What Is The Difference Between A Shareholder And A Stakeholder? The Ultimate Guide

Let’s cut to the chase here, shall we? If you've ever wondered what is the difference between a shareholder and a stakeholder, you're not alone. These two terms are tossed around in business meetings, boardrooms, and even casual conversations about companies. But do you really know what they mean and how they differ? Stick with me, and we’ll break it down step by step. Understanding this distinction is crucial, whether you're an investor, entrepreneur, or just someone curious about the inner workings of businesses.

Now, before we dive deep into the nitty-gritty, let’s establish one thing—shareholders and stakeholders are both essential to a company’s success. However, their roles, interests, and levels of involvement vary significantly. Think of it like a big family gathering where everyone has a role to play, but not everyone is related by blood. Some are investors, others are employees, customers, suppliers, or even the local community. It’s a complex web, but don’t worry, we’ll untangle it for you.

So, if you’re ready to learn the ropes and get a clearer picture of what makes shareholders and stakeholders tick, let’s get started. By the end of this article, you’ll have a solid grasp of their differences and why both are vital for any organization. Keep reading, and let’s make sense of this together!

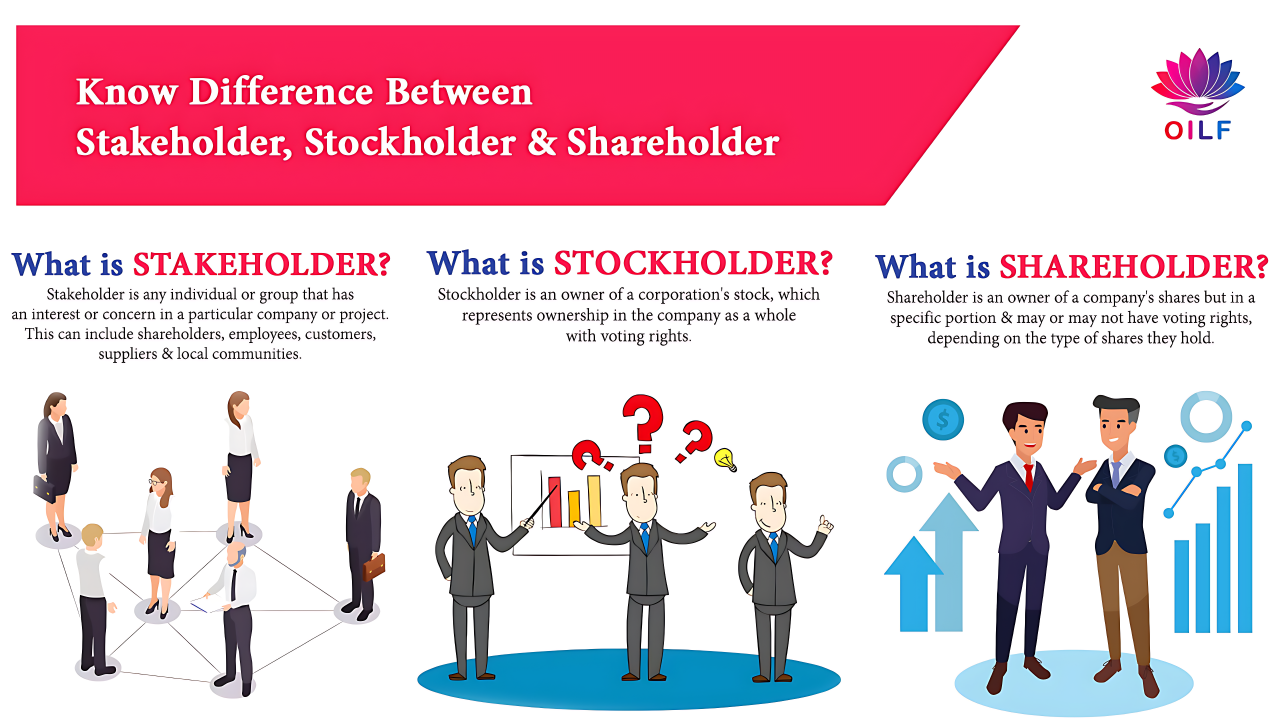

Defining Shareholders: Who Are They, Really?

Alright, let’s talk about shareholders. In simple terms, shareholders are individuals or entities that own shares of a company’s stock. They’re the folks who’ve invested their money in a business, hoping to see returns in the form of dividends or capital appreciation. Think of them as partial owners of the company, with voting rights and a say in major decisions. But here’s the kicker—they’re primarily focused on financial gains.

Shareholders can range from small-time investors who own a handful of shares to large institutional investors like mutual funds or pension funds. Their involvement in the company’s operations can vary. Some are passive investors who simply collect dividends, while others take an active role in shaping the company’s direction through shareholder meetings and voting on key issues. It’s all about the bottom line for them—profit.

Key Characteristics of Shareholders

- Ownership: Shareholders own a portion of the company, represented by the shares they hold.

- Financial Interest: Their primary goal is to maximize returns on their investment.

- Voting Rights: Depending on the type of shares they own, shareholders may have the right to vote on important company matters.

