PNC Bank ABA Routing: The Ultimate Guide You've Been Searching For

So, you've probably stumbled upon this page because you're trying to figure out the PNC Bank ABA routing number. Don't worry, you're not alone. Whether you're setting up direct deposits, sending wire transfers, or just trying to understand how banking systems work, knowing your routing number is crucial. But here's the thing: not all routing numbers are created equal, and they can vary depending on your location and the type of transaction. Let's break it down together, shall we?

Look, let's face it. Banking can be confusing, especially when you're dealing with numbers and codes that seem like they're written in a secret language. But fear not, because we're about to decode the mystery of PNC Bank ABA routing numbers. This guide is here to make sure you're not left scratching your head the next time someone asks for your routing info.

And hey, if you're anything like me, you probably want to get straight to the point. No fluff, no nonsense. That's exactly what we're doing here. So buckle up, grab a cup of coffee, and let's dive into everything you need to know about PNC Bank ABA routing numbers. You're gonna thank me later.

What Exactly is a PNC Bank ABA Routing Number?

Alright, let's start with the basics. A PNC Bank ABA routing number is essentially a nine-digit code that banks use to identify where your money is coming from or going to. Think of it like a home address for your bank account. Without it, transactions would be like sending a letter without a return address—chaos!

Now, here's the kicker: PNC Bank has different routing numbers depending on the state you're in. Yeah, I know, it sounds complicated, but trust me, it's not that bad once you get the hang of it. For example, if you're in Pennsylvania, your routing number might be different from someone in Ohio. It's all about location, location, location.

Why Does the Routing Number Matter?

Let me ask you something: have you ever tried to set up a direct deposit or send money to a friend and realized you didn't have the right routing number? Yeah, it's a nightmare. That's why knowing your PNC Bank ABA routing number is so important. It ensures that your money gets to the right place without any hiccups.

Plus, different types of transactions might require different routing numbers. For instance, a wire transfer might need a different number than an ACH transaction. See? It's not just one-size-fits-all. But don't sweat it—we'll cover all of that in just a bit.

How to Find Your PNC Bank ABA Routing Number

Alright, so you're probably wondering, "How do I find my PNC Bank ABA routing number?" Well, there are a few ways to do it, and I'm about to spill the tea on all of them.

