Unlocking The Secrets Of Double Top Pattern Meaning: Your Ultimate Trading Guide

Ever wondered what the double top pattern really means and how it can impact your trading decisions? If you're diving into the world of technical analysis, understanding this powerful chart pattern is like having a secret weapon in your arsenal. The double top pattern isn't just some random squiggle on a chart—it's a clear signal that the market might be shifting gears. Whether you're a seasoned trader or just starting out, grasping the double top pattern meaning can make all the difference in your investment strategy.

Imagine this: you're scrolling through your chart, and suddenly you notice two peaks that look eerily similar, like a mountain range with a valley in between. That, my friend, is what we call a double top. But it's not just about spotting two peaks; it's about what those peaks are telling you. They're whispering secrets about potential trend reversals and market psychology. And hey, who doesn't love a good market secret?

Now, before we dive deeper into the nitty-gritty, let's set the stage. The double top pattern meaning isn't just about predicting where prices might go; it's about understanding why they might go there. By the end of this guide, you'll not only know what a double top is but also how to use it to your advantage. So buckle up, because we're about to unravel the mysteries of this chart pattern powerhouse.

What Exactly is a Double Top Pattern?

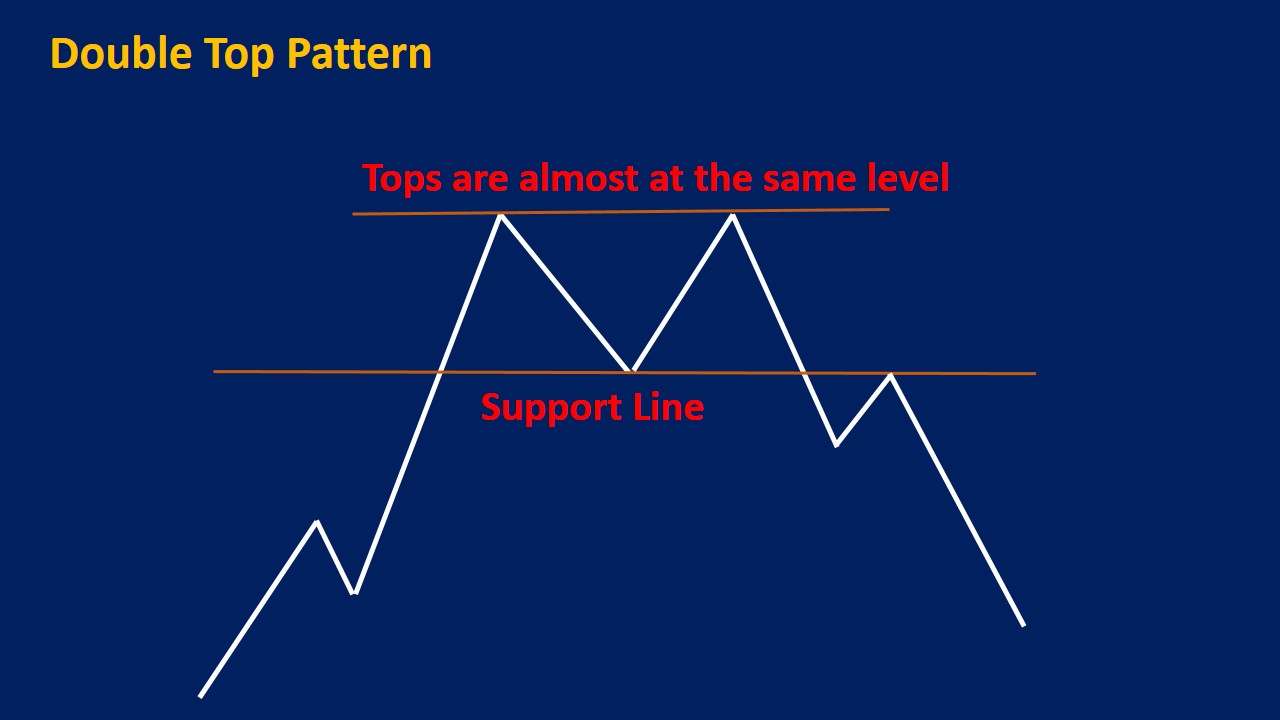

Let's break it down. A double top pattern is like a two-step dance that the market performs on your chart. It happens when prices rise to a certain level, pull back, and then rise again to the same level before falling. Think of it as the market testing its strength twice and failing both times. This pattern usually signals that an uptrend might be losing steam, and a reversal could be on the horizon.

Here's the kicker: the double top isn't just about the peaks. The valley between them, known as the "trough," plays a crucial role. It's like the pause in a musical piece that sets up the next note. When prices break below this trough, traders take notice because it often indicates that the downward movement is gaining momentum.

Why Should You Care About Double Tops?

Because they're a goldmine of information for traders. The double top pattern meaning is all about potential reversals. If you can spot one early, you're in a position to make informed decisions about buying, selling, or holding your assets. It's like having a crystal ball that gives you a glimpse into the market's future moves.

- It signals a possible end to an uptrend.

- It can help you time your trades more effectively.

