Harshad Mehta Died: The Untold Story Of India's Infamous Stock Market Scandal

When you hear the name Harshad Mehta, it immediately brings up memories of one of India's darkest financial scandals. The man who once ruled the Bombay Stock Exchange became a symbol of greed and corruption. But beyond the headlines, there's a deeper story that needs to be told. This is not just about a man who fell from grace but a cautionary tale of how ambition can lead to destruction.

Harshad Mehta's story is like a Hollywood drama, filled with twists and turns that left the Indian financial market reeling. His rise was meteoric, and his fall was just as dramatic. As we dive into this story, we’ll explore the man behind the headlines and the impact his actions had on the financial world.

Today, we’re not just recounting his death but also understanding the legacy he left behind. Harshad Mehta didn't just die; he left a mark on India's financial history that continues to resonate. So, buckle up as we take you through the life, the scandal, and the untimely demise of Harshad Mehta.

Here's a quick guide to what we'll cover:

- Biography: Who Was Harshad Mehta?

- Early Life and Career

- The Rise to Fame: How Harshad Mehta Dominated the Stock Market

- The Scandal: What Happened?

- Impact on the Indian Stock Market

- Arrest and Trial: The Legal Fallout

- Harshad Mehta Died: The Final Chapter

- Legacy: What Did Harshad Mehta Leave Behind?

- Conclusion: Lessons Learned

Biography: Who Was Harshad Mehta?

Before we dive into the scandal and his untimely death, let's talk about who Harshad Mehta really was. He wasn't just some random guy; he was a financial wizard who knew how to play the market like a pro. But like any good story, there's more to him than meets the eye. Here's a quick look at the man behind the headlines:

| Full Name | Harshad Shantilal Mehta |

|---|---|

| Born | July 17, 1954, in Mumbai, India |

| Died | June 1, 2001, in Mumbai, India |

| Profession | Stockbroker, Trader, and Financial Consultant |

| Known For | Masterminding the 1992 Indian Stock Market Scandal |

Harshad Mehta was born in Mumbai and grew up in a middle-class family. His journey from a small-time trader to a financial giant is a tale of ambition and risk-taking. But as we'll see, ambition alone can sometimes lead to downfall.

Early Life and Career

Harshad Mehta didn't start out as a stock market guru. In fact, his early days were pretty ordinary. He worked as a clerk at a brokerage firm, learning the ropes of the financial world. But something inside him sparked a desire to succeed. He wasn't content with just being another cog in the wheel; he wanted to be the wheel itself.

By the late 1980s, Harshad had built a reputation as a savvy trader. He wasn't just good; he was great. His ability to predict market trends and make profitable trades earned him the nickname "The Big Bull." People looked up to him, and he became a role model for many aspiring traders.

The Rise to Fame: How Harshad Mehta Dominated the Stock Market

By the early 1990s, Harshad Mehta was a force to be reckoned with. He had a Midas touch when it came to the stock market, turning everything he touched into gold. But how did he do it? It wasn't just about being smart; it was about being daring. Harshad took risks that others wouldn't dare to take, and it paid off—big time.

Here are some key points about his rise to fame:

- He used innovative trading strategies that were ahead of their time.

- He built a network of influential contacts in the financial world.

- He wasn't afraid to challenge the status quo and break the rules when necessary.

But as they say, with great power comes great responsibility. And Harshad Mehta wasn't exactly known for playing by the rules.

The Scandal: What Happened?

The 1992 Indian Stock Market Scandal is one of the biggest financial scandals in history. Harshad Mehta was at the center of it all, using a complex web of manipulative practices to artificially inflate stock prices. It was a scheme that involved banks, brokers, and even the Reserve Bank of India.

Here's a breakdown of how the scandal unfolded:

- Harshad used fake bank receipts to secure loans from banks.

- He funneled the money into the stock market, driving up prices.

- When the bubble burst, the market crashed, leaving investors in turmoil.

The scandal shook the foundations of India's financial system and led to widespread reforms. But for Harshad Mehta, it was the beginning of the end.

Impact on the Indian Stock Market

The repercussions of the Harshad Mehta scandal were far-reaching. It wasn't just about one man's greed; it was about systemic failures that allowed such a scheme to occur. The Indian government and financial regulators were forced to take action, implementing measures to prevent similar incidents in the future.

Some of the key changes included:

- Stricter regulations on bank loans and financial transactions.

