Rising Channel Pattern: Your Ultimate Guide To Unlocking Market Trends

Hey there, fellow traders and market enthusiasts! If you’ve ever been curious about how professional traders identify trends and make informed decisions, you’re in the right place. Today, we’re diving deep into the world of the rising channel pattern, a powerful technical analysis tool that can help you spot opportunities in the financial markets. Whether you’re a beginner or a seasoned trader, understanding this pattern could be your key to unlocking profitable trades. So, buckle up and let’s get started!

The rising channel pattern is not just another buzzword in the trading world; it’s a game-changer for those who want to take their trading skills to the next level. Imagine being able to predict where the market is headed with a high degree of accuracy. Sounds too good to be true? Well, with the right knowledge and practice, it’s absolutely possible.

In this article, we’ll break down everything you need to know about the rising channel pattern, from its basics to advanced strategies. We’ll also sprinkle in some real-world examples, tips, and tricks to help you master this technique. So, if you’re ready to level up your trading game, keep reading!

What is a Rising Channel Pattern Anyway?

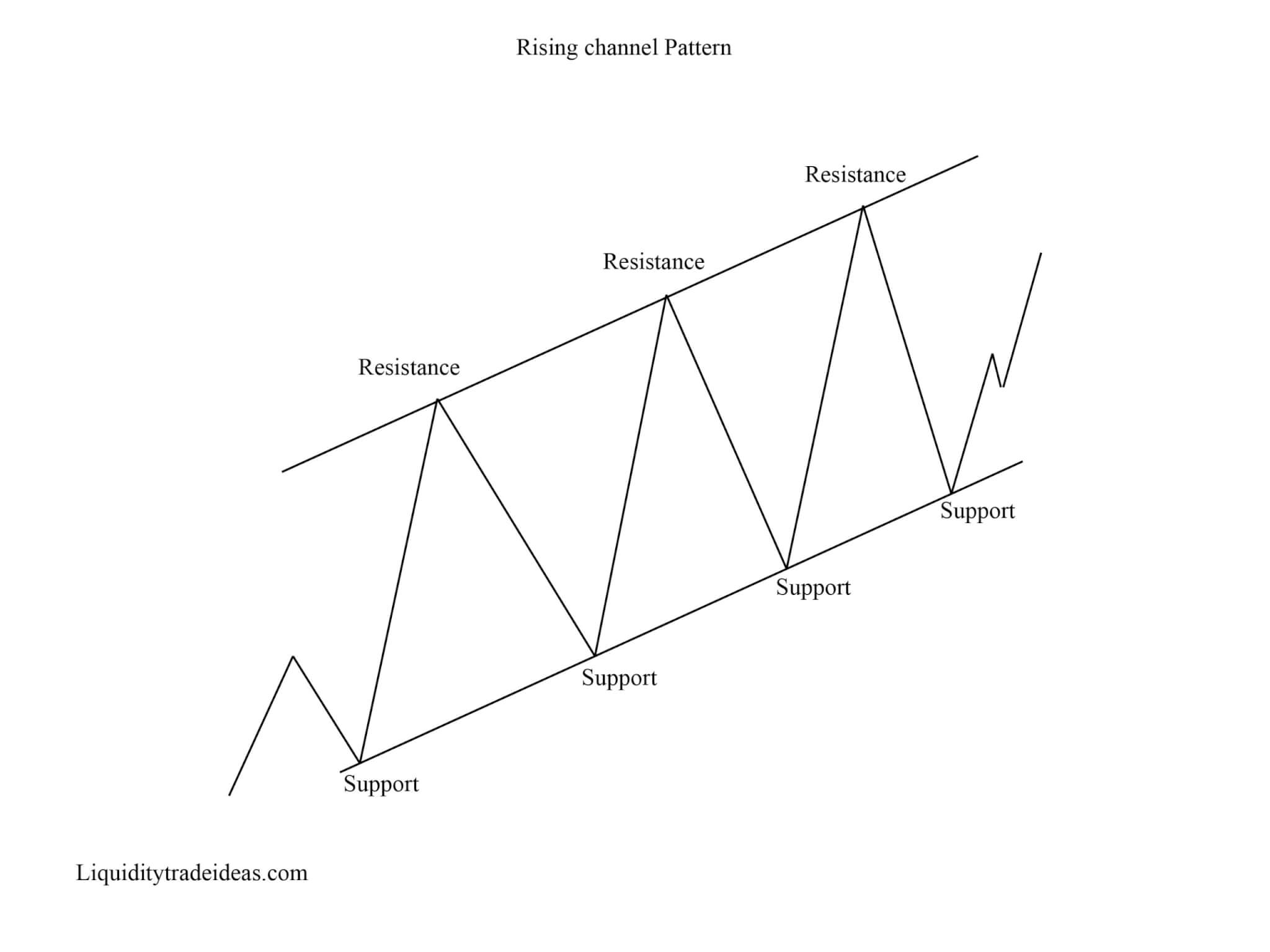

Alright, let’s start with the basics. A rising channel pattern is essentially a chart pattern that forms when the price of an asset moves between two parallel upward-sloping trend lines. Think of it like a ladder where the price keeps climbing higher, bouncing off these trend lines. It’s a visual representation of an uptrend, and it’s one of the most reliable patterns in technical analysis.

This pattern is particularly useful because it helps traders identify potential entry and exit points. By drawing these trend lines, you can anticipate where the price might reverse or continue its upward trajectory. And trust me, being able to predict these movements can make a huge difference in your trading success.

Now, here’s the fun part – the rising channel pattern can be applied to various financial instruments, including stocks, forex, commodities, and even cryptocurrencies. So, no matter what you’re trading, this pattern has got your back.

Why Should You Care About Rising Channel Patterns?

