List Of PPP Loan Recipients By Name: The Inside Scoop

Ever wonder who's benefiting from the PPP loan program? You're not alone. The list of PPP loan recipients by name has become a hot topic, sparking debates on transparency, fairness, and accountability. As businesses struggle to stay afloat, understanding who’s getting the financial support can shed light on how these funds are distributed. So, buckle up, because we're diving deep into the world of PPP loans and uncovering some surprising truths.

Now, let’s get one thing straight—PPP loans were created to help small businesses survive during tough times. But as with any government program, there's always a bit of drama involved. Some companies got the cash they needed, while others were left scratching their heads. This article aims to break down the list of PPP loan recipients by name, offering clarity and insights into how this program works.

Before we jump into the nitty-gritty, let’s address why this matters. If you're a business owner, a curious taxpayer, or just someone who loves digging into financial scandals, this article is for you. We’ll explore the ins and outs of the PPP loan program, how to access the list of recipients, and what it all means for the economy. Let’s go!

What Exactly Are PPP Loans?

Alright, let’s start with the basics. PPP stands for Paycheck Protection Program, and it’s a lifeline for businesses hit hard by economic challenges. Introduced as part of the CARES Act, these loans are designed to help companies keep their employees on payroll. In simple terms, if you qualify, you can apply for a PPP loan to cover operational costs like salaries, rent, and utilities.

Here's the kicker: if you use the loan funds as intended, a portion—or even all of it—can be forgiven. That’s right, forgiven. No strings attached (well, almost). This makes PPP loans incredibly appealing to businesses desperate for financial relief.

But how does it work? Let’s break it down:

- Eligibility: Small businesses, self-employed individuals, and nonprofits can apply.

- Loan Amount: Typically capped at 2.5 times your average monthly payroll costs.

- Forgiveness: Spend the funds on eligible expenses within 24 weeks, and you might qualify for loan forgiveness.

