Stock Trading Lessons For Beginners: Your Ultimate Guide To Navigating The Market

So, you've decided to dip your toes into the world of stock trading, huh? Welcome to the wild ride that is Wall Street—well, maybe not that wild, but still pretty exciting. Stock trading lessons for beginners are crucial if you want to avoid losing your shirt in the market. Whether you're looking to make some quick cash or build long-term wealth, this guide will help you navigate the basics and set you up for success.

Stock trading might sound intimidating at first, but trust me, it's not rocket science. Sure, there's a lot to learn, but with the right mindset and tools, you'll be trading like a pro in no time. The key is to start small, stay informed, and most importantly, don't let emotions dictate your decisions.

Now, before we dive into the nitty-gritty of stock trading lessons for beginners, let's talk about why this journey is worth it. Imagine being able to grow your money while you sleep or even retire early. Sounds too good to be true? It's not. With the right strategies and knowledge, you can make your financial dreams a reality. So, buckle up, because we're about to take you on a journey through the world of stocks!

Understanding the Basics of Stock Trading

Let's start with the basics, shall we? Stock trading is essentially buying and selling shares of publicly traded companies. When you buy a stock, you're essentially buying a tiny piece of that company. Cool, right? But here's the thing—stock trading isn't just about picking stocks randomly and hoping for the best. There's a lot more to it.

What Exactly is a Stock?

A stock represents ownership in a company. When you buy a stock, you become a shareholder, which means you have a claim on a portion of the company's assets and earnings. Simple enough, right? But here's where it gets interesting—stocks can go up or down in value based on a variety of factors, including the company's performance, market conditions, and even global events.

For example, if a company reports strong earnings, its stock price might go up. On the flip side, if there's a scandal or the company performs poorly, the stock price could plummet. That's why it's important to do your research and understand what you're getting into.

Key Terms to Know

Before you start trading, there are a few key terms you should familiarize yourself with:

- Stock Exchange: A marketplace where stocks are bought and sold. The most famous ones are the New York Stock Exchange (NYSE) and NASDAQ.

- Broker: A person or platform that facilitates the buying and selling of stocks. You'll need a brokerage account to trade stocks.

- Bid and Ask: The bid is the highest price a buyer is willing to pay for a stock, while the ask is the lowest price a seller is willing to accept.

- Dividends: Payments made by a company to its shareholders, usually as a reward for owning the stock.

These terms might seem overwhelming at first, but once you get the hang of them, they'll become second nature.

Why Stock Trading Lessons for Beginners Are Essential

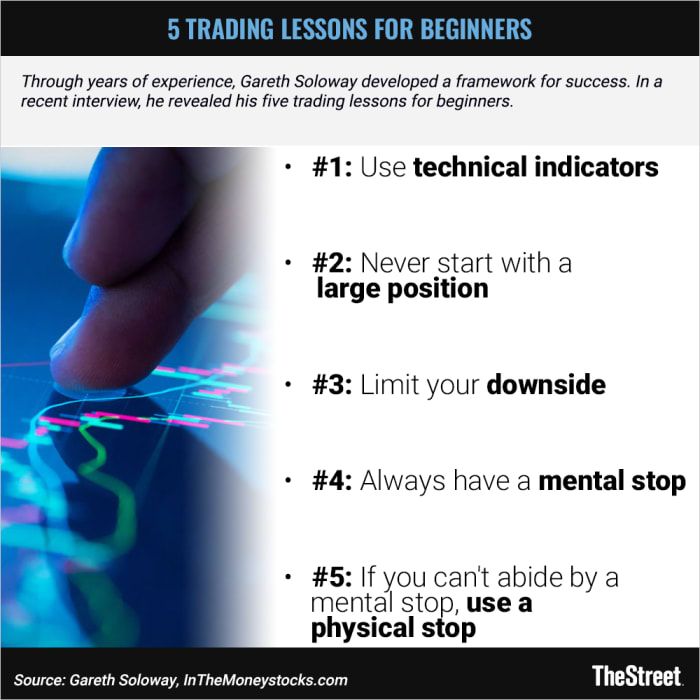

Now that you know the basics, let's talk about why stock trading lessons for beginners are so important. Think of it this way—if you were learning to drive, would you just jump into the car and start speeding down the highway? Probably not. You'd take driving lessons, practice in a safe environment, and gradually build up your skills. The same applies to stock trading.

Here are a few reasons why these lessons are crucial:

- They help you understand the risks involved in trading.

- They teach you how to read market trends and make informed decisions.

- They give you the confidence to start trading without feeling overwhelmed.

By taking the time to learn the ropes, you'll be better equipped to handle the ups and downs of the market.

Setting Up Your Brokerage Account

One of the first steps in your stock trading journey is setting up a brokerage account. Think of this as your gateway to the stock market. There are plenty of brokers out there, so how do you choose the right one? Here are a few things to consider:

- Fees: Some brokers charge commissions for each trade, while others offer commission-free trading. Make sure to check the fee structure before signing up.

- Platform Features: Look for a platform that's user-friendly and offers the tools you need, like charting software and research reports.

- Customer Support: You want a broker that offers reliable customer support in case you run into any issues.