Let’s face it – trading can be unpredictable and sometimes downright chaotic. But with the rising channel pattern, you can bring some order to the chaos. This pattern provides a structured approach to analyzing price movements, making it easier to spot trends and make informed decisions.

One of the biggest advantages of using this pattern is its ability to help you identify high-probability trading opportunities. Instead of relying on gut feelings or random guesses, you can use the rising channel pattern to pinpoint when to enter or exit a trade. And let’s be honest, who doesn’t want to improve their chances of success?

Plus, this pattern is not only useful for short-term traders but also for long-term investors. Whether you’re looking to scalp quick profits or hold onto an asset for a longer period, the rising channel pattern can provide valuable insights.

How to Identify a Rising Channel Pattern

So, how do you spot a rising channel pattern on a chart? It’s actually simpler than you might think. Here’s a step-by-step guide:

- Step 1: Look for an uptrend. You’ll know it’s an uptrend when the price is making higher highs and higher lows.

- Step 2: Draw a trend line connecting the higher lows. This will serve as the lower boundary of your rising channel.

- Step 3: Draw another trend line parallel to the first one, connecting the higher highs. This will be the upper boundary of your rising channel.

- Step 4: Voila! You’ve just identified a rising channel pattern.

Now, here’s a pro tip – the more times the price touches these trend lines, the stronger the pattern becomes. So, if you see the price bouncing off these lines multiple times, you know you’re dealing with a solid rising channel.

Common Mistakes to Avoid

As with any trading strategy, there are some pitfalls to watch out for when using the rising channel pattern. Here are a few common mistakes that traders often make:

- Overdrawing trend lines: Sometimes, traders get too excited and start drawing trend lines everywhere. Stick to the most obvious and reliable ones to avoid confusion.

- Ignoring other indicators: While the rising channel pattern is powerful, it’s not a magic bullet. Always combine it with other technical indicators for a more comprehensive analysis.

- Jumping the gun: Don’t rush into a trade just because you see a rising channel. Wait for confirmation signals before pulling the trigger.

