Option Trading Basics: A Beginner's Guide To Unlocking The Market

Option trading basics can be intimidating for anyone stepping into the world of finance. But here's the deal—options trading isn’t as complicated as it seems. Think of it as a game where you have the power to make calculated moves, and with the right strategy, you can turn the odds in your favor. Whether you're a complete newbie or someone looking to fine-tune your skills, this guide will break down everything you need to know about option trading basics in simple terms.

You might’ve heard whispers about how options can supercharge your portfolio, or maybe someone told you it’s risky business. But before we dive headfirst into the deep end, let’s get one thing straight—options trading is all about understanding the rules of the game. And trust me, once you grasp the basics, it’ll feel like second nature.

Now, before we move on, here’s the lowdown: this guide isn’t just a bunch of jargon-filled paragraphs. It’s designed to help you navigate the world of options trading with confidence. So, whether you’re here to learn the ropes or sharpen your skills, you’re in the right place. Let’s get started!

What Are Options? A Quick Overview

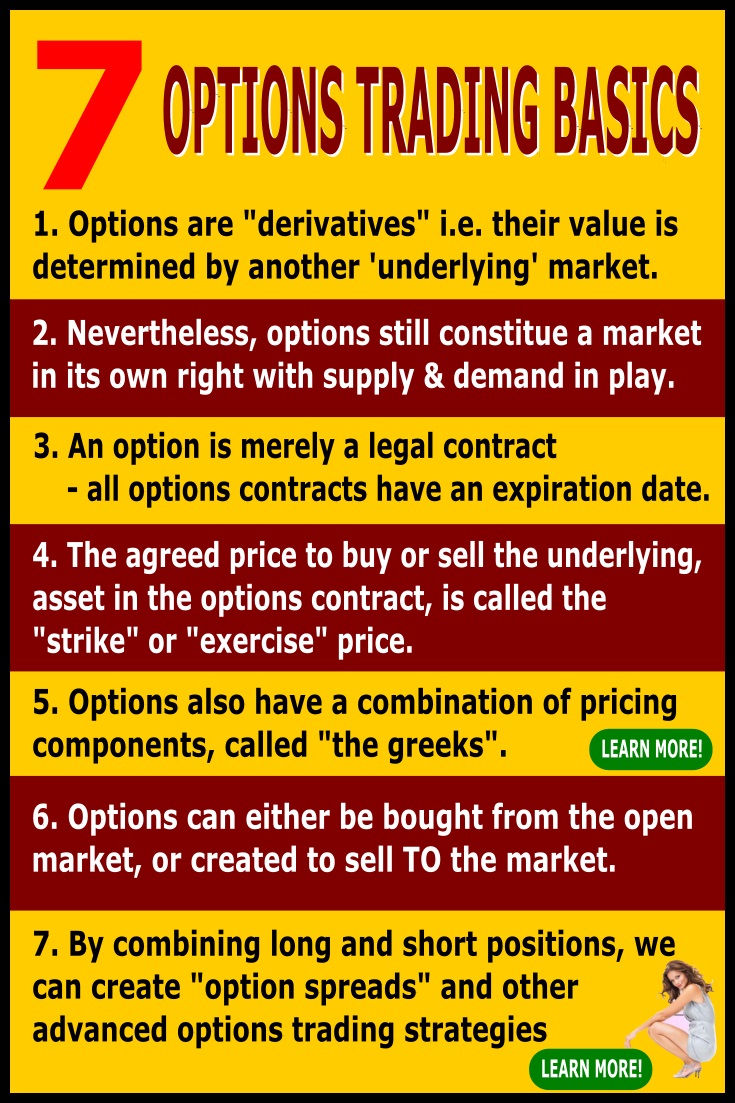

Alright, let’s kick things off by answering the million-dollar question—what exactly are options? Simply put, options are contracts that give you the right, but not the obligation, to buy or sell a stock at a specific price within a certain timeframe. Think of it like a lease agreement for stocks, but instead of renting a house, you’re leasing the right to buy or sell shares.

Here’s the cool part: options can be used for a variety of purposes, from hedging your portfolio to generating income. They’re like a Swiss Army knife for traders, offering flexibility and versatility in the market. And don’t worry if this sounds confusing right now—we’ll break it down further as we go along.

Types of Options: Calls and Puts

Now that we’ve covered the basics, let’s talk about the two main types of options: calls and puts. Calls give you the right to buy a stock at a specific price, while puts give you the right to sell. Here’s a quick breakdown:

- Calls: Think of calls as betting on a stock’s price going up. If you believe a stock will rise, you can buy a call option to lock in a lower price.

- Puts: On the flip side, puts are like betting on a stock’s price going down. If you think a stock will drop, you can buy a put option to sell it at a higher price.

See? It’s not rocket science. Calls and puts are the building blocks of options trading, and mastering them is key to unlocking the full potential of this strategy.

Key Components of Option Contracts

Every option contract has a few key components that you need to understand. These are like the DNA of options trading, and they determine how the contract works. Let’s take a closer look:

1. Strike Price

The strike price is the price at which you can buy or sell the underlying stock. It’s like the agreed-upon price in your contract. For example, if you buy a call option with a strike price of $50, you have the right to buy the stock at $50, regardless of its current market price.

