Mastering The Sell Ex-Dividend Date Strategy: Unlock Hidden Gains

Let me paint you a picture here. Imagine you're sitting at the edge of Wall Street, sipping your coffee, watching numbers flash on the big screen. You hear whispers about "sell ex-dividend date" strategies that could make you some serious cash. But wait, what exactly is this ex-dividend date thing? How does it work? And most importantly, how can it help you make smarter investment decisions? Well, buckle up because we're about to dive deep into the world of dividends and stock trading.

Now, the term "sell ex-dividend date" might sound like some complicated financial jargon, but trust me, it's not as scary as it seems. It's basically the date when the stock starts trading without its next dividend. If you sell on or after this date, you still get the dividend payout. Sounds like a sweet deal, right? But there's more to it than meets the eye. This strategy can be your golden ticket to maximizing profits in the stock market.

Before we jump into the nitty-gritty, let's set the stage. This article is your ultimate guide to understanding the sell ex-dividend date strategy. We'll cover everything from the basics to advanced tactics, all while keeping it real and easy to digest. So whether you're a seasoned trader or just starting out, there's something here for everyone. Let's get this party started!

What Exactly is the Ex-Dividend Date?

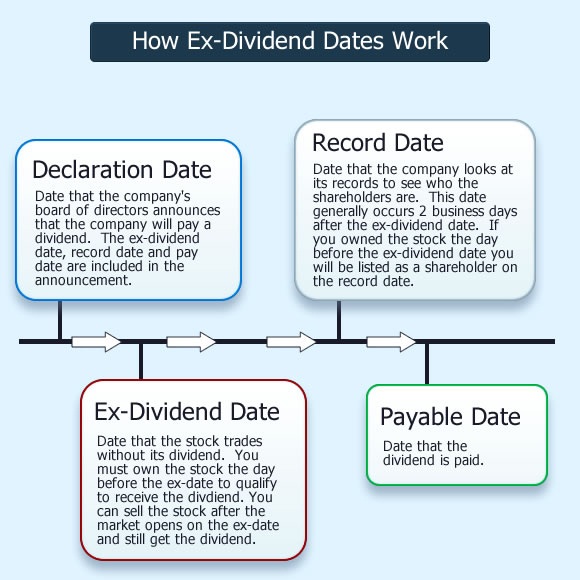

Okay, so let's break it down. The ex-dividend date is like the VIP pass to the dividend party. It's the date when the stock starts trading without its next dividend. If you own the stock before this date, congratulations, you're on the guest list and you'll get the dividend. But if you buy after this date, sorry, no party for you. Simple, right?

Here's the kicker: if you sell your stock on or after the ex-dividend date, you still get the dividend. This is where the sell ex-dividend date strategy comes into play. It's all about timing your moves to maximize your returns. Think of it like a dance, where you need to step in and out at just the right moments.

Why Should You Care About Ex-Dividend Dates?

Now, you might be wondering, why does this even matter? Well, here's the thing. Understanding ex-dividend dates can give you a competitive edge in the stock market. It's like having insider knowledge without breaking any rules. By timing your trades around these dates, you can potentially increase your profits and reduce your risks. And who doesn't want that?

Plus, it's not just about the money. Knowing about ex-dividend dates can help you make more informed investment decisions. It gives you a clearer picture of what's happening with your stocks and how they might perform in the future. So whether you're looking to grow your wealth or just want to be a smarter investor, this knowledge is power.

Understanding the Sell Ex-Dividend Date Strategy

Alright, let's get into the meat of the matter. The sell ex-dividend date strategy is all about timing your stock sales to capture the dividend payout. Here's how it works: you buy the stock before the ex-dividend date, hold onto it until the dividend is paid, and then sell it. Simple enough, right? But there's a bit more to it than just buying and selling.

You see, when the ex-dividend date hits, the stock price usually drops by the amount of the dividend. So if you sell after this date, you might not get as much for your stock as you did before. But here's the catch: you still get the dividend. So even though the stock price might be lower, you're still coming out ahead. It's like getting a discount on your stock purchase.

Benefits of the Sell Ex-Dividend Date Strategy

Let's talk about the perks. The biggest benefit of this strategy is that it can help you generate consistent income from your investments. Instead of waiting for the stock price to go up, you can make money from the dividends. And since dividends are usually paid quarterly, you can create a steady stream of income.

Another advantage is that it can reduce your tax burden. Dividends are often taxed at a lower rate than capital gains, so by focusing on dividends, you might end up paying less in taxes. Plus, by selling after the ex-dividend date, you can potentially avoid short-term capital gains taxes altogether. It's like getting a double bonus.

How to Identify the Right Stocks for Ex-Dividend Date Trading

Now that you know the basics, let's talk about how to find the right stocks for this strategy. First off, you want to look for companies with a history of paying consistent dividends. These are usually well-established companies with strong financials. Think blue-chip stocks like Coca-Cola or Johnson & Johnson.

Next, you want to consider the dividend yield. This is the percentage of the stock price that the dividend represents. A higher yield means more income, but it also means more risk. So you need to find a balance that works for you. And don't forget to check the ex-dividend date. You want to make sure you have enough time to execute your strategy before the date arrives.

