NYC State Income Tax: A Comprehensive Guide To Understanding And Managing Your Taxes

Welcome to the wild world of NYC state income tax! If you're living in the Big Apple or planning to move here, buckle up because this ride is about to get interesting. Taxes in New York City can be a bit of a headache, but don't worry—we're here to break it down for you in a way that's easy to digest. Whether you're a resident, a small business owner, or just trying to make sense of all the numbers, understanding NYC state income tax is crucial for your financial well-being. Let’s dive right in and make sense of the chaos!

When it comes to taxes, New York City has a reputation for being one of the most complicated tax environments in the country. But hey, what else would you expect from a city that never sleeps? The good news is, once you understand how NYC state income tax works, you’ll be better equipped to manage your finances and avoid any nasty surprises come tax season.

So, whether you're a seasoned pro or a complete newbie when it comes to taxes, this guide will walk you through everything you need to know about NYC state income tax. From the basics to the nitty-gritty details, we’ve got you covered. Let’s get started!

What Exactly is NYC State Income Tax?

Alright, let’s start with the basics. NYC state income tax is essentially a tax imposed by the state of New York on the income earned by individuals, corporations, and other entities. This tax is separate from federal income tax and is calculated based on your income level. In simple terms, it’s the government's way of saying, "Hey, thanks for living and working here—we need some of that money to keep things running smoothly!"