Once you've chosen a broker, the account setup process is usually pretty straightforward. You'll need to provide some personal information, like your Social Security number, and link a bank account for funding.

Developing a Trading Strategy

Now that you have a brokerage account, it's time to develop a trading strategy. A strategy is basically a plan that outlines how you'll approach the market. It helps you stay disciplined and avoid making impulsive decisions.

Types of Trading Strategies

There are several types of trading strategies, each with its own pros and cons. Here are a few popular ones:

- Day Trading: Buying and selling stocks within the same day. This strategy requires a lot of time and attention, but it can be lucrative if done correctly.

- Swing Trading: Holding stocks for a few days to a few weeks, aiming to profit from short-term price swings.

- Position Trading: Holding stocks for longer periods, usually months or even years, focusing on long-term trends.

Which strategy you choose depends on your goals, risk tolerance, and the amount of time you can dedicate to trading.

Creating Your Own Strategy

While it's helpful to learn about different strategies, it's also important to create one that works for you. Start by identifying your goals—do you want to make quick profits or build long-term wealth? Then, determine your risk tolerance—how much are you willing to lose? Finally, decide how much time you can dedicate to trading.

Remember, your strategy doesn't have to be perfect right away. It's okay to tweak it as you gain more experience.

Learning to Read the Market

Reading the market is one of the most important stock trading lessons for beginners. It involves analyzing data, trends, and news to make informed decisions. Here are a few tools and techniques to help you get started:

Technical Analysis

Technical analysis involves studying historical price movements and patterns to predict future trends. Traders use charts and indicators to identify potential buy and sell signals. Some popular indicators include:

- Moving Averages: Smooth out price data to show trends more clearly.

- Relative Strength Index (RSI): Measures the speed and change of price movements to identify overbought or oversold conditions.

- Bollinger Bands: Show price volatility and potential breakout points.

While technical analysis can be powerful, it's not foolproof. Always combine it with other forms of analysis for a more complete picture.

Fundamental Analysis

Fundamental analysis involves evaluating a company's financial health and overall value. This includes looking at factors like earnings, revenue, debt, and industry trends. Some key metrics to consider:

- Earnings Per Share (EPS): Measures a company's profitability.

- Price-to-Earnings (P/E) Ratio: Compares a stock's price to its earnings.

- Debt-to-Equity Ratio: Shows how much debt a company has relative to its equity.

Fundamental analysis is especially useful for long-term investors who want to find undervalued stocks.

Risk Management in Stock Trading

Let's face it—trading stocks comes with risks. But the good news is, you can manage those risks with the right strategies. Here are a few tips to help you protect your portfolio:

- Set Stop-Loss Orders: Automatically sell a stock if it drops below a certain price, limiting your losses.

- Diversify Your Portfolio: Don't put all your eggs in one basket. Spread your investments across different stocks, sectors, and asset classes.

- Stick to Your Plan: Don't let emotions cloud your judgment. Stick to your trading strategy, even when the market gets volatile.

Risk management is all about balancing potential rewards with potential losses. By taking a disciplined approach, you can minimize your risks and increase your chances of success.

Common Mistakes to Avoid

Even the best traders make mistakes from time to time. The key is to learn from them and avoid repeating them. Here are a few common mistakes beginners often make:

- Overtrading: Trading too frequently can lead to high fees and emotional decision-making.

- Chasing Stocks: Buying a stock just because it's going up can be risky if you don't understand the underlying fundamentals.

- Ignoring Stop-Loss Orders: Letting your emotions override your risk management strategy can result in bigger losses.

By being aware of these pitfalls, you'll be better equipped to avoid them and stay on track.

Resources for Further Learning

Now that you've learned the basics, it's time to dive deeper into the world of stock trading. Here are a few resources to help you continue your education:

- Online Courses: Platforms like Coursera and Udemy offer courses on stock trading for beginners.

- Books: "The Intelligent Investor" by Benjamin Graham and "A Random Walk Down Wall Street" by Burton Malkiel are great reads for aspiring traders.

- Podcasts: Listen to podcasts like "The Investors Podcast" or "The Motley Fool" for insights and analysis.

Remember, learning is a lifelong process. The more you know, the better equipped you'll be to navigate the stock market.

Conclusion: Taking the Next Step

Stock trading lessons for beginners are just the starting point on your journey to financial independence. By understanding the basics, setting up a brokerage account, developing a strategy, and managing risks, you'll be well on your way to becoming a successful trader.

But here's the thing—trading isn't a get-rich-quick scheme. It takes time, patience, and discipline to succeed. So, don't rush the process. Take it one step at a time, and before you know it, you'll be trading like a pro.

Now, it's your turn. Are you ready to take the next step in your trading journey? Leave a comment below and let me know what you've learned from this guide. And don't forget to share it with your friends who might find it helpful. Until next time, happy trading!

Table of Contents

- Understanding the Basics of Stock Trading

- Key Terms to Know

- Why Stock Trading Lessons for Beginners Are Essential

- Setting Up Your Brokerage Account

- Developing a Trading Strategy

- Types of Trading Strategies

- Learning to Read the Market

- Technical Analysis

- Fundamental Analysis

- Risk Management in Stock Trading

- Common Mistakes to Avoid

- Resources for Further Learning

- Conclusion: Taking the Next Step