Spot Vs Strike Price: The Ultimate Breakdown For Smart Investors

When it comes to trading and investing, understanding the difference between spot price and strike price is crucial if you wanna make informed decisions. Imagine walking into a casino without knowing the rules of the game – yeah, that's kinda how jumping into financial markets without this knowledge feels. Whether you're trading stocks, options, or forex, knowing these terms can be the difference between walking away with profits or losing your hard-earned cash. So, let's dive in and break it all down in a way that even your non-finance friends could understand.

Now, don't worry if you're new to all this jargon. We've got you covered. In this article, we'll explore everything you need to know about spot vs strike price, including what they mean, how they work, and why they matter in the world of finance. You'll also learn some pro tips to help you navigate the markets like a champ.

Think of this article as your cheat sheet for mastering spot vs strike price. By the time you're done reading, you'll have a solid foundation to start making smarter investment choices. So grab your favorite drink, get comfy, and let's unravel the mystery of these two key concepts in the financial world.

What Exactly is Spot Price?

Let's start with the basics. The spot price is simply the current market price of an asset at any given moment. It's like checking the price tag on a shirt in a store – that's the spot price. If you want to buy or sell something right now, the spot price tells you exactly how much it'll cost or how much you'll get.

Spot prices are constantly changing because they're influenced by supply and demand, economic news, and other factors. For example, if there's breaking news about a company's earnings report, you might see its stock's spot price jump or drop in seconds. This real-time nature makes spot prices super important for traders who want to act quickly.

Understanding Strike Price in Options Trading

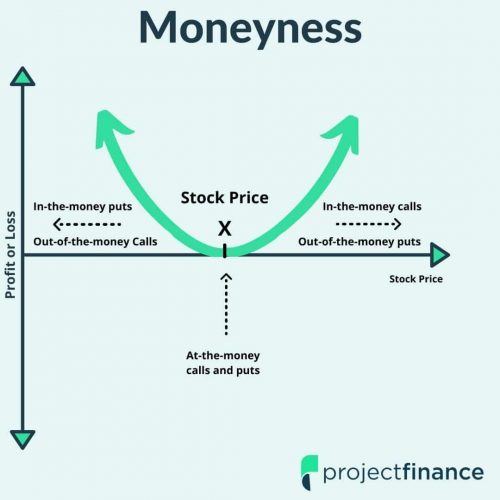

Alright, now let's talk about strike price. Unlike spot price, which is about what's happening right now, strike price is all about the future. In options trading, the strike price is the predetermined price at which you can buy (call option) or sell (put option) an asset when the option is exercised.

Here's the kicker: the value of an option depends heavily on its relationship with the spot price. If the spot price is above the strike price for a call option, it's considered "in the money." But if it's below, it's "out of the money." The same logic applies to put options, just flipped. Understanding this relationship is key to making profitable trades in options.

The Key Differences Between Spot vs Strike Price

So, what's the main difference between these two prices? Well, spot price is all about the present, while strike price is about the future. Spot price is dynamic and changes constantly, whereas strike price is fixed when you buy an option. Let's break it down further:

- Timeframe: Spot price is immediate, while strike price is tied to a specific date in the future.

- Usage: Spot price is used for buying or selling assets right now, while strike price is used in options contracts.

- Volatility: Spot prices can be super volatile, but strike prices remain constant throughout the life of the option.

How Spot and Strike Prices Work Together

Now that we've covered the basics, let's look at how these two prices interact in the world of options trading. The relationship between spot and strike prices determines whether an option is profitable or not. For instance, if you bought a call option with a strike price of $50 and the spot price rises to $60, congratulations – you're sitting on a winning trade!

But here's the thing: timing is everything. If the spot price doesn't move in your favor before the option expires, you could end up losing your investment. That's why smart traders always keep an eye on both prices and adjust their strategies accordingly.

Factors That Influence Spot Prices

So, what makes spot prices move up and down? There are several factors at play:

- Economic indicators like GDP growth and inflation rates.

- Company-specific news, such as earnings reports or product launches.

- Global events, like geopolitical tensions or natural disasters.

- Market sentiment – sometimes, people just feel optimistic or pessimistic, and that can drive prices.

Understanding these factors can help you predict how spot prices might change, giving you an edge in your trading decisions.

