What Is The Difference Between Shareholder And Stakeholder? A Comprehensive Guide

Let's dive straight into it, folks. If you're here, chances are you've stumbled upon the terms "shareholder" and "stakeholder" and are wondering what sets them apart. Well, you're in the right place. In today's business landscape, understanding these two terms is crucial whether you're an entrepreneur, investor, or just someone curious about how businesses operate. So, buckle up as we break down the differences in a way that's both informative and easy to grasp.

At first glance, the words "shareholder" and "stakeholder" might sound similar, but trust me, they couldn't be more different. While both groups are important to a company's success, their roles, interests, and priorities vary significantly. We'll explore these distinctions in depth, but first, let's set the stage by defining what exactly we're talking about here. Ready? Let's go!

In this article, we'll cover everything from their definitions to their roles in the business ecosystem. Whether you're looking to make informed investment decisions or simply want to expand your business knowledge, this guide will give you a solid foundation. So, let's get started!

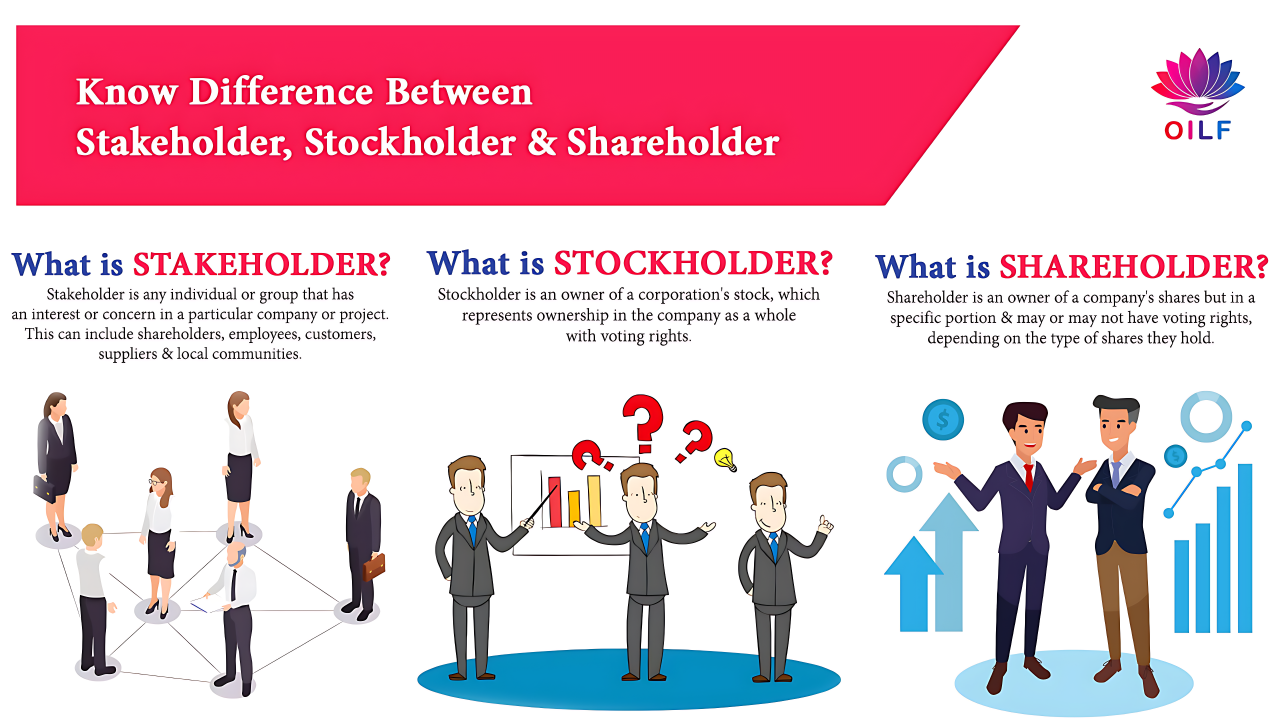

Understanding Shareholders: Who Are They?

Alright, let's start with shareholders. These are the folks who own shares in a company. They're essentially partial owners, and their investment gives them certain rights and privileges within the organization. Shareholders can range from individual investors to large institutional funds, and their primary goal is usually financial gain through dividends or stock appreciation. Pretty straightforward, right?

Here's the kicker though—shareholders are primarily concerned with the company's profitability and return on investment. They want to see their stocks grow, and their interests are often tied to the company's financial performance. Now, this doesn't mean they don't care about other aspects, but let's face it, their focus is on the bottom line.

Key Characteristics of Shareholders

- Own equity in the company through stock ownership.

- Have voting rights on certain company decisions, like electing board members.

- Receive dividends if the company distributes profits.

- Primarily focused on financial returns and stock value.