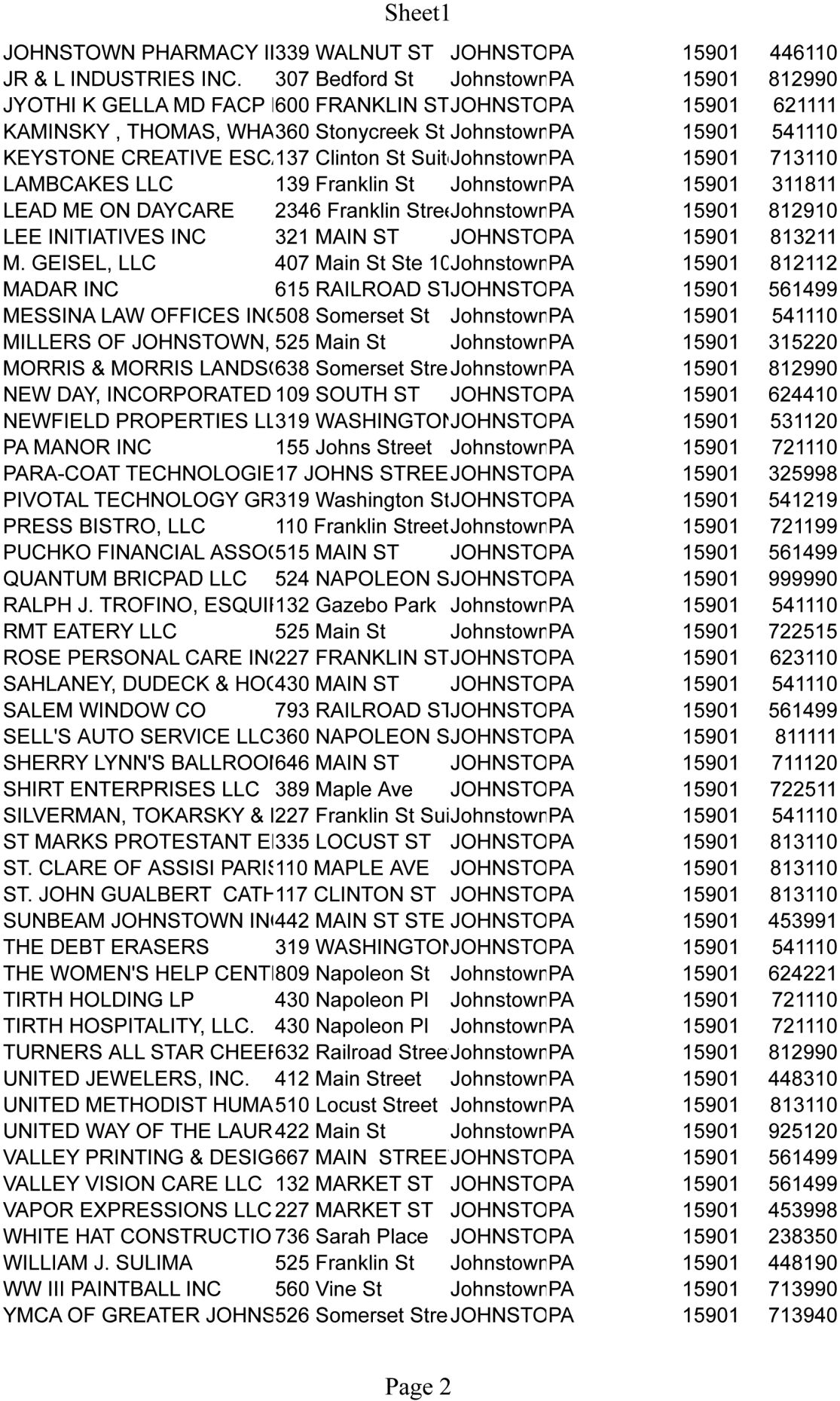

Now that we’ve covered the basics, let’s move on to the juicy part—the list of PPP loan recipients by name.

Why Does the List of PPP Loan Recipients Matter?

Transparency is key in any financial program, and the PPP loan list is no exception. Knowing who’s receiving these funds can help ensure they’re going to the right places. Here’s why this list is so important:

First off, it promotes accountability. If taxpayers are footing the bill, they deserve to know where their money’s going. Plus, it helps prevent fraud. By making the list public, we can identify any fishy business practices and hold companies accountable.

But here’s the thing—accessing this list isn’t always easy. Some information is publicly available, but digging deeper requires a bit of effort. Don’t worry, though. We’ll guide you through the process later in this article.

Understanding the Impact

The list of PPP loan recipients by name isn’t just about numbers; it’s about people. Real people with real businesses trying to survive. For some, these loans were a lifeline. For others, they were a missed opportunity.

Let’s look at the numbers. As of the latest data, over 11 million loans have been approved, totaling more than $800 billion. That’s a lot of cash flowing into the economy. But who’s getting it? And are the right businesses benefiting?

How to Access the List of PPP Loan Recipients by Name

Ready to dig in? Accessing the list of PPP loan recipients by name is easier than you might think. Here’s how you can do it:

Step 1: Head over to the Small Business Administration (SBA) website. They’ve got a treasure trove of information waiting for you.

Step 2: Look for the PPP loan data section. It’s usually updated regularly, so you’ll get the latest info.

Step 3: Download the datasets. You can filter by state, industry, and loan amount to find exactly what you’re looking for.

Step 4: Start analyzing. Use tools like Excel or Google Sheets to sort through the data and uncover some interesting insights.

Pro tip: If you’re not a data wizard, don’t sweat it. There are plenty of third-party websites that break down the information in user-friendly formats.

Tips for Navigating the Data

Got the data but not sure where to start? Here are a few tips:

- Focus on your local area to see how businesses in your community are faring.

- Compare industries to see which sectors are benefiting the most.

- Look for outliers—companies receiving unusually large or small loans.

- Keep an eye out for familiar names. You might be surprised by who’s on the list.

Remember, the goal is to gain insights, not to judge. Every business has its own unique challenges, and understanding their circumstances can provide valuable context.

