Understanding The Difference Between Shareholder And Stakeholder: A Comprehensive Guide

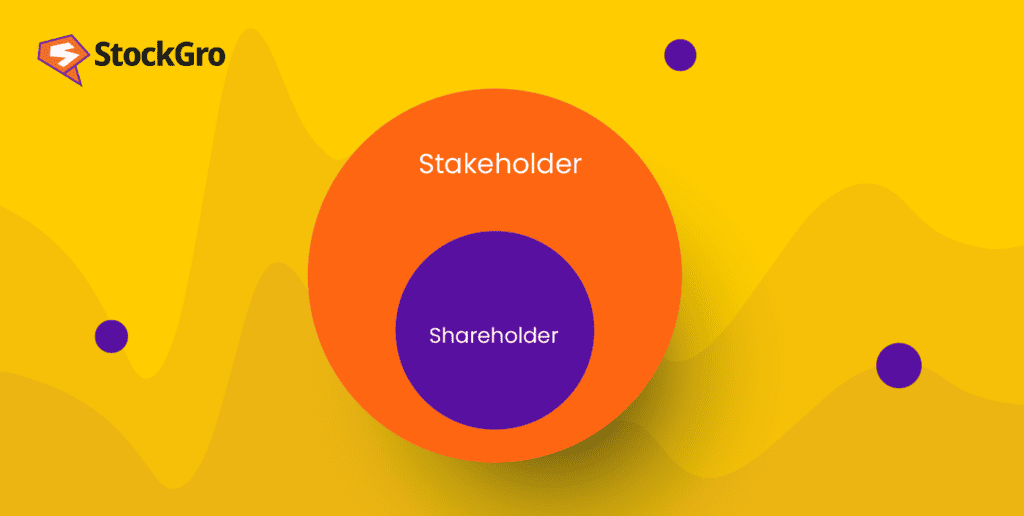

When you dive into the world of business and corporate governance, two terms that often pop up are "shareholder" and "stakeholder." But what exactly is the difference between shareholder and stakeholder? Well, let's break it down in a way that even your grandma could understand. Both terms refer to individuals or groups who have an interest in a company's performance, but their roles and motivations differ significantly. So, if you've ever scratched your head wondering about this distinction, you're in the right place.

Let's face it, the business world can sometimes feel like a maze filled with jargon and complicated terms. But don't worry, because today we're going to simplify things for you. Understanding the difference between shareholder and stakeholder is crucial if you want to navigate the corporate landscape effectively. Whether you're an entrepreneur, investor, or just someone curious about how businesses operate, this knowledge can make a big difference.

Imagine a company as a big ship sailing through the ocean of commerce. Shareholders are like the investors who bought tickets on the ship, hoping to make a profit from the journey. Stakeholders, on the other hand, are all the people affected by the ship's voyage—crew members, passengers, the port authorities, and even the environment. Now that you have a basic idea, let's dive deeper into the specifics.

