Unleashing The Power Of Online Stock Trading Programs: Your Ultimate Guide

Listen up, folks! If you've ever wondered how to dive into the world of online stock trading programs, you're in the right place. This ain't just another boring article; it's your go-to guide for everything you need to know about trading stocks online. Whether you're a newbie or a seasoned trader looking to level up, we've got you covered. So, buckle up and let's get started!

Online stock trading programs have completely revolutionized the way we invest. These platforms are designed to make trading more accessible, efficient, and user-friendly. They're not just tools—they're your partners in navigating the often volatile world of finance. But before you jump in, there’s a lot to learn, and that’s where we come in.

Now, I’m not here to sugarcoat things. Trading stocks online can be both exciting and challenging, but with the right knowledge and tools, you can turn that challenge into opportunity. Stick around, and we’ll break it all down for you step by step.

Why Online Stock Trading Programs Matter

In today's fast-paced world, convenience is king, and that’s exactly what online stock trading programs bring to the table. They allow you to trade stocks from the comfort of your home, office, or even while sipping coffee at your favorite café. These platforms have leveled the playing field, giving retail investors access to tools that were once reserved for Wall Street professionals.

Key Benefits:

- 24/7 access to global markets

- Real-time data and analysis

- User-friendly interfaces

- Low transaction fees

- Automation features for advanced traders

But hey, don’t just take my word for it. According to a report by Statista, the number of retail investors using online trading platforms has skyrocketed in recent years. This trend shows no signs of slowing down anytime soon.

Top 10 Online Stock Trading Programs You Need to Know

There’s no shortage of options when it comes to online stock trading programs. But how do you choose the right one? Let’s dive into the top 10 platforms that are making waves in the industry.

1. Robinhood

Robinhood is like the cool kid on the block. It offers commission-free trading, making it super appealing to beginners. Plus, its sleek interface is easy to navigate, even if you’ve never traded before. However, it lacks some advanced features that serious traders might crave.

2. TD Ameritrade

If you’re looking for a platform with serious firepower, TD Ameritrade is your best bet. It boasts an impressive suite of tools, including Thinkorswim, which is perfect for advanced traders. The only downside? It might feel a bit overwhelming for beginners.

3. E*TRADE

E*TRADE strikes a nice balance between simplicity and functionality. Whether you’re a rookie or a pro, this platform has something for everyone. Its Web Platform and Mobile App are packed with features that cater to all levels of traders.

4. Fidelity

Fidelity is a powerhouse in the financial world. Known for its robust research tools and low fees, it’s an excellent choice for long-term investors. If you’re into mutual funds or ETFs, Fidelity has got you covered.

5. Charles Schwab

Charles Schwab is another giant in the industry. It offers a wide range of investment options and top-notch customer support. Plus, its trading platform is intuitive and easy to use, making it a great option for both beginners and experienced traders.

