Mastering Trading IQ: Unlocking The Secrets To Profitable Trading

So here’s the deal, folks—trading IQ is not just about intelligence or numbers on a screen. It’s about mastering strategies, understanding market behavior, and most importantly, knowing yourself. If you're diving into the world of trading, you better have your wits about you because it's a game where the smartest players win. And guess what? Your trading IQ can make all the difference. Let me break it down for you, because trust me, this isn’t something you want to skip.

Now, before we jump into the nitty-gritty of trading IQ, let’s talk about why it matters. In today’s fast-paced financial world, trading isn’t just about buying and selling stocks or currencies. It’s about staying ahead of the curve, analyzing trends, and making decisions that could either make or break your financial future. Trading IQ isn’t just about knowing the rules—it’s about knowing how to play the game better than everyone else. And that’s exactly what we’re going to cover here.

Whether you're a beginner looking to dip your toes into the trading waters or a seasoned trader seeking to refine your skills, this guide is your golden ticket. We’ll explore everything from the basics of trading IQ to advanced strategies that could skyrocket your success. So, buckle up, because we’re about to take you on a journey that could change the way you think about trading forever.

What Exactly Is Trading IQ?

Alright, let’s get down to business. Trading IQ refers to the combination of knowledge, skills, and intuition that traders use to navigate the financial markets. It’s not just about being smart; it’s about being smart in the right way. Think of it like this: trading IQ is the secret sauce that separates successful traders from those who end up losing their shirts. It’s about understanding the markets, reading trends, and making informed decisions.

Here’s a fun fact: trading IQ isn’t something you’re born with—it’s something you develop over time. It’s like building a muscle. The more you practice, the stronger it gets. And trust me, in the world of trading, having a strong trading IQ is like having a superpower. It allows you to see opportunities that others might miss and avoid pitfalls that could cost you big time.

Why Does Trading IQ Matter?

Let’s face it—trading is risky business. Without the right tools and mindset, you’re basically rolling the dice every time you make a trade. But here’s the thing: trading IQ helps you stack the odds in your favor. It gives you the confidence to make decisions based on data, not emotions. And let’s be real, emotions can be a trader’s worst enemy.

Here’s a quick rundown of why trading IQ matters:

- It helps you identify profitable opportunities.

- It reduces the risk of making costly mistakes.

- It improves your decision-making skills.

- It builds your confidence as a trader.

Building Your Trading IQ: Where to Start

So, you’re ready to boost your trading IQ. Great! But where do you even start? The good news is, there are plenty of resources out there to help you get started. From online courses to books and even mentorship programs, the options are endless. But before you dive in, there are a few key things you need to focus on.

Understanding the Basics

Before you can master trading IQ, you need to understand the basics. This means learning about different types of trades, market trends, and financial instruments. Think of it like learning the rules of a game before you start playing. Without a solid foundation, you’re setting yourself up for failure.

Here are some key concepts to focus on:

- Stocks vs. Options

- Forex Trading

- Cryptocurrencies

- Technical Analysis

Developing a Trading Strategy

Now that you’ve got the basics down, it’s time to develop a trading strategy. A good trading strategy is like a roadmap—it guides you through the market and helps you make informed decisions. But here’s the catch: not all strategies are created equal. What works for one trader might not work for another. That’s why it’s important to find a strategy that aligns with your goals and risk tolerance.

Key Components of a Trading Strategy

Here are some key components to consider when developing your trading strategy:

- Risk Management

- Entry and Exit Points

- Position Sizing

- Market Timing

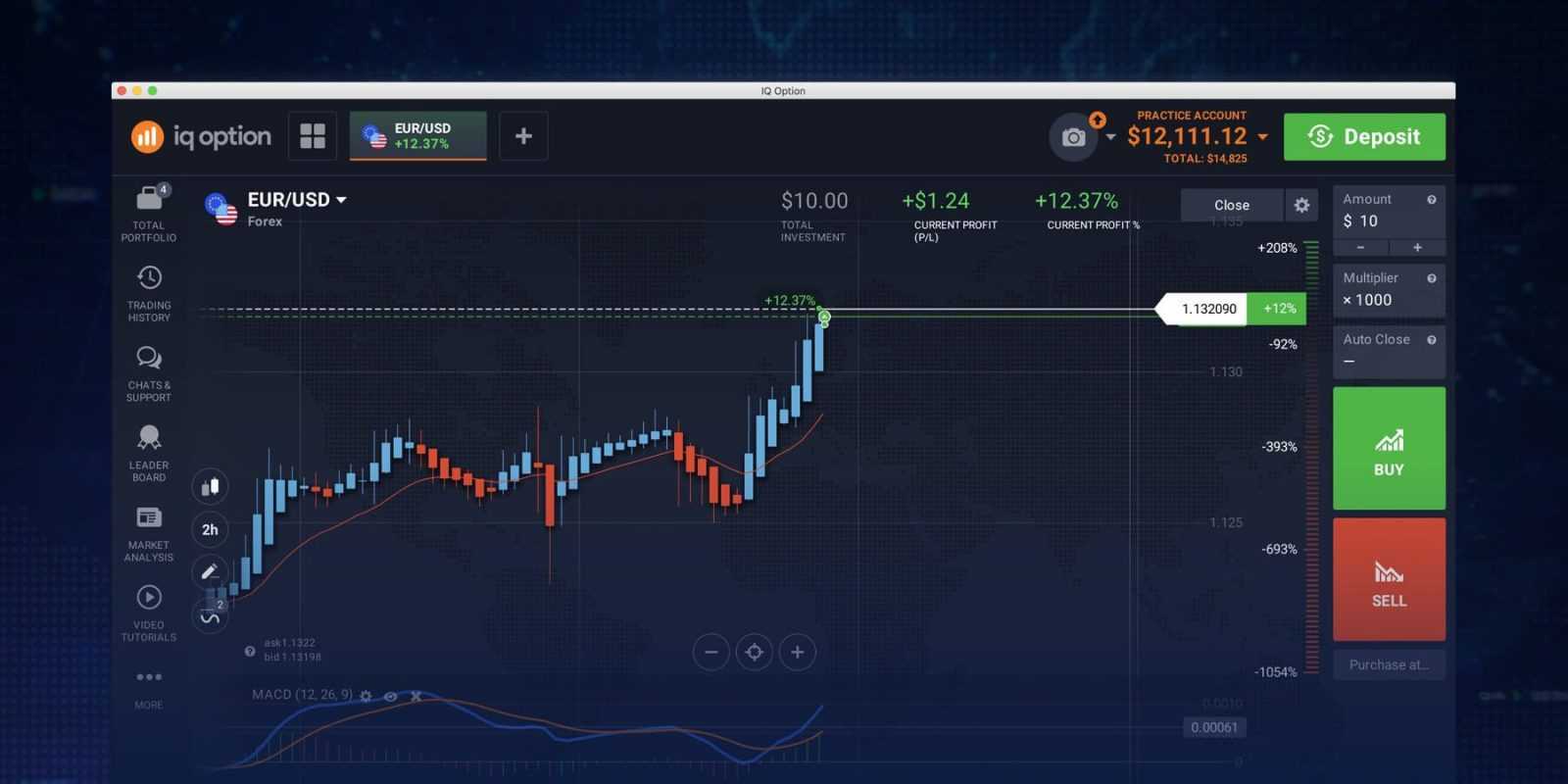

Mastering Technical Analysis

Technical analysis is one of the cornerstones of trading IQ. It involves using charts and indicators to predict future price movements. Sounds complicated, right? Well, it can be, but with the right tools and knowledge, anyone can learn to master it. Think of technical analysis as your crystal ball—it helps you see what’s coming next in the market.

Tools for Technical Analysis

Here are some tools you can use for technical analysis:

- Candlestick Charts

- Moving Averages

- Relative Strength Index (RSI)

- Bollinger Bands

Managing Risk in Trading

Risk management is one of the most important aspects of trading IQ. Without it, even the best trading strategies can fail. The key is to protect your capital while maximizing your profits. It’s like wearing a helmet while riding a bike—you never know when you’ll need it, but you’re sure glad you have it when you do.

Best Practices for Risk Management

Here are some best practices for managing risk in trading:

- Set Stop-Loss Orders

- Use Position Sizing

- Limit Leverage

- Stay Informed

Staying Informed: The Key to Success

In the world of trading, knowledge is power. Staying informed about market trends, economic indicators, and geopolitical events is crucial for success. It’s like having a weather forecast for the financial markets. The more you know, the better equipped you are to make informed decisions.

Sources for Staying Informed

Here are some sources you can use to stay informed:

- Financial News Websites

- Economic Calendars

- Market Analysis Reports

- Social Media

Building Confidence as a Trader

Confidence is a key component of trading IQ. Without it, you’re likely to second-guess yourself and make poor decisions. But here’s the thing: confidence doesn’t come overnight. It’s something you build over time through experience and success. And trust me, there’s nothing quite like the feeling of making a profitable trade.

Tips for Building Confidence

Here are some tips for building confidence as a trader:

- Start Small

- Practice with a Demo Account

- Learn from Your Mistakes

- Stay Consistent

Common Mistakes to Avoid

Even the best traders make mistakes. The key is to learn from them and avoid repeating them. Some common mistakes include overtrading, not sticking to a strategy, and letting emotions cloud your judgment. By avoiding these pitfalls, you can increase your chances of success.

How to Avoid Common Mistakes

Here are some ways to avoid common trading mistakes:

- Create a Trading Plan

- Stick to Your Strategy

- Manage Your Emotions

- Review Your Performance

Staying Ahead of the Curve

In the world of trading, staying ahead of the curve is crucial. Markets are constantly evolving, and so should your trading IQ. This means staying informed about new technologies, trends, and strategies. It’s like upgrading your software—regular updates keep you running smoothly.

Ways to Stay Ahead of the Curve

Here are some ways to stay ahead of the curve:

- Follow Industry Leaders

- Attend Conferences and Workshops

- Join Trading Communities

- Experiment with New Strategies

Conclusion: Elevate Your Trading IQ

So there you have it, folks—a comprehensive guide to mastering trading IQ. Whether you’re just starting out or looking to refine your skills, remember that trading IQ is all about knowledge, strategy, and confidence. By focusing on these key areas, you can increase your chances of success and achieve your financial goals.

Now, here’s the thing: knowledge is only half the battle. The other half is taking action. So, what are you waiting for? Start applying what you’ve learned and watch your trading IQ soar. And don’t forget to share your thoughts and experiences in the comments below. Who knows? You might just inspire someone else to take the leap into the world of trading.

Table of Contents:

- What Exactly Is Trading IQ?

- Why Does Trading IQ Matter?

- Building Your Trading IQ: Where to Start

- Understanding the Basics

- Developing a Trading Strategy

- Mastering Technical Analysis

- Managing Risk in Trading

- Staying Informed: The Key to Success

- Building Confidence as a Trader

- Common Mistakes to Avoid

- Staying Ahead of the Curve