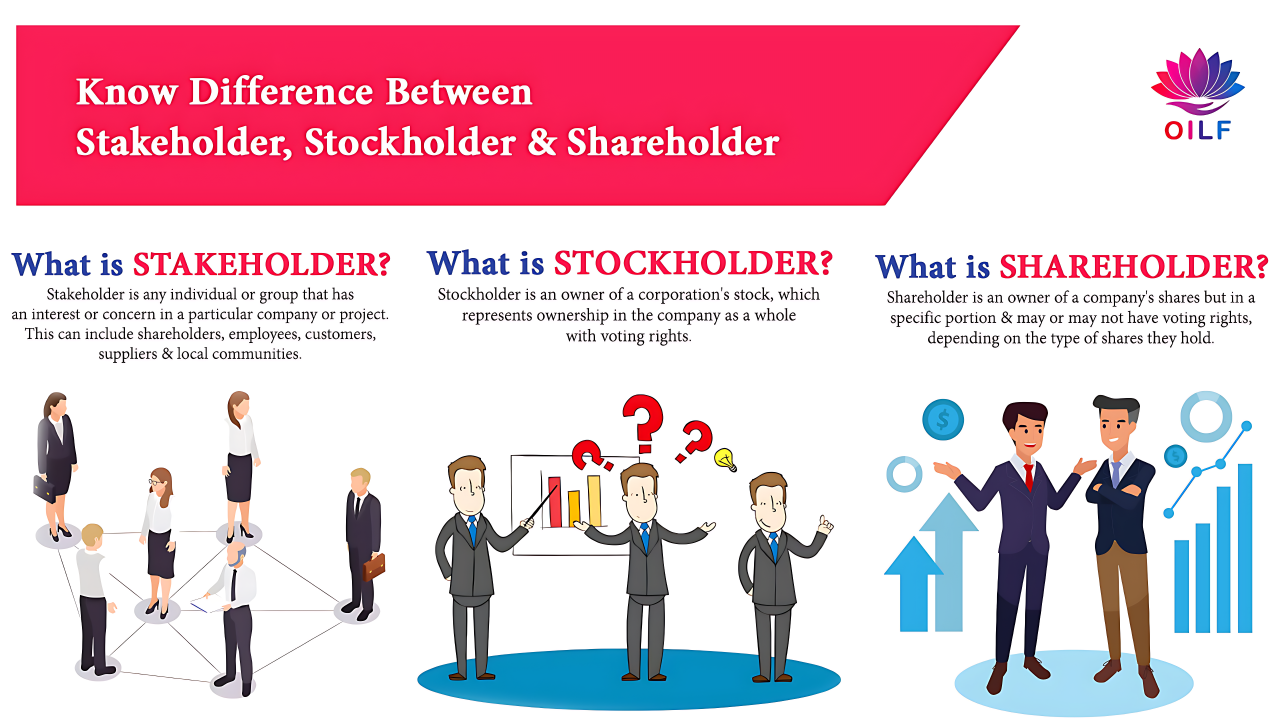

What Exactly Is a Shareholder?

A shareholder is essentially an individual or entity that owns shares in a company. They've put their money into the business, and in return, they receive a portion of the company's profits, usually in the form of dividends. Think of shareholders as the financial backbone of a company. Their primary interest lies in maximizing their return on investment. They attend annual meetings, vote on major decisions, and keep a close eye on the company's performance.

Here are some key points about shareholders:

- They own equity in the company.

- Their main goal is to increase wealth through stock appreciation and dividends.

- They have voting rights and can influence corporate decisions.

- Shareholders bear the financial risk if the company performs poorly.

For example, if you own 100 shares of a tech company and its stock price skyrockets, you're probably celebrating like it's New Year's Eve. But if the company tanks, well, that's when the stress kicks in. Shareholders are in it for the financial gain, plain and simple.

Defining Stakeholders: Who Are They?

Now let's shift gears and talk about stakeholders. Stakeholders are a much broader group that includes anyone who has an interest in or is affected by the company's actions. This could range from employees and suppliers to customers, communities, and even the environment. Stakeholders don't necessarily own a financial stake in the company, but their well-being is tied to its success or failure.

Here's a quick breakdown of who stakeholders might include:

- Employees who rely on the company for their livelihood.

- Customers who depend on the company's products or services.

- Suppliers who provide essential materials for the business.

- Local communities that are impacted by the company's operations.

Think about it this way: a manufacturing plant might provide jobs to hundreds of people, but it could also pollute the local river. The employees benefit from the jobs, but the community suffers from the environmental impact. That's why stakeholders often have competing interests that need to be balanced.

Key Differences Between Shareholders and Stakeholders

Now that we've defined both terms, let's highlight the key differences between shareholder and stakeholder. This is where the rubber meets the road, folks. While both groups are important to a company's success, their priorities and roles are quite distinct.

Financial vs. Non-Financial Interests: Shareholders are primarily concerned with financial returns, while stakeholders care about a wide range of factors, including social responsibility and sustainability.

Ownership vs. Influence: Shareholders own a piece of the company, whereas stakeholders influence the company through their relationships and interactions.

Risk vs. Impact: Shareholders bear the financial risk of investment, while stakeholders experience the broader impact of the company's actions, whether positive or negative.

The Role of Shareholders in Corporate Governance

Shareholders play a critical role in corporate governance. They're the ones who elect the board of directors, approve major decisions, and hold management accountable. Without shareholders, companies wouldn't have the capital they need to grow and thrive. But let's be real, shareholders aren't just sitting around waiting for their checks to arrive. They're actively involved in shaping the company's direction.

Here are some of the ways shareholders influence corporate governance:

- Voting on key issues like mergers and acquisitions.

- Participating in shareholder meetings to voice concerns.

- Filing shareholder resolutions to push for specific changes.

For instance, if a group of shareholders believes a company isn't doing enough to address climate change, they might file a resolution demanding more sustainable practices. This shows that shareholders aren't just passive investors—they can be powerful agents of change.

How Stakeholders Impact Business Success

Stakeholders, on the other hand, impact business success in ways that go beyond financial performance. A company that neglects its stakeholders is like a ship sailing without a rudder. Sure, it might make some progress, but it's likely to crash and burn eventually. That's why smart companies prioritize stakeholder engagement and work to balance competing interests.

Here are a few examples of how stakeholders influence business success:

- Employees who feel valued and supported are more productive and loyal.

- Customers who trust a company are more likely to remain loyal and recommend its products.

- Communities that benefit from a company's presence are less likely to resist its operations.

In today's world, where corporate social responsibility is more important than ever, companies can't afford to ignore their stakeholders. It's not just about doing the right thing—it's about ensuring long-term sustainability and profitability.

Why the Difference Between Shareholder and Stakeholder Matters

You might be wondering why this distinction between shareholder and stakeholder even matters. Well, here's the deal: understanding the difference helps companies make better decisions. By recognizing the unique needs and interests of both groups, businesses can create strategies that benefit everyone involved. It's like cooking a perfect stew—you need the right ingredients in the right proportions to make it taste great.

