Unpacking The Difference Between A Stakeholder And A Shareholder: A Deep Dive

**Let's face it, folks—when it comes to business terminology, things can get a little confusing. You’ve probably heard the terms "stakeholder" and "shareholder" tossed around in board meetings, business articles, or even casual conversations about company performance. But what exactly is the difference between a stakeholder and a shareholder?** It’s not just a matter of semantics; understanding these distinctions is crucial for anyone looking to navigate the world of corporate operations, whether you're an entrepreneur, an investor, or just someone curious about how businesses work.

Here’s the deal: both stakeholders and shareholders play vital roles in the success (or failure) of a company. However, their interests, involvement, and influence differ significantly. If you’ve ever wondered why some people care about a company’s social impact while others only care about profits, you’re on the right track. In this article, we’ll break down these differences in a way that’s easy to digest, so you can walk away feeling confident about your newfound knowledge.

Before we dive deep into the nitty-gritty, let’s set the stage. This isn’t just about definitions—it’s about understanding the bigger picture. By the end of this read, you’ll have a clear grasp of how stakeholders and shareholders interact, the impact they have on businesses, and why it matters to you. So buckle up, because we’re about to unravel the mystery behind these two business buzzwords!

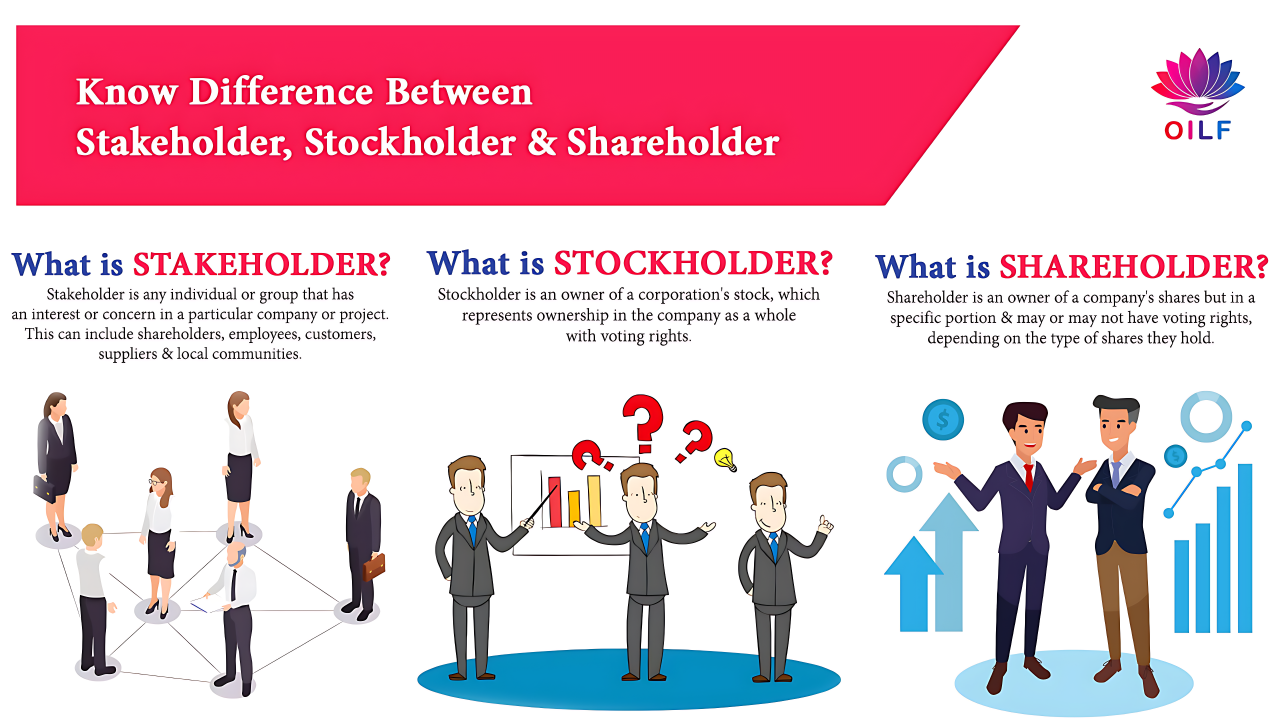

What Exactly is a Stakeholder?