- It provides a clear entry and exit point for short positions.

How to Identify a Double Top Pattern

Spotting a double top isn't rocket science, but it does require a keen eye and some practice. Here's what you need to look for:

First, you'll see an initial peak where prices hit a high point. Then, they'll retreat, forming a trough. After that, prices will rise again, testing the same high point but failing to break through. Once they fall below the trough, you've got yourself a double top. Easy, right?

Key Characteristics of a Double Top

But wait, there's more! To confirm you're looking at a legit double top, keep an eye out for these key characteristics:

- Two Peaks at Similar Levels: The peaks don't have to be identical, but they should be close enough to form a recognizable pattern.

- A Clear Trough: The valley between the peaks should be distinct and provide a solid support level.

- A Break Below the Trough: This is the clincher. When prices dip below the trough, it's a strong signal that the pattern is complete.

Double Top Pattern Meaning in Action

Now that you know what to look for, let's see how the double top pattern meaning plays out in real-life trading scenarios. Imagine you're analyzing a stock, and you notice it's forming a double top. What does this mean for your trading strategy?

Well, if you're a short seller, it's like Christmas in July. The double top signals that the stock might be about to decline, giving you the perfect opportunity to enter a short position. On the flip side, if you're long on the stock, it might be time to reconsider your position or set a stop-loss to protect your gains.

Real-World Examples

Let's take a look at some historical examples. Back in 2000, the NASDAQ Composite formed a massive double top, signaling the end of the dot-com bubble. Traders who recognized this pattern were able to exit their positions before the market crashed. It's proof that understanding the double top pattern meaning can be a game-changer.

Factors Influencing Double Top Patterns

While the double top pattern itself is pretty straightforward, there are several factors that can influence its formation and outcome:

- Volume: High trading volume during the formation of the peaks and the breakdown can strengthen the pattern's reliability.

- Market Sentiment: If the market is bullish, a double top might not have the same impact as it would in a bearish market.

- Economic Indicators: Economic news and events can affect how the pattern plays out. For instance, a positive earnings report might prevent a breakdown even if a double top forms.

How Volume Affects Double Tops

Volume is like the heartbeat of the market. When volume spikes during the formation of the peaks and the breakdown, it's a strong indicator that the pattern is valid. On the other hand, if volume is low, the pattern might not have the same predictive power.

Double Top vs. Other Chart Patterns

While the double top pattern is powerful, it's not the only game in town. Let's compare it to some other popular chart patterns:

Double Bottom Pattern

Think of the double bottom as the double top's mirror image. Instead of two peaks, you've got two troughs. It signals a potential reversal from a downtrend to an uptrend. Both patterns are valuable tools for predicting market movements, but they work in opposite directions.

Head and Shoulders Pattern

This pattern consists of three peaks, with the middle one being the highest. Like the double top, it often indicates a trend reversal. However, the head and shoulders pattern tends to be more complex and requires more analysis to confirm.

Strategies for Trading Double Tops

Knowing the double top pattern meaning is one thing, but knowing how to trade it is another. Here are some strategies to consider:

- Short Selling: Enter a short position when prices break below the trough.

- Stop-Loss Orders: Protect your trades by setting stop-loss orders above the second peak.

- Profit Targets: Use the distance between the peaks and the trough to set realistic profit targets.

Risk Management Tips

Trading with double tops can be lucrative, but it's not without risks. Always remember to:

- Limit your position size to manage risk.

- Monitor volume and market sentiment to confirm the pattern.

- Stay disciplined and stick to your trading plan.

Common Mistakes to Avoid

Even the best traders make mistakes. Here are some common pitfalls to watch out for when trading double tops:

- Jumping the Gun: Don't enter a trade too early. Wait for a clear breakdown below the trough.

- Ignoring Volume: Volume is your friend. Don't overlook it when analyzing the pattern.

- Overtrading: Stick to your strategy and don't let emotions drive your decisions.

How to Avoid These Mistakes

Practice makes perfect. Use demo accounts to test your strategies without risking real money. Also, keep a trading journal to track your progress and learn from your mistakes.

Conclusion: Mastering the Double Top Pattern

In summary, the double top pattern meaning is all about potential trend reversals and market shifts. By understanding how to identify and trade double tops, you can enhance your trading strategy and make more informed decisions. Remember to:

- Look for two peaks and a distinct trough.

- Wait for a breakdown below the trough before entering a trade.

- Monitor volume and other market factors to confirm the pattern.

So, what are you waiting for? Dive into your charts, spot those double tops, and start unlocking the secrets of the market. And don't forget to share your experiences and insights in the comments below. Happy trading!

Table of Contents

- What Exactly is a Double Top Pattern?

- Why Should You Care About Double Tops?

- How to Identify a Double Top Pattern

- Key Characteristics of a Double Top

- Double Top Pattern Meaning in Action

- Real-World Examples

- Factors Influencing Double Top Patterns

- How Volume Affects Double Tops

- Double Top vs. Other Chart Patterns

- Strategies for Trading Double Tops

- Risk Management Tips

- Common Mistakes to Avoid

- How to Avoid These Mistakes