New York Income Tax: A Comprehensive Guide For Residents And Taxpayers

Hey there, friend! If you're diving into the world of New York income tax, you're in the right place. Taxes might sound like a buzzkill, but understanding them is key to keeping more of your hard-earned cash in your pocket. New York income tax isn't just some random number you see on your paycheck; it's a crucial part of how the state funds its services. So, buckle up and let's break it down together, shall we?

Now, I know what you're thinking—"Do I really need to know all this tax stuff?" The answer is a big fat yes. Whether you're a lifelong New Yorker or just moved to the city that never sleeps, knowing how income tax works can save you from unexpected surprises come tax season. And who doesn't love saving money, right?

Let's face it, taxes can get pretty complicated. But don't worry, I'm here to make it easier for you. We'll cover everything from how New York income tax is calculated to the deductions and credits that could help you save big time. Stick around because this is gonna be a wild ride!

Understanding New York Income Tax

So, what exactly is New York income tax? It's basically the money you pay to the state of New York based on how much you earn. The more you make, the more you contribute. But hey, it's not all bad news. This tax helps fund schools, roads, public services, and even those cool museums you love visiting.

How New York Income Tax Works

Here's the deal: New York uses a progressive tax system. That means your tax rate goes up as your income increases. For instance, if you're single and earning $50,000 a year, you'll pay a different rate compared to someone making $150,000. It's like a sliding scale that adjusts based on your earnings.

Let me break it down for you:

- Lower income = Lower tax rate

- Higher income = Higher tax rate

It's all about fairness, ensuring everyone contributes according to their ability to pay.

Key Factors Affecting Your New York Income Tax

Alright, now let's talk about the factors that influence how much you owe in New York income tax. These aren't just random numbers; they're based on your income, filing status, and deductions. Let's dive into each one.

Your Income Level

Your income is the biggest factor in determining your tax bill. The more you earn, the more you'll owe. But don't freak out just yet. Remember, New York uses that progressive tax system we talked about earlier. So, only the portion of your income above certain thresholds gets taxed at higher rates.

Filing Status

Your filing status also plays a huge role. Are you single, married filing jointly, or head of household? Each status has its own tax brackets and deductions. For example, married couples filing jointly often get more favorable rates compared to single filers. It's all about maximizing your savings.

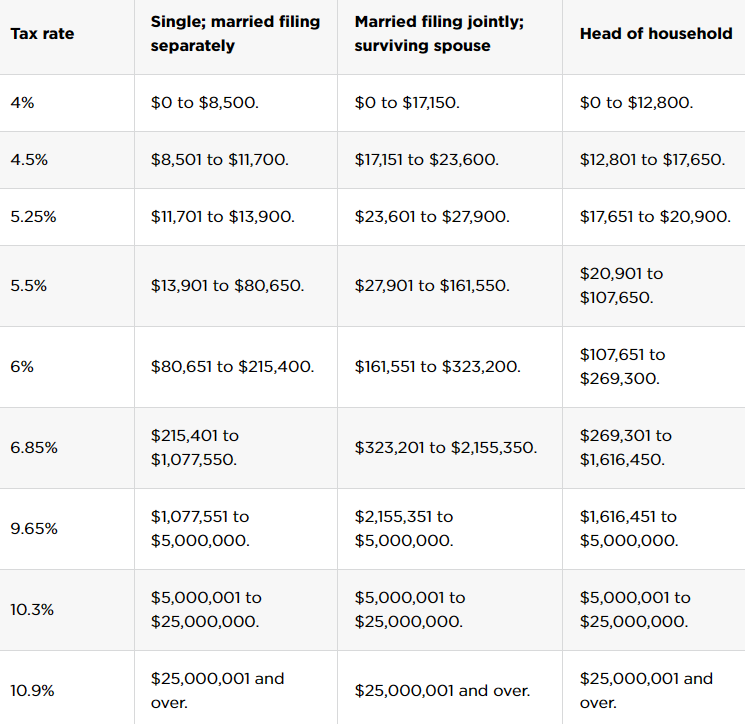

New York Income Tax Brackets

Let's get into the nitty-gritty of New York's income tax brackets. These brackets determine how much tax you'll pay based on your income. Here's a quick rundown:

For the 2023 tax year, the rates are as follows:

- $0 – $8,500: 4%

- $8,501 – $11,700: 4.5%

- $11,701 – $13,900: 5.25%

- $13,901 – $21,400: 5.9%

- $21,401 – $80,650: 6.09%

- $80,651 – $215,400: 6.33%

- $215,401 – $1,077,550: 6.65%

- $1,077,551 and above: 8.82%

See? It's like a ladder where each rung represents a higher tax rate. But don't worry, you only pay the higher rate on the income that falls within that bracket.