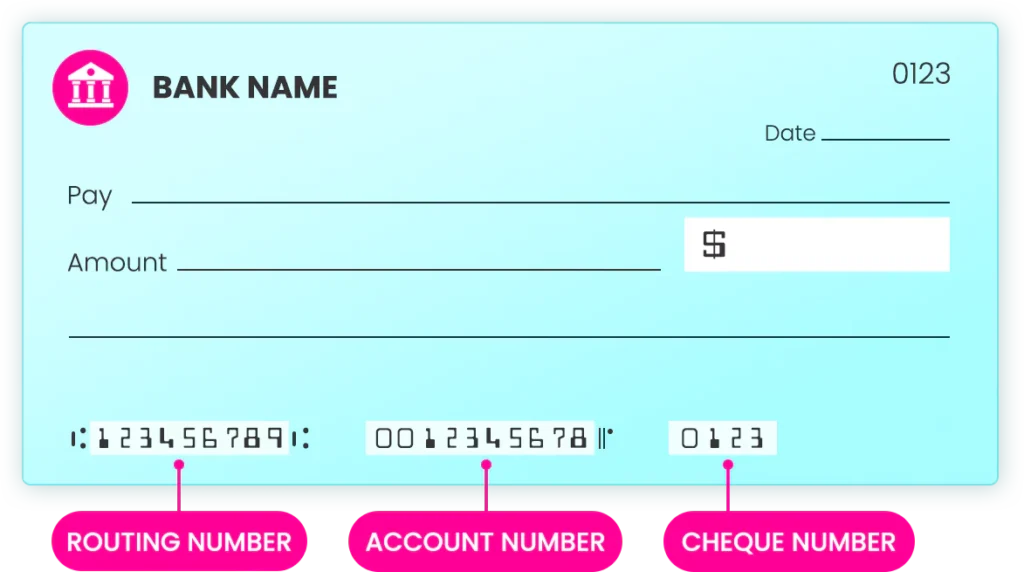

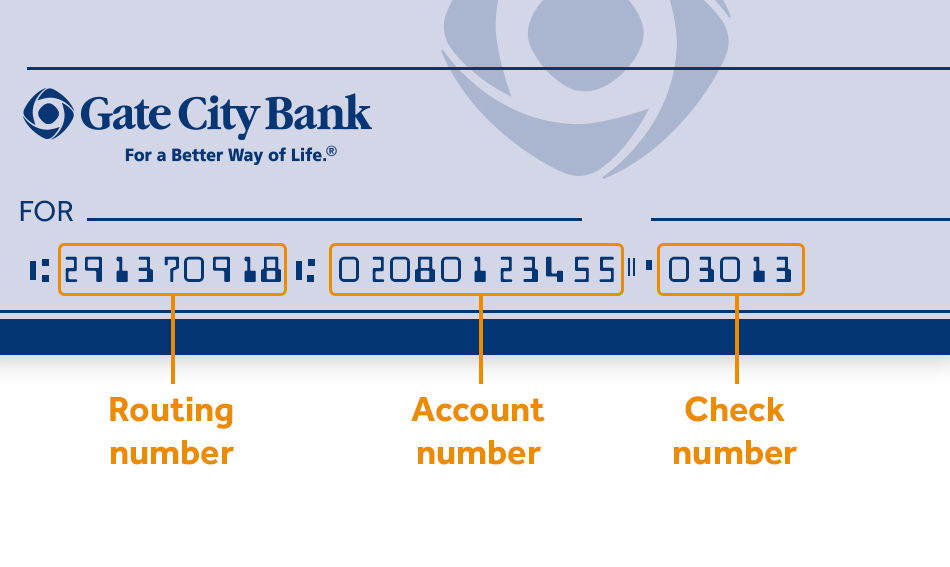

Check Your Checks

First things first: take a look at your personal checks. The routing number is the first set of numbers on the bottom left-hand corner. Boom, instant gratification. But hey, if you're like me and haven't used checks in years, don't panic. There are other ways to find it.

Log Into Your Online Banking

Another easy way to find your routing number is by logging into your PNC Bank online account. Once you're in, just head over to the account summary section, and voila! Your routing number should be right there for you to see. Pretty straightforward, right?

Call Customer Service

If all else fails, you can always give PNC Bank's customer service a ring. They're super helpful and can provide you with your routing number in no time. Just make sure you have your account info handy so they can verify your identity.

Common PNC Bank ABA Routing Numbers

Now, let's get into the nitty-gritty. Below is a list of some common PNC Bank ABA routing numbers based on different states. Keep in mind that these numbers might vary depending on your specific account type, so always double-check with your bank if you're unsure.

- Pennsylvania: 031000051

- Ohio: 041001039

- Michigan: 072000326

- Illinois: 071000505

- Florida: 063102156

See? Not so scary after all. But remember, these are just examples. Always confirm with your bank to make sure you're using the correct number.

Understanding the Difference Between ACH and Wire Transfers

Alright, let's talk about the elephant in the room: ACH vs. wire transfers. What's the difference, and why does it matter? Great question. Let me break it down for you.

ACH Transfers

ACH (Automated Clearing House) transfers are typically used for things like direct deposits, bill payments, and recurring payments. They're usually free and take a couple of business days to process. Think of them as the slow and steady option.

Wire Transfers

On the other hand, wire transfers are faster and more secure, but they often come with a fee. They're great for sending large amounts of money or when you need the funds to arrive quickly. Just keep in mind that wire transfers might require a different routing number than ACH transfers.

Tips for Using PNC Bank ABA Routing Numbers

Now that you know what a PNC Bank ABA routing number is and how to find it, let's talk about some tips to make sure you're using it correctly.

- Double-check the number: Typos happen, but when it comes to routing numbers, even one wrong digit can cause major problems. Always double-check the number before submitting it.

- Verify the transaction type: Make sure you're using the right routing number for the type of transaction you're making. ACH and wire transfers might require different numbers.

- Keep it secure: Your routing number is sensitive information, so don't just throw it around like it's no big deal. Treat it like the valuable asset it is.

Common Mistakes to Avoid

Let's face it, we've all made mistakes when it comes to banking. But here are a few common ones to avoid when dealing with PNC Bank ABA routing numbers:

- Using the wrong number: Like I said before, different states and transaction types might require different routing numbers. Using the wrong one can cause delays or even rejected transactions.

- Not verifying the number: Always confirm the routing number with your bank before using it. You don't want to find out later that you've been using the wrong one.

- Sharing it carelessly: Your routing number is private information. Don't just hand it out to anyone who asks for it. Make sure you're dealing with a trusted source.

Why Trust PNC Bank for Your Financial Needs?

Alright, let's talk about why PNC Bank is a solid choice for your banking needs. First off, they've been around since 1852, so they know a thing or two about banking. They offer a wide range of services, from personal banking to commercial banking, and they're always innovating to keep up with the times.

Plus, PNC Bank is known for its excellent customer service. Whether you're calling them, chatting online, or visiting a branch, you can expect to be treated with respect and professionalism. And let's not forget about their security measures. Your money is in good hands with PNC Bank.

Final Thoughts

So there you have it, folks. Everything you need to know about PNC Bank ABA routing numbers. From finding your routing number to understanding the difference between ACH and wire transfers, we've covered it all.

Remember, banking doesn't have to be complicated. With the right information and a little bit of know-how, you can navigate the world of banking with ease. And if you ever have questions or need help, don't hesitate to reach out to PNC Bank's customer service team. They're there to help you every step of the way.

Now, here's your call to action: if you found this guide helpful, drop a comment below and let me know. Or better yet, share it with a friend who might find it useful. And if you're looking for more banking tips and tricks, be sure to check out our other articles. You won't regret it, promise.

Table of Contents

- PNC Bank ABA Routing: The Ultimate Guide You've Been Searching For

- What Exactly is a PNC Bank ABA Routing Number?

- Why Does the Routing Number Matter?

- How to Find Your PNC Bank ABA Routing Number

- Check Your Checks

- Log Into Your Online Banking

- Call Customer Service

- Common PNC Bank ABA Routing Numbers

- Understanding the Difference Between ACH and Wire Transfers

- Tips for Using PNC Bank ABA Routing Numbers

- Common Mistakes to Avoid

- Why Trust PNC Bank for Your Financial Needs?

- Final Thoughts