Top Industries Benefiting from PPP Loans

So, which industries are raking in the PPP loan cash? Let’s take a look:

Healthcare: Hospitals, clinics, and healthcare providers have been major beneficiaries. With the pandemic putting immense pressure on the healthcare system, it’s no surprise they needed financial support.

Restaurants: The hospitality industry took a massive hit, and many restaurants turned to PPP loans to stay afloat. From mom-and-pop diners to high-end eateries, the list includes businesses of all sizes.

Retail: Brick-and-mortar stores faced tough times as consumers shifted to online shopping. PPP loans helped many retailers keep their doors open.

Construction: Projects were delayed or canceled, leaving construction companies struggling to pay their workers. PPP loans provided much-needed relief.

Surprising Entries on the List

While most recipients are legitimate businesses in need, there have been some eyebrow-raising entries. For example, some large corporations managed to secure PPP loans despite having deep pockets. This sparked outrage and led to policy changes to ensure funds were directed to smaller, more vulnerable businesses.

Then there are the celebrity-owned businesses. Yes, you read that right. A few famous faces have appeared on the list, sparking debates about whether they truly needed the financial assistance.

The Controversy Surrounding PPP Loans

No program this big can avoid controversy, and PPP loans are no exception. Here are a few of the biggest debates:

Fraud: Unfortunately, some bad actors saw PPP loans as an opportunity to exploit the system. Cases of fraud have been reported, leading to investigations and arrests.

Equity: Critics argue that the program didn’t do enough to reach minority-owned businesses. While efforts were made to address this, disparities still exist.

Loan Forgiveness: The forgiveness process has been criticized for being overly complex and burdensome. Many businesses are still waiting to find out if their loans will be forgiven.

These issues highlight the challenges of implementing such a massive financial program. While the intentions were good, execution hasn’t always been perfect.

How to Avoid Common Pitfalls

If you’re considering applying for a PPP loan, here’s how to avoid common mistakes:

- Ensure you meet all eligibility requirements before applying.

- Keep meticulous records of how you spend the loan funds.

- Stay informed about updates to the program and forgiveness rules.

- Seek professional advice if you’re unsure about any part of the process.

By taking these steps, you can increase your chances of a smooth experience and maximize the benefits of the PPP loan program.

Lessons Learned from the PPP Loan Program

As we look back on the PPP loan program, there are a few key takeaways:

Transparency Matters: Making the list of PPP loan recipients by name public has been crucial for accountability and trust.

Policy Adjustments Are Necessary: The program evolved over time to address issues like fraud and equity. This shows the importance of flexibility in large-scale initiatives.

Businesses Need Support: The demand for PPP loans underscores the financial struggles many businesses face. It’s a reminder of the importance of safety nets during tough times.

These lessons can inform future programs, ensuring they’re more effective and equitable.

What’s Next for PPP Loans?

As the economy continues to recover, the future of PPP loans remains uncertain. Will there be another round of funding? How will forgiveness be handled? These are questions that remain unanswered for now.

What we do know is that the program has left a lasting impact on the business landscape. It’s sparked conversations about financial support, transparency, and the role of government in helping businesses thrive.

Final Thoughts

So, there you have it—the lowdown on the list of PPP loan recipients by name. Whether you’re a business owner, a curious taxpayer, or just someone who loves a good financial drama, this topic has something for everyone.

Remember, the PPP loan program was created to help businesses survive. While it hasn’t been perfect, it’s made a significant difference for many. By understanding how it works and who’s benefiting, we can all play a role in ensuring accountability and fairness.

Now, it’s your turn. Dive into the data, share your insights, and let’s keep the conversation going. And if you found this article helpful, don’t forget to drop a comment or share it with your network. Together, we can make a difference.

Table of Contents

- What Exactly Are PPP Loans?

- Why Does the List of PPP Loan Recipients Matter?

- How to Access the List of PPP Loan Recipients by Name

- Top Industries Benefiting from PPP Loans

- The Controversy Surrounding PPP Loans

- Lessons Learned from the PPP Loan Program

- Final Thoughts

- Understanding the Impact

- Tips for Navigating the Data

- How to Avoid Common Pitfalls