Think of shareholders as the investors who put their money where their mouth is. They take risks by investing in a company, and in return, they expect rewards. It's a give-and-take relationship that drives the stock market and fuels corporate growth. But hey, not everyone is in it for the money, and that's where stakeholders come into play.

Defining Stakeholders: A Broader Perspective

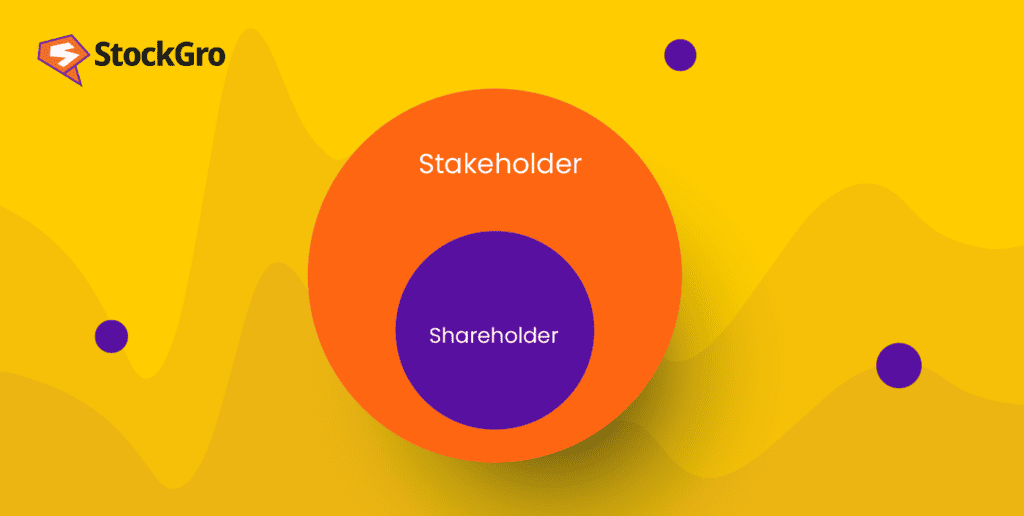

Now, let's shift gears and talk about stakeholders. Unlike shareholders, stakeholders have a broader connection to the company. They include employees, customers, suppliers, local communities, and even the environment. Stakeholders are anyone who has an interest in or is affected by the company's actions and performance. It's like a web of interconnected relationships that go beyond just financial concerns.

Here's the deal—stakeholders care about more than just profits. They're interested in the company's social responsibility, ethical practices, and long-term sustainability. For instance, employees want job security and fair treatment, while customers expect quality products and services. It's a much more holistic view of what makes a company successful.

Types of Stakeholders

- Internal Stakeholders: Employees, management, and board members.

- External Stakeholders: Customers, suppliers, investors, and the community.

- Environmental Stakeholders: Groups concerned with the company's impact on the environment.

So, you see, stakeholders are a diverse bunch with varying interests. Their influence can shape a company's decisions and policies, often pushing for practices that benefit society as a whole. It's all about balance—balancing profits with purpose. But how do these two groups interact? Let's find out.

Key Differences Between Shareholders and Stakeholders

Alright, now that we've defined both terms, let's highlight the key differences. Think of shareholders as the financial backbone of a company, while stakeholders are the broader support system. Here's a quick breakdown:

- Shareholders own a part of the company, whereas stakeholders have an interest in its success.

- Shareholders are primarily motivated by financial returns, while stakeholders have a wider range of interests.

- Shareholders have voting rights, whereas stakeholders influence the company through other means, like advocacy or consumer behavior.

It's like comparing apples and oranges—both are fruits, but they serve different purposes. Shareholders are all about the numbers, while stakeholders are about the bigger picture. But here's the thing—both are essential for a company's long-term success.

Financial vs. Non-Financial Interests

Let's dive deeper into the financial and non-financial aspects. Shareholders are all about the money—dividends, stock prices, and profits. Stakeholders, on the other hand, care about a company's impact on society, the environment, and its ethical practices. It's a dual focus that companies need to manage carefully.

For example, a company might prioritize cutting costs to boost shareholder value, but if it comes at the expense of employee welfare or environmental sustainability, stakeholders might raise a red flag. It's a delicate balance that requires strategic thinking and long-term planning.

Why Both Groups Matter

Here's the million-dollar question—why do both shareholders and stakeholders matter? The answer is simple—because they both play crucial roles in a company's success. Shareholders provide the capital needed for growth and expansion, while stakeholders ensure that the company operates responsibly and sustainably.

Think of it like a seesaw—both sides need to be balanced for the company to thrive. Ignoring either group can lead to problems down the line. For instance, focusing solely on shareholder value might alienate employees and customers, while prioritizing stakeholders without considering financial realities could jeopardize the company's viability.