- Risk: Shareholders bear the financial risk of the company’s performance. If the company fails, they could lose their investment.

Now that we’ve got a clearer picture of shareholders, let’s move on to stakeholders. But first, here’s a quick recap—shareholders are investors who own shares and are primarily concerned with financial returns. Keep this in mind as we explore the other side of the coin.

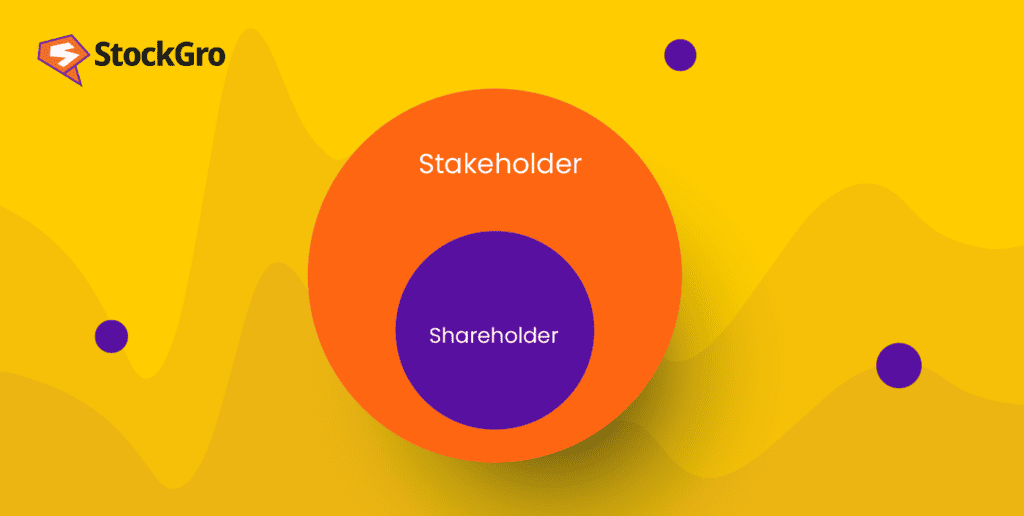

Understanding Stakeholders: A Broader Perspective

While shareholders are all about the money, stakeholders have a much broader scope of interest. Stakeholders are any individuals or groups that have an interest in or are affected by the actions and outcomes of a company. This includes employees, customers, suppliers, local communities, and even the environment. Think of them as the extended family of a business—everyone who has a stake in its success or failure.

Stakeholders aren’t necessarily financially invested in the company, but their well-being is closely tied to the company’s performance. For instance, employees rely on the company for their livelihood, while customers depend on its products or services. Stakeholders often have diverse and sometimes conflicting interests, making it a challenge for companies to balance their needs.

Types of Stakeholders

- Internal Stakeholders: Employees, managers, and directors who work within the company.

- External Stakeholders: Customers, suppliers, investors, and the local community who interact with the company from the outside.

- Primary Stakeholders: Those who engage in economic transactions with the company, like customers and suppliers.

- Secondary Stakeholders: Those indirectly affected by the company’s actions, such as government regulators and the media.

As you can see, stakeholders encompass a wide range of groups with varying interests. This diversity makes it essential for companies to adopt a stakeholder-centric approach to ensure long-term sustainability and success. But how exactly do their roles differ from those of shareholders? Let’s explore that next.

The Core Difference Between Shareholders and Stakeholders

Here’s where things get interesting. The main difference between shareholders and stakeholders lies in their focus and level of involvement. Shareholders are primarily concerned with financial returns, while stakeholders have a broader interest in the company’s overall impact. Let me break it down for you:

Shareholders are like the shareholders of a sports team—they’ve invested money and want to see it grow. They’re interested in profits, dividends, and stock price appreciation. On the other hand, stakeholders are like the fans, players, and community surrounding the team. They care about the team’s performance, but their interests extend beyond just the scoreboard. They’re invested in the team’s reputation, community impact, and long-term sustainability.

Key Differences at a Glance

- Focus: Shareholders focus on financial returns, while stakeholders focus on overall impact.

- Involvement: Shareholders have a direct financial stake, whereas stakeholders have varying levels of involvement and interest.

- Decision-Making: Shareholders have voting rights and can influence company decisions, while stakeholders may not have formal decision-making power but can influence indirectly through advocacy or boycotts.

So, while both groups are important, their motivations and roles differ significantly. Understanding these differences is crucial for businesses aiming to create value for all parties involved. But why does this distinction matter so much? Let’s find out.

Why Does This Distinction Matter?

Alright, here’s the deal—the distinction between shareholders and stakeholders matters because it affects how companies operate and prioritize their goals. In the past, businesses often prioritized shareholder value above all else, focusing solely on profit maximization. However, the modern business landscape demands a more balanced approach.

Companies that focus only on shareholders may neglect the needs and concerns of other stakeholders, leading to negative consequences. For example, cutting costs by outsourcing jobs may benefit shareholders in the short term but harm employees and the local community in the long run. On the flip side, companies that adopt a stakeholder-centric approach often enjoy greater trust, loyalty, and long-term success.