- Increased transparency in stock market operations.

- Improved oversight and accountability in the financial sector.

While these changes were necessary, they came at a cost. The scandal left a lasting impact on investor confidence, and it took years for the market to recover.

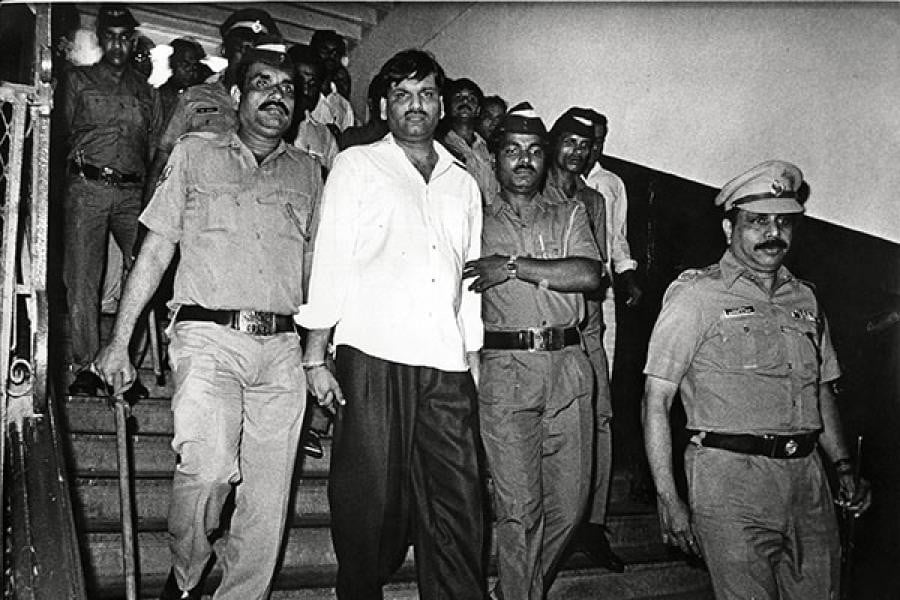

Arrest and Trial: The Legal Fallout

After the scandal broke, Harshad Mehta was arrested and faced multiple charges, including fraud and conspiracy. The trial was a media circus, with every detail of his life being scrutinized. But despite the evidence against him, Harshad maintained his innocence, claiming he was a victim of circumstances.

The legal process was long and arduous, with numerous appeals and delays. By the time the trial concluded, Harshad Mehta was already a shadow of his former self. The scandal had taken its toll, both financially and emotionally.

Harshad Mehta Died: The Final Chapter

On June 1, 2001, Harshad Mehta passed away at the age of 46. His death was sudden and unexpected, leaving many questions unanswered. Officially, the cause of death was listed as a heart attack, but rumors swirled about foul play. Whatever the truth may be, one thing is certain: Harshad Mehta's story ended in tragedy.

His death was a shock to many, not just because of the circumstances but because it marked the end of an era. Harshad Mehta wasn't just a stockbroker; he was a symbol of a time when ambition knew no bounds. His legacy, however, is a mixed bag of admiration and criticism.

Legacy: What Did Harshad Mehta Leave Behind?

Harshad Mehta's legacy is a complicated one. On one hand, he was a brilliant mind who revolutionized the Indian stock market. On the other hand, he was a cautionary tale of how greed can lead to destruction. His actions had a lasting impact on the financial world, both in India and globally.

Some key takeaways from his legacy include:

- He highlighted the need for stronger regulations in the financial sector.

- He served as a warning about the dangers of unchecked ambition.

- He inspired a generation of traders to think outside the box, albeit with caution.

Harshad Mehta may be gone, but his story continues to resonate. It's a reminder that success, no matter how great, is meaningless if it comes at the expense of integrity.

Conclusion: Lessons Learned

As we wrap up this story, it's important to reflect on the lessons we can learn from Harshad Mehta's life and death. His rise and fall are a testament to the power of ambition, but also a warning about the dangers of unchecked greed. The financial world is a complex and ever-evolving landscape, and those who navigate it must do so with caution and integrity.

We encourage you to share your thoughts and insights in the comments below. What do you think about Harshad Mehta's story? Do you think he was a victim of circumstance, or was he responsible for his own downfall? Let's keep the conversation going and learn from the past to build a better future.

And don't forget to check out our other articles for more fascinating stories and insights. Until next time, stay informed and stay curious!