By avoiding these mistakes, you can significantly improve your chances of success when using the rising channel pattern.

Real-World Examples of Rising Channel Patterns

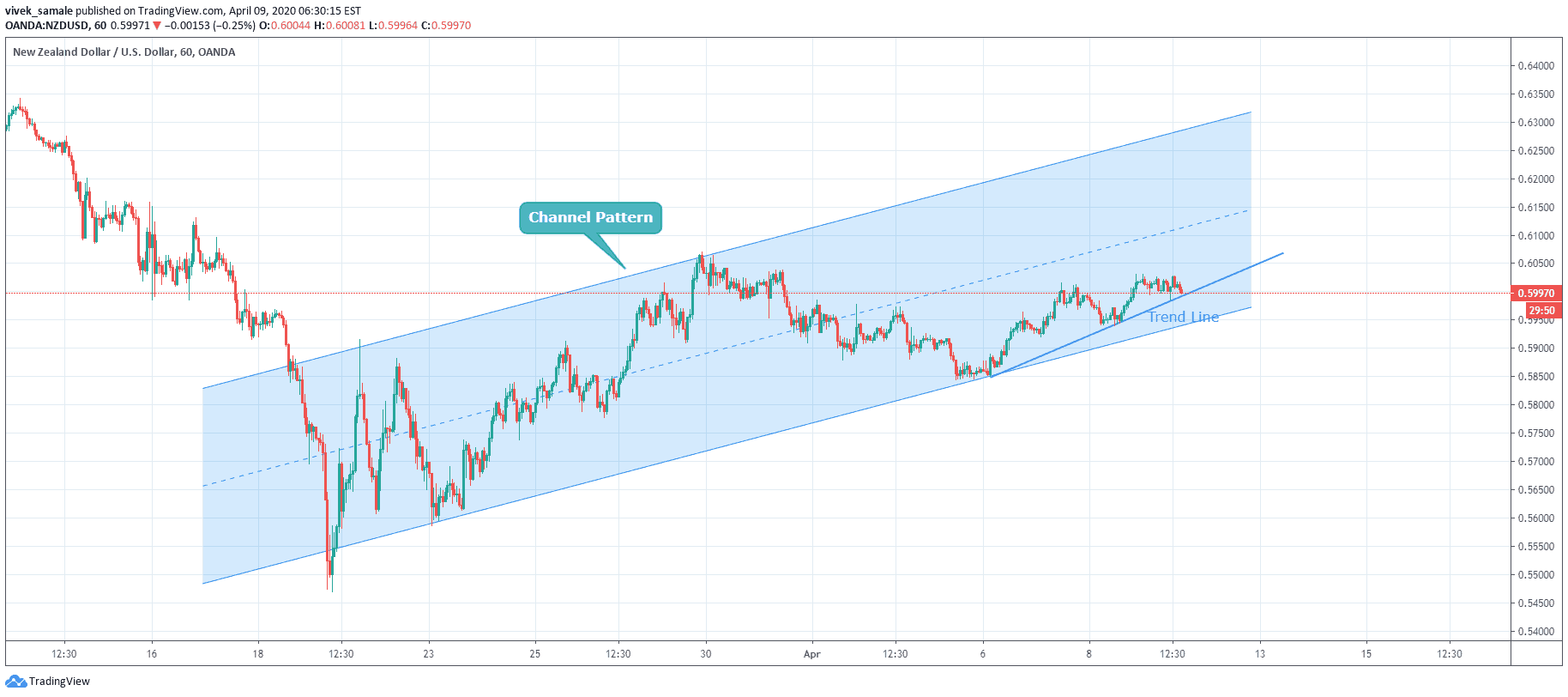

Talking about theory is great, but nothing beats seeing real-world examples. Let’s take a look at how the rising channel pattern has played out in actual trading scenarios.