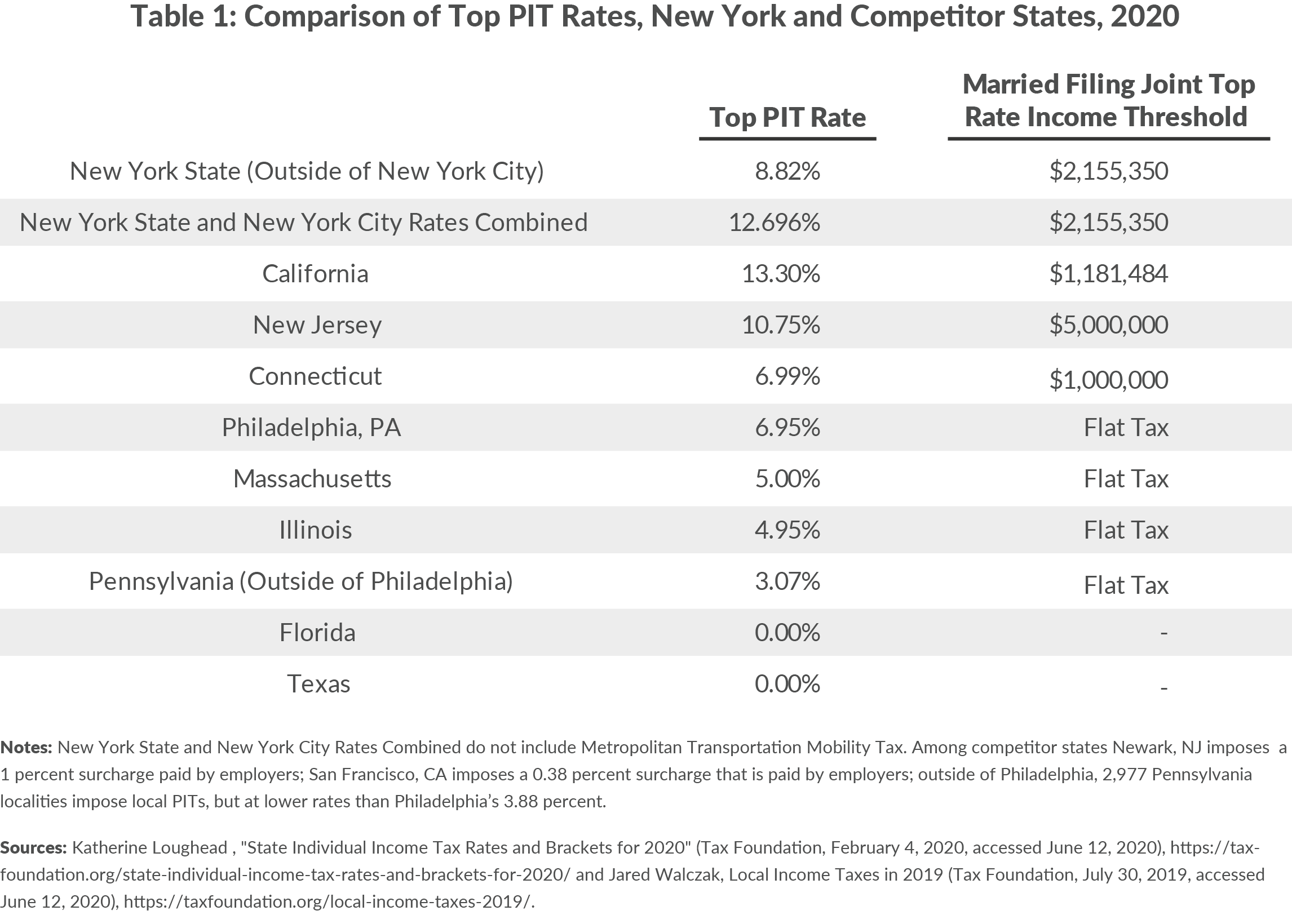

Now, here’s the kicker: NYC also has its own local income tax on top of the state tax. So, if you’re earning money in the city, you’ll be paying both state and city income taxes. Sounds like a lot, right? But don’t panic—we’ll break it down step by step.

Who Needs to Pay NYC State Income Tax?

Not everyone has to pay NYC state income tax, but if you live or work in New York City, chances are you’re on the hook. Here’s a quick rundown of who needs to pay:

- Residents: If you live in New York City for more than 183 days in a year, you’re considered a resident and are required to pay both state and city income taxes.

- Non-Residents: Even if you don’t live in NYC, if you work here, you’ll still have to pay NYC income tax on the income you earn in the city.

- Business Owners: If you own a business in NYC, you’ll also need to pay taxes on the income generated by your business.

It’s important to note that the rules can get a little tricky, especially for non-residents or those who work remotely. So, it’s always a good idea to consult with a tax professional if you’re unsure about your status.

How Much Do You Need to Pay?

Now, let’s talk about the numbers. NYC state income tax rates vary depending on your income level. As of 2023, the state tax rates range from 4% to 8.82% for individuals, while the city tax rates range from 3.078% to 3.936%. That’s right—depending on how much you earn, you could be paying anywhere from 7% to over 12% of your income in taxes!

Income Tax Brackets in NYC

Here’s a breakdown of the current tax brackets for NYC residents:

- State Tax:

- 4% for income up to $8,500

- 4.5% for income between $8,501 and $11,700

- 5.25% for income between $11,701 and $13,900

- 6% for income between $13,901 and $21,400

- 6.49% for income between $21,401 and $80,650

- 6.65% for income between $80,651 and $215,400

- 8.82% for income over $215,401

- City Tax:

- 3.078% for income up to $12,000

- 3.359% for income between $12,001 and $25,000

- 3.648% for income between $25,001 and $50,000

- 3.896% for income between $50,001 and $100,000

- 3.936% for income over $100,000

As you can see, the more you earn, the more you pay. But hey, that’s the price of living in one of the greatest cities in the world, right?

How to Calculate Your NYC State Income Tax

Calculating your NYC state income tax might sound like a daunting task, but with the right tools and information, it’s actually pretty straightforward. Here’s a step-by-step guide to help you out:

First, you’ll need to determine your taxable income. This is your total income minus any deductions or exemptions you qualify for. Once you have your taxable income, you can use the tax brackets we discussed earlier to calculate how much you owe.

For example, let’s say you’re a single filer with a taxable income of $50,000. Based on the current tax brackets, you’d pay:

- State Tax: 6.49% on the first $80,650 of your income, which comes out to around $3,260.

- City Tax: 3.896% on the portion of your income between $50,001 and $100,000, which comes out to around $1,948.

So, in total, you’d be paying around $5,208 in state and city income taxes. Not too bad, right?

Tax Deductions and Credits

Now, here’s where things get interesting. The good news is, there are plenty of deductions and credits you can take advantage of to lower your tax bill. Some of the most common ones include:

- Standard Deduction: This is a set amount you can deduct from your income, depending on your filing status. For single filers, the standard deduction is $8,400 as of 2023.

- Itemized Deductions: If you have a lot of expenses, like mortgage interest or medical bills, you might be better off itemizing your deductions instead of taking the standard deduction.