2. Expiration Date

Options contracts don’t last forever. They have an expiration date, which is the last day you can exercise your option. Once the expiration date hits, the contract becomes worthless unless it’s exercised. So, timing is everything in options trading.

3. Premium

The premium is the cost of buying an option. It’s like the rent you pay for the contract. The premium is influenced by factors like the stock’s price, volatility, and time until expiration. The higher the premium, the more expensive the option.

Why Learn Option Trading Basics?

So, why should you bother learning option trading basics? Well, here’s the deal: options trading offers a unique set of advantages that can help you achieve your financial goals. Let’s explore some of the reasons why it’s worth your time:

- Hedging: Options can protect your portfolio from market downturns. Think of them as insurance policies for your investments.

- Income Generation: By selling options, you can generate additional income from your portfolio. It’s like earning rent from your stocks.

- Leverage: Options allow you to control a large number of shares with a relatively small investment. This can amplify your returns, but it also comes with risks.

See what I mean? Options trading isn’t just about making quick profits—it’s about building a well-rounded investment strategy.

Understanding Option Pricing

Now, let’s talk about one of the most important aspects of options trading: pricing. Option prices are influenced by several factors, including:

Intrinsic Value

Intrinsic value is the difference between the strike price and the current market price of the stock. For example, if a stock is trading at $60 and you have a call option with a strike price of $50, the intrinsic value is $10. This is the actual worth of the option if exercised immediately.

Time Value

Time value is the extra amount you pay for the option based on the time remaining until expiration. The longer the time, the higher the time value. This is because there’s more potential for the stock’s price to move in your favor.

Volatility

Volatility measures how much a stock’s price fluctuates. Higher volatility means there’s more uncertainty in the market, which can increase the price of options. Think of it like insurance premiums—higher risk means higher costs.

Common Option Trading Strategies

Once you’ve mastered the basics, it’s time to explore some common option trading strategies. These strategies can help you achieve different goals, whether you’re looking to hedge your portfolio or generate income. Here are a few to consider:

1. Covered Calls

Covered calls involve selling call options on stocks you already own. This strategy generates income while limiting your upside potential. It’s like renting out a room in your house—it brings in extra cash, but you might miss out on big gains.

2. Protective Puts

Protective puts involve buying put options to hedge against potential losses in your portfolio. It’s like buying insurance for your investments, ensuring you’re protected if the market takes a turn for the worse.

3. Straddles

Straddles involve buying both call and put options with the same strike price and expiration date. This strategy is used when you expect a big move in the stock’s price, but you’re not sure which direction it will go.

Risks and Challenges in Option Trading

While options trading can be rewarding, it’s not without its risks. Here are a few challenges to keep in mind:

- Leverage Risk: Options can amplify your gains, but they can also magnify your losses. Always trade within your risk tolerance.

- Time Decay: Options lose value as they get closer to expiration. This can eat into your profits if you’re not careful.

- Market Volatility: Sudden changes in the market can impact your options’ value. Stay informed and adjust your strategy accordingly.

Remember, options trading is a game of strategy, and understanding the risks is key to long-term success.

How to Get Started with Option Trading

Ready to take the plunge into options trading? Here’s a step-by-step guide to help you get started:

1. Educate Yourself

Before you start trading, make sure you understand the basics. Read books, watch tutorials, and practice with a demo account. Knowledge is power, and the more you know, the better equipped you’ll be to succeed.

2. Choose a Broker

Find a reputable broker that offers options trading. Look for one with low fees, good customer service, and a user-friendly platform. Some popular options include TD Ameritrade, E*TRADE, and Interactive Brokers.

3. Start Small

Don’t jump in headfirst—start small and build your way up. Use strategies like covered calls and protective puts to minimize risk while you learn the ropes.

Tips for Successful Option Trading

Here are a few tips to help you become a successful options trader:

- Set Clear Goals: Know what you want to achieve with options trading, whether it’s generating income or hedging your portfolio.

- Stick to a Plan: Develop a trading plan and stick to it. Discipline is key to long-term success.

- Stay Informed: Keep up with market news and trends. The more informed you are, the better decisions you can make.

Remember, options trading is a marathon, not a sprint. Stay patient, stay disciplined, and let the wins add up over time.

Conclusion

In conclusion, option trading basics aren’t as daunting as they seem. By understanding the key components of options contracts, exploring different strategies, and managing risks, you can unlock the full potential of this powerful tool. Whether you’re looking to hedge your portfolio, generate income, or amplify your returns, options trading offers a world of possibilities.

So, what are you waiting for? Dive in, learn, and start building your options trading strategy today. And don’t forget to share your thoughts and experiences in the comments below. Let’s keep the conversation going!

Table of Contents

- What Are Options? A Quick Overview

- Types of Options: Calls and Puts

- Key Components of Option Contracts

- Why Learn Option Trading Basics?

- Understanding Option Pricing

- Common Option Trading Strategies

- Risks and Challenges in Option Trading

- How to Get Started with Option Trading

- Tips for Successful Option Trading

- Conclusion