Factors to Consider When Choosing Stocks

Here are some key factors to keep in mind when selecting stocks for ex-dividend date trading:

- Dividend History: Look for companies with a track record of paying dividends consistently.

- Dividend Yield: Consider the yield to ensure it aligns with your income goals.

- Financial Health: Check the company's financial statements to ensure they can sustain dividend payments.

- Market Conditions: Consider the overall market environment and how it might affect your strategy.

Timing Your Trades Around Ex-Dividend Dates

Timing is everything in this game. You need to be precise when executing your trades around the ex-dividend date. Here's a step-by-step guide:

- Buy Before the Ex-Dividend Date: Make sure you own the stock before the ex-dividend date to qualify for the dividend.

- Hold Until the Dividend is Paid: Wait until the dividend is paid out before making any moves.

- Sell After the Ex-Dividend Date: Once the dividend is in your pocket, you can sell the stock without worrying about missing out on the payout.

Remember, the stock price might drop after the ex-dividend date, but that's okay. You've already secured your dividend, so you're still coming out ahead. It's all about playing the long game and focusing on the bigger picture.

Risks and Considerations

Of course, no strategy is without its risks. Here are a few things to keep in mind:

- Stock Price Fluctuations: The stock price can be volatile, so be prepared for ups and downs.

- Market Conditions: Economic factors can affect dividend payments, so stay informed about market trends.

- Tax Implications: Make sure you understand the tax consequences of your trades to avoid any unpleasant surprises.

Maximizing Your Returns with the Sell Ex-Dividend Date Strategy

So how do you take this strategy to the next level? Here are a few tips to help you maximize your returns:

First, diversify your portfolio. Don't put all your eggs in one basket. By spreading your investments across different stocks, you can reduce your risk and increase your chances of success. Think of it like a buffet – you want to try a little bit of everything.

Second, reinvest your dividends. This is a great way to compound your returns over time. By reinvesting your dividends, you can buy more shares and increase your income potential. It's like getting free money to buy more stocks.

Advanced Tactics for Seasoned Investors

For those of you who want to take things a step further, here are some advanced tactics:

- Option Strategies: Consider using options to enhance your returns. This can be a bit more complex, but it can also be very rewarding.

- ETFs and Mutual Funds: Look into dividend-focused ETFs and mutual funds. These can provide instant diversification and access to a wide range of dividend-paying stocks.

- Automated Systems: Some investors use automated systems to execute their trades. This can help you stay disciplined and stick to your strategy.

Real-World Examples and Case Studies

Let's look at some real-world examples to see how the sell ex-dividend date strategy can work in practice. Take Coca-Cola, for instance. They've been paying dividends for over 60 years, and their ex-dividend date is usually around the same time every quarter. By timing your trades around these dates, you can potentially generate consistent income from your investment.

Another example is Johnson & Johnson. They've increased their dividend every year for the past 59 years. By buying before the ex-dividend date and selling after, you can capture both the dividend and any potential price appreciation. It's like hitting two birds with one stone.

Data and Statistics

According to a study by Morningstar, dividend-paying stocks have outperformed non-dividend-paying stocks over the long term. In fact, over the past 40 years, dividend-paying stocks have returned an average of 9.3% annually, compared to 7.4% for non-dividend-paying stocks. This highlights the power of dividends as a source of income and growth.

Tax Implications and Planning

Taxes can eat into your profits, so it's important to plan accordingly. Here are a few tax tips to keep in mind:

- Qualified Dividends: These are taxed at a lower rate than ordinary income, so make sure you meet the holding period requirements to qualify.

- Capital Gains: If you sell your stock for a profit, you might owe capital gains taxes. Be mindful of this when timing your trades.

- Retirement Accounts: Consider using retirement accounts like IRAs to shelter your dividend income from taxes.

Consulting a Tax Professional

When in doubt, it's always a good idea to consult a tax professional. They can help you navigate the complexities of dividend taxation and ensure you're maximizing your after-tax returns. Think of them as your financial GPS, guiding you to your destination safely and efficiently.

Conclusion: Take Action and Start Building Your Wealth

So there you have it, the ultimate guide to mastering the sell ex-dividend date strategy. By understanding the basics, identifying the right stocks, and timing your trades effectively, you can unlock hidden gains and build long-term wealth. Remember, it's not just about making money – it's about making smart decisions that align with your financial goals.

Now it's your turn. Are you ready to take the plunge and start implementing this strategy? Leave a comment below and let me know what you think. And if you found this article helpful, don't forget to share it with your friends and fellow investors. Together, we can all become smarter, savvier investors. So what are you waiting for? Let's make some moves!

Table of Contents:

- What Exactly is the Ex-Dividend Date?

- Understanding the Sell Ex-Dividend Date Strategy

- How to Identify the Right Stocks for Ex-Dividend Date Trading

- Timing Your Trades Around Ex-Dividend Dates

- Maximizing Your Returns with the Sell Ex-Dividend Date Strategy

- Real-World Examples and Case Studies

- Tax Implications and Planning