Why Strike Prices Matter in Options Trading

When you're trading options, the strike price is your golden ticket. It's the price that determines whether your option will be profitable or not. Here's why it matters:

- It sets the threshold for profit or loss in your trade.

- It affects the premium you pay for the option – options with strike prices closer to the spot price usually cost more.

- It helps you plan your strategy – do you want an option with a high strike price for a potential big payout, or a lower one for more stability?

Choosing the right strike price is like picking the perfect lock for your safe – get it wrong, and you might not get the results you're hoping for.

Real-World Examples of Spot vs Strike Price

Let's bring this all to life with some examples. Imagine you're trading options for Apple Inc. (AAPL). The current spot price is $150, and you buy a call option with a strike price of $160. If Apple releases a killer new product and the spot price jumps to $170, your option is now "in the money," and you could sell it for a profit.

But what if the spot price only rises to $155? In that case, your option would still be "out of the money," and you'd lose the premium you paid for it. This example shows just how important it is to time your trades and choose the right strike price.

How to Use Spot and Strike Prices in Your Strategy

Now that you know how these prices work, let's talk strategy. Here are a few tips to help you use spot and strike prices effectively:

- Always compare the spot price to the strike price before buying an option.

- Consider the time value of the option – the longer you have until expiration, the more chances the spot price has to move in your favor.

- Stay informed about factors that could affect the spot price, like earnings reports or economic data releases.

Remember, trading is a game of probabilities. By understanding spot vs strike price, you can stack the odds in your favor and increase your chances of success.

Data and Statistics to Support Your Understanding

According to a study by the CBOE, about 70% of options expire worthless. That might sound scary, but it also highlights the importance of choosing the right strike price and timing your trades carefully. Another interesting stat: options with strike prices near the current spot price tend to have higher trading volumes, making them more liquid and easier to buy or sell.

These numbers show just how crucial it is to do your research and make informed decisions. Don't just rely on gut feelings – use data to guide your strategy.

Where to Find Reliable Data

If you're looking for reliable sources of data on spot and strike prices, here are a few options:

- Investopedia – Great for learning the basics and staying updated on market trends.

- CBOE – The Chicago Board Options Exchange offers tons of data and insights on options trading.

- Federal Reserve – For economic indicators that can affect spot prices.

These resources can help you stay informed and make smarter trading decisions.

Common Mistakes to Avoid

Even the best traders make mistakes, but you can avoid some common pitfalls by keeping these tips in mind:

- Don't get too attached to a specific strike price – be flexible and adjust your strategy as needed.

- Don't ignore the time value of options – even if the spot price moves in your favor, you could still lose if the option expires too soon.

- Don't underestimate the power of research – always do your homework before making a trade.

Remember, trading is a marathon, not a sprint. Stay patient, stay informed, and let your knowledge of spot vs strike price guide you to success.

How to Stay Updated on Market Trends

Staying on top of market trends is key to mastering spot vs strike price. Here are a few ways to stay informed:

- Follow financial news outlets like CNBC or Bloomberg.

- Join online trading communities to share insights and learn from others.

- Use trading apps and platforms that offer real-time data and alerts.

The more you know, the better equipped you'll be to navigate the markets and make profitable trades.

Conclusion: Take Action and Start Trading Smarter

So there you have it – the lowdown on spot vs strike price. By understanding these two key concepts, you're already ahead of the curve in the world of finance. Remember, the spot price is all about the present, while the strike price is about the future. Together, they form the foundation of options trading and can help you make smarter investment decisions.

Now it's your turn to take action. Start by doing your research, experimenting with different strategies, and most importantly, stay informed. And don't forget to share this article with your friends – knowledge is power, and the more people who understand spot vs strike price, the better off we'll all be.

Got any questions or tips of your own? Drop a comment below and let's keep the conversation going. Happy trading, and may the odds be ever in your favor!

Table of Contents

- What Exactly is Spot Price?

- Understanding Strike Price in Options Trading

- The Key Differences Between Spot vs Strike Price

- How Spot and Strike Prices Work Together

- Factors That Influence Spot Prices

- Why Strike Prices Matter in Options Trading

- Real-World Examples of Spot vs Strike Price

- How to Use Spot and Strike Prices in Your Strategy

- Data and Statistics to Support Your Understanding

- Common Mistakes to Avoid