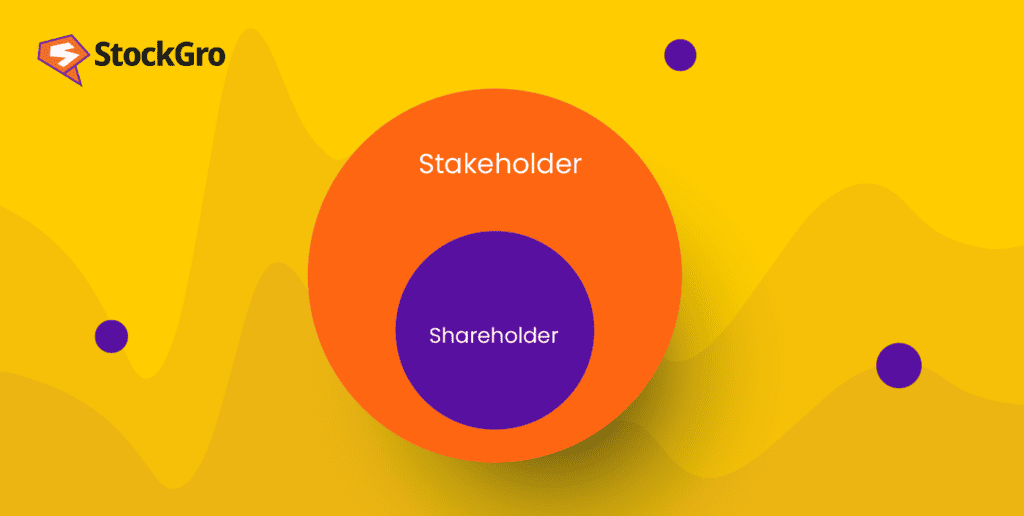

Alright, let’s start with the basics. A stakeholder is anyone who has an interest or concern in the success or failure of a business. That’s right—anyone. It’s a pretty broad term, and that’s because stakeholders come in all shapes and sizes. Think employees, customers, suppliers, local communities, and even the government. These are all examples of stakeholders, and they all have a stake (pun intended) in how a company operates.

Here’s the kicker: stakeholders don’t necessarily own a part of the company. Their involvement might be indirect, but their interests are deeply tied to the company’s performance. For instance, if a factory pollutes a nearby river, the local community—especially those who rely on that water source—becomes a stakeholder in that company’s actions. Makes sense, right?

Types of Stakeholders

Now that we’ve defined what a stakeholder is, let’s break it down further. Stakeholders can be divided into two main categories: internal and external. Internal stakeholders are those who are directly involved in the company’s operations, like employees and management. External stakeholders, on the other hand, are outside the company but still affected by its actions, such as customers, suppliers, and the public.

- Internal Stakeholders: Think of these as the people who make the company tick. Employees, executives, and board members all fall into this category. Their interests are usually tied to job security, compensation, and career growth.

- External Stakeholders: These are the folks who interact with the company but aren’t directly employed by it. Customers want quality products, suppliers need reliable partners, and the government expects compliance with regulations.

And What About a Shareholder?

Now, let’s shift gears and talk about shareholders. Unlike stakeholders, shareholders have a direct financial interest in the company. They own shares of stock, which means they literally own a piece of the business. Shareholders are often referred to as equity owners, and their primary goal is usually to maximize their return on investment (ROI).

Here’s where it gets interesting: shareholders have voting rights in certain company decisions, such as electing board members or approving major mergers. However, their influence is typically limited to financial matters. While they care about the company’s success, their focus is usually on profit margins and stock prices rather than social or environmental impacts.

Key Characteristics of Shareholders

Shareholders come in different flavors, too. Some are individual investors, while others are institutional investors like pension funds or mutual funds. Regardless of their background, all shareholders share a few common traits:

- Ownership: Shareholders own a portion of the company, which gives them a say in certain decisions.

- Profit Motive: Their primary interest is in the company’s financial performance. They want to see dividends paid out or stock prices rise.

- Risk Tolerance: Shareholders are willing to take on some level of risk in exchange for potential rewards. However, this risk tolerance varies depending on the type of investor.

Spotting the Differences: Stakeholder vs Shareholder

Now that we’ve defined both terms, let’s highlight the key differences between a stakeholder and a shareholder. This is where things start to get juicy. While both groups are important to a company’s success, their motivations and roles are fundamentally different.

Scope of Interest

Stakeholders have a broader scope of interest. They care about more than just financial performance. For example, a customer might be concerned about product quality, while a supplier might prioritize timely payments. On the other hand, shareholders are laser-focused on financial returns. They want to see their investments grow, plain and simple.

Level of Influence

When it comes to decision-making, shareholders usually have more formal power. They can vote on major company decisions and even influence the board of directors. Stakeholders, however, rely on other forms of influence, such as public pressure or advocacy campaigns. For instance, if a company ignores environmental concerns, environmental groups (a type of stakeholder) might launch a campaign to hold the company accountable.

Why Does This Matter?

Understanding the difference between a stakeholder and a shareholder isn’t just an academic exercise—it has real-world implications. Companies that fail to recognize the needs of both groups risk alienating key supporters. For example, a company that prioritizes shareholder profits at the expense of employee well-being might face high turnover rates or even strikes. On the flip side, a company that focuses too much on pleasing stakeholders might neglect its financial obligations to shareholders.

Here’s the bottom line: successful businesses strike a balance between stakeholder and shareholder interests. They recognize that both groups are essential to long-term success. By aligning their strategies with the needs of both, companies can create value for everyone involved.

The Importance of Corporate Social Responsibility (CSR)

One area where stakeholders and shareholders often collide is in the realm of Corporate Social Responsibility (CSR). Shareholders might see CSR initiatives as a drain on profits, while stakeholders view them as essential for ethical business practices. Finding common ground here is crucial. Companies that invest in CSR not only improve their reputation but also attract socially conscious investors who value more than just financial returns.

Real-World Examples

Talking about theory is all well and good, but let’s bring it back to reality with some real-world examples. Take Tesla, for instance. Elon Musk’s electric car company has a diverse group of stakeholders, from environmentalists who support its mission to reduce carbon emissions to customers who want reliable, high-performance vehicles. At the same time, Tesla’s shareholders are eager to see the company’s stock price soar. Balancing these competing interests is no small feat, but it’s a challenge Tesla has managed to navigate successfully.

On the flip side, consider the 2010 Deepwater Horizon oil spill. BP, the company responsible for the disaster, faced intense pressure from stakeholders, including environmental groups and local communities affected by the spill. Meanwhile, shareholders were concerned about the financial impact of cleanup costs and lawsuits. In this case, BP’s failure to address stakeholder concerns early on led to a public relations nightmare and significant financial losses for shareholders.

Lessons Learned from These Examples

What can we learn from these examples? First, companies need to be transparent and proactive in addressing stakeholder concerns. Second, they must communicate effectively with shareholders to manage expectations. Finally, they should strive to create value for both groups by aligning their interests whenever possible.

How Companies Can Engage Stakeholders and Shareholders

Engaging stakeholders and shareholders effectively requires a strategic approach. Here are a few tips for companies looking to build strong relationships with both groups:

- Regular Communication: Keep stakeholders informed about company initiatives and progress. Shareholders, too, appreciate transparency, especially when it comes to financial performance.

- Feedback Mechanisms: Create channels for stakeholders to voice their concerns and suggestions. This could be through surveys, town hall meetings, or social media engagement.

- Corporate Governance: Establish clear policies and procedures for decision-making that consider the interests of both stakeholders and shareholders.

Technology’s Role in Engagement

In today’s digital age, technology plays a crucial role in stakeholder and shareholder engagement. Companies can use social media platforms to reach a wider audience, while shareholder portals provide a secure space for financial discussions. Additionally, data analytics tools can help companies track stakeholder sentiment and make informed decisions.

Future Trends in Stakeholder and Shareholder Relations

As the business landscape continues to evolve, so too will the relationship between stakeholders and shareholders. Here are a few trends to watch:

- Sustainability: More companies are prioritizing sustainability as a core part of their business strategy. This aligns with the growing demand from stakeholders for ethical and environmentally responsible practices.

- ESG Investing: Environmental, Social, and Governance (ESG) factors are becoming increasingly important to shareholders. Investors are looking beyond financial performance to assess a company’s impact on society and the planet.

- Technological Advancements: Emerging technologies like blockchain and artificial intelligence are transforming how companies engage with stakeholders and shareholders. These tools offer new ways to enhance transparency and accountability.

Preparing for the Future

To stay ahead of the curve, companies need to adapt to these changing dynamics. This means rethinking traditional business models and embracing a more holistic approach to value creation. By doing so, they can build trust with both stakeholders and shareholders, ensuring long-term success in an increasingly complex world.

Conclusion: Bridging the Gap

So, there you have it—the difference between a stakeholder and a shareholder explained in plain English. While both groups play vital roles in a company’s success, their interests and involvement differ significantly. Understanding these distinctions is key to building strong relationships with both parties and creating value for everyone involved.

As we’ve seen, companies that prioritize stakeholder engagement while maintaining strong shareholder relations tend to fare better in the long run. By aligning their strategies with the needs of both groups, businesses can navigate the challenges of today’s business environment and position themselves for future success.

Now it’s your turn! If you found this article helpful, feel free to leave a comment or share it with your network. And if you’re hungry for more insights into the world of business, be sure to check out our other articles. After all, knowledge is power—and power is what it takes to thrive in today’s competitive landscape.

Table of Contents

- What Exactly is a Stakeholder?

- Types of Stakeholders

- And What About a Shareholder?

- Key Characteristics of Shareholders

- Spotting the Differences: Stakeholder vs Shareholder

- Scope of Interest

- Level of Influence

- Why Does This Matter?

- The Importance of Corporate Social Responsibility (CSR)

- Real-World Examples

- How Companies Can Engage Stakeholders and Shareholders

- Future Trends in Stakeholder and Shareholder Relations

- Conclusion: Bridging the Gap