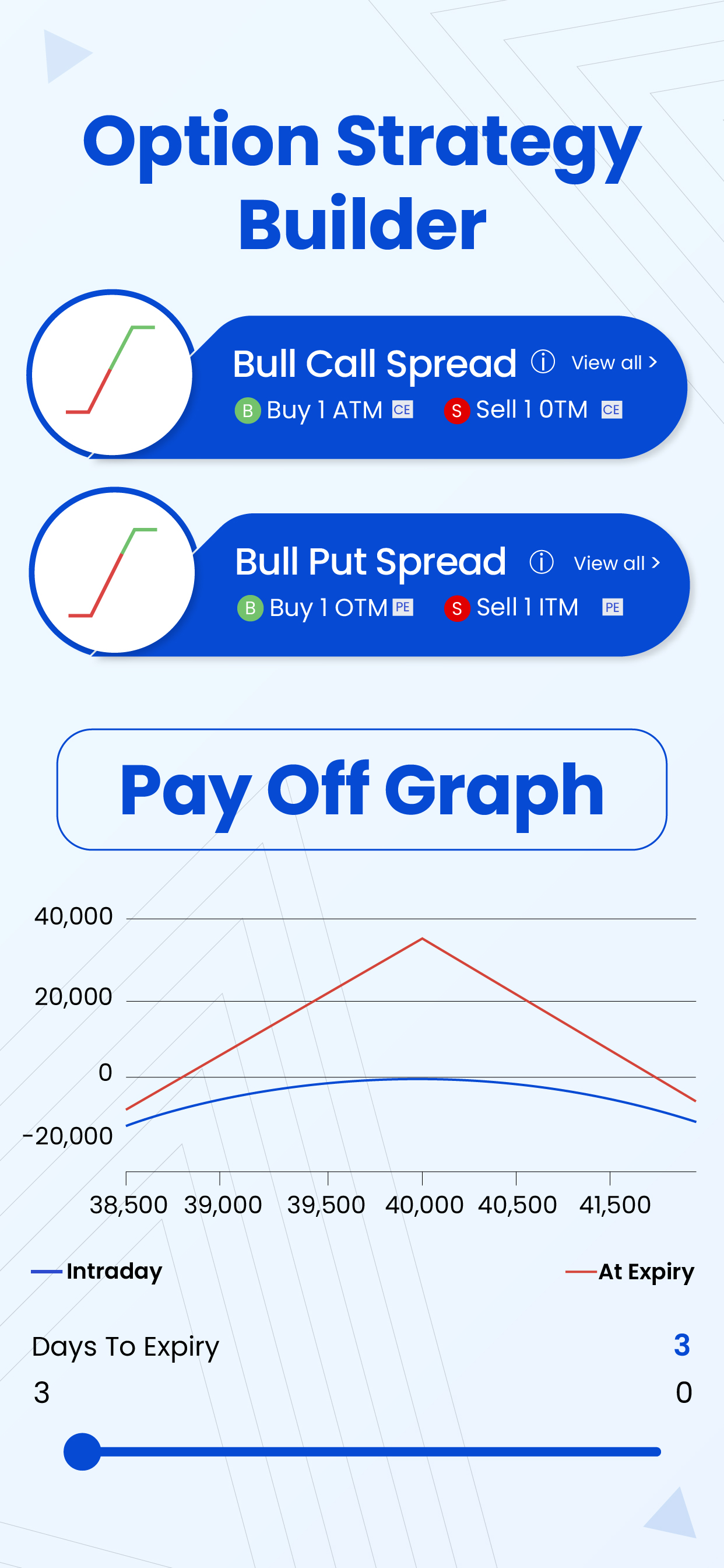

Understanding the Features of Online Stock Trading Programs

Not all online stock trading programs are created equal. Each platform comes with its own set of features, and understanding them is crucial if you want to make the most out of your trading experience. Here’s what you should look for:

User Interface

A user-friendly interface can make or break your trading experience. You want a platform that’s easy to navigate, especially if you’re new to trading. Look for platforms with clean designs and intuitive layouts.

Research Tools

Good research tools are essential for making informed trading decisions. Whether it’s real-time market data, news feeds, or analysis tools, these features can give you a competitive edge in the market.

Mobile Accessibility

In today’s mobile-first world, having a platform that works seamlessly on your smartphone is a must. Check if the platform offers a dedicated app and whether it’s available on both iOS and Android.

How to Choose the Right Online Stock Trading Program

Choosing the right online stock trading program can feel like picking a needle in a haystack. But don’t worry, we’ve got a few tips to help you make the right decision:

- Define your goals: Are you a beginner or an advanced trader?

- Consider your budget: Look for platforms with low fees and no hidden costs.

- Check the platform’s reputation: Read reviews and testimonials from other users.

- Test the waters: Many platforms offer demo accounts, so take advantage of them.

Remember, there’s no one-size-fits-all solution. What works for one person might not work for another. Take your time, do your research, and choose wisely.

Common Mistakes to Avoid in Online Stock Trading

Trading stocks online can be lucrative, but it’s not without its pitfalls. Here are some common mistakes to avoid:

1. Lack of Research

Jumping into trades without doing your homework is a recipe for disaster. Always research the stocks you’re interested in and stay updated on market trends.

2. Emotional Trading

Emotions can cloud your judgment and lead to poor decisions. Stick to your trading strategy and avoid making impulsive moves based on fear or greed.

3. Overtrading

Trading too frequently can eat into your profits due to transaction fees and taxes. Be mindful of your trading frequency and focus on quality over quantity.

How Online Stock Trading Programs Impact Your Portfolio

Using the right online stock trading program can significantly impact your portfolio’s performance. These platforms provide access to a wide range of investment opportunities, from individual stocks to ETFs and options. They also offer tools to help you manage risk and optimize your returns.

For instance, many platforms allow you to set up automatic investment plans, which can help you build wealth over time. Additionally, features like stop-loss orders and trailing stops can protect your investments from sudden market downturns.

Security and Privacy in Online Stock Trading Programs

When it comes to online trading, security and privacy should always be top priorities. Make sure the platform you choose uses encryption and two-factor authentication to protect your account. Additionally, check if the platform is regulated by reputable financial authorities like the SEC or FINRA.

Here are some red flags to watch out for:

- Platforms that don’t disclose their regulatory status

- Suspiciously low fees with hidden charges

- Poor customer support

Future Trends in Online Stock Trading Programs

The world of online stock trading is constantly evolving. Here are some trends to watch out for:

1. AI-Powered Trading

Artificial intelligence is increasingly being used to enhance trading platforms. These tools can analyze vast amounts of data and provide actionable insights to help you make better trading decisions.

2. Blockchain Technology

Blockchain is revolutionizing the way transactions are processed. Some platforms are already experimenting with blockchain to improve security and transparency.

3. Social Trading

Social trading platforms allow users to follow and mimic the trades of successful investors. This trend is gaining popularity, especially among younger investors.

Expert Tips for Maximizing Your Online Stock Trading Experience

Ready to take your trading game to the next level? Here are some expert tips to help you maximize your online stock trading experience:

- Start small and gradually increase your investments as you gain experience.

- Set clear goals and develop a solid trading strategy.

- Stay informed by following financial news and market trends.

- Continuously educate yourself by reading books, attending webinars, and joining online communities.

Conclusion: Time to Take Action

So, there you have it—your ultimate guide to online stock trading programs. Whether you’re a beginner or an experienced trader, the right platform can make all the difference. Remember, knowledge is power, and the more you know, the better equipped you’ll be to succeed in the world of online trading.

Now, it’s your turn to take action. Explore the platforms we’ve discussed, test them out, and find the one that suits your needs. And don’t forget to share your thoughts in the comments below. Who knows? You might just inspire someone else on their trading journey!

Table of Contents:

- Why Online Stock Trading Programs Matter

- Top 10 Online Stock Trading Programs You Need to Know

- Understanding the Features of Online Stock Trading Programs

- How to Choose the Right Online Stock Trading Program

- Common Mistakes to Avoid in Online Stock Trading

- How Online Stock Trading Programs Impact Your Portfolio

- Security and Privacy in Online Stock Trading Programs

- Future Trends in Online Stock Trading Programs

- Expert Tips for Maximizing Your Online Stock Trading Experience

- Conclusion: Time to Take Action