Routing Number PNC Bank: A Beginner's Guide To Navigating Your Bank Transactions

Alright, let’s dive straight into the heart of the matter. If you’re here, chances are you’ve got questions about routing numbers for PNC Bank. Maybe you’re trying to set up a direct deposit or send some money to a buddy overseas. Either way, routing numbers are like your bank’s secret code that helps ensure your cash gets where it needs to go. So, let’s break it down for you in a way that’s easy to digest and super helpful!

Now, before we get into the nitty-gritty details, it’s important to understand why routing numbers even exist. Back in the day, when banks were just starting out, they needed a way to identify themselves in the financial world. Enter the routing number—a nine-digit code that acts like an address for your bank. For PNC Bank, this number is crucial when you’re dealing with payments, transfers, or anything else involving your account.

But hold up—there’s more to it than just knowing what a routing number is. You’ve got to know how to find it, how to use it, and why it matters for your financial transactions. That’s where this guide comes in. We’ll walk you through everything you need to know about routing numbers for PNC Bank, step by step, so you don’t have to stress about messing up your payments. Let’s do this!

What Exactly is a Routing Number for PNC Bank?

Alright, let’s get technical for a sec. A routing number for PNC Bank is essentially a unique code assigned to the bank to help identify it during transactions. Think of it as the bank’s ZIP code in the financial world. Without it, your money could end up in the wrong place, and nobody wants that.

This nine-digit code is used primarily for domestic transactions within the U.S. It’s what banks use to process checks, direct deposits, and wire transfers. And here’s the kicker—PNC Bank has different routing numbers depending on the state you’re in. So, if you’re moving or dealing with someone in a different state, you might need a different number.

Why Does PNC Bank Have Multiple Routing Numbers?

Great question! PNC Bank operates in multiple states across the U.S., and each state has its own unique routing number. This is because the Federal Reserve Bank assigns routing numbers based on geographic regions. So, if you’re in Pennsylvania, your routing number might be different from someone in Ohio or Florida.

Here’s a quick breakdown of some common PNC Bank routing numbers:

- Pennsylvania: 043000056

- Ohio: 041001039

- Florida: 067011359

Now, keep in mind that these numbers are subject to change, so always double-check with your local branch or your account statement for the most accurate information.

How to Find Your PNC Bank Routing Number

Alright, so now you know why routing numbers matter. But how do you actually find yours? Don’t worry—it’s easier than you think. Here are a few simple ways to track down your PNC Bank routing number:

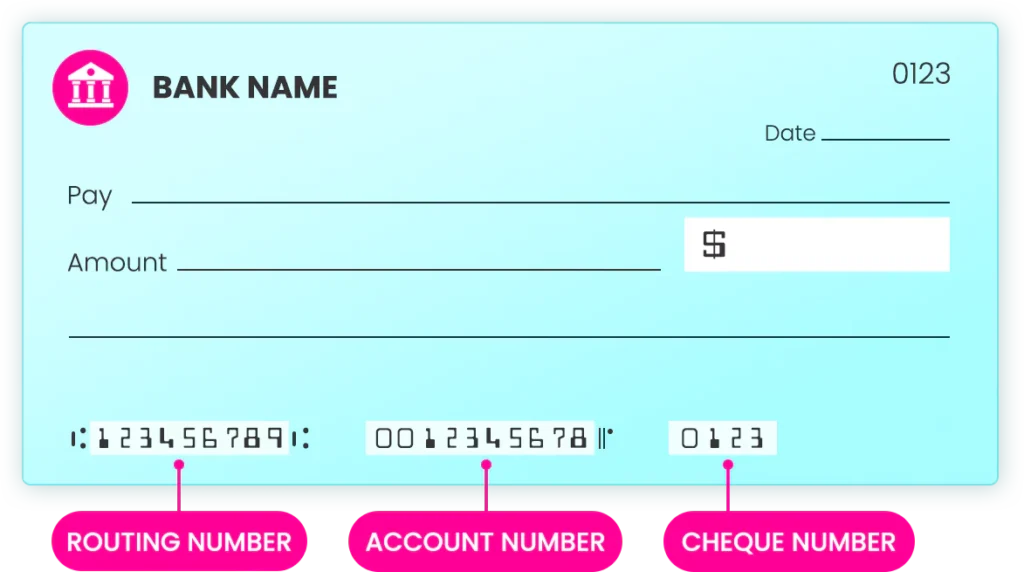

1. Check Your Checks

Yep, it’s as easy as pulling out one of those little pieces of paper from your checkbook. Look at the bottom left corner of your check. You’ll see a series of numbers. The first nine digits on the left? That’s your routing number. The next set of numbers is your account number, and the last set is your check number.