Striking the Right Balance

So, how do companies strike the right balance? It starts with a clear understanding of both groups' needs and interests. Companies need to communicate openly with shareholders about their financial strategies while also engaging with stakeholders to address their concerns. It's all about building trust and transparency.

For example, companies can adopt practices like corporate social responsibility (CSR) initiatives to align with stakeholder interests while still delivering value to shareholders. It's a win-win situation that benefits everyone involved.

Impact on Corporate Governance

Now, let's talk about how shareholders and stakeholders influence corporate governance. Governance refers to the systems and processes by which companies are directed and controlled. Both groups play a significant role in shaping these systems.

Shareholders have voting rights, which give them a say in major company decisions, like electing board members or approving mergers. Stakeholders, on the other hand, influence governance through advocacy, activism, and consumer behavior. For instance, a company might adopt environmentally friendly practices to appeal to environmentally conscious stakeholders.

Best Practices in Governance

Here are some best practices that companies can adopt to ensure good governance:

- Engage with both shareholders and stakeholders regularly.

- Be transparent about financial and non-financial performance.

- Adopt sustainable practices that align with stakeholder interests.

- Ensure accountability and ethical decision-making.

By following these practices, companies can build a governance framework that supports both financial success and social responsibility.

Real-World Examples

Let's bring this discussion to life with some real-world examples. Take Tesla, for instance. Its shareholders are excited about the company's rapid growth and stock performance, but its stakeholders, including environmental groups and customers, are equally invested in its mission to accelerate the world's transition to sustainable energy.

Another example is Starbucks, which has successfully balanced shareholder value with stakeholder interests. The company pays dividends to its shareholders while also investing in fair trade coffee, employee benefits, and community programs that appeal to its stakeholders.

Lessons from Success Stories

What can we learn from these examples? First, companies that prioritize both shareholders and stakeholders tend to perform better in the long run. Second, transparency and communication are key to managing both groups effectively. Finally, aligning business practices with stakeholder interests can enhance a company's reputation and brand value.

Challenges in Managing Shareholders and Stakeholders

Of course, managing both shareholders and stakeholders isn't without its challenges. Companies often face conflicts of interest, where the needs of one group clash with the other. For instance, a decision to cut costs might please shareholders but upset employees and customers. It's a delicate balancing act that requires careful consideration.

Another challenge is measuring the impact of stakeholder engagement. While financial performance is easy to quantify, assessing the value of stakeholder relationships can be more subjective. Companies need to develop metrics that capture both financial and non-financial outcomes.

Solutions to Common Challenges

Here are some solutions to common challenges:

- Develop a clear strategy that aligns with both shareholder and stakeholder interests.

- Use data and analytics to measure the impact of stakeholder engagement.

- Engage in open and honest communication with both groups.

By addressing these challenges proactively, companies can create a sustainable model that benefits everyone involved.

The Future of Shareholders and Stakeholders

Looking ahead, the relationship between shareholders and stakeholders is likely to evolve. As more companies adopt sustainable practices and prioritize social responsibility, the lines between the two groups may blur. We might see a shift towards a more integrated approach that considers both financial and non-financial factors in decision-making.

Technology will also play a role in this evolution. Advances in data analytics and artificial intelligence will help companies better understand and engage with both groups. It's an exciting time for corporate governance, and the future looks bright for companies that embrace this change.

Trends to Watch

Here are some trends to watch in the coming years:

- Growing emphasis on environmental, social, and governance (ESG) factors.

- Increased use of technology to enhance stakeholder engagement.

- Greater transparency and accountability in corporate practices.

By staying ahead of these trends, companies can position themselves for long-term success in a rapidly changing world.

Conclusion

So, there you have it—a comprehensive guide to understanding the difference between shareholders and stakeholders. While both groups are essential for a company's success, their roles and interests differ significantly. Shareholders focus on financial returns, while stakeholders care about the broader impact of a company's actions.

The key takeaway is that companies need to balance both groups' needs to thrive in today's business environment. By adopting best practices in governance, engaging with stakeholders, and communicating openly with shareholders, companies can build a sustainable model that benefits everyone involved.

Now, it's your turn. Have you ever wondered about the difference between these two groups? Do you think companies are doing enough to balance shareholder and stakeholder interests? Let us know in the comments below, and don't forget to share this article with your friends and colleagues. Together, let's keep the conversation going!

Table of Contents

- Understanding Shareholders: Who Are They?

- Defining Stakeholders: A Broader Perspective

- Key Differences Between Shareholders and Stakeholders

- Why Both Groups Matter

- Impact on Corporate Governance

- Real-World Examples

- Challenges in Managing Shareholders and Stakeholders

- The Future of Shareholders and Stakeholders

- Conclusion