The Business Case for Stakeholder-Centric Approach

- Increased Trust: Engaging with stakeholders builds trust and strengthens relationships.

- Improved Reputation: Companies that prioritize stakeholder interests often enjoy a better reputation, attracting more customers and investors.

- Long-Term Sustainability: A stakeholder-centric approach ensures the company’s long-term viability by addressing social, environmental, and economic concerns.

As you can see, balancing the interests of shareholders and stakeholders is key to creating a sustainable and successful business. But how do companies achieve this balance? Let’s take a closer look.

Strategies for Balancing Shareholder and Stakeholder Interests

Now that we understand the importance of balancing shareholder and stakeholder interests, let’s talk about how companies can achieve this. It’s not always easy, but with the right strategies, it’s definitely doable. Here are a few approaches:

1. Adopting a Triple Bottom Line Approach

The triple bottom line (TBL) framework focuses on three Ps—Profit, People, and Planet. By considering financial, social, and environmental impacts, companies can create value for both shareholders and stakeholders. This approach encourages businesses to think beyond profits and consider the broader impact of their actions.

2. Engaging in Corporate Social Responsibility (CSR)

CSR initiatives allow companies to address the concerns of stakeholders while also benefiting shareholders. For example, investing in sustainable practices may increase costs in the short term but can lead to long-term savings and improved brand reputation.

3. Transparent Communication

Open and honest communication with both shareholders and stakeholders is crucial. Companies should regularly share updates on their performance, challenges, and plans to address stakeholder concerns. This builds trust and ensures everyone is on the same page.

By implementing these strategies, companies can create a harmonious balance between shareholder and stakeholder interests, leading to greater success and sustainability.

Real-World Examples: Companies Getting It Right

Talking about theories is great, but let’s see how some companies are putting these principles into practice. Here are a few examples of businesses that successfully balance shareholder and stakeholder interests:

1. Patagonia

Patagonia is a great example of a company that prioritizes stakeholders while also delivering value to shareholders. Known for its commitment to environmental sustainability, Patagonia invests heavily in eco-friendly practices and advocates for environmental causes. Despite these investments, the company continues to grow and deliver strong financial returns.

2. Microsoft

Microsoft has made significant strides in adopting a stakeholder-centric approach. Under the leadership of CEO Satya Nadella, the company has focused on diversity, inclusion, and sustainability. These efforts have not only improved the company’s reputation but also boosted its financial performance.

3. Unilever

Unilever’s Sustainable Living Plan is a prime example of balancing shareholder and stakeholder interests. By focusing on reducing environmental impact and improving social outcomes, Unilever has achieved impressive growth while also addressing stakeholder concerns.

These examples show that it’s possible to create value for both shareholders and stakeholders when done right. But what about the challenges? Let’s explore that next.

Challenges in Balancing Shareholder and Stakeholder Interests

Of course, it’s not all sunshine and rainbows. Balancing shareholder and stakeholder interests comes with its own set of challenges. Here are a few common obstacles companies face:

1. Conflicting Interests

Shareholders and stakeholders often have conflicting interests. For example, shareholders may want to cut costs to increase profits, while employees may demand higher wages and better working conditions. Finding a middle ground can be tricky.

2. Short-Term vs. Long-Term Focus

Shareholders often focus on short-term gains, while stakeholders may prioritize long-term sustainability. This can create tension, especially when short-term decisions conflict with long-term goals.

3. Measurement and Reporting

Measuring and reporting the impact on stakeholders can be challenging. Unlike financial metrics, social and environmental impacts are harder to quantify and communicate effectively.

Despite these challenges, companies that persevere and find innovative solutions often emerge stronger and more successful. So, how can you apply these lessons to your own business or investments? Let’s wrap things up with some final thoughts.

Conclusion: Taking Action

Alright, we’ve covered a lot of ground here. To recap, understanding the difference between shareholders and stakeholders is crucial for anyone involved in the business world. Shareholders are focused on financial returns, while stakeholders have a broader interest in the company’s overall impact. Balancing these interests is key to creating a sustainable and successful business.

So, what can you do? If you’re an investor, consider the broader impact of your investments and support companies that prioritize stakeholder interests. If you’re a business leader, adopt strategies like the triple bottom line approach, engage in CSR initiatives, and communicate openly with all stakeholders. Together, we can create a business landscape that benefits everyone.

Before you go, I’d love to hear your thoughts. Do you have any questions or insights to share? Leave a comment below, and let’s keep the conversation going. And don’t forget to share this article with anyone who might find it helpful. Together, we can make a difference!

Table of Contents

Defining Shareholders: Who Are They, Really?

Understanding Stakeholders: A Broader Perspective

The Core Difference Between Shareholders and Stakeholders

Why Does This Distinction Matter?

Strategies for Balancing Shareholder and Stakeholder Interests

Real-World Examples: Companies Getting It Right

Challenges in Balancing Shareholder and Stakeholder Interests

There you have it—a comprehensive guide to understanding the difference between shareholders and stakeholders. Thanks for sticking with me, and I hope you found this article insightful and valuable!