What Are Heikin Ashi Candles: A Beginner’s Guide To Smoother Trading

Ever wondered what Heikin Ashi candles are and how they can transform your trading game? If you're tired of chaotic price movements and want a clearer picture of market trends, this guide is for you. Heikin Ashi candles offer a unique way to visualize price action, making it easier to spot trends and make informed decisions. Whether you're a newbie or a seasoned trader, understanding Heikin Ashi can give you an edge in the market.

Let’s be honest, trading can be overwhelming. Between the endless charts, indicators, and confusing jargon, it’s easy to get lost. But here’s the good news: tools like Heikin Ashi candles simplify the process. By smoothing out price data, these candles help you focus on the bigger picture instead of getting distracted by every little price swing.

Before we dive deeper, let me tell you why Heikin Ashi candles are worth your attention. Unlike traditional Japanese candlesticks, Heikin Ashi provides a clearer representation of trends, filtering out noise and helping you identify potential buy or sell signals. Stick with me, and by the end of this article, you'll know exactly how to use them in your trading strategy.

Table of Contents

- What Are Heikin Ashi Candles?

- The History of Heikin Ashi

- How Heikin Ashi Candles Are Calculated

- Benefits of Using Heikin Ashi Candles

- Key Differences Between Heikin Ashi and Traditional Candlesticks

- Identifying Trends with Heikin Ashi

- Spotting Reversals Using Heikin Ashi

- Limitations of Heikin Ashi Candles

- Building a Trading Strategy with Heikin Ashi

- Best Tools for Using Heikin Ashi Candles

What Are Heikin Ashi Candles?

Heikin Ashi candles are like the chill version of regular candlesticks. They help traders see the market trends without all the crazy noise that traditional charts sometimes throw at you. Instead of showing every single price movement, Heikin Ashi smooths things out, making it easier to spot uptrends, downtrends, or even sideways markets.

Think of it like watching a movie with subtitles versus without. Traditional candlesticks give you all the raw data, but sometimes it’s hard to follow the story. Heikin Ashi candles are like those subtitles—they clarify what’s happening in the market so you don’t miss any important plot twists.

Why Use Heikin Ashi?

Here’s the deal: if you're looking for clarity in your trading charts, Heikin Ashi is your new best friend. It’s not just about prettier charts; it’s about better decision-making. By focusing on the overall trend, you can avoid false signals and reduce the stress of constant price swings.

For example, imagine you’re trading in a volatile market. Traditional candlesticks might show you a ton of red and green bars flipping back and forth. With Heikin Ashi, those same bars could be telling you that the market is actually in a strong uptrend. That’s powerful stuff.

The History of Heikin Ashi

Heikin Ashi wasn’t just invented out of thin air. It has roots in traditional Japanese candlestick charting, which dates back centuries. The term "Heikin Ashi" roughly translates to "average bar" in Japanese, and that’s exactly what it does—it averages out price data to give you a smoother chart.

Over time, traders realized that while traditional candlesticks are great for detailed analysis, they can also be overwhelming. That’s where Heikin Ashi stepped in. It’s like an upgrade to the classic candlestick chart, designed to make life easier for traders who want to focus on the big picture.

Who Uses Heikin Ashi?

These days, Heikin Ashi is used by traders across the globe. From forex to stocks and even cryptocurrencies, this tool has found its way into almost every market. Beginners love it because it simplifies complex data, while pros appreciate how it highlights key trends without the clutter.

How Heikin Ashi Candles Are Calculated

Now let’s get into the nitty-gritty. Calculating Heikin Ashi candles isn’t rocket science, but it does involve a bit of math. Here’s the basic formula:

- Open = (Previous Open + Previous Close) / 2

- High = Highest value of (Current High, Current Open, Current Close)

- Low = Lowest value of (Current Low, Current Open, Current Close)

- Close = (Current Open + Current High + Current Low + Current Close) / 4

Don’t worry if this seems confusing at first. Most charting platforms do the calculations for you, so you don’t have to break out the calculator. What’s important is understanding what each component represents:

Breaking Down the Components

Each Heikin Ashi candle tells a story. The open represents the midpoint of the previous candle, giving you continuity. The high and low show the extremes of the current price range, while the close provides an average of all the data points. Together, they create a picture of the market that’s both accurate and easy to read.

Benefits of Using Heikin Ashi Candles

So, why should you care about Heikin Ashi candles? Here are a few reasons:

- Clearer Trends: Heikin Ashi makes it easier to spot trends by smoothing out price data.

- Fewer False Signals: Since the charts are less noisy, you’re less likely to act on fakeouts.

- Improved Confidence: When you can clearly see where the market is heading, your trades become more confident.

Imagine being able to look at a chart and instantly know whether you should buy, sell, or hold. That’s the power of Heikin Ashi.