Example 1: In 2020, the stock of Tesla Inc. formed a perfect rising channel pattern during its meteoric rise. Traders who identified this pattern early were able to ride the wave and make substantial profits.

Example 2: In the forex market, the EUR/USD pair often forms rising channel patterns during strong uptrends. These patterns provide excellent opportunities for currency traders to capitalize on price movements.

These examples show that the rising channel pattern is not just a theoretical concept but a practical tool that can be applied in real trading situations.

Advanced Strategies for Mastering Rising Channel Patterns

Once you’ve got the basics down, it’s time to level up your skills with some advanced strategies. Here are a few techniques to help you master the rising channel pattern:

Combining with Moving Averages

Moving averages can be a great complement to the rising channel pattern. By overlaying moving averages on your chart, you can get additional confirmation signals for your trades. For example, if the price crosses above a moving average while staying within the rising channel, it could be a strong buy signal.

Using Fibonacci Retracement

Fibonacci retracement levels can help you identify potential support and resistance areas within the rising channel. By combining these levels with the trend lines, you can pinpoint precise entry and exit points.

These advanced strategies can take your trading to the next level, but remember – practice makes perfect. Don’t be afraid to experiment and find what works best for you.

Data and Statistics Supporting Rising Channel Patterns

Numbers don’t lie, and when it comes to the rising channel pattern, the stats are impressive. Studies have shown that this pattern has a success rate of over 70% when used correctly. That’s a pretty solid track record, wouldn’t you say?

According to a report by TradingView, traders who incorporate the rising channel pattern into their strategies tend to outperform those who don’t. The pattern’s ability to provide clear entry and exit points gives traders a significant edge in the market.

These statistics highlight the importance of understanding and utilizing the rising channel pattern in your trading arsenal.

How Rising Channel Patterns Fit Into Your Trading Plan

Now that you know all about the rising channel pattern, how do you integrate it into your overall trading plan? Here are a few tips:

- Set clear goals: Define what you want to achieve with this pattern. Are you looking for short-term gains or long-term growth?

- Develop a risk management strategy: Always set stop-loss orders to protect your capital, even when using a reliable pattern like the rising channel.

- Stay disciplined: Stick to your plan and avoid making impulsive decisions based on emotions.

By incorporating the rising channel pattern into your trading plan, you can create a more structured and profitable approach to trading.

Expert Insights and Recommendations

When it comes to the rising channel pattern, the experts have plenty to say. According to renowned trader Mark Minervini, “Trend lines are one of the most powerful tools in technical analysis, and the rising channel pattern is a prime example of their effectiveness.”

Another expert, John Carter, emphasizes the importance of combining the rising channel pattern with other indicators. “Don’t rely on a single tool,” he advises. “Use the rising channel pattern as part of a broader strategy for the best results.”

These insights from industry leaders highlight the value of the rising channel pattern and the need for a well-rounded approach to trading.

Conclusion: Take Action and Start Trading

Well, there you have it – everything you need to know about the rising channel pattern. From its basics to advanced strategies, we’ve covered it all. Remember, the key to success in trading is knowledge, practice, and discipline.

So, what are you waiting for? Start applying the rising channel pattern to your trades today. And don’t forget to share this article with your fellow traders – knowledge is power, and the more we share, the better we all become.

Lastly, if you have any questions or want to share your experiences with the rising channel pattern, drop a comment below. We’d love to hear from you!

Table of Contents

- What is a Rising Channel Pattern Anyway?

- Why Should You Care About Rising Channel Patterns?

- How to Identify a Rising Channel Pattern

- Common Mistakes to Avoid

- Real-World Examples of Rising Channel Patterns

- Advanced Strategies for Mastering Rising Channel Patterns

- Data and Statistics Supporting Rising Channel Patterns

- How Rising Channel Patterns Fit Into Your Trading Plan

- Expert Insights and Recommendations

- Conclusion: Take Action and Start Trading