2. Log In to Your Online Banking

Prefer doing things digitally? No problem. Just log in to your PNC Bank online account and navigate to the account summary page. You should see your routing number listed there under account details. It’s usually right next to your account number.

3. Call PNC Bank Customer Service

Still can’t find it? Give PNC Bank’s customer service a ring. They can provide you with your routing number over the phone. Just make sure you have your account information handy to verify your identity.

Using Your PNC Bank Routing Number

Now that you’ve got your routing number, what do you do with it? Well, here’s where things get a little more practical. Routing numbers are used for all sorts of transactions, so let’s break down the most common ones:

Setting Up Direct Deposits

If you’re getting paid via direct deposit, you’ll need to provide your employer with your PNC Bank routing number and account number. This ensures your paycheck lands directly in your account without any hiccups.

Transferring Money Between Accounts

Whether you’re moving money between your own accounts or sending funds to a friend or family member, the routing number is key. Just make sure you’re using the right number based on your location.

Wire Transfers

For larger transactions, like buying a house or sending money overseas, you’ll need to use a wire transfer. PNC Bank has specific routing numbers for wire transfers, so be sure to confirm which one you need with your bank.

Common Questions About PNC Bank Routing Numbers

Alright, let’s address some of the most frequently asked questions about PNC Bank routing numbers. These are the things that tend to trip people up, so we’ll clear them up for you here:

1. Are Routing Numbers the Same for All PNC Bank Accounts?

Nope! As we mentioned earlier, PNC Bank has different routing numbers based on your state. So, if you’re dealing with someone in a different state, you might need a different number.

2. Can I Use My Routing Number for International Transactions?

Not exactly. For international transactions, you’ll typically need a SWIFT code instead of a routing number. PNC Bank provides SWIFT codes for these types of transfers, so be sure to check with your bank for the correct code.

3. What Happens if I Use the Wrong Routing Number?

Using the wrong routing number can cause delays or even result in your transaction being rejected. That’s why it’s so important to double-check your number before initiating any transfers or payments.

Security Tips for Your PNC Bank Routing Number

Now, let’s talk about keeping your routing number safe. While it’s not as sensitive as your account number or PIN, it’s still important to protect it. Here are a few tips to keep your financial info secure:

- Don’t share your routing number unless absolutely necessary.

- Store your checks and account statements in a safe place.

- Use strong passwords for your online banking account.

Remember, your financial security is your responsibility. Taking these precautions can help prevent any unwanted issues down the line.

Understanding the Importance of Routing Numbers

Alright, let’s zoom out for a sec and talk about why routing numbers are so important in the grand scheme of things. In today’s digital age, financial transactions happen lightning-fast. Routing numbers help ensure that all those transactions are processed accurately and efficiently.

Without routing numbers, banks would be in chaos. Imagine trying to send money to someone without knowing which bank to send it to. It’d be like trying to mail a letter without an address. Routing numbers provide that essential piece of information, keeping the financial system running smoothly.

Conclusion: Mastering Your PNC Bank Routing Number

So, there you have it—a comprehensive guide to PNC Bank routing numbers. From understanding what they are to finding and using them, you’re now equipped with all the knowledge you need to navigate your financial transactions with ease.

Remember, always double-check your routing number before initiating any transfers or payments. And if you’re ever unsure, don’t hesitate to reach out to PNC Bank’s customer service for assistance.

Now, it’s your turn. Got any questions or tips about routing numbers? Drop them in the comments below. And if you found this guide helpful, be sure to share it with your friends and family. Let’s help everyone get their finances in order!

Table of Contents

- What Exactly is a Routing Number for PNC Bank?

- Why Does PNC Bank Have Multiple Routing Numbers?

- How to Find Your PNC Bank Routing Number

- Using Your PNC Bank Routing Number

- Common Questions About PNC Bank Routing Numbers

- Security Tips for Your PNC Bank Routing Number

- Understanding the Importance of Routing Numbers

- Conclusion: Mastering Your PNC Bank Routing Number