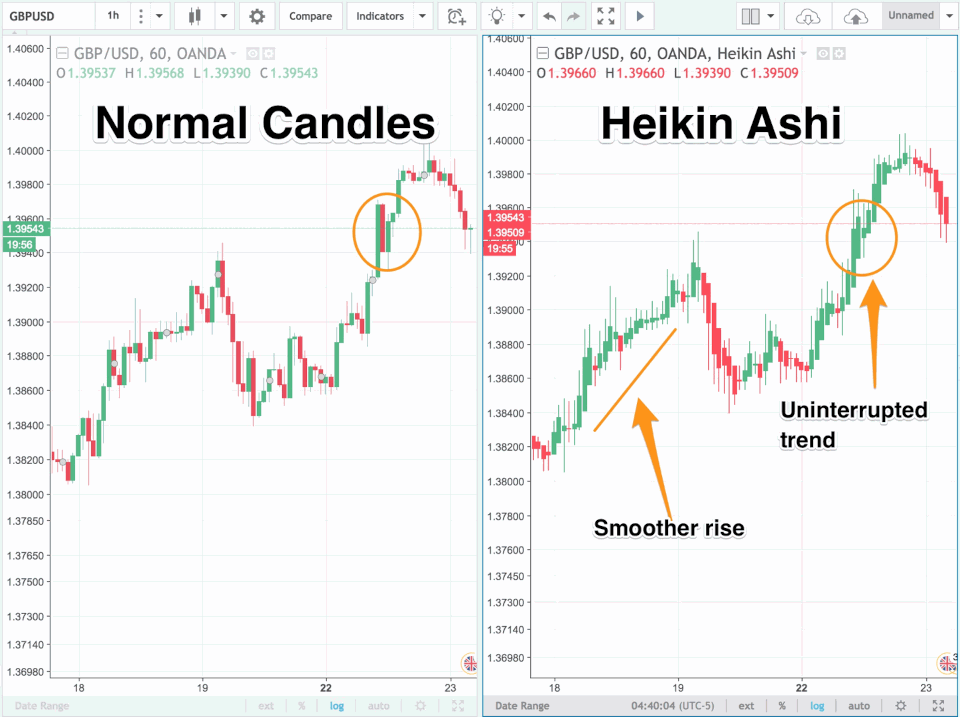

Key Differences Between Heikin Ashi and Traditional Candlesticks

While both Heikin Ashi and traditional candlesticks serve the same purpose, they do it in different ways. Traditional candlesticks show you every price movement, warts and all. Heikin Ashi, on the other hand, filters out the noise, giving you a cleaner chart.

Here’s a quick comparison:

- Traditional Candlesticks: Show raw price data, including every uptick and downtick.

- Heikin Ashi Candles: Average out price data, focusing on the overall trend rather than individual movements.

Which One Should You Use?

It depends on your trading style. If you’re into detailed analysis, traditional candlesticks might be better for you. But if you prefer a simpler, more intuitive approach, Heikin Ashi is the way to go.