Deductions and Credits to Lower Your New York Income Tax

Who doesn't love a good tax break? New York offers a variety of deductions and credits to help lower your tax bill. Let's take a look at some of the most popular ones.

Standard Deduction

Most taxpayers can claim the standard deduction, which reduces their taxable income. For 2023, the standard deduction amounts are:

- Single filers: $8,500

- Married filing jointly: $17,000

- Head of household: $12,000

It's like a freebie the government gives you to help lower your tax burden.

Itemized Deductions

If you have a lot of expenses, itemizing might be a better option. You can deduct things like mortgage interest, property taxes, and charitable contributions. Just make sure the total exceeds the standard deduction; otherwise, you're leaving money on the table.

Tax Credits

Credits are even better than deductions because they directly reduce the amount of tax you owe. Some popular credits in New York include:

- Child Tax Credit

- Earned Income Tax Credit (EITC)

- Property Tax Credit

These credits can add up and save you a ton of money.

New York Income Tax for Non-Residents

What if you don't live in New York but earn income there? Fear not, the state has you covered. Non-residents are subject to New York income tax on any income earned within the state. This includes wages, business income, and even rental property earnings.

Now, here's the kicker: Non-residents can't claim the same deductions as residents. But don't worry, there are still ways to minimize your tax liability. For example, you can deduct certain business expenses or claim credits for taxes paid to other states.

Filing Your New York Income Tax Return

Filing your tax return doesn't have to be a nightmare. With the right tools and information, you can get it done in no time. Here's what you need to know:

Deadlines

Mark your calendars, folks! The deadline for filing New York income tax is typically April 15th. If you miss the deadline, you might face penalties and interest on any unpaid taxes. So, don't procrastinate!

Online Filing

Most people file their taxes online these days. It's faster, easier, and often free. New York offers an e-filing option through its official website. Just gather your documents, answer a few questions, and hit submit. Voila! You're done.

Tips for Reducing Your New York Income Tax

Let's talk strategy. Here are some tips to help you reduce your New York income tax:

- Maximize your deductions and credits

- Contribute to retirement accounts like a 401(k) or IRA

- Keep detailed records of your expenses

- Consult a tax professional if you're unsure

Remember, every little bit helps. The more you plan ahead, the more you save.

New York Income Tax and the Economy

Now, let's zoom out and look at the bigger picture. New York income tax plays a vital role in the state's economy. The revenue generated helps fund essential services like education, healthcare, and infrastructure. It's like a circle of life where everyone contributes and benefits.

But here's the thing: High tax rates can sometimes discourage businesses from setting up shop in New York. That's why the state is always looking for ways to balance the budget while keeping taxes competitive. It's a delicate dance, but one that's crucial for long-term growth.

Frequently Asked Questions About New York Income Tax

Let's wrap up with some common questions people have about New York income tax:

What happens if I don't pay my taxes?

Well, that's never a good idea. If you fail to pay your taxes, you could face penalties, interest, and even legal action. The state takes its revenue seriously, so it's best to stay compliant.

Can I file an extension?

Absolutely! If you need more time to file your return, you can request an extension. Just be aware that this only extends the filing deadline, not the payment deadline. You still need to pay any taxes owed by April 15th.

Do I need a tax attorney?

Not necessarily, but it can be helpful if you have a complicated tax situation. Tax attorneys specialize in navigating the intricacies of tax law and can help you avoid costly mistakes.

Conclusion

And there you have it, folks! A comprehensive guide to New York income tax. From understanding how it works to maximizing your deductions and credits, you're now armed with the knowledge to tackle tax season like a pro.

Remember, taxes don't have to be scary. With a little planning and preparation, you can minimize your tax bill and keep more of your money where it belongs—in your pocket. So, go forth and conquer those taxes!

Before you go, I'd love to hear your thoughts. Do you have any questions or tips to share? Drop a comment below and let's keep the conversation going. And don't forget to share this article with your friends and family. Knowledge is power, and who knows, you might just help someone save a buck or two!

Table of Contents:

- Understanding New York Income Tax

- Key Factors Affecting Your New York Income Tax

- New York Income Tax Brackets

- Deductions and Credits to Lower Your New York Income Tax

- New York Income Tax for Non-Residents

- Filing Your New York Income Tax Return

- Tips for Reducing Your New York Income Tax

- New York Income Tax and the Economy

- Frequently Asked Questions About New York Income Tax

- Conclusion