For example, a company that focuses solely on maximizing shareholder value might cut costs by outsourcing jobs, which could harm local communities and employees. On the other hand, a company that prioritizes stakeholder well-being might invest in sustainable practices, even if it means lower short-term profits. Both approaches have their pros and cons, but the key is finding the right balance.

Shareholder Theory vs. Stakeholder Theory

Now let's dive into the big debate: shareholder theory vs. stakeholder theory. These two frameworks represent different approaches to corporate governance and decision-making. Shareholder theory, championed by economists like Milton Friedman, argues that a company's primary responsibility is to maximize shareholder value. Stakeholder theory, on the other hand, suggests that companies should consider the needs and interests of all stakeholders in their decision-making process.

Here's a quick comparison:

- Shareholder Theory: Focuses on financial returns and treats shareholders as the primary beneficiaries of a company's success.

- Stakeholder Theory: Emphasizes the importance of balancing the interests of all stakeholders, including employees, customers, and the community.

Which approach is better? That's a question that has sparked heated debates among academics, business leaders, and policymakers. Some argue that focusing on shareholders leads to short-term thinking and neglects long-term sustainability. Others believe that prioritizing stakeholders can dilute a company's focus and lead to inefficiencies. Ultimately, the answer depends on the company's goals and values.

Case Studies: Real-World Examples

To make things more concrete, let's look at a couple of real-world examples that illustrate the difference between shareholder and stakeholder. These case studies will help you see how companies navigate the complex landscape of corporate governance.

Example 1: Tesla's Focus on Stakeholders

Tesla, the electric car giant, is often cited as a company that prioritizes stakeholders over shareholders. While its stock price has soared in recent years, Tesla's leadership has consistently emphasized its mission to accelerate the world's transition to sustainable energy. This means investing heavily in research and development, even if it means lower profits in the short term. Tesla's success shows that focusing on stakeholders can pay off in the long run.

Example 2: Enron's Focus on Shareholders

On the flip side, we have Enron, a company that became infamous for its focus on maximizing shareholder value at all costs. Enron's leadership engaged in fraudulent accounting practices to inflate its stock price, ultimately leading to its collapse. This cautionary tale serves as a reminder that prioritizing shareholders above all else can lead to disaster if ethical considerations are ignored.

How to Balance Shareholder and Stakeholder Interests

So, how can companies strike the right balance between shareholder and stakeholder interests? It's not always easy, but there are strategies that can help. First and foremost, companies need to adopt a long-term perspective that considers the needs of all stakeholders. This might involve setting up advisory boards, conducting stakeholder surveys, or implementing sustainability initiatives.

Here are some practical tips for balancing interests:

- Communicate openly and transparently with both shareholders and stakeholders.

- Set clear goals that align with the company's mission and values.

- Measure and report on both financial and non-financial performance metrics.

Ultimately, the key is to create a culture of trust and collaboration that benefits everyone involved. Companies that succeed in this regard are more likely to thrive in the long term.

Legal and Ethical Considerations

When it comes to the difference between shareholder and stakeholder, legal and ethical considerations play a crucial role. In many jurisdictions, companies are legally required to prioritize shareholder interests, but that doesn't mean they can ignore stakeholders entirely. Ethical leadership demands a commitment to fairness, transparency, and accountability.

Here are some important points to keep in mind:

- Companies must comply with laws and regulations that protect the rights of both shareholders and stakeholders.

- Corporate social responsibility initiatives can help build trust and goodwill with stakeholders.

- Leadership should be guided by ethical principles, even when faced with difficult decisions.

By balancing legal obligations with ethical considerations, companies can create a framework for sustainable success.

Conclusion: The Final Word on Shareholder vs. Stakeholder

Well, there you have it—a comprehensive look at the difference between shareholder and stakeholder. Whether you're an investor, entrepreneur, or just someone curious about how businesses work, understanding this distinction is crucial. Shareholders and stakeholders both play important roles in a company's success, but their priorities and motivations differ significantly.

As you've seen, the debate between shareholder theory and stakeholder theory is far from settled. Some companies choose to focus on maximizing shareholder value, while others prioritize the needs of all stakeholders. The key is finding the right balance that aligns with your company's goals and values.

So, what's the takeaway? If you're looking to make informed decisions in the business world, don't just focus on the bottom line. Take the time to consider the broader impact of your actions on all stakeholders. And remember, the most successful companies are those that create value for everyone involved.

Now, it's your turn! If you found this article helpful, feel free to leave a comment or share it with your friends. And if you're hungry for more knowledge, be sure to check out our other articles on business and finance. Until next time, stay sharp and keep learning!

Table of Contents

- What Exactly Is a Shareholder?

- Defining Stakeholders: Who Are They?

- Key Differences Between Shareholders and Stakeholders

- The Role of Shareholders in Corporate Governance

- How Stakeholders Impact Business Success

- Why the Difference Between Shareholder and Stakeholder Matters

- Shareholder Theory vs. Stakeholder Theory

- Case Studies: Real-World Examples

- How to Balance Shareholder and Stakeholder Interests