Value investing isn't about quick wins. It's about holding onto investments for the long haul, allowing them to appreciate over time.

These principles form the backbone of any value investing class and are essential for anyone looking to succeed in this field.

Why Should You Take a Value Investing Class?

Taking a value investing class isn't just about learning how to invest; it's about gaining a competitive edge in the financial world. Here are a few reasons why you should consider enrolling:

First off, these classes provide you with a solid foundation in financial analysis. You'll learn how to read financial statements, calculate key metrics, and assess a company's overall health. This knowledge is invaluable, whether you're managing your own portfolio or working in the financial industry.

Secondly, value investing classes teach you how to think like a value investor. You'll learn to look beyond the headlines and focus on what really matters – the fundamentals. This mindset shift can be a game-changer in the world of investing.

Benefits of Value Investing Class

- Enhanced understanding of financial markets

- Improved decision-making skills

- Access to a community of like-minded investors

- Practical tools and resources for portfolio management

And let's not forget the networking opportunities. Many value investing classes offer forums, webinars, and other platforms where you can connect with fellow investors. These connections can be invaluable when it comes to sharing ideas, discussing strategies, and learning from each other's experiences.

Types of Value Investing Classes Available

Not all value investing classes are created equal. Depending on your goals and preferences, you may want to consider different types of classes:

Online Courses

Online value investing classes are perfect for those who prefer flexibility. You can learn at your own pace, from the comfort of your home. Platforms like Coursera, Udemy, and LinkedIn Learning offer a wide range of courses taught by industry experts.

In-Person Workshops

If you're more of a hands-on learner, in-person workshops might be the way to go. These events often include interactive sessions, case studies, and Q&A with instructors. They're great for building relationships and gaining practical experience.

University Programs

For those looking for a more formal education, many universities offer value investing courses as part of their business or finance programs. These programs often provide a deeper dive into the subject, with access to research facilities and experienced faculty.

What to Expect in a Value Investing Class

So, what can you expect when you enroll in a value investing class? Here's a breakdown of the typical curriculum:

- Introduction to value investing principles

- Financial statement analysis

- Stock valuation techniques

- Risk management strategies

- Case studies of successful value investors

Most classes also include practical exercises, such as building a mock portfolio or analyzing real-world companies. These activities help reinforce the concepts you're learning and give you hands-on experience.

Common Challenges in Value Investing Class

While value investing classes can be incredibly rewarding, they do come with their own set of challenges. One of the biggest hurdles is mastering the technical aspects of financial analysis. Terms like P/E ratio, EPS, and ROE might sound intimidating at first, but with practice, they'll become second nature.

Another challenge is staying disciplined. Value investing requires patience and a long-term perspective, which can be difficult in today's fast-paced world. However, the rewards of sticking with it can be well worth the effort.

How to Choose the Right Value Investing Class

With so many options available, choosing the right value investing class can be overwhelming. Here are a few tips to help you make the best decision:

- Look for classes taught by experienced instructors with a proven track record in value investing.

- Check for reviews and testimonials from past students to gauge the quality of the program.

- Consider the format that suits your learning style – online, in-person, or hybrid.

- Ensure the class covers the specific topics you're interested in, such as international markets or sustainable investing.

Remember, the right class for you might not be the right class for someone else. Take the time to research and find a program that aligns with your goals and preferences.

Success Stories from Value Investing Class Graduates

One of the best ways to gauge the effectiveness of a value investing class is to look at the success stories of its graduates. Take Sarah, for example, who enrolled in an online value investing course after losing money in the stock market. Armed with newfound knowledge, she rebuilt her portfolio and achieved a 15% annual return over the next five years.

Or consider John, a retired engineer who took a university-level value investing class to keep his mind sharp. He now manages a small fund for his community, teaching others the principles he learned in class.

Lessons Learned from Real-Life Investors

These success stories highlight the importance of education in the world of investing. By learning from experienced investors and applying their strategies, you can avoid common pitfalls and increase your chances of success.

Tips for Maximizing Your Value Investing Class Experience

To get the most out of your value investing class, here are a few tips:

- Engage actively with the material – don't just passively consume it.

- Ask questions and participate in discussions with your peers and instructors.

- Apply what you learn in real-world scenarios, even if it's just with a small amount of money.

- Stay updated with the latest trends and developments in the financial world.

Remember, the key to success in value investing is continuous learning and adaptation. The more you practice and refine your skills, the better you'll become.

The Future of Value Investing Class

As the financial landscape continues to evolve, so too does the world of value investing. With the rise of ESG investing, crypto-assets, and other emerging trends, value investing classes are adapting to meet the needs of modern investors.

In the future, we may see more hybrid classes that combine traditional value investing principles with cutting-edge technologies like AI and blockchain. These innovations could open up new opportunities for investors and make value investing even more accessible to the masses.

Final Thoughts

In conclusion, value investing class is an invaluable resource for anyone looking to master the art of smart investing. Whether you're a beginner or an experienced investor, these classes offer the knowledge, tools, and community you need to succeed in the financial world.

So, what are you waiting for? Take the first step towards financial freedom by enrolling in a value investing class today. And don't forget to share your journey with others – the more we learn from each other, the stronger our community becomes.

Got any questions or thoughts? Drop a comment below, and let's keep the conversation going!

Table of Contents

- What Exactly is Value Investing Class?

- Why Should You Take a Value Investing Class?

- Types of Value Investing Classes Available

- What to Expect in a Value Investing Class

- How to Choose the Right Value Investing Class

- Success Stories from Value Investing Class Graduates

- Tips for Maximizing Your Value Investing Class Experience

- The Future of Value Investing Class