- Tax Credits: These are dollar-for-dollar reductions in your tax bill. Some popular credits include the Earned Income Tax Credit (EITC) and the Child Tax Credit.

Taking advantage of these deductions and credits can save you a significant amount of money, so it’s definitely worth exploring your options.

Important Deadlines to Keep in Mind

When it comes to taxes, timing is everything. Here are some important deadlines you need to keep in mind:

- April 15th: This is the deadline for filing your state and federal tax returns. If you miss this deadline, you could face penalties and interest on any taxes you owe.

- Quarterly Estimated Tax Payments: If you’re self-employed or have income that’s not subject to withholding, you’ll need to make quarterly estimated tax payments. These are due on April 15th, June 15th, September 15th, and January 15th of the following year.

Setting reminders for these deadlines can save you a lot of headaches down the road. Trust me, you don’t want to be scrambling to file your taxes at the last minute!

Penalties for Late Filing or Payment

If you fail to file your taxes or pay what you owe on time, the consequences can be pretty harsh. Here’s what you can expect:

- Late Filing Penalty: If you don’t file your tax return by the deadline, you’ll be charged a penalty of 5% of the unpaid taxes for each month your return is late, up to a maximum of 25%.

- Late Payment Penalty: If you don’t pay your taxes on time, you’ll be charged a penalty of 0.5% of the unpaid taxes for each month the payment is late, up to a maximum of 25%.

- Interest Charges: On top of the penalties, you’ll also have to pay interest on any unpaid taxes. The interest rate is determined by the IRS and is subject to change.

So, moral of the story? File your taxes on time and pay what you owe to avoid any unnecessary fees or penalties.

Tips for Reducing Your NYC State Income Tax

Now that you know the basics, let’s talk about some strategies you can use to reduce your NYC state income tax. Here are a few tips to help you save money:

- Maximize Your Deductions: As we mentioned earlier, taking advantage of deductions can significantly lower your taxable income. Be sure to review all the deductions you qualify for and claim them on your tax return.

- Contribute to Retirement Accounts: Contributions to retirement accounts like IRAs or 401(k)s are tax-deductible, which means they can lower your taxable income. It’s a win-win—save for retirement and reduce your taxes at the same time!

- Take Advantage of Tax Credits: Don’t forget about those tax credits! They can provide substantial savings and are worth exploring if you qualify.

By implementing these strategies, you can keep more of your hard-earned money in your pocket and reduce your overall tax burden.

Working with a Tax Professional

If all this talk about taxes has your head spinning, don’t worry—you’re not alone. That’s where a tax professional comes in. A good tax preparer or accountant can help you navigate the complexities of NYC state income tax and ensure you’re taking advantage of all available deductions and credits.

Not only can a tax professional save you time and hassle, but they can also potentially save you money by finding deductions or credits you might have missed. So, if you’re feeling overwhelmed, it might be worth investing in some professional help.

Common Mistakes to Avoid

When it comes to taxes, even the smallest mistake can lead to big problems. Here are some common mistakes to watch out for:

- Not Keeping Track of Expenses: If you’re self-employed or run a business, it’s crucial to keep detailed records of all your expenses. This will make it easier to claim deductions and avoid any issues with the IRS.

- Missing Deadlines: As we discussed earlier, missing tax deadlines can result in penalties and interest. Set reminders and stay organized to avoid any last-minute stress.

- Not Reviewing Your Return: Before submitting your tax return, take the time to review it carefully for any errors or omissions. A small mistake could lead to big problems down the road.

Avoiding these common pitfalls can save you a lot of headaches and ensure a smoother tax filing process.

Staying Informed and Up-to-Date

Tax laws and regulations are constantly changing, so it’s important to stay informed and up-to-date. Follow reputable sources like the IRS website or consult with a tax professional to ensure you’re aware of any changes that could affect your taxes.

By staying informed, you’ll be better equipped to handle any changes and make the most of your tax situation.

Conclusion

And there you have it—a comprehensive guide to understanding and managing your NYC state income tax. From the basics to the more advanced strategies, we’ve covered everything you need to know to take control of your taxes and make the most of your finances.

Remember, taxes don’t have to be scary. With the right information and

![NYC & NYS Tax Calculator [Interactive] Hauseit](https://www.hauseit.com/wp-content/uploads/2023/02/NYC-Income-Tax-Calculator.jpg)