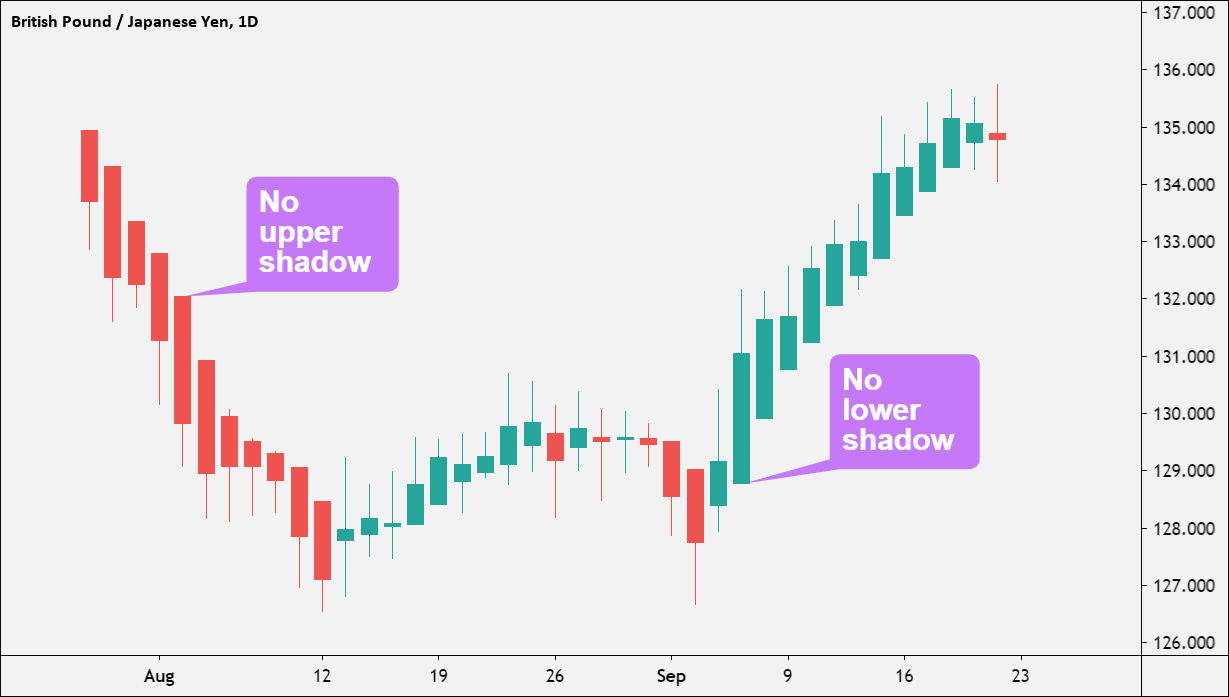

Identifying Trends with Heikin Ashi

One of the biggest advantages of Heikin Ashi candles is their ability to highlight trends. When you see a series of green candles with no wicks, it’s a strong signal that the market is in an uptrend. Conversely, red candles with no wicks indicate a downtrend.

Here’s a pro tip: Always look for patterns in the Heikin Ashi chart. For example, if you notice that the green candles are getting longer over time, it could mean the uptrend is gaining momentum. On the flip side, shorter red candles might suggest a weakening downtrend.

How to Spot Strong Trends

Strong trends in Heikin Ashi charts are easy to identify. Look for:

- Consistent color patterns (all green or all red).

- No wicks or very small wicks.

- Longer candles as the trend progresses.

Spotting Reversals Using Heikin Ashi

Reversals are a trader’s bread and butter, and Heikin Ashi makes them easier to spot. When you see a shift from green to red candles or vice versa, it could signal a potential reversal. Additionally, the appearance of wicks on previously clean candles might indicate that the trend is losing steam.

For instance, imagine you’ve been in a long uptrend with nothing but green candles. Suddenly, you notice a few red candles with long wicks. This could be a warning sign that the market is about to turn.

Confirming Reversals

While Heikin Ashi is great for spotting potential reversals, it’s always a good idea to confirm them with other indicators. Tools like RSI or MACD can help you double-check your findings and avoid acting on false signals.

Limitations of Heikin Ashi Candles

As awesome as Heikin Ashi is, it’s not perfect. One of its biggest drawbacks is that it lags behind real-time price movements. This means it might not be the best choice for scalpers or traders who rely on immediate data.

Additionally, because Heikin Ashi smooths out price data, it can sometimes miss short-term opportunities. That’s why many traders use it in conjunction with other tools to get a more complete picture.

When Not to Use Heikin Ashi

Here are a few situations where Heikin Ashi might not be the best choice:

- Highly volatile markets where every tick matters.

- Scalping strategies that require lightning-fast decisions.

- Markets with no clear trend, where Heikin Ashi might fail to provide useful insights.

Building a Trading Strategy with Heikin Ashi

Now that you know the ins and outs of Heikin Ashi, let’s talk about how to incorporate it into your trading strategy. The key is to combine it with other tools and indicators to create a well-rounded approach.

For example, you could use Heikin Ashi to identify trends and then confirm them with moving averages or oscillators. This way, you’re not relying on a single tool but rather building a robust system that works together.

Step-by-Step Guide to Using Heikin Ashi

Ready to put Heikin Ashi into action? Here’s how:

- Set up your chart to display Heikin Ashi candles.

- Look for clear trends (all green or all red candles).

- Confirm trends with other indicators like RSI or MACD.

- Enter trades based on your analysis, but always manage risk carefully.

Best Tools for Using Heikin Ashi Candles

Not all charting platforms are created equal when it comes to Heikin Ashi. Some of the best options include:

- TradingView: Offers customizable Heikin Ashi charts and a wide range of indicators.

- MetaTrader: Allows you to switch between Heikin Ashi and traditional candlesticks with ease.

- Thinkorswim: Provides advanced charting features and integration with other trading tools.

No matter which platform you choose, make sure it’s one you’re comfortable with. After all, the best tools are the ones you actually use.

Final Thoughts

Heikin Ashi candles are a game-changer for traders who want to simplify their charts and focus on what really matters. By smoothing out price data and highlighting trends, they make it easier to make informed decisions. Just remember to use them wisely and always combine them with other tools for the best results.

So, what are you waiting for? Dive into the world of Heikin Ashi and take your trading to the next level. And hey, don’t forget to share this article with your trading